Turkey Childrenswear Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Apparel (Baby and Toddler Wear, Boys Apparel, Girls Apparel), Footwear (Boys Footwear, Girls Footwear), Accessories (Boys Accessories, Girls Accessories), Others), Age Group (Infant/Toddler (Below 2 years), Kids/Children (2 - 14 years)), Price Category (Mass, Premium), Sales Channel (Retail Offline, Retail Online)

- FMCG

- Dec 2025

- VI0705

- 110

-

Turkey Childrenswear Market Statistics and Insights, 2026

- Market Size Statistics

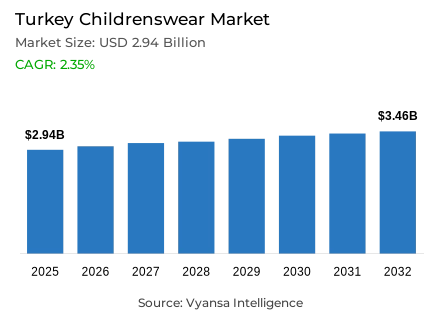

- Childrenswear in Turkey is estimated at USD 2.94 billion in 2025.

- The market size is expected to grow to USD 3.46 billion by 2032.

- Market to register a cagr of around 2.35% during 2026-32.

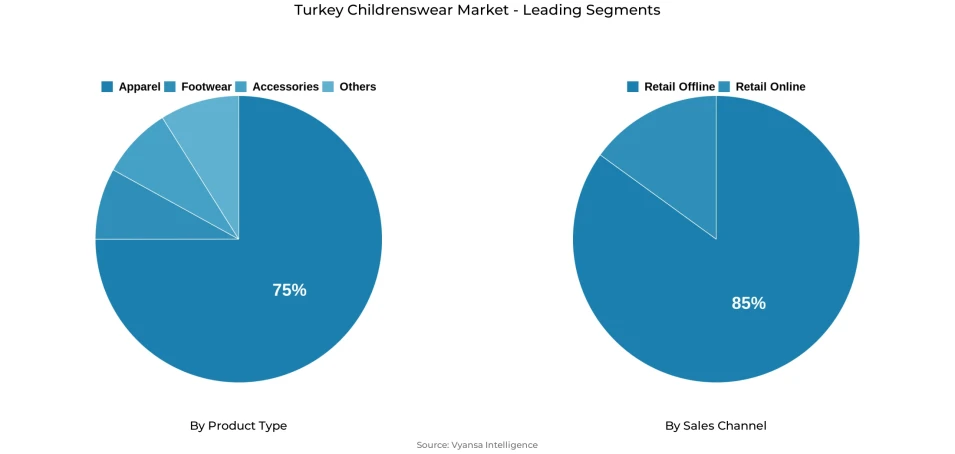

- Product Type Shares

- Apparel grabbed market share of 75%.

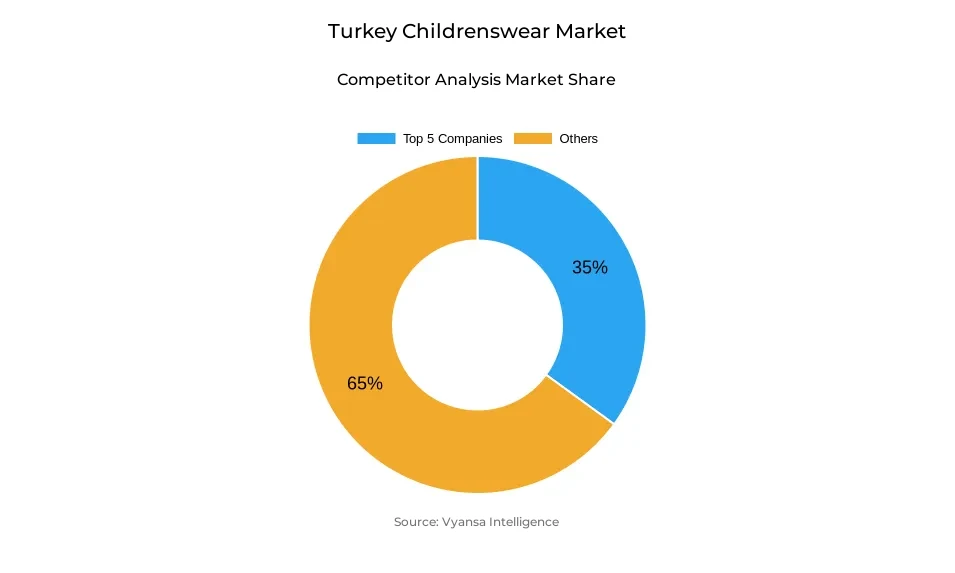

- Competition

- More than 20 companies are actively engaged in producing childrenswear in Turkey.

- Top 5 companies acquired around 35% of the market share.

