Chile Healthy Snacks Market Report: Trends, Growth and Forecast (2026-2032)

Category (Low/No Fat & Salt Snacks (Low Fat Snacks, No Fat Snacks, Low Salt Snacks, No Salt Snacks), Low/No Sugar & Caffeine Snacks (Low Sugar Snacks, No Sugar Snacks, No Added Sugar Snacks, No Caffeine Snacks), Allergy / Free-from / Specialized Diet Snacks (Gluten-Free Snacks, Dairy-Free Snacks, Lactose-Free Snacks, Hypoallergenic Snacks, Keto Snacks, Meat-Free Snacks, No Allergens Snacks, Plant-Based Snacks, Vegan Snacks, Vegetarian Snacks, Weight Management Snacks), Fortified / Nutrient-Enhanced Snacks (Good Source of Antioxidants Snacks, Good Source of Minerals Snacks, Good Source of Omega-3s Snacks, Good Source of Vitamins Snacks, High Fibre Snacks, High Protein Snacks, Probiotic Snacks, Superfruit Snacks), Health & Wellness-Oriented Snacks (Bone and Joint Health Snacks, Brain Health and Memory Snacks, Cardiovascular Health Snacks, Digestive Health Snacks, Energy Boosting Snacks, Immune Support Snacks, Skin Health Snacks, Vision Health Snacks), Natural Snacks, Organic Snacks), Product Type (Meat Snacks, Nuts, Seeds & Trail Mixes, Dried Fruit Snacks, Cereal & Granola Bars, Others), Packaging (Bag & Pouches, Boxes, Cans, Jars, Others), Sales Channel (Retail Offline, Retail Online)

- Food & Beverage

- Dec 2025

- VI0701

- 120

-

Chile Healthy Snacks Market Statistics and Insights, 2026

- Market Size Statistics

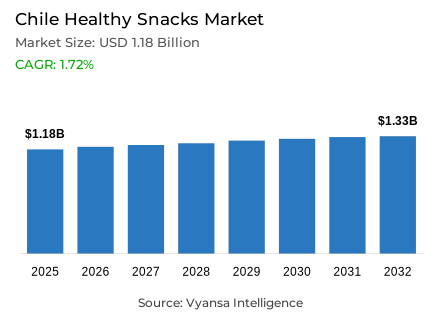

- Healthy snacks in Chile is estimated at USD 1.18 billion in 2025.

- The market size is expected to grow to USD 1.33 billion by 2032.

- Market to register a cagr of around 1.72% during 2026-32.

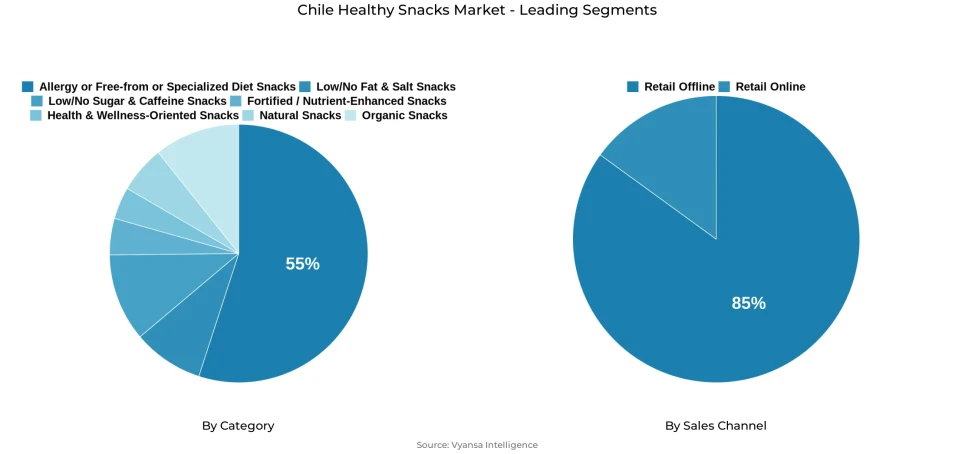

- Category Shares

- Allergy / free-from / specialized diet snacks grabbed market share of 55%.

