Vietnam Skin Care Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Body Care, Facial Care, Hand Care, Skin Care Sets/Kits), By Category (Premium, Mass), By Gender (Men, Women, Unisex), By End User (Adults, Teenagers, Children), By Packaging (Tubes, Bottles, Jars, Others), By Sales Channel (Online, Offline)

- FMCG

- Dec 2025

- VI0131

- 127

-

Vietnam Skin Care Market Statistics, 2025

- Market Size Statistics

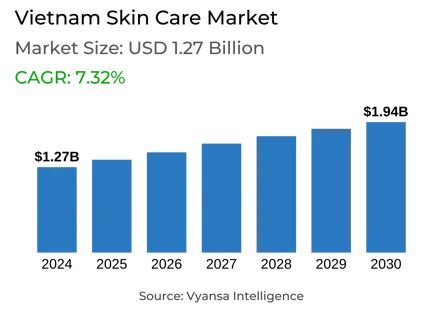

- Skin Care in Vietnam is estimated at $ 1.27 Billion.

- The market size is expected to grow to $ 1.94 Billion by 2030.

- Market to register a CAGR of around 7.32% during 2025-30.

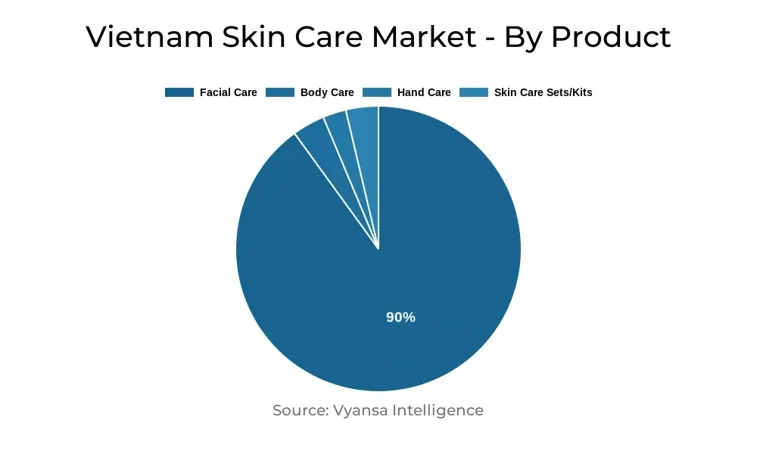

- Product Shares

- Facial Care grabbed market share of 90%.

- Competition

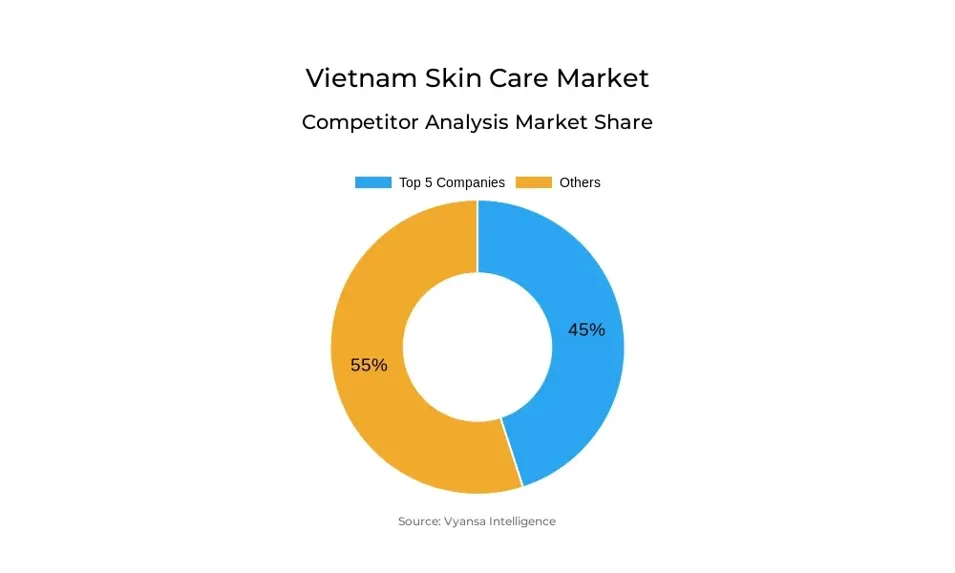

- More than 20 companies are actively engaged in producing Skin Care in Vietnam.

- Top 5 companies acquired 45% of the market share.

- Procter & Gamble Vietnam Ltd, Shiseido Cosmetics Vietnam Co Ltd, Rohto-Mentholatum Vietnam Co Ltd, L'Oréal Vietnam Co Ltd, Unilever Vietnam International Co Ltd etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 70% of the market.

