Australia Colour Cosmetics Market Report: Trends, Growth and Forecast (2026-2032)

Category (Eye Make-Up (Eye Liner/Pencil, Eye Shadow, Mascara, Others), Facial Make-Up (BB/CC Creams, Blusher/Bronzer/Highlighter, Foundation/Concealer, Powder, Others), Lip Products (Lip Gloss, Lip Liner/Pencil, Lipstick, Others), Nail Products (Nail Polish, Nail Treatments/Strengthener, Polish Remover, Others), Colour Cosmetics Sets/Kits), Price (Premium, Mass), Gender (Men, Women, Unisex), Packaging Type (Travel/Mini Size, Standard Size, Professional/Salon Size), Form (Creams/Gels, Lotions, Sprays, Solid, Others), Nature (Organic, Inorganic), Sales Channel (Retail Offline, Retail Online)

- FMCG

- Dec 2025

- VI0700

- 115

-

Australia Colour Cosmetics Market Statistics and Insights, 2026

- Market Size Statistics

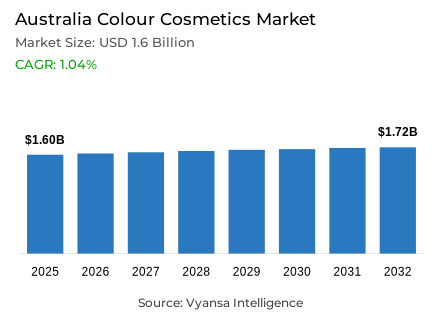

- Colour cosmetics in Australia is estimated at USD 1.6 billion in 2025.

- The market size is expected to grow to USD 1.72 billion by 2032.

- Market to register a cagr of around 1.04% during 2026-32.

- Category Shares

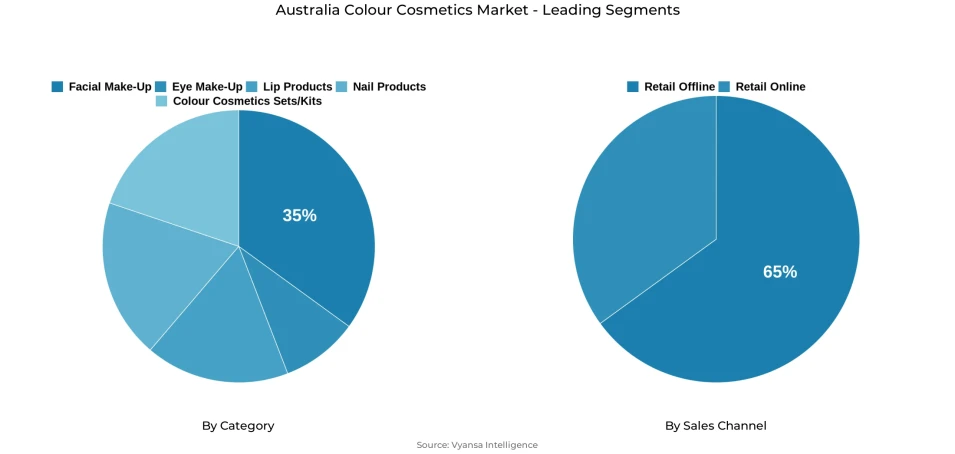

- Facial make-up grabbed market share of 35%.