- Za Giyim Ithalat Ihracat ve Ticaret Ltd Sti; H&M Hennes & Mauritz AB; adidas Spor Malzemeleri Satis ve Pazarlama AS; LC Waikiki Magazacilik Hizmetleri Tic AS; Defacto Perakende Tic AS etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Turkey Childrenswear Market Outlook

Turkey childrenswear market is Valued at USD 2.94 billion in 2025, and will be valued at approximately USD 3.46 billion by 2032, exhibiting a CAGR of about 2.35% during 2026-2032. While inflationary pressures in the economy persist alongside currency weakness, parents' investment in their children's clothing continues to drive better performance for childrenswear than menswear and womenswear. This segment is clearly price-sensitive, with households aiming for cheap yet good-quality items. The leading brands include LC Waikiki, Defacto, and H&M. The segment holds around 75% of the total market share; therefore, apparel will see continued demand because of frequent replacements required for a child's growth.

However, falling birth rates continue to weigh on overall sales growth. Economic instability, unemployment, and shifting social patterns have encouraged many couples to delay parenthood. Many brands are now targeting teen apparel as a new, emerging segment impelled by fashion-conscious youth and fast-changing style preferences. The growth of teenagers’ influence in the choice of clothes is encouraging brands like Mavi, Zara, and LC Waikiki to expand more dedicated collections targeting this age group, especially in casual wear and back-to-school clothing.

E-commerce will continue to be a key growth driver through the forecast period, bolstered by a new generation of millennial parents who are comfortable making purchases online. The growing prevalence of social media sites, such as TikTok and YouTube, will further influence children's fashion trends, particularly among young girls. Certainly, brands that can effectively engage end userss with various digital marketing initiatives, influencer partnerships, and interactive shopping experiences are those poised for a leading position within this ever-changing retail landscape.

All of the players will still maintain their focus on sustainability and affordability, twin drivers for both brands and end users. Innovation will be led by growing awareness of eco-friendly and organic materials, with fast fashion players such as Zara and LC Waikiki continuing to expand via value-driven pricing and discount campaigns. With over 85% of total sales coming from retail offline channels alone, physical stores will still be dominant, helped by promotional offers and multibuy deals set to retain price-sensitive parents in a highly competitive market landscape.

Turkey Childrenswear Market Growth DriverIncreasing Price Sensitivity Strengthens Demand for Affordable Childrenswear

The childrenswear market in Turkey is largely driven by the price sensitivity that is increasing as households strive to cope with high inflation and a constantly depreciating Turkish Lira. According to the Turkish Statistical Institute, end users prices rose year-over-year by more than 65% in 2024, drastically shrinking disposable incomes. Parents are therefore prioritizing affordability and have moved toward mid-range and private-label brands like LC Waikiki, Defacto, and Koton, which still see very strong demand because of competitive pricing and frequent promotions.

Childrenswear remains more resistant to economic ups and downs than adult apparel because clothing for children is basically indispensable and needs frequent replacement to accommodate their growth. According to the World Bank, 22% of Turkey's population falls in the age group below 14 years, meaning that there is continuous demand for kids' apparel. That young base, coupled with the concentration on value-for-money goods, helps the market keep its steady performance, while household purchasing power is falling.

Turkey Childrenswear Market ChallengeDeclining Birth Rate and Economic Volatility Restrict Market Growth

The long-term prospects of the childrenswear market in Turkey are still dimmed by its falling birth rate and economic instability. In 2023, the fertility rate was 1.51 children per woman, according to TurkStat, which was down from 1.70 in 2018, indicating a continuous contraction of the potential end users base. This depicts demographic changes that are a reflection of increased female workforce participation and delayed parenthood among young couples due to economic uncertainty. The shrinking numbers of births are a major limitation to future market growth.

Furthermore, persistent inflation and currency fluctuations continue to raise production and import costs, affecting both manufacturers and end users. According to the International Monetary Fund (IMF), Turkey’s inflation rate ranks among the highest within the OECD, increasing cost pressures across the supply chain. These conditions restrict spending power and make it challenging for retailers to maintain price competitiveness while ensuring quality and innovation, thereby constraining overall market growth.

Turkey Childrenswear Market TrendFast Fashion and Teen-Focused Apparel Gain Momentum

Fast fashion is increasingly becoming a strong influence in Turkey's childrenswear market, with brands adapting to changing tastes and preferences among younger age groups. LC Waikiki, H&M, and Zara expand their collections by offering fashionable yet affordable designs to appeal to fashion-conscious teenagers. As many as 8% of Turkey's population, according to the World Bank, are within the age group of 10-14 years, which is significantly influenced by exposure to social media and fashion trends. This increasing segment triggers frequent renewals in the wardrobe, thus driving consistent market turnover.

