Spain Beer Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Dark Beer (Ale, Sorghum Beer, Weissbier/Weizen/Wheat Beer), Lager (Flavoured/Mixed Lager, Standard Lager (Premium Lager (Domestic Premium Lager, Imported Premium Lager), Mid-Priced Lager (Domestic Mid-Priced Lager, Imported Mid-Priced Lager), Economy Lager (Domestic Economy Lager, Imported Economy Lager))), Non/Low Alcohol Beer (Low Alcohol Beer, Non Alcoholic Beer), Stout, Others (Porter, Malt etc.)), Production (Macro Brewery, Micro Brewery, Craft Brewery), Packaging Type (Bottles, Cans, Others), Sales Channel (On-Trade, Off-Trade)

- Food & Beverage

- Dec 2025

- VI0704

- 110

-

Spain Beer Market Statistics and Insights, 2026

- Market Size Statistics

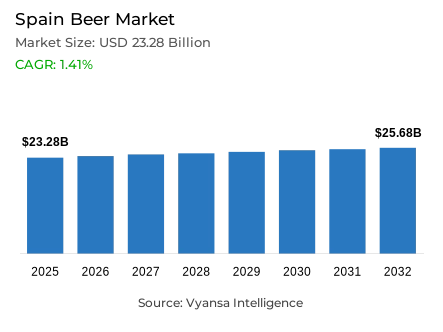

- Beer in Spain is estimated at USD 23.28 billion in 2025.

- The market size is expected to grow to USD 25.68 billion by 2032.

- Market to register a cagr of around 1.41% during 2026-32.

- Product Type Shares

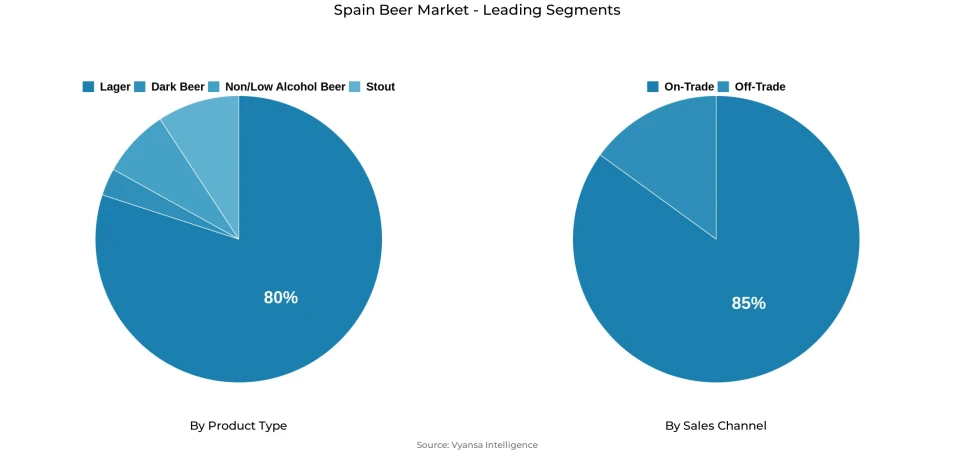

- Lager grabbed market share of 80%.

- Lager to witness a volume cagr of around 0.63%.

- Competition

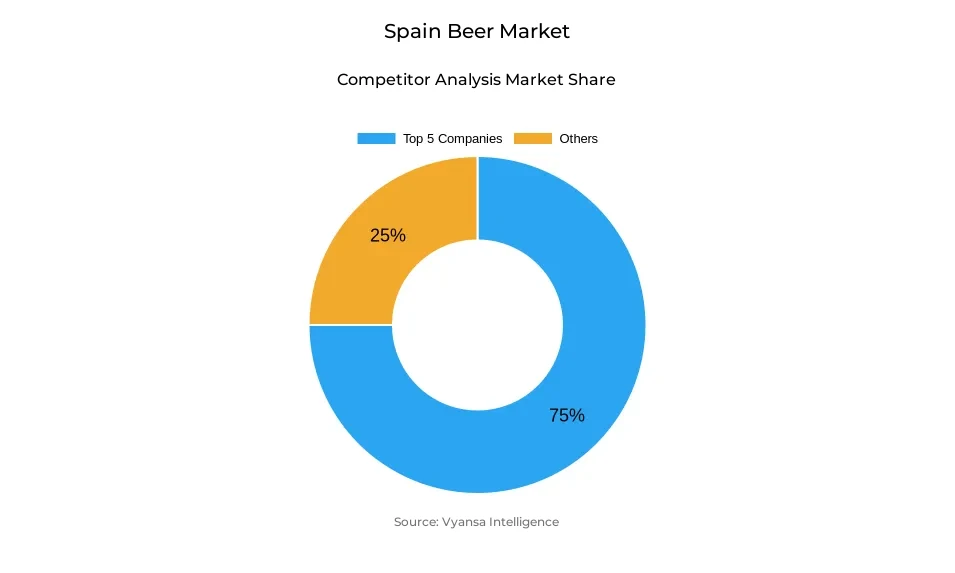

- More than 15 companies are actively engaged in producing beer in Spain.

