Belgium Colour Cosmetics Market Report: Trends, Growth and Forecast (2026-2032)

Category (Eye Make-Up (Eye Liner/Pencil, Eye Shadow, Mascara, Others), Facial Make-Up (BB/CC Creams, Blusher/Bronzer/Highlighter, Foundation/Concealer, Powder, Others), Lip Products (Lip Gloss, Lip Liner/Pencil, Lipstick, Others), Nail Products (Nail Polish, Nail Treatments/Strengthener, Polish Remover, Others), Colour Cosmetics Sets/Kits), Price (Premium, Mass), Gender (Men, Women, Unisex), Packaging Type (Travel/Mini Size, Standard Size, Professional/Salon Size), Form (Creams/Gels, Lotions, Sprays, Solid, Others), Nature (Organic, Inorganic), Sales Channel (Retail Offline, Retail Online)

- FMCG

- Dec 2025

- VI0714

- 115

-

Belgium Colour Cosmetics Market Statistics and Insights, 2026

- Market Size Statistics

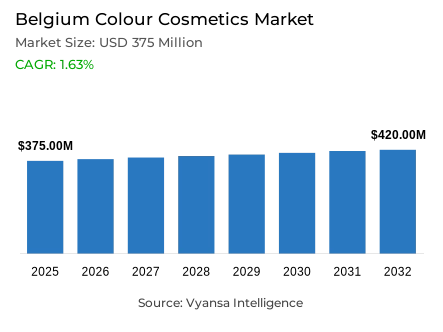

- Colour cosmetics in Belgium is estimated at USD 375 million in 2025.

- The market size is expected to grow to USD 420 million by 2032.

- Market to register a cagr of around 1.63% during 2026-32.

- Category Shares

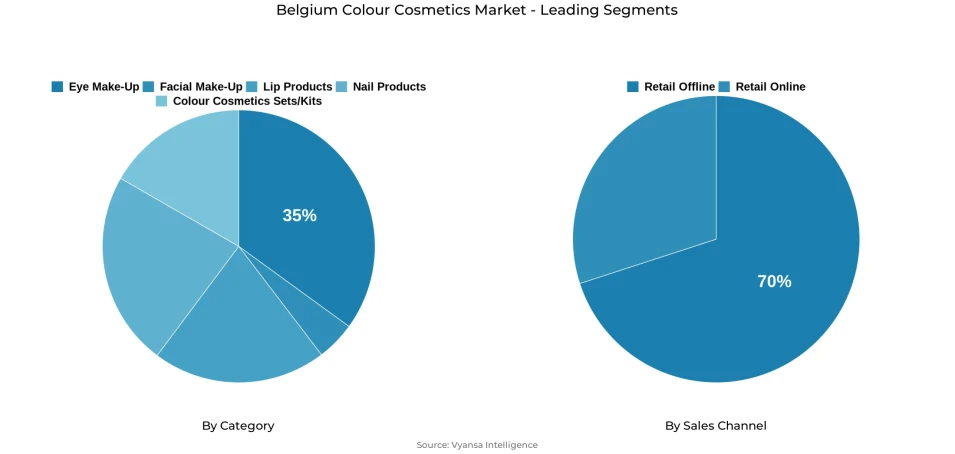

- Eye make-up grabbed market share of 35%.