Brands are also expanding into teen-specific apparel, combining comfort, affordability, and up-to-date aesthetics to appeal to the young end-user. The Ministry of Trade of the Republic of Turkey adds that e-commerce penetration within the apparel sales sector has already surpassed 40%, thereby allowing fast-fashion brands to reach out to end-end userss via online retail and targeted digital campaigns. These illustrate how teen-oriented collections and rapid design cycles drive new forms of competitiveness within Turkey's childrenswear sector.

Turkey Childrenswear Market OpportunityDigitalisation and Eco-Friendly Apparel Shape Future Growth

Further opportunities in the digital space and sustainability promise to shape the future of Turkey's childrenswear market over the next few years. According to the reports from BTK, in the year 2024, e-commerce transactions went up nearly 25%, showing a clear shift in people's choice for online purchasing. Tech-savvy millennial parents are turning to digital platforms for convenience, variety, and price comparison. Social media platforms like Instagram and TikTok feature children's fashion, with many brands using the sites to increase their digital presence.

At the same time, ecological awareness influences end users orientation to sustainable and organic materials. According to the Ministry of Environment, Urbanisation and Climate Change, there is a growing demand for eco-friendly textiles, such as organic cotton and recyclable fibers. The Turkish brands respond with equally eco-conscious collections, able to balance affordability with an ethical appeal. This coming together of digital retail and sustainability could mark the next phase of evolution in the childrenswear market in Turkey.

Turkey Childrenswear Market Segmentation Analysis

By Product Type

- Apparel

- Footwear

- Accessories

- Others

The segment with the highest share under Product Type is apparel, accounting for nearly 75% of the Turkey childrenswear market. The strong dominance of apparel is largely due to the frequent replacement cycle, as children quickly outgrow their clothes. Parents continue to prioritise spending on children’s clothing even amid economic uncertainty, making apparel a resilient category compared to menswear or womenswear. The rising popularity of affordable and mainstream brands further supports growth in this segment, catering to families facing financial constraints.

Furthermore, the growth in fashion trends among teens is speeding up demand for new styles and designs, forcing parents to make more current purchases. Furthermore, social media is also growing its impact, and leading companies such as LC Waikiki, Defacto, and H&M have begun to launch ‘teen' collections, further shaping preferences. This ensures that apparel remains the largest and most essential category in the childrenswear market.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under Sales Channel is retail offline, which captured around 85% of the Turkey childrenswear market. Turkish parents still prefer to shop in physical stores to check the quality, size, and fabric before purchasing clothing for their children. The dominance of offline retail is also supported by the widespread presence of domestic chains such as LC Waikiki and Defacto, which maintain strong brand trust and offer affordable pricing options across the country.

Despite the rapid growth of e-commerce and social media-driven sales, offline stores continue to provide the assurance and convenience that parents seek, especially for essential purchases. Discount campaigns, multibuy offers, and seasonal promotions further attract price-sensitive shoppers. Therefore, retail offline is expected to remain the leading channel in childrenswear sales, although online channels have been gradually increasing their presence.

List of Companies Covered in Turkey Childrenswear Market

The companies listed below are highly influential in the Turkey childrenswear market, with a significant market share and a strong impact on industry developments.

- Za Giyim Ithalat Ihracat ve Ticaret Ltd Sti

- H&M Hennes & Mauritz AB

- adidas Spor Malzemeleri Satis ve Pazarlama AS

- LC Waikiki Magazacilik Hizmetleri Tic AS

- Defacto Perakende Tic AS

- Koton Magazacilik Tekstil San ve Tic AS

- Civil Civil Giyim Tekstil Ürünleri Insaat Turizm Ve Kuyumculuk San Tic Ltd Sirketi

- Panco Giyim San ve Tic AS

- Nike Türkiye AS

- Demsa Ic ve Dis Ticaret AS

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Turkey Childrenswear Market Policies, Regulations, and Standards

4. Turkey Childrenswear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Turkey Childrenswear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Baby and Toddler Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Boys Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Girls Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Boys Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Girls Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Boys Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Girls Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Age Group

5.2.2.1. Infant/Toddler (Below 2 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Kids/Children (2 - 14 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Category

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Turkey Apparel Childrenswear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Turkey Footwear Childrenswear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Turkey Accessories Childrenswear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.LC Waikiki Magazacilik Hizmetleri Tic AS

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Defacto Perakende Tic AS

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Koton Magazacilik Tekstil San ve Tic AS

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Civil Giyim Tekstil Ürünleri Insaat Turizm Ve Kuyumculuk San Tic Ltd Sirketi

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Panco Giyim San ve Tic AS

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Za Giyim Ithalat Ihracat ve Ticaret Ltd Sti

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.H&M Hennes & Mauritz AB

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.adidas Spor Malzemeleri Satis ve Pazarlama AS

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Nike Türkiye AS

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Demsa Ic ve Dis Ticaret AS

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Age Group |

|

| By Price Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.