- Top 5 companies acquired around 75% of the market share.

- Mercadona SA; Cía Cervecera de Canarias SA (Cercasa); La Zaragozana SA; Mahou SA; Heineken España SA etc., are few of the top companies.

- Sales Channel

- On-trade grabbed 85% of the market.

Spain Beer Market Outlook

The Spain beer market had a value of $23.28 billion in 2025 is expected to grow to $ 25.68 Billion by 2032 with a CAGR of around 1.41% during 2026–2032. The growth will be steady because of Spain's healthy beer culture, increasing tourism, and continuing innovations in non/low-alcohol beverages. Yet, growing concern for health and responsible drinking among the younger population is poised to redefine the conventional consumption scenario, with the end user looking for moderation over volume.

Lager, which comprises almost 80% of overall beer sales, will be the volume driver, with a volume CAGR of approximately 0.63% over the forecast period. In this category, mainstream and mid-range lagers like Estrella Damm, Cruzcampo, Mahou Clasica, and San Miguel Especial will remain widely popular, whereas premium offerings like Heineken and Estrella Galicia will appeal to health-oriented but experience-oriented end users. The increasing take-up of non/low-alcohol beers, spearheaded by developments like San Miguel 0,0 and El Águila Sin Filtrar 0.0, will also underpin category diversification.

The industry is still extremely concentrated, with the leading five firms taking about 75% of overall share. Major brewers like Mahou SA and Heineken España SA are scaling up sustainable production and portfolio growth to respond to changing end-user demands. Initiatives for renewable power, reusable packaging, and lower carbon emissions are also likely to enhance brand equity and long-term development.

The on-trade channel dominates this segment, with almost 85% of total beer sales coming from the thriving hospitality industry and strong tourist numbers in Spain. Beer remains integral to social and leisure occasions, with a growing number of bars and restaurants contributing to continued end users use of beer. There are additional growth prospects in the future for beer in Spain, as end users enjoy more flavoured, low-alcohol, and functional beers, establishing Spain as a key market in Western Europe for innovation in beers.

Spain Beer Market Growth DriverDominant Cultural and Social Drinking Patterns Facilitating Beer Use

In Spain beer market continues to be a focal point of social and cultural life as it has become established in everyday event and tradition. Beer drinking is ordinary and habitual, it serves a purpose not just for a special occasion nor is it unique to certain situations, it is an ongoing ritual of social interaction either while eating, during events or generally when being social with friends or family regularly. This cultural disposition toward beer serves to normalize its consumption across the nation among all age groups, and local events and festivals help to establish beer as a uniting drink.

The outdoor culture in Spain also enhances the opportunity for social alcohol consumption, as beer is often enjoyed as a cool drink to ease the hot weather conditions. The social custom of shared drinking continues to be a vital component of Spanish culture, which keeps the demand in the market going. This is why breweries continue to gain from the deeply ingrained practices that make beer an elemental component of cultural and social life.

Spain Beer Market TrendShift Towards Healthier and Mindful Drinking Habits

Growing focus on health and wellness is prompting end users in Spain to become more mindful of their alcohol intake, encouraging a shift toward lighter and low-alcohol beer options. This trend is quite evident among the younger generations who are focusing on wellness and moderation. Increasing awareness of the health hazards of alcohol consumption has prompted end users to look at non-alcoholic and low-alcohol beers that fit into wellness-driven choices. Consequently, Spain emerged as one of the strongest markets in Western Europe for non-alcoholic beer with robust end users acceptance and increased distribution across retail and on-trade channels.

This sustained evolution mirrors how health-aware tendencies are remodeling conventional drinking habits. Beer companies are addressing this by producing lighter, low-ABV, and functional beer options that deliver the same level of refreshment and flavour sensation without the compromise on taste. This lifestyle-influenced redefinition is further changing beer drinking habits in Spain.