- Competition

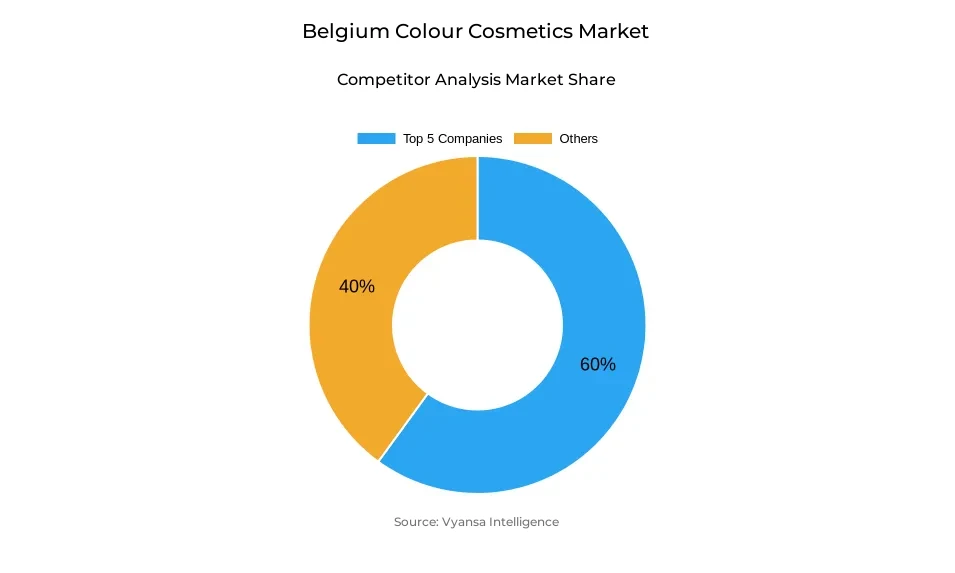

- More than 20 companies are actively engaged in producing colour cosmetics in Belgium.

- Top 5 companies acquired around 60% of the market share.

- Estée Lauder Belgium NV SA; Ici Paris XL Parfumerie SA; Bourjois SA; L'Oréal Belgilux SA; Cosnova GmbH etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

Belgium Colour Cosmetics Market Outlook

The Belgium colour cosmetics market is expected to grow steadily over 2026–32 as end user confidence gradually improves. The market is valued at USD 375 million in 2025 and projected to reach USD 420 million by 2032, expanding at a CAGR of around 1.63%. After years of price-driven growth, stabilising prices are likely to support a more natural recovery in demand. While colour cosmetics continue to be viewed as non-essential during periods of financial pressure, easing inflation and stronger purchasing power are expected to encourage increased spending, especially on everyday make-up. Eye make-up, which holds a 35% share, will remain the largest category, supported by ongoing interest in affordable mass brands that offer premium-like features.

Mass brands are expected to retain their strength, but premium brands such as Lancôme, Clinique, and Estée Lauder-are set to gradually regain demand as economic conditions improve. Younger end users who shifted to mass brands during 2023–24 may return to premium options once budgets recover. At the same time, brands like Kiko Milano, Catrice and Essence are likely to stay dynamic thanks to strong value positioning and frequent innovation. The market will also see rising interest in mass BB/CC creams, which are forecast to be the fastest-growing category due to their multifunctional benefits and increasing affordability.

In terms of sales channels, retail offline hold around 70% of the market and will continue to dominate, especially supermarkets, small grocers, and variety stores. However, the strongest momentum will come from health and personal care stores such as Kruidvat and Medi-Market, which offer wider assortments and strong visibility for both mass and premium brands. These retailers are expected to gain share at the expense of supermarkets and traditional beauty specialists.

Reatil online will also continue expanding as Belgian end users become more familiar with online purchasing and benefit from improved digital platforms offered by retailers. With price stabilisation, broader Sales Channels, and rising interest in natural, convenient and affordable beauty products, the Belgium colour cosmetics market is well positioned for gradual but sustained growth.

Belgium Colour Cosmetics Market Growth Driver

Price Stabilisation Embedding a Shift Towards Mass Market Value

A prominent trend within Belgium color cosmetic market is price stabilisation. Mass brands have reinforced their position as they became associated with value for money and incorporated traditional premium brand attributes, which included enhanced skin comfort ingredients, and price. Within 2024, it appears that price levels have reached a stable position, reducing pressure on end users. However, it should be noted that limitations on price have encouraged price-conscious active support. It can thus be seen that mass brands maintained an efficient position with value-for-money and incorporated attributes associated with premium brands. Mass brands maintained an efficient position as they incorporated attributes associated with premium brands. It should be noted that price changes have influenced the market.