Vietnam Skin Care Market Outlook

Vietnam skin care market will sustain strong value growth during 2025–2030, driven by increasing disposable incomes and an increasingly ageing population. Consumers will spend more on their budgets to keep skin young and healthy-looking, with skin care products being increasingly regarded as daily necessities. Needs for anti-ageing products, especially among older consumers, will drive sales in major categories such as moisturisers and treatments.

Moisturisers and treatments will probably continue to be the most dynamic area. These offer benefits not only for hydration but also for skin issues like sensitivity, barrier repair, and environmental stress. Consumers are being attracted by hybrid products that blend hydration with actives such as peptides, retinol, and ceramides, providing multifunctional solutions through simpler routines.

Digital marketing, particularly on a channel such as TikTok, is predicted to be central to determining brand presence and customer participation. Livestream shopping, influencer collaborations, and online-only offers will continue e-commerce growth. Offline channels such as supermarkets will also be crucial, particularly in suburban and rural regions, because of physical access to products and faith in in-store promotions.

Indigenous brands are expected to have a larger share in the competitive market by emphasizing innovation, quality, and social interaction. Brands such as Cocoon are spearheading this trend through the utilization of novel ingredient mixtures and science-sound launches, driving consumer confidence. During the forecast period, product effectiveness and efficacy will continue to be fundamental to innovation, emphasizing gentle, multi-benefit, and protective formulations appropriate for Vietnam's climate and skin care requirements.

Vietnam Skin Care Market Growth Driver

Vietnam's ageing population, along with increasing disposable incomes, will also be a major growth driver of the skin care market during 2025–2030. With people becoming increasingly aware of their appearance as they age, skin care is being considered an integral part of personal routines. This change is driving increased expenditure on products that keep skin youthful and healthy-looking.

Demand for treatments and moisturisers is especially robust, underpinned by a broader consumer interest in daily care. Older consumers are actively looking for products with anti-ageing properties, and moisturisers are appreciated not only for hydration but also for skin barrier repair and sensitivity relief. The popularity of hybrid products that blend moisturization with actives such as peptides, ceramides, and retinol is also likely to underpin ongoing expansion, as consumers seek multi-functional solutions to counter changing skin issues.

Vietnam Skin Care Market Trend

Between 2025 and 2030, effectiveness and efficiency are likely to spur innovation within Vietnam's skin care industry. Consumers are gravitating towards fewer steps but highly effective routines that prioritize nourishment and protection of the skin. The double cleansing movement, fueled by TikTok, will continue to be strong—pairing oil or balm cleansers with facial cleansers for enhanced effects. Multifunctional products that both hydrate and deliver anti-ageing benefits will trend upward, enabling consumers to simplify their everyday routines.

Sun care products that incorporate tone-up and brightening aspects will become a everyday staple. South Korean brands are spearheading this trend using TikTok seeding activities. As such, skin care companies are gearing towards TikTok-first marketing—utilizing livestreaming, interactive promotions, and deep discounts. Based on a survey, these strategies are consolidating TikTok's influence in driving beauty and personal care trends throughout Vietnam.

Vietnam Skin Care Market Opportunity

Domestic players are set to become solid challengers during 2025–2030 with the ongoing enhancement of product quality and ingredient creativity. vietnam skin care brands are becoming popular, particularly among young consumers, thanks to their emphasis on clean formulas and functional attributes. Most are extending their online and offline presence, with some of them even surpassing international players in social engagement and promotion efforts.

A prime example is Cocoon, which has fortified its presence on top-shelf retail and online websites. In the later part of 2024, the brand introduced its Sen Hậu Giang Facial Cleanser & Toner, which is scientifically formulated with prebiotics such as Beta-glucan and Xylitol derivatives to take care of the skin microbiome and desensitize the skin. With two years of research behind it, the launch has further strengthened consumer confidence in local innovation. Such initiatives by other regional players are expected to redefine the competitive scenario during the forecast period.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 1.27 Billion |

| USD Value 2030 | $ 1.94 Billion |

| CAGR 2025-2030 | 7.32% |

| Largest Category | Facial Care segment leads with 90% market share |

| Top Drivers | Rising Demand Driven by Ageing Demographics and Higher Incomes |

| Top Trends | Rising Traction Towards Simplified and Functional Routines Gaining Market Share |

| Top Opportunities | Local Brands Gaining Traction with Quality and Innovation |

| Key Players | Procter & Gamble Vietnam Ltd, Shiseido Cosmetics Vietnam Co Ltd, Rohto-Mentholatum Vietnam Co Ltd, L'Oréal Vietnam Co Ltd, Unilever Vietnam International Co Ltd, AmorePacific Vietnam JSC, Estée Lauder Vietnam Co Ltd, Hanoi International Friendship Hospital JSC, Beiersdorf Vietnam Ltd Co, FineToday Co Ltd and Others. |

Vietnam Skin Care Market Segmentation Analysis

The most significant market share under the sales channel segment is retail offline, dominated by beauty specialists in 2024. These outlets court consumers with a plethora of brands at different price points and provide store consultations by trained professionals. Tailor-made product recommendations according to specific skin issues keep establishing the trust and loyalty of consumers. This customized shopping experience is a core area of strength, though beauty professionals are slowly losing market share as online channels expand steadily.