Spain Beer Market OpportunityInnovation and Product Experimentation to Drive Future Growth

Innovation in Beer-making and experimentation with flavours are likely to offer sound growth prospects during the forecast period. Spanish breweries are investing in the development of new products, with a focus on flavoured, non-alcoholic, and functional beers addressing changing end-user consumption patterns. With wellness and mindful drinking catching up, brewers will tend to launch products that link health benefits with creativity, including low-calorie recipes, herbal infusions, and fruit-based flavors. These innovations serve to maintain the old drinkers while gaining new segments looking for varied and responsible drinking.

As the pace of innovation increases, Spain breweries will use research and green brewing methods to enhance product attractiveness. Branding will be enhanced through trials of natural ingredients, reduced carbonation, and unique tastes. This emphasis on innovation will provide new opportunities for differentiation and long-term expansion in the Spain Beer Market.

Spain Beer Market Segmentation Analysis

By Product Type

- Dark Beer

- Lager

- Non/Low Alcohol Beer

- Stout

The segment with highest market share under Product Type is Lager, with a share of around 80% in the Spain Beer Market. Lager maintains its leading position thanks to its strong popularity base and extensive availability in various price segments—premium, mid-price, and economy. Mahou Cinco Estrellas, Estrella Galicia, and Cruzcampo brands have established deep customer loyalty among final end users by ensuring consistent quality and local roots. Rising numbers of premium and craft lagers also make the segment attractive, particularly among young end users looking for unique flavours and improved drinking experience.

The long-term preference for lager is also aided by the fact that it is versatile and well-suited to both everyday and social consumption. The breweries keep innovating in this category with lighter, easy-drinking varieties well-suited to Spain sunny weather and changing consumption patterns. With a volume CAGR of amost 0.63% on a steady basis, lager will continue to maintain its leadership position in the forecast period.

By Sales Channel

- On-Trade

- Off-Trade

The segment with highest market share under Sales Channel is On-Trade, with a share of around 85% of the Spain Beer Market. Beer drinking in restaurants, bars, and cafés is still firmly entrenched in Spanish culture, where drinking is a part of everyday life. The success of the tourism industry continues to reinforce the On-trade channel since tourists often consume local brews and premium beers in hospitality venues.

The robust performance of on-trade sales is underpinned, too, by brewers partnerships with hospitality outlets, off-trade-only promotions, and the expanding popularity of non/low-alcohol beers on tap. Beer generates high levels of turnover in pubs, particularly smaller ones, a testament to its continued relevance in the hospitality economy of the country. As Spain's tourist and leisure economy continue to grow, the on-trade channel will be an important driver of growth for the beer market.

List of Companies Covered in Spain Beer Market

The companies listed below are highly influential in the Spain beer market, with a significant market share and a strong impact on industry developments.

- Mercadona SA

- Cía Cervecera de Canarias SA (Cercasa)

- La Zaragozana SA

- Mahou SA

- Heineken España SA

- Damm SA

- Hijos de Rivera SA

- Centros Comerciales Carrefour SA

- Eroski, Grupo

- GModelo Europa SA

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Spain Beer Market Policies, Regulations, and Standards

4. Spain Beer Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Spain Beer Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.1.2.By Quantity Sold in Million Litres

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Dark Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Ale- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Sorghum Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Weissbier/Weizen/Wheat Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Flavoured/Mixed Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Standard Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.1. Premium Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.1.1. Domestic Premium Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.1.2. Imported Premium Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.2. Mid-Priced Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.2.1. Domestic Mid-Priced Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.2.2. Imported Mid-Priced Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.3. Economy Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.3.1. Domestic Economy Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.3.2. Imported Economy Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Non/Low Alcohol Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Low Alcohol Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Non Alcoholic Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Stout- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Others (Porter, Malt etc.) - Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Production

5.2.2.1. Macro Brewery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Micro Brewery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Craft Brewery- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Packaging Type

5.2.3.1. Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Cans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. On-Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Off-Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Spain Dark Beer Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Quantity Sold in Million Litres

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Production- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Spain Lager Beer Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.1.2.By Quantity Sold in Million Litres

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Production- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Spain Non/Low Alcohol Beer Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.1.2.By Quantity Sold in Million Litres

8.2. Market Segmentation & Growth Outlook

8.2.1.By Production- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Spain Stout Beer Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.1.2.By Quantity Sold in Million Litres

9.2. Market Segmentation & Growth Outlook

9.2.1.By Production- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Mahou SA

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Heineken España SA

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Damm SA

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Hijos de Rivera SA

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Centros Comerciales Carrefour SA

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Mercadona SA

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Cía Cervecera de Canarias SA (Cercasa)

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. La Zaragozana SA

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Eroski, Grupo

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. GModelo Europa SA

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Production |

|

| By Packaging Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.