- Competition

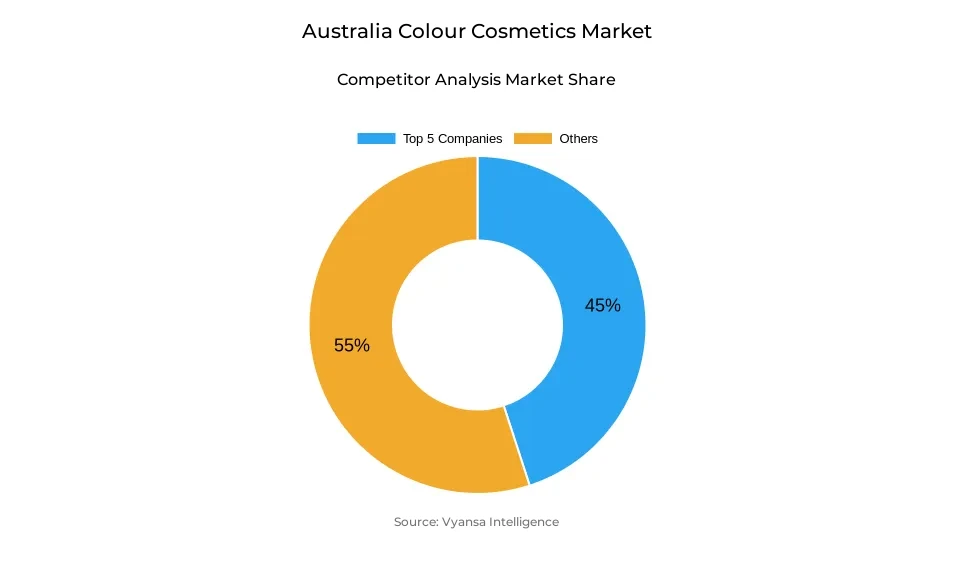

- More than 20 companies are actively engaged in producing colour cosmetics in Australia.

- Top 5 companies acquired around 45% of the market share.

- LVMH Perfumes & Cosmetics Group Pty Ltd; Chanel Australia Pty Ltd; Napoleon Perdis Cosmetics Pty Ltd; L'Oréal Australia Pty Ltd; Estée Lauder Pty Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 65% of the market.

Australia Colour Cosmetics Market Outlook

The Australia Colour Cosmetics Market is projected to grow from USD 1.6 billion in 2025 to USD 1.72 billion by 2032, reflecting a CAGR of 1.04%. After a strong rebound in 2023 and a period of stabilisation in 2024, the market is expected to shift toward steady, value-driven growth. Cost-of-living pressures will make end user more selective in their purchases, while product innovation will remain a key driver of industry momentum. Facial make-up, accounting for 35% of the market, will continue to be central because of rising demand for hybrid skincare-makeup solutions and ongoing social media influence. Meanwhile, lipcare will benefit from the continued “lipstick effect,” as end user favour small luxury items even in tight economic conditions.

Traditional retail will remain the dominant sales channel, holding 65% of total market share, supported by leading beauty specialists such as Mecca and Sephora. These retailers will continue to differentiate themselves through immersive store experiences, expert advice, and strong brand engagement. Supermarkets are also becoming more relevant, with loyalty programmes and accessible brands like MCoBeauty and e.l.f. Beauty gaining favour among value-driven shoppers. While e-commerce will stay important for product discovery and education, its growth will moderate as end user rebalance between online and in-store shopping post-pandemic.

Looking ahead, the market will see rising demand for multifunctional, wellness-oriented, and premium-textured formulations. Lip products are expected to be the fastest-growing segment through 2032 due to high replenishment rates and increasing interest in hybrid formulae featuring actives like hyaluronic acid, peptides, and SPF. Brands will need to connect emotionally with end user by offering products that combine performance with visible skin benefits.

Innovation will increasingly shape the competitive landscape, with AI-enabled tools, virtual try-on, and shade-matching technologies enhancing consumer experiences across channels. Growing expectations around clean beauty and sustainable packaging will further influence product development. Together, these trends will support a stable and resilient growth trajectory for Australia’s colour cosmetics market through 2032.

Australia Colour Cosmetics Market Growth Driver

Skinification and Multi-Tasking Formulations Driving Product Upgrades and Market Growth

Skinification and multi-tasking innovation are the major forces fueling the color cosmetics market in Australia. A range of skincare actives such as hyaluronic acids, peptides, SPF, and botanicals are being incorporated into foundation formulas, concealers, lip products, and glossing products because of the dual benefits they provide. By adding more value, these innovations are fueling upgrade purchases.