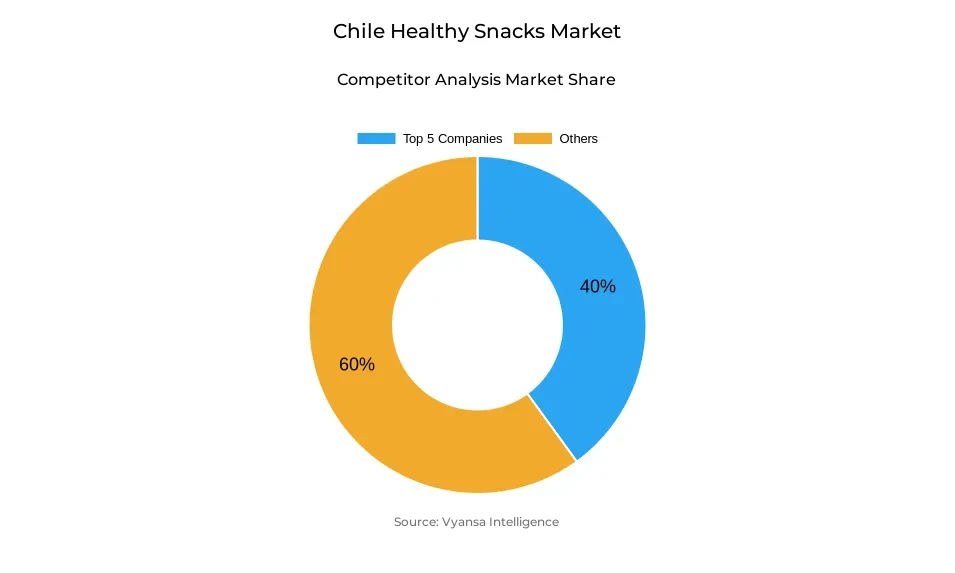

- Competition

- More than 10 companies are actively engaged in producing healthy snacks in Chile.

- Top 5 companies acquired around 40% of the market share.

- Bio-Zentrale Naturprodukte GmbH; ICB SA; Katjes Group; Nestlé SA; PepsiCo Inc etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Chile Healthy Snacks Market Outlook

The Chile Healthy Snacks Market was valued at USD 1.18 billion in 2025 and is projected to reach USD 1.33 billion at a CAGR of 1.72% from 2026-2032. The market will continue with a positive outlook as Chile end users grow more aware and interested in healthy food. The inflation pressures, despite which healthy snacking will be seen as indulgent treats for end users, will have no immediate effect on end-consumer demand and will instead drive a recovery as end users discretionary incomes improve and the stability of economies drives people back to healthy snacking.

Allergy / Free-from / Specialized Diet Snacks leads with around 55% market share due to rising sales of lactose-free and gluten-free food. Lactose intolerance affects about half of Chileans, and, as a result, there continues to be a demand for specialty lactose-free food like salty snacks, ice cream, and flavored biscuits. Additionally, there continues to be a demand for gluten-free food with various brands introducing novel food like quinoa and amaranth chips, fruit sticks, and rice food that is vegan and gluten-free.

The market will be driven in the long term due to the rising popularity of vegan, plant-based, and high-protein snacking. Chile end users are taking steps towards lowering the usage of animal-derived ingredients due to rising consciousness about animal welfare and sustainable living. Chip and ice cream brands NotCo and PepsiCo are capitalizing on these trends and introducing vegan and plant-based products within ice cream and salty snack food.

The Retail offline market still leads as a sales channel and represents approximately 85% market share. Nevertheless, retail online continues penetrating the market as people increasingly seek convenience and diversity. During the forecast period, health benefits like sugar-free, less fat, and natural will still be influencing product development and thus market growth as end users increasingly adopt healthy lifestyles.

Chile Healthy Snacks Market Growth DriverIncreasing Health Awareness and Food Habits among Chileans

Rising awareness about healthy living practices continues to fuel the demand for healthy snacking. As per the Ministry of Health, MINSAL, approximately 74.2% of Chile’s adult population is either obese or overweight. Moreover, approximately 32.6% of Chileans are at a high risk of heart disease due to inappropriate food consumption. All these factors have promoted healthier snacking demands with low calorie and fortified contents.

