Vietnam Ice Cream Market Report: Trends, Growth and Forecast (2025-2030)

By Category (Frozen Yoghurt, Impulse Ice Cream, Plant-based Ice Cream, Take-Home Ice Cream), By Leading Flavours (Chocolate, Vanilla, Strawberry, Cookies & Cream, Caramel, Mango, Pralines & Cream, Kulfi), By Format (Cup, Stick, Cone, Brick), By Sales Channel (Retail Offline, Retail E-Commerce)

- Food & Beverage

- Dec 2025

- VI0009

- 119

-

Vietnam Ice Cream Market Statistics and Insights, 2025

- Market Size Statistics

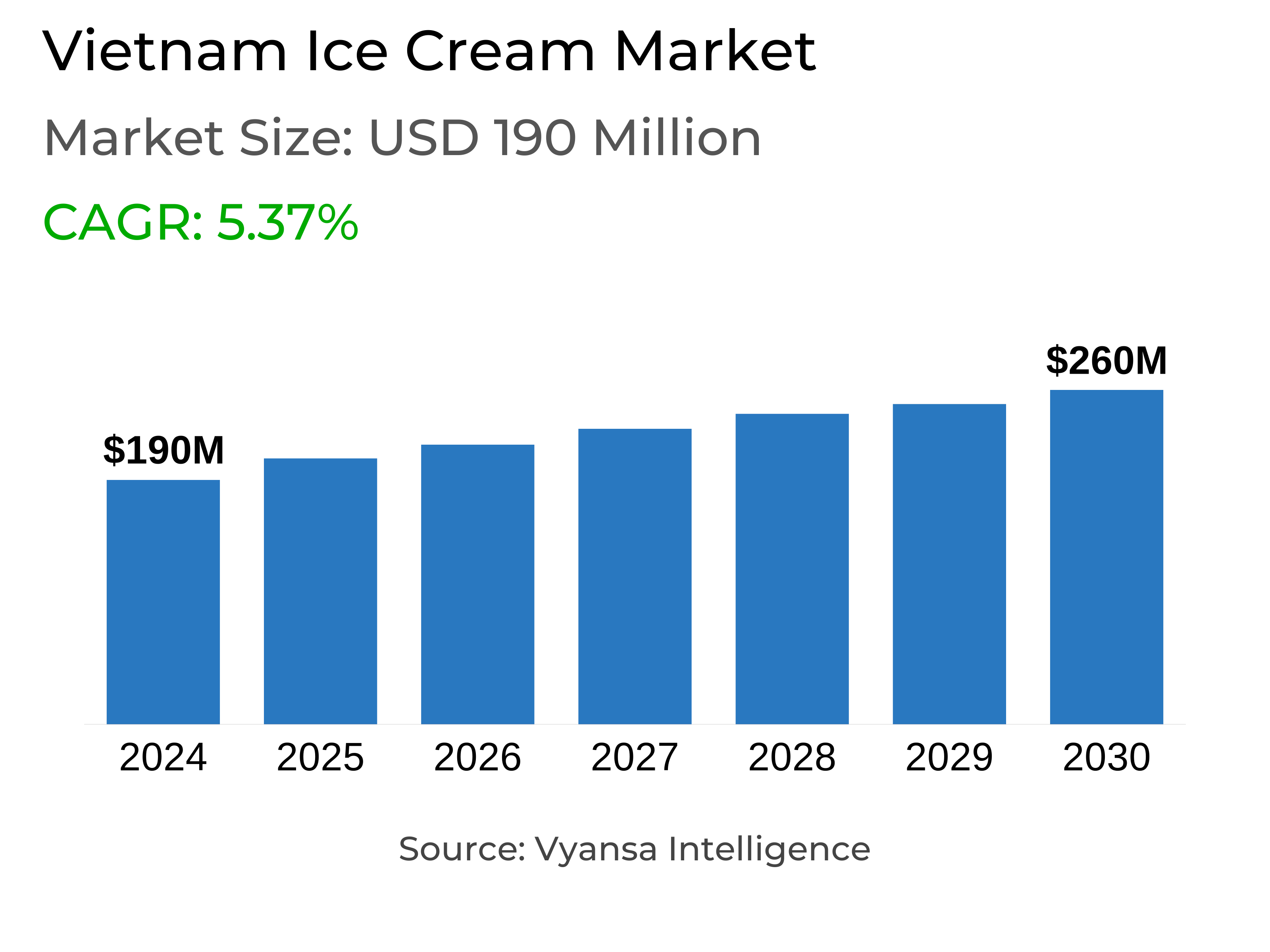

- Ice Cream in Vietnam is estimated at $ 190 Million.

