Canada Healthy Snacks Market Report: Trends, Growth and Forecast (2026-2032)

Category (Low/No Fat & Salt Snacks (Low Fat Snacks, No Fat Snacks, Low Salt Snacks, No Salt Snacks), Low/No Sugar & Caffeine Snacks (Low Sugar Snacks, No Sugar Snacks, No Added Sugar Snacks, No Caffeine Snacks), Allergy / Free-from / Specialized Diet Snacks (Gluten-Free Snacks, Dairy-Free Snacks, Lactose-Free Snacks, Hypoallergenic Snacks, Keto Snacks, Meat-Free Snacks, No Allergens Snacks, Plant-Based Snacks, Vegan Snacks, Vegetarian Snacks, Weight Management Snacks), Fortified / Nutrient-Enhanced Snacks (Good Source of Antioxidants Snacks, Good Source of Minerals Snacks, Good Source of Omega-3s Snacks, Good Source of Vitamins Snacks, High Fibre Snacks, High Protein Snacks, Probiotic Snacks, Superfruit Snacks), Health & Wellness-Oriented Snacks (Bone and Joint Health Snacks, Brain Health and Memory Snacks, Cardiovascular Health Snacks, Digestive Health Snacks, Energy Boosting Snacks, Immune Support Snacks, Skin Health Snacks, Vision Health Snacks), Natural Snacks, Organic Snacks), Product Type (Meat Snacks, Nuts, Seeds & Trail Mixes, Dried Fruit Snacks, Cereal & Granola Bars, Others), Packaging (Bag & Pouches, Boxes, Cans, Jars, Others), Sales Channel (Retail Offline, Retail Online)

- Food & Beverage

- Dec 2025

- VI0696

- 110

-

Canada Healthy Snacks Market Statistics and Insights, 2026

- Market Size Statistics

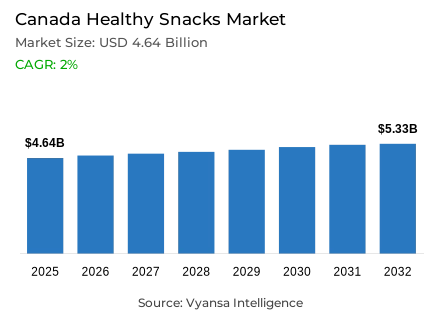

- Healthy snacks in Canada is estimated at USD 4.64 billion in 2025.

- The market size is expected to grow to USD 5.33 billion by 2032.

- Market to register a cagr of around 2% during 2026-32.

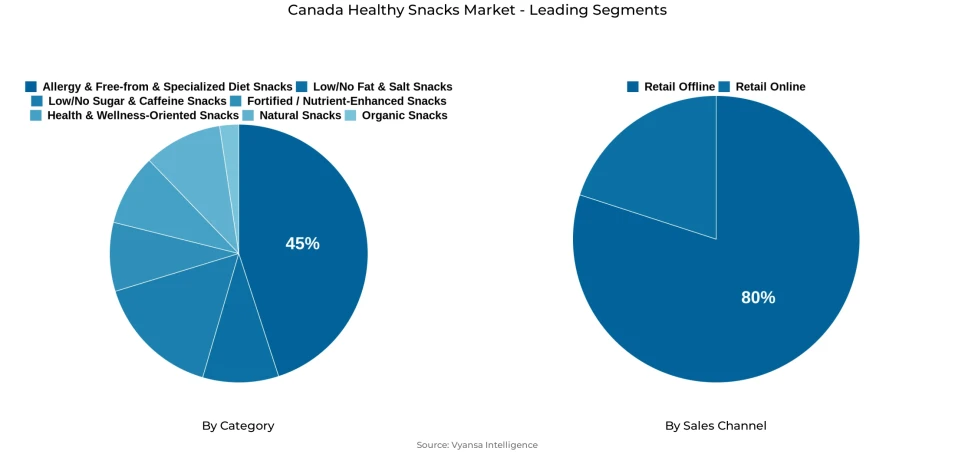

- By Category Shares

- Allergy / free-from / specialized diet snacks grabbed market share of 45%.