Local and global competitors, ranging from luxury brands and prestige product innovators to disruptors within mass markets, have engaged with hybrids and treatment-and-color product lines. The lipstick effect and product repurchase driven by lip goods have heightened these advancements and factors making lip goods relatively more resilient. By combining skinification and product functionality, there would be an overall market foundation enabling single-digit growth rates and generating additional value within an ongoing single transaction. Growth within makeup and makeup product innovation would be driven because it effectively and rewardingly suits rapid product development.

Australia Colour Cosmetics Market Challenge

Cost-of-living Pressure and Promotional Compression

Cost-of-living pressures and intense promotional activity are the primary challenges constraining australia colour cosmetics market. In 2024 end user rationalised discretionary spend and retailers amplified promotions, softening current-value growth and encouraging trading-down behaviour. Annual CPI inflation eased to 3.6% in the March 2024 quarter, according to the Australian Bureau of Statistics, yet ongoing price sensitivity reduced willingness to trade up—especially for higher-ticket facial make-up items that rely on perceived premium value.

This squeeze compressed margins and heightened launch risk for premium and niche innovations. Supermarkets and mass players leveraged value positioning, while beauty specialists had to defend price integrity through elevated experiences and exclusive assortments. Brands must therefore prioritise clear functional claims, demonstrable skin-care benefits, and compelling storytelling to justify price premiums otherwise, they risk margin erosion and share loss in a market where end user are increasingly selective. Strategic promotions should focus on trial and measurable long-term loyalty and retention metrics.

Australia Colour Cosmetics Market Trend

Shift Toward Hybrid Makeup With Skin-Health Benefits

A key trend influencing the color cosmetics market in Australia today is the rising trend of skinification and multi-correcting. Also known as skinperfecting or skin perfectors, these products have become increasingly sought after as end-use end user demand more from makeup products. Not only want they beautifying effects but also benefits for skin. As a result, multi-correcting products like tinted serums, peptide-based concealers, lip balms with high SPF, and foundations with hyaluronic would be highly sought after.

The recent focus on SPF within facial and lip products can be seen as very closely associated with an awareness about sun screen within Australia due to the fact that it is predicted that there will be about 18,964 new instances of melanoma among Australians by 2024, as stated by Cancer Australia. Hence, there is an emerging trend about products that address multiple benefits, with a focus on hydration and anti-aging properties.

Australia Colour Cosmetics Market Opportunity

Digital Personalisation, Ethical Positioning & New Formats

Digital personalisation, sustainability, and innovation have a large market appeal for brands wanting to gain market share and trade-up as market normalization occurs. Internet penetration stands at 97.1% within the 2023 population, and digital discovery, social commerce, and AI shade match make scalable appeal within an educated and trend-driven audience who will be willing to pay more due to targeted experiences.

Moreover, with the growing demand among end user for multi-use and skin-centric products, and an ever-increasing interest in SPF and eco-packaging, there will be opportunities for more premium hybrids, refill packaging, and open-ingredients product lines. Packages, sets, and experiences that clearly communicate benefits and efficacy—masterclasses, lab-proven efficacy statements, and shade testing will drive adoption and loyalty. At the same time, relaxing import restrictions will allow specialty and premium brands to fully enter specialist and supermarket retail, and vegan and cruelty-free third-party statements will offer more credibility and premium-orientation among value- and principle-driven end user.

Australia Colour Cosmetics Market Segmentation Analysis

By Category

- Eye Make-Up

- Facial Make-Up

- Lip Products

- Nail Products

- Colour Cosmetics Sets/Kits

The segment with highest market share under category is facial make-up, which claimed 35% market share. This category leads as end users remain drawn to products that enhance their skin tones and also offer additional benefits. The trend involving hybrids like foundation serums, moisturizer with tints, and concealer with active ingredients will attract more people due to its unique benefits that combine skin and color benefits.