The 2024 National Food Consumption Survey (ENCA) shows that 61% of Chile end users follow consumption levels with respect to dietary quality, displaying specific tendencies toward vegetable and organic products. As a consequence, there is a trend among brands emphasizing healthy food with more protein, fibers, and nutrients, reflecting chile focus on health as a preventive practice. Urbanization and international standards are central drivers for changes within consumption.

Chile Healthy Snacks Market ChallengeInflation and Declining Purchasing Power Restrict Premium Snack Demand

Despite rising health consciousness, persistent inflation and broader economic pressures continue to constrain end-user uptake of premium snacking products. According to an annual statement given by the Central Bank of Chile in 2024, there is an inflation rate of 4.8%, thus lowering the disposable income among households. At the same time, it was shown that there is a 5.2% drop in discretionary food consumption.

To address market accessibility, product size has been reduced. Local ingredients will also be promoted. These measures will make healthy snacking accessible while still offering value. By balancing cost with innovation, people will be enabled to have healthy snacks.

Chile Healthy Snacks Market TrendShift Towards Plant Based, Lactose Free, and Gluten Free Snacks

Chile is witnessing a growing inclination toward plant-based, allergen-free snack formats, reflecting a broader shift in end-user preferences toward health-aligned product choices. According to Food and Agriculture Organization data, chile end users at an approximate rate of 22% indicate that they are either flexitarian or vegetarians. Simultaneously, approximately 48-50% of chile end users have shown some form of lactose intolerance, as estimated by MINSAL.

Gluten-free snack foods are also on an uptrend, driven by government-backed educative efforts about coeliac disease. The clean label movement, which stresses transparency and eco-friendly operations, continues to revolutionize the packed snack food category based on an ever-changing set of end users values.

Chile Healthy Snacks Market OpportunityExpanding Market for Lower Sugar, Functional, and Sustainable Snacks

Chile active regulatory and value shifts offer significant market opportunities. Because Chile began requiring compliance with the Law of Food Labelling and Advertising No. 20.606 in 2012, more than 83% of Chileans have looked at nutrition warning labels before buying packaged food products, leading to market opportunities for healthy no sugar, low sodium, and fat-free snack food products.

At the same time, ethical consumption becomes more mainstream, with the Ministry of the Environment estimating that 51% of Chileans cut back on animal-product food consumption as a form of support for sustainable aims. Consumption driven by vegan, high-protein, and eco-labeled snack food demand aligns with a healthy and ethical mind-set and presents an opportunity.

Chile Healthy Snacks Market Segmentation Analysis

By Category

- Low/No Fat & Salt Snacks

- Low/No Sugar & Caffeine Snacks

- Allergy / Free-from / Specialized Diet Snacks

- Fortified / Nutrient-Enhanced Snacks

- Health & Wellness-Oriented Snacks

- Natural Snacks

- Organic Snacks

The segment with highest market share under Category is Allergy/Free-from/Specialized Diet Snacks, with approximately 55% market share within the Chile Healthy Snacks Market. It consists of products that are either lactose-free, gluten-free, and vegan or plant-based. Given that about half of chile end users are either lactose intolerant or have some level of it, the market for these products keeps rising. Clean label products with features including no added sugar, lower salt option, and natural ingredients have emerged because more and more end-users are demanding healthier snacking options.

At the same time, local brands are innovating within this category with new product offerings based on ancient grains such as quinoa and amaranth. Also, the focus on digestive health, immunity, and low levels of allergens will help maintain this category at the top spot in 2032, as Chileans increasingly turn to healthy and clean practices.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under sales channels is retail offline, which constitutes almost 85% of share. Supermarkets, hypermarkets, and convenience stores act as major points of procurement for end-users who opt for immediate access to health-centric snacking options. Even after facing challenges from inflation, retail stores have emerged as leaders because they offer a broad product range, attractive prices, and preferences among users to check labels on packets.