- Competition

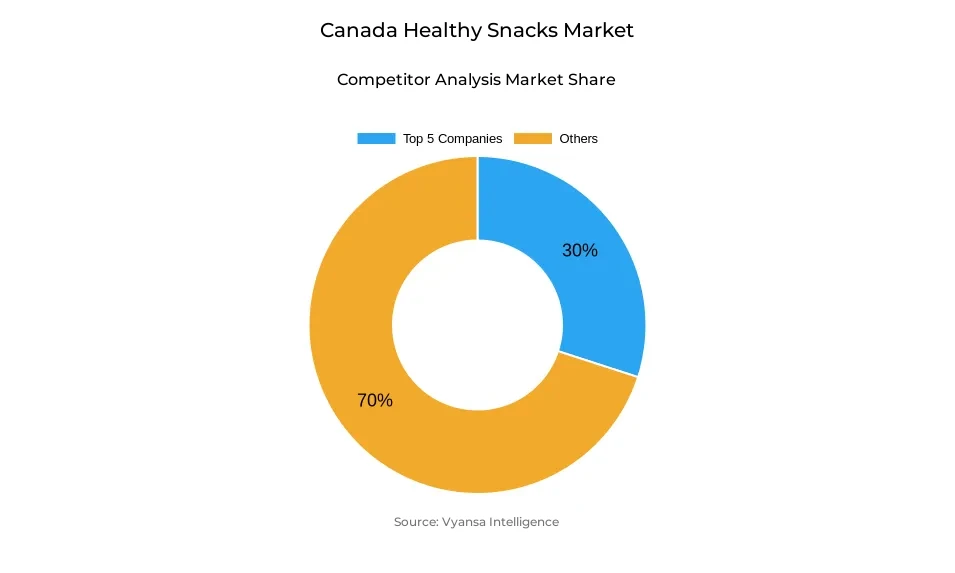

- More than 10 companies are actively engaged in producing healthy snacks in Canada.

- Top 5 companies acquired around 30% of the market share.

- Unilever Group; Riverside Natural Foods Ltd; General Mills Inc; PepsiCo Inc; Chocoladefabriken Lindt & Sprüngli AG etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 80% of the market.

Canada Healthy Snacks Market Outlook

The Canada Healthy Snacks Market was valued at USD 4.64 billion in 2025 and is predicted to reach USD 5.33 billion by 2032, registering a CAGR of approximately 2% during 2026 and 2032. The healthy snacking market will continue with its high growth due to a heightened interest among people for better for you food and beverages because of a growing understanding about weight management and health problems associated with rising obesity. Moreover, more than two-thirds of Canadians are either overweight or obese, thus fueling demand for healthy snacks with low sugar content, low fat, and high-protein ingredients. As a response to these emerging demands, healthier product offerings like vegan chocolates, high-protein ice cream, and vegetable chips are appearing on shelves.

Allergy / Free-from / Specialized Diet Snacks comprise the biggest market share at approximately 45%, driven primarily by a growing interest in gluten-free, plant-based, and vegan. The market for gluten-free snacking, which reached approximately CAD 1.7 billion in 2023, will remain predominant, most notably for savory and salty products. Companies such as PepsiCo, with gluten-free Lays, and better-for-you start-ups Wholesome Bar and Healthy Crunch are satisfying health-conscious shoppers with natural, high fibre, and additive-free ingredients due to rising numbers of flexitarian and food-intolerant shoppers.

The upcoming food labeling regulation, due to be introduced by 2026, will impact the market as it will be law that requires warning labels be put on food with excessive sugar, salt, and saturated fat. Although it may be a challenge for smaller brands as it will raise compliance costs, it will encourage the adoption of clean labels. Already, there is a high demand for clean labels with added benefits like vitamins and proteins.

Retail Offline accounts for approximately 80% market share. However, with an increase in demands for convenience and variety, online retailing soon followed. Looking ahead, some product trends that would include gluten-free, plant-based, and low/no sugar snacking will continue. It will be a result of an ever-growing favor for healthy snacking practices across Canada.

Canada Healthy Snacks Market Growth DriverIncreasing Health Awareness and Weight Regulation Focus

Health consciousness and weight control remain major drivers for the health and wellness snack category within the Canada market. As per Statistics Canada, 68% of Canadians were classified as being either obese or overweight within the age group 18-79 years as of 2022-2024, up from 60% before the pandemic. Not surprisingly, as a result of a more health-conscious focus, demands for healthier snacking alternatives have driven growth. Even after the pandemic, there continues to be a heightened interest in snacking at home, with an emphasis on healthier nutrition and greater wellness.