During the forecast period, facial make-up is also set to maintain its leading position as market demand continues to turn towards multi-use and skin-friendly make-up. The influence of social media trends and make-up routines promoted on these platforms will continue to affect these market preferences as innovation from high-end and masstige make-up continues.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under sales channel is retail offline, which captured about 65% of share. Beauty experts, drugstores, and supermarkets continue to be main touch points at which women discover and experience color cosmetic products. Their value derives from the benefits of experiential retail and shade matching.

During the forecast period, retail offline will continue its leading position because of its high level of engagement, personalized service, and comprehensive merchandising offering. Although online shopping experiences growth, offline experiences like consultations and master classes will remain at the heart of buying. Its strength will lie in its capability to offer convenience and experiences associated with beauty.

List of Companies Covered in Australia Colour Cosmetics Market

The companies listed below are highly influential in the Australia colour cosmetics market, with a significant market share and a strong impact on industry developments.

- LVMH Perfumes & Cosmetics Group Pty Ltd

- Chanel Australia Pty Ltd

- Napoleon Perdis Cosmetics Pty Ltd

- L'Oréal Australia Pty Ltd

- Estée Lauder Pty Ltd

- Coty Australia Pty Ltd

- Revlon Australia Pty Ltd

- Nude by Nature Sales Pty Ltd

- Clarins Australia Pty Ltd

- Shiseido (Australia) Pty Ltd

Competitive Landscape

Since L'Oréal continued its overall leadership position in the colour cosmetics market in Australia as it consistently remained committed to its global portfolio and alignment with science-backed innovation and trend concepts such as skinification and multi-beauty. Nevertheless, L'Oréal's leadership position began to be increasingly disrupted by fast-moving and value-centric competitors, most notably MCoBeauty and e.l.f. Beauty, which capitalized on the ‘luxe-for-less’ trend and TikTok-driven viral phenomena to pull younger and price-advantageous shoppers into supermarkets and mass retail. L'Oréal's prestige brands, including Lancôme, YSL Beauty, and Urban Decay, were also disrupted on offer by trend-advocating alternatives within specialist retails featuring Mecca and Sephora. MCoBeauty remained the leading challenger brand, widely expanding within Woolworths and Big W stores and capitalizing on ‘dupe’ culture, cruelty-free assertions, and low price-value signals. Nevertheless, totality, fragmentation accelerated as a result of economic disruptors and new and divergent beauty demands and experiential buying.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Australia Colour Cosmetics Market Policies, Regulations, and Standards

4. Australia Colour Cosmetics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Australia Colour Cosmetics Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Eye Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Eye Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Eye Shadow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Mascara- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Facial Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. BB/CC Creams- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Blusher/Bronzer/Highlighter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Foundation/Concealer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Lip Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Lip Gloss- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Lip Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lipstick- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Nail Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Nail Polish- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Nail Treatments/Strengthener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Polish Remover- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Price

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Packaging Type

5.2.4.1. Travel/Mini Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Standard Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Professional/Salon Size- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Form

5.2.5.1. Creams/Gels- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Lotions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Sprays- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Solid- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Nature

5.2.6.1. Organic- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Inorganic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Australia Eye Make-Up Colour Cosmetics Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Australia Facial Make-Up Colour Cosmetics Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Australia Lip Products Colour Cosmetics Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Australia Nail Products Colour Cosmetics Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Australia Colour Cosmetics Sets/Kits Colour Cosmetics Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Price- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Gender- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. L'Oréal Australia Pty Ltd

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Estée Lauder Pty Ltd

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Coty Australia Pty Ltd

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Revlon Australia Pty Ltd

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Nude by Nature Sales Pty

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. LVMH Perfumes & Cosmetics Group Pty Ltd

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Chanel Australia Pty Ltd

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Napoleon Perdis Cosmetics Pty Ltd

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Clarins Australia Pty Ltd

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Shiseido (Australia) Pty Ltd

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Price |

|

| By Gender |

|

| By Packaging Type |

|

| By Form |

|

| By Nature |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.