The macroeconomic environment also supports this driver. Belgium inflation rate lessened slightly to 2.3% in 2024 compared with previous years, which eliminated the steep price drivers. Within a market where buyers rate beauty as a non-essential category, stable pricing and mass market innovation act as an pull factor, and affordable and practical products drive resilience.

Belgium Colour Cosmetics Market Challenge

Perceived Non-Essential Nature of Colour Cosmetics Products

A key concern within the Belgium colour cosmetics market within is the lingering sentiment that make-up per se remains a discretionary product area, highly dependent on uncertain market priorities. When spending budgets were limited, some end users might have removed make-up from consideration completely, without engaging with even the most essential product offerings. Although eye make-up once again was an exception because it affects a very specific outcome that impacts a user’s appeal, it still categorized as mature and conservative.

The economic arena also supports and maintains this challenge. The growth rate of belgium real GDP diminished to 1.5% within 2023, and it still continues. As buyers still practice selectivity and value for money, product brands have a tougher role to play in proving relevance and value. The challenge goes beyond being affordable and aims at reinstating make-up as an important and worthwhile category.

Belgium Colour Cosmetics Market Trend

Functional Enhancement via BB/CC Combination Formulations

A trend influencing the belgium colour cosmetics market is the growing importance of BB/CC cream hybrids. These offer a combination of skincare attributes and colour correction. At a period in which money within the purchasing basket keeps fluctuating, people will turn more and more towards multi-use products. BB/CC cream hybrids combine the attributes of foundation, moisturiser, and a skin toner all in one. This could very well appeal to the more pragmatic and cost-conscious people of Belgium. Also, with a small foundation and potentially rapid adoption rates, an accelerated growth rate amongst BB/CC cream hybrids might be anticipated. It should be noted that BB/CC cream hybrids will probably be the most rapidly expanding mass market.

The high level of digital information engagement in Belgium underscores this shift. Noting that 94% of Belgiums were internet users as of 2024, it appears that easy access to product demos, dermatological tips, and ingredients-based information will drive an ever-increasing market for hybrids claiming skin comfort, breathability, and natural finishes. As more and more shoppers tap into online sources for beautification tips, there will be a growing market demand for product hybrids.

Belgium Colour Cosmetics Market Opportunity

Rebound of Premium Cosmetics Supported by Economic Recovery

A opportunity within belgium colour cosmetic market is the forthcoming revived growth within the premium cosmetic category. The premium market fell within 2023-2024 as Generation Z and Alpha individuals opted for mass alternatives but with strengthening purchasing power, growth within these premium products will soon be reviving. As a result, there would be a clear opening for premium lipstick, skin solution, and eye makeup products with sensorial and emotive attributes.

A supportive economic environment for Belgium makes this opportunity possible. According to Eurostat, there are rising levels of real wage growth within the EU in 2024, indicating a restoration of discretionary income. As financial strain lessens, it will have a disproportionately positive impact on premium categories, as these are driven more by emotions and experiences. Those brands with a focus on storytelling and tangible efficacy will be best poised.

Belgium Colour Cosmetics Market Segmentation Analysis

By Category

- Eye Make-Up

- Facial Make-Up

- Lip Products

- Nail Products

- Colour Cosmetics Sets/Kits

The segment with highest market share under category is eye make-up, as it captured 35% of the market share for colour cosmetics in Belgium. Eye make-up again topped 2024 as people still considered these products essential even as they reduced spending on non-essential expenses. Despite its mature status as a category, there was still a large demand for mascaras, eyeliners, and brow products, and this was driven by mass brands offering premium performance at more affordable price points.