Functional foods offering energy and immunity benefits are also being increasingly sought after. Health and nutrition guidelines offered by Health Canada are promoting consumption limits on sugar, saturated fats, and sodium, thus encouraging healthier snacking practices among Canadians. It presents an opportunity for snack food manufacturers to develop healthier snack food products that fulfill health and nutrition goals. Health and nutrition-minded consumption trends are altering snack food consumption preferences among various demographics.

Canada Healthy Snacks Market ChallengeRegulatory and Cost Pressures from Labelling Legislation

Evolving regulatory requirements in Canada present significant operational and compliance challenges for snack food manufacturers, affecting formulation, labeling, and market adaptability. Beginning from January 2026, food packaging will be required to have front of package nutrition labels warning against food products with high sugar, sodium, and saturated fatty acids, as made mandatory by Health Canada. Healthier ingredients, including organic and plant-based ingredients, will be more expensive on the other hand, price-conscious end users will be more resistant to purchasing at higher costs either new or healthier versions.

Companies will have to walk a tightrope on compliance, cost of ingredients, and affordability if they are to maintain market share and competitivity. It will cost a great deal to adapt production processes and research and develop new products that comply with standards. Those who make changes ahead of emerging health demands will be better poised to reap market rewards.

Canada Healthy Snacks Market TrendShift towards Plant-based, Organic, and Functional Snacks

Plant-based, organic, and functional snack food consumption is on an uptrend in the Canada market. According to major research with key end users 15% of Canadians are flexetarians, 4% are vegetarians, and 2% are vegan, clearly indicating a rising trend towards consuming more plant-based food. Food consumption, ranging from gluten-free, dairy-free, and vegan food, will continue on a mainstream trend within the Canada market. Functional snack food, like energy-boosting bars and fibrewise biscuits, will remain attractive to Canada who favor a healthy diet for healthy living.

It also identifies factors that relate to health and sustainability issues, as more and more people with health consciousness turn to eco-friendly and healthier vegan alternatives. Studies have shown that today, more and more people value more healthy food with added functionalities like protein, fibers, and superfoods. The convergence of market and sustainability goals will drive the market with more brands responding with enhancements in product offerings and improvements.

Canada Healthy Snacks Market OpportunityBroadening Immune-Boosting Snack Range

There is a great opportunity for growth within the health and wellness snack market in Canada. As a result of the pandemic, Canadians end users have shown an interest in enhancing overall health and boosting immunity. There is an increase in the demand for healthy food and nutrition among Canadians. End users are looking for healthy snacking options.

Immunity-boosting ingredients like protein, fibers, vitamins, and minerals, as well as superfoods like chia seeds, flaxseeds, and goji berries, added as fortified elements within snack food brands have immense market scope among the ever-growing end users base demanding immunity-boosting and energy-boosting food products. Smaller brands have already capitalized on online business and larger brands are introducing innovative products. Immunity-boosting food products are set to emerge as a highly attractive area for growth within the forecast period based on growing end users awareness.

Canada Healthy Snacks Market Segmentation Analysis

By Category

- Low/No Fat & Salt Snacks

- Low/No Sugar & Caffeine Snacks

- Allergy / Free-from / Specialized Diet Snacks

- Fortified / Nutrient-Enhanced Snacks

- Health & Wellness-Oriented Snacks

- Natural Snacks

- Organic Snacks

The segment with highest market share under category is allergy/free-from/specialized diet snacks, with approximately 45% market share within the Canada Healthy Snacks Market. Allergy/Free-from/Specialized Diet Snacks comprise gluten-free, dairy-free, plant-based, and special snack food products that are targeted at end-consumers with dietary restrictions and health preferences. Rising awareness among Canadians pertaining to food allergies and weight control has driven the demand for these products.

In this category, gluten-free and snack bars have the leading value share because they not only offer health benefits but are easy to digest as well. Companies have introduced these products with high protein and low sugar content and fortified with healthy ingredients like chia, flax, and coconut. Moreover, consumers getting attracted towards more and more vegan products have given an uninterrupted leading role to these products.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under Sales Channel is retail offline, with a share of approximately 80% in the Canada Healthy Snacks Market. Supermarkets, hypermarkets, and convenience stores remain the main Sales Channels channels for healthy food options, as they provide immediate availability and a product offering for end users. The offline platform will offer opportunities for product trials as end users are in a position to examine labels and ingredients, which act as a determinant for health-seeking end users.