Retail offline stores act as major launch platforms for local and foreign brands offering lactose-free, gluten-free, and plant-based snack food products. Private labels offered by large retailing enterprises like Cencosud Cuisine & Co have also boosted the retail offline platform with affordable yet healthy options. As Chileans remain committed to purchasing preferred products offline, this market share will remain at the leading position with no interruption.

List of Companies Covered in Chile Healthy Snacks Market

The companies listed below are highly influential in the Chile healthy snacks market, with a significant market share and a strong impact on industry developments.

- Bio-Zentrale Naturprodukte GmbH

- ICB SA

- Katjes Group

- Nestlé SA

- PepsiCo Inc

- Empresas Carozzi SA

- Ze Farms SA

- Productos SKS Farms Cia Ltda

- Lakshmi & Sons Ltd

- Santiveri SA

Competitive Landscape

Chile Healthy Snacks Market reflected an increasingly competitive landscape shaped by inflation-sensitive end users and rising health-consciousness. Arcor SAIC regained leadership in lactose-free snacks by aligning pricing with budget-conscious shoppers and maintaining dominance in lactose-free savoury biscuits through its Selz brand, while Nestlé SA remained strong in lactose-free ice cream and led gluten-free snacks with a 33% value share, driven by the popularity of its Savory and Baci lines. Domestic companies strengthened competition through affordable innovations and expanding private label offerings such as Cencosud’s Cuisine & Co. Premium local brands like Ecovida and Tika boosted visibility in gluten-free segments with natural, vegan, and no-added-sugar formulations. In the emerging keto segment, August Storck KG led via Werther’s Original, though rising competitors such as Lakshmi & Sons and Vimaroja SA are poised to erode share as keto innovation accelerates across salty snacks and confectionery.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Chile Healthy Snacks Market Policies, Regulations, and Standards

4. Chile Healthy Snacks Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Chile Healthy Snacks Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Low/No Fat & Salt Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Low Fat Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. No Fat Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Low Salt Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. No Salt Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Low/No Sugar & Caffeine Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Low Sugar Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. No Sugar Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. No Added Sugar Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. No Caffeine Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Allergy / Free-from / Specialized Diet Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Gluten-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Dairy-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lactose-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Hypoallergenic Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.5. Keto Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.6. Meat-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.7. No Allergens Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.8. Plant-Based Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.9. Vegan Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.10. Vegetarian Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.11. Weight Management Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Fortified / Nutrient-Enhanced Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Good Source of Antioxidants Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Good Source of Minerals Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Good Source of Omega-3s Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Good Source of Vitamins Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.5. High Fibre Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.6. High Protein Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.7. Probiotic Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.8. Superfruit Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Health & Wellness-Oriented Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.1. Bone and Joint Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.2. Brain Health and Memory Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.3. Cardiovascular Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.4. Digestive Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.5. Energy Boosting Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.6. Immune Support Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.7. Skin Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.8. Vision Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Natural Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Organic Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Product Type

5.2.2.1. Meat Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Nuts, Seeds & Trail Mixes- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Dried Fruit Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Cereal & Granola Bars- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Packaging

5.2.3.1. Bag & Pouches- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Boxes- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Jars- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Chile Low/No Fat & Salt Snacks Healthy Snacks Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Chile Low/No Sugar & Caffeine Snacks Healthy Snacks Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Chile Allergy / Free-from / Specialized Diet Snacks Healthy Snacks Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Chile Fortified / Nutrient-Enhanced Snacks Healthy Snacks Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Chile Health & Wellness-Oriented Snacks Healthy Snacks Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Packaging- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Chile Natural Snacks Healthy Snacks Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Packaging- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Chile Organic Snacks Healthy Snacks Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Packaging- Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. Nestlé SA

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. PepsiCo Inc

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Empresas Carozzi SA

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Ze Farms SA

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. Productos SKS Farms Cia Ltda

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. Bio-Zentrale Naturprodukte GmbH

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. ICB SA

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Katjes Group

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Lakshmi & Sons Ltd

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Santiveri SA

13.1.10.1.Business Description

13.1.10.2.Product Portfolio

13.1.10.3.Collaborations & Alliances

13.1.10.4.Recent Developments

13.1.10.5.Financial Details

13.1.10.6.Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Product Type |

|

| By Packaging |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.