- The market size is expected to grow to $ 260 Million by 2030.

- Market to register a CAGR of around 5.37% during 2025-30.

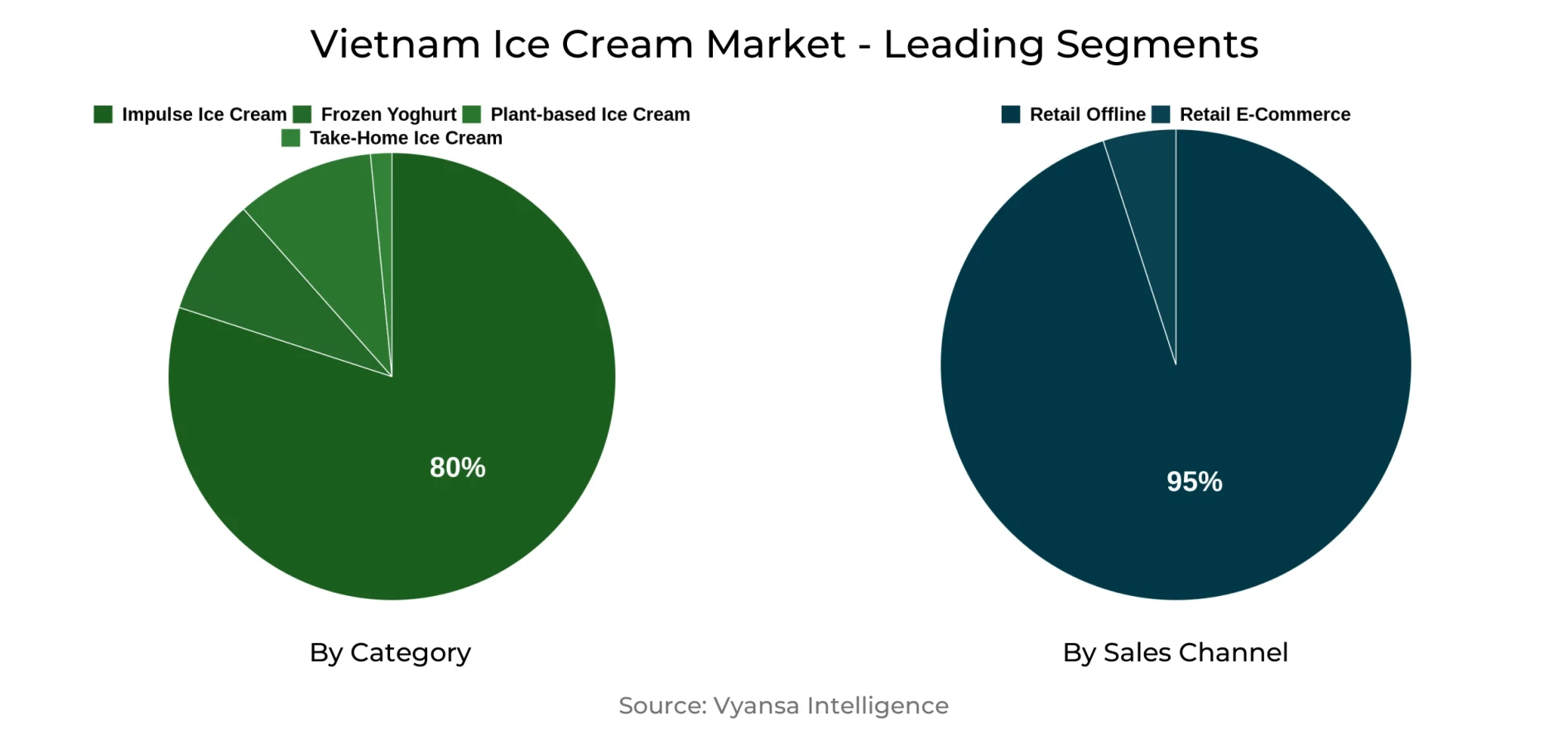

- Product Shares Shares

- Impulse Ice Cream grabbed market share of 80%.