Supermarkets are among the most vibrant offline channels, showing double-digit growth in 2024. Expanding into additional provinces and suburbs has made them more accessible, particularly in areas with poor online or specialist store presence. Carrying familiar skin care brands, in-store promotions, and special gifts, supermarkets have become a robust offline option. Being able to see and sample products prior to purchase is yet another vote of confidence from consumers for this burgeoning category.

Top Companies in Vietnam Skin Care Market

The top companies operating in the market include Procter & Gamble Vietnam Ltd, Shiseido Cosmetics Vietnam Co Ltd, Rohto-Mentholatum Vietnam Co Ltd, L'Oréal Vietnam Co Ltd, Unilever Vietnam International Co Ltd, AmorePacific Vietnam JSC, Estée Lauder Vietnam Co Ltd, Hanoi International Friendship Hospital JSC, Beiersdorf Vietnam Ltd Co, FineToday Co Ltd, etc., are the top players operating in the Vietnam Skin Care Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Vietnam Skin Care Market Policies, Regulations, and Standards

4. Vietnam Skin Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Vietnam Skin Care Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Firming Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. General Purpose Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Facial Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.1. Acne Treatments- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.2. Face Masks- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3. Facial Cleansers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.1. Liquid- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.2. Cream- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.3. Gel- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.4. Bar Cleansers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.5. Facial Cleansing Wipes- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4. Moisturisers and Treatments- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4.1. Basic Moisturisers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4.2. Anti-Agers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.5. Lip Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.6. Toners- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Hand Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.4. Skin Care Sets/Kits- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Category

5.2.2.1. Premium- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Women- Market Insights and Forecast 2020-2030, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By End User

5.2.4.1. Adults- Market Insights and Forecast 2020-2030, USD Million

5.2.4.2. Teenagers- Market Insights and Forecast 2020-2030, USD Million

5.2.4.3. Children- Market Insights and Forecast 2020-2030, USD Million

5.2.5.By Packaging

5.2.5.1. Tubes- Market Insights and Forecast 2020-2030, USD Million

5.2.5.2. Bottles- Market Insights and Forecast 2020-2030, USD Million

5.2.5.3. Jars- Market Insights and Forecast 2020-2030, USD Million

5.2.5.4. Others- Market Insights and Forecast 2020-2030, USD Million

5.2.6.By Sales Channel

5.2.6.1. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.6.2. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Vietnam Body Care Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By Category- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Gender- Market Insights and Forecast 2020-2030, USD Million

6.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

6.2.5.By Packaging- Market Insights and Forecast 2020-2030, USD Million

6.2.6.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. Vietnam Facial Care Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Category- Market Insights and Forecast 2020-2030, USD Million

7.2.3.By Gender- Market Insights and Forecast 2020-2030, USD Million

7.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

7.2.5.By Packaging- Market Insights and Forecast 2020-2030, USD Million

7.2.6.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Vietnam Hand Care Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2020-2030, USD Million

8.2.2.By Gender- Market Insights and Forecast 2020-2030, USD Million

8.2.3.By End User- Market Insights and Forecast 2020-2030, USD Million

8.2.4.By Packaging- Market Insights and Forecast 2020-2030, USD Million

8.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. Vietnam Skin Care Sets/Kits Market Statistics, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2020-2030, USD Million

9.2.2.By Gender- Market Insights and Forecast 2020-2030, USD Million

9.2.3.By End User- Market Insights and Forecast 2020-2030, USD Million

9.2.4.By Packaging- Market Insights and Forecast 2020-2030, USD Million

9.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. L'Oréal Vietnam Co Ltd

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Unilever Vietnam International Co Ltd

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. AmorePacific Vietnam JSC

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Estée Lauder Vietnam Co Ltd

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Hanoi International Friendship Hospital JSC

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Procter & Gamble Vietnam Ltd

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Shiseido Cosmetics Vietnam Co Ltd

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Rohto-Mentholatum Vietnam Co Ltd

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Beiersdorf Vietnam Ltd Co

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. FineToday Co Ltd

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Category |

|

| By Gender |

|

| By End User |

|

| By Packaging |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.