Although Retail online continues to gain popularity, retail offline still leads the market because it is more convenient compared to online stores for daily snacking and bulk purchases. A major brand benefits from special product sections and bundled promotions at offline retailing stores and thus ensures that retail offline leads the market as a prime driver for healthy snacking sales in Canada.

List of Companies Covered in Canada Healthy Snacks Market

The companies listed below are highly influential in the Canada healthy snacks market, with a significant market share and a strong impact on industry developments.

- Unilever Group

- Riverside Natural Foods Ltd

- General Mills Inc

- PepsiCo Inc

- Chocoladefabriken Lindt & Sprüngli AG

- Ferrero & Related Parties

- The PUR Co Inc

- Kerr Bros Ltd

- Mondelez International Inc

- Danone Groupe

Competitive Landscape

The competitive landscape in Canada’s health and wellness snacks market in 2023 reflects rising demand for better-for-you products, enabling niche innovators to challenge long-established multinationals. While major players such as Nestlé, Unilever, General Mills, Mondelez, and PepsiCo continue to dominate categories like frozen desserts, sweet biscuits and savoury snacks, they are increasingly pressured by emerging brands positioning around gluten free, plant-based, high-protein, and low-sugar claims. PepsiCo maintains leadership in gluten free salty snacks through its strong Lay’s portfolio, while new entrants such as Peacasa, Paramo Good Chips, Hippie Snacks, and functional brands like Wholesome Bar, Healthy Crunch, and Better Chocolate expand consumer choices with cleaner labels and added nutritional benefits. In energy-boosting snacks, Dare Foods leads, followed by fast-rising competitors like Wellness Natural, reflecting shifting consumer interest toward functional, protein-rich, and high-fibre formulations that support satiety and active lifestyles.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Canada Healthy Snacks Market Policies, Regulations, and Standards

4. Canada Healthy Snacks Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Canada Healthy Snacks Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Low/No Fat & Salt Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Low Fat Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. No Fat Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Low Salt Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. No Salt Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Low/No Sugar & Caffeine Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Low Sugar Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. No Sugar Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. No Added Sugar Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. No Caffeine Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Allergy / Free-from / Specialized Diet Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Gluten-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Dairy-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lactose-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Hypoallergenic Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.5. Keto Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.6. Meat-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.7. No Allergens Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.8. Plant-Based Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.9. Vegan Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.10. Vegetarian Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.11. Weight Management Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Fortified / Nutrient-Enhanced Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Good Source of Antioxidants Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Good Source of Minerals Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Good Source of Omega-3s Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Good Source of Vitamins Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.5. High Fibre Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.6. High Protein Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.7. Probiotic Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.8. Superfruit Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Health & Wellness-Oriented Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.1. Bone and Joint Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.2. Brain Health and Memory Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.3. Cardiovascular Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.4. Digestive Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.5. Energy Boosting Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.6. Immune Support Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.7. Skin Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.8. Vision Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Natural Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Organic Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Product Type

5.2.2.1. Meat Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Nuts, Seeds & Trail Mixes- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Dried Fruit Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Cereal & Granola Bars- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Packaging

5.2.3.1. Bag & Pouches- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Boxes- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Jars- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Canada Low/No Fat & Salt Snacks Healthy Snacks Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Canada Low/No Sugar & Caffeine Snacks Healthy Snacks Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Canada Allergy / Free-from / Specialized Diet Snacks Healthy Snacks Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Canada Fortified / Nutrient-Enhanced Snacks Healthy Snacks Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Canada Health & Wellness-Oriented Snacks Healthy Snacks Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Packaging- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Canada Natural Snacks Healthy Snacks Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Packaging- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Canada Organic Snacks Healthy Snacks Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Packaging- Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. PepsiCo Inc

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. Chocoladefabriken Lindt & Sprüngli AG

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Ferrero & related parties

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. PUR Co Inc

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. Kerr Bros Ltd

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. Unilever Group

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. Riverside Natural Foods Ltd

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. General Mills Inc

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Mondelez International Inc

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Danone Groupe

13.1.10.1.Business Description

13.1.10.2.Product Portfolio

13.1.10.3.Collaborations & Alliances

13.1.10.4.Recent Developments

13.1.10.5.Financial Details

13.1.10.6.Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Product Type |

|

| By Packaging |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.