- Impulse Ice Cream to witness a volume CAGR of around 6.99%.

- Competition

- More than 10 companies are actively engaged in producing Ice Cream in Vietnam.

- Top 5 companies acquired 80% of the market share.

- Nestlé Vietnam Co Ltd, TNC Consumer Goods JSC, Phan Nam Monterosa Trading JSC, Kido Group, Aice Yummy Vietnam Co Ltd etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 95% of the market.

Vietnam Ice Cream Market Outlook

In 2024, Vietnam's ice cream market crept back into positive retail volume growth, overcoming a number of residual challenges. Inflationary pressures remain influencing consumer behaviors, creating cost-conscious spending habits that deprioritize discretionary treats such as ice cream. Furthermore, ice cream's high sugar content goes against current health and wellness trends. The market also does not exist in terms of development in product lines like plant-based ice cream, frozen yoghurt, and ice cream desserts, restricting choice and variety for health or vegan consumers.

In spite of these challenges, innovation is a major strength. Operators are addressing the need for novel flavor experiences with the introduction of exotic and local flavors like black sugar pearl, blueberry, and watermelon. Market leader Kido Group uses its manufacturing sites to speed up development and bring products to market quickly. Its efforts, such as Merino Kool Kem Che Co Ba Saigon and Merino Xplus, reflect an approach of merging classic Vietnam flavors with ice cream.

Retail ice cream is confronted with intense competition from foodservice channels, with rapid-growing chains such as Mixue leading the way. This chain had in excess of 1,000 units at the close of 2023. Units sell soft serve at prices comparable to packaged ice cream, cutting into retail sales. Foodservice growth, tourism recovery, and hot weather are still driving total demand, though.

Single-serve dairy ice cream dominates the sector and will continue to grow as demand rises for convenient, on-the-go packaging. Although e-commerce is in its early stages, digital activation via social media such as TikTok and Zalo gives brands opportunities to connect with consumers and foster loyalty. The market will see better performance during the forecast period as economic and travel recovery accelerate.

Vietnam Ice Cream Market Growth Driver

Ice cream is anticipated to revert to higher sales during the forecast period, in accordance with the economic recovery and consumers' enhanced purchasing power. This will be backed by the continued foodservice channel recovery, together with anticipated high levels of tourism and the warm climate in the nation.

Vietnam Ice Cream Market Trend

End users of Vietnam are increasingly attracted to fresh, novel ice cream flavors as part of a wider interest in varied taste experiences within the snack category. In turn, major players are rolling out new, innovative variants that combine both foreign and traditional ingredients. Of particular note is the launch by Kido Group of Merino Kool Kem Che Co Ba Saigon, which combines a classic Vietnam sweet soup flavor with ice cream. The company previously introduced Merino Xplus, a red bean ice cream infused with white chocolate and brown rice for texture, in comfortable flavours such as durian, taro, red bean, and green bean. Kido's control of production plants allows for quicker product development, providing it an advantage in responding to changing consumer tastes. The trend captures a shift towards flavour discovery and cultural genuineness in Vietnam's ice cream market.

Vietnam Ice Cream Market Opportunity

Although e-commerce is still quite insignificant in the case for delivery of ice creams in Vietnam, internet sites offer a promising avenue for the players to improve brand exposure and customer interaction. Facebook and TikTok are being used actively to establish closer ties with the customers. Apart from this, merchants like 7-Eleven, conventional stores, and foodservice providers like restaurants are also increasingly leveraging digital platforms like Zalo and Grab to increase their presence in their local markets. An impressive one is that between TikTok and Kido Group, which resulted in the debut of a shopping entertainment channel in late 2023. The platform launched on TikTok in Vietnam, giving its users a combined experience of entertainment and shopping, while seeking to become an entertainment commercial hub for food reviews and fashion. The step reinforces the growing potential of online channels to drive brand image and consumption in the ice cream category.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 190 Million |

| USD Value 2030 | $ 260 Million |

| CAGR 2025-2030 | 5.37% |

| Largest Category | Impulse Ice Cream segment leads with 80% market share |

| Top Drivers | Rising Disposable Incomes Coupled with Tourism and Foodservice Channel Revival |

| Top Trends | Growing Preference for Innovative and Culturally Inspired Flavour Combinations |

| Top Opportunities | Expanding Digital Engagement and E-Commerce Integration through Social Platforms |

| Key Players | Nestlé Vietnam Co Ltd, TNC Consumer Goods JSC, Phan Nam Monterosa Trading JSC, Kido Group, Aice Yummy Vietnam Co Ltd, Unilever Vietnam International Co Ltd, Vietnam Dairy Products JSC (Vinamilk), Trang Tien Service & Trading Co Ltd, Thuy Ta JSC and Others. |