Eye make-up products were also the most dynamic market, as they enjoyed visibility on social media and R&D advancements involving highly precise and lasting formulas. Mass brands included more features previously reserved for traditional, luxury brands, making them more attractive to yet more budget-conscious end users. All these factors will encourage the leading position of eye make-up products.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under Sales Channel is concerned, is retail offline, accounting around 70% market share in colour cosmetics market. supermarkets and small local stores accounts for the largest share under the retail offine segment. These provided easy accessibility and convenience with regards to colour cosmetic products.

Moreover, they were an attractive option for budget-conscious people. Specifically, among retail offline convenience stores, health and personal care stores also emerged as more relevant with extended product offerings and successful positioning of mass brands Catrice and Essence. Variety stores were the most dynamic among offline formats, driven by impulse buying and attractive price points. Despite increasingly rising retail online, retail offline retained its leading share due to ease of access, variety, and familiarity.

List of Companies Covered in Belgium Colour Cosmetics Market

The companies listed below are highly influential in the Belgium colour cosmetics market, with a significant market share and a strong impact on industry developments.

- Estée Lauder Belgium NV SA

- Ici Paris XL Parfumerie SA

- Bourjois SA

- L'Oréal Belgilux SA

- Cosnova GmbH

- Kiko SpA

- Yves Rocher Benelux NV SA

- Parfums Christian Dior SAB

- Coty Benelux NV

- Clarins SA

Competitive Landscape

Compet L’Oréal Belgilux SA continued to lead Belgium’s market for colour cosmetic products in 2024, with its extensive product lineup covering Garnier, L’Oréal Paris, Lancôme, Helena Rubinstein, and Gemey/Maybelline; yet, it also witnessed a decrease in value share as Lancôme suffered share loss and L’Oréal Paris came under pressure from increasingly popular mass offerings from Catrice, Essence, and Kiko Milano. These competitors were the most dynamic players of 2024, with Cosnova GmbH (owners of Catrice and Essence) and Kiko SpA increasingly successful due to expanding Sales Channels networks, particularly via health and personal care retailing giants like Kruidvat. Their successful strategy of delivering trendy and highly engaging products at budget-friendly prices encouraged an enormous response among price-conscious end users amidst stable prices and limited purchasing capabilities. Consequently, despite market shifts toward mass products and Sales Channels via retailers, it became increasingly easier, and thus, market competition less unfavorable, as these two forces, Cosnova and Kiko, emerged as prominent new market threats against L’Oréal’s unchallenged market leadership.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Belgium Colour Cosmetics Market Policies, Regulations, and Standards

4. Belgium Colour Cosmetics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Belgium Colour Cosmetics Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Eye Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Eye Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Eye Shadow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Mascara- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Facial Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. BB/CC Creams- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Blusher/Bronzer/Highlighter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Foundation/Concealer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Lip Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Lip Gloss- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Lip Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lipstick- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Nail Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Nail Polish- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Nail Treatments/Strengthener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Polish Remover- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Price

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Packaging Type

5.2.4.1. Travel/Mini Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Standard Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Professional/Salon Size- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Form

5.2.5.1. Creams/Gels- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Lotions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Sprays- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Solid- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Nature

5.2.6.1. Organic- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Inorganic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Belgium Eye Make-Up Colour Cosmetics Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Belgium Facial Make-Up Colour Cosmetics Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Belgium Lip Products Colour Cosmetics Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Belgium Nail Products Colour Cosmetics Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Belgium Colour Cosmetics Sets/Kits Colour Cosmetics Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Price- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Gender- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. L'Oréal Belgilux SA

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Cosnova GmbH

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Kiko SpA

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Yves Rocher Benelux NV SA

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Christian Dior SAB, Parfums

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Estée Lauder Belgium NV SA

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Ici Paris XL Parfumerie SA

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Bourjois SA

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Coty Benelux NV

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Clarins SA

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Price |

|

| By Gender |

|

| By Packaging Type |

|

| By Form |

|

| By Nature |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.