Vietnam Ice Cream Market Segmentation Analysis

The most penetrated segment in the Vietnam Ice Creams Market by market share is Impulse Ice Cream, which is chiefly propelled by the good performance of its subsegment—Single Portion Dairy Ice Cream. This subsegment is forecast to record healthy total volume sales growth throughout the forecast period, which will lead the category as a whole. Growth is inextricably tied to tourism recovery in Vietnam, and 2023 saw a significant increase in foreign tourist arrivals over the previous year. Yet, as tourist numbers fall short of pre-pandemic levels, the market retains further recovery potential. Moreover, the nation's warm climate continues to fuel demand for cool, palate-refreshing snacks such as ice cream. Consumers become more and more fond of on-the-go formats, such as single-serve cups, sticks, and cones, favoring the steady growth of impulse items in the market.

Top Companies in Vietnam Ice Cream Market

The top companies operating in the market include Nestlé Vietnam Co Ltd, TNC Consumer Goods JSC, Phan Nam Monterosa Trading JSC, Kido Group, Aice Yummy Vietnam Co Ltd, Unilever Vietnam International Co Ltd, Vietnam Dairy Products JSC (Vinamilk), Trang Tien Service & Trading Co Ltd, Thuy Ta JSC, etc., are the top players operating in the Vietnam Ice Cream Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Vietnam Ice Cream Market Policies, Regulations, and Standards

4. Vietnam Ice Cream Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Vietnam Ice Cream Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.1.2.By Volume in Million Litres

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Frozen Yoghurt- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.2. Impulse Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.2.1. Single Portion Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.2.2. Single Portion Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.3. Plant-based Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4. Take-Home Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.1. Take-Home Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.1.1. Bulk Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.1.2. Multi-Pack Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.2. Take-Home Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.2.1. Bulk Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.2.2. Multi-Pack Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.By Leading Flavours

5.2.2.1. Chocolate- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.2. Vanilla- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.3. Strawberry- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.4. Cookies & Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.5. Caramel- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.6. Mango- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.7. Pralines & Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.8. Kulfi- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.By Format

5.2.3.1. Cup- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.2. Stick- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.3. Cone- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.4. Brick- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.5. Others (Sandwich, Tub, etc.)- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1. Grocery Retailers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.1. Convenience Retailers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.1.1. Convenience Stores- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.1.2. Forecourt Retailers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.2. Supermarkets- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.3. Hypermarkets- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.4. Food & Drink Specialists- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.5. Small Local Grocers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.2. Retail E-Commerce- Market Insights and Forecast, 2020-2030, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Vietnam Frozen Yoghurt Ice Cream Market Outlook, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Volume in Million Litres

6.2. Market Segmentation & Growth Outlook

6.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

6.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

7. Vietnam Impulse Ice Cream Market Outlook, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.1.2.By Volume in Million Litres

7.2. Market Segmentation & Growth Outlook

7.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

7.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

8. Vietnam Plant-based Ice Cream Market Outlook, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.1.2.By Volume in Million Litres

8.2. Market Segmentation & Growth Outlook

8.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

8.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

9. Vietnam Take-Home Ice Cream Market Outlook, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.1.2.By Volume in Million Litres

9.2. Market Segmentation & Growth Outlook

9.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

9.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Kido Group

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Aice Yummy Vietnam Co Ltd

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Unilever Vietnam International Co Ltd

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Vietnam Dairy Products JSC (Vinamilk)

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Trang Tien Service & Trading Co Ltd

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Nestlé Vietnam Co Ltd

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. TNC Consumer Goods JSC

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Phan Nam Monterosa Trading JSC

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Thuy Ta JSC

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Fanny Vietnam Co Ltd

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Leading Flavours |

|

| By Format |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.