Vietnam Colour Cosmetics Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Eye Make-Up (Eye Liner/Pencil, Eye Shadow, Mascara, Others), Facial Make-Up (BB/CC Creams, Blusher/Bronzer/Highlighter, Foundation/Concealer, Powder, Others), Lip Products (Lip Gloss, Lip Liner/Pencil, Lipstick, Others), Nail Products (Nail Polish, Nail Treatments/Strengthener, Polish Remover, Others), Colour Cosmetics Sets/Kits), By Price (Premium, Mass), By Gender (Men, Women, Unisex), By Packaging Type (Travel/Mini Size, Standard Size, Professional/Salon Size), By Form (Creams/Gels, Lotions, Sprays, Solid, Others), By Nature (Organic, Inorganic), By Sales Channel (Retail Offline, Retail Online)

- FMCG

- Feb 2026

- VI0937

- 125

-

Vietnam Colour Cosmetics Market Statistics and Insights, 2026

- Market Size Statistics

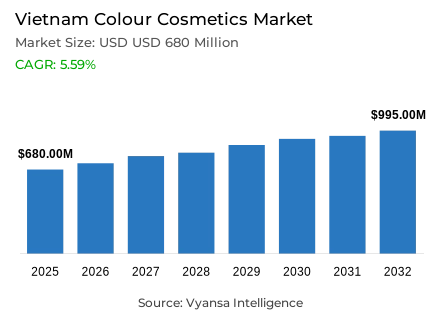

- Colour cosmetics in Vietnam is estimated at USD 680 million in 2025.

- The market size is expected to grow to USD 995 million by 2032.

- Market to register a cagr of around 5.59% during 2026-32.

- Category Shares

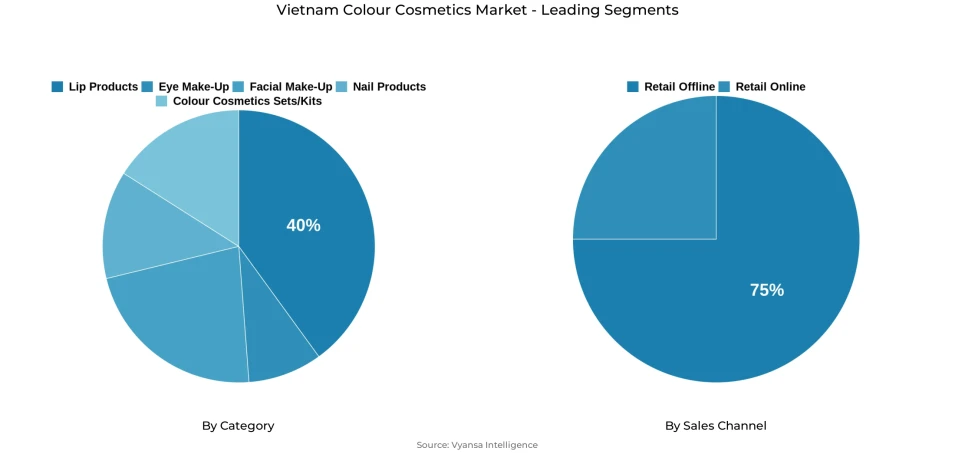

- Lip products grabbed market share of 40%.

- Competition

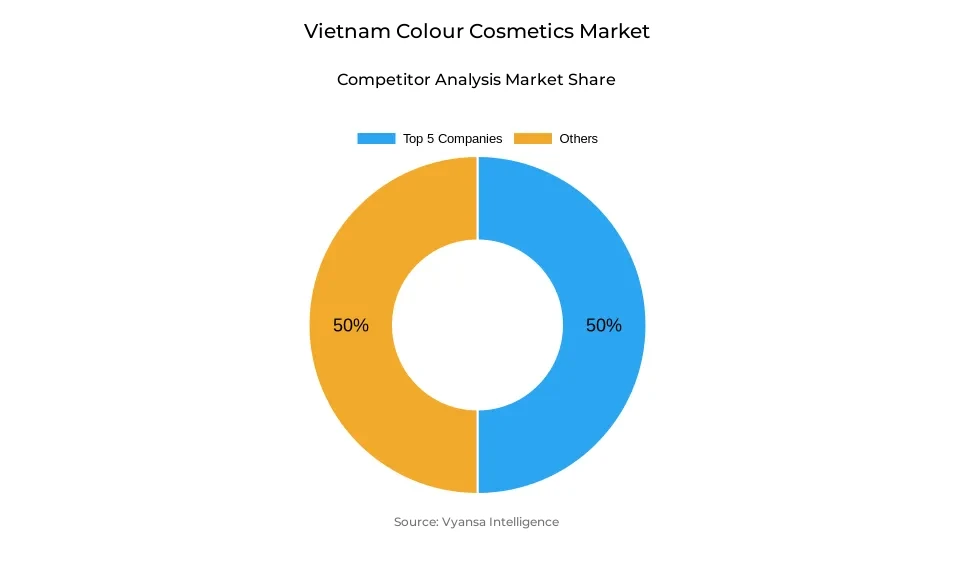

- More than 20 companies are actively engaged in producing colour cosmetics in Vietnam.

- Top 5 companies acquired around 50% of the market share.

- AmorePacific Vietnam JSC; LG Vina Cosmetics Co Ltd; DM&C Co Ltd; L'Oréal Vietnam Co Ltd; C-Store Vietnam Co Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

Vietnam Colour Cosmetics Market Outlook

The Vietnam colour cosmetics market is in a healthy growth cycle, which is backed by the fast development of young, social-media-driven end users and the high rate of new product launches. The market will grow to USD 680 million in 2025 and to USD 995 million in 2032 with a compound annual growth rate of about 5.59% in the 2026–2032 period. The main force behind growth is the rising daily usage of make-up, particularly among Generation Z and Millennials who are trendsetters on Tik Tok and other social media, making make-up a part of their daily lives instead of a luxury.

The highest category is lip products, which occupy approximately 40% of the market share. The high dynamism of this segment is ensured by the regular introduction of lipsticks, tints, and glosses in new shades and formats. Meanwhile, facial make-up is becoming the fastest-growing category, with the need to have lightweight, long-lasting and sweat-resistant formulations that are appropriate in the hot and humid climate of Vietnam.

Retail is still predominantly offline, with about 75% of sales being made through physical retail outlets. The market is dominated by beauty specialists since end users appreciate testers, expert opinion, and physical testing before buying. However, e-commerce is growing at a very high rate, which is backed by livestream selling, influencer campaigns, and huge online discounts.

On the whole, the market perspective is optimistic, and its growth is supported by the rise of incomes, the power of social-media, and the growing demand of hybrid make-up products with the ability to combine beauty and skin-care advantages.

Vietnam Colour Cosmetics Market Growth DriverDigital, Younger Population.

The demographic composition of Vietnam is highly favourable to the development of the colour-cosmetics market. The population is approximately 70% working-age 15–64 years old, with a median age of a little more than 32 years, which makes Vietnam one of the youngest large markets in Southeast Asia. This youthful demographic is very concerned with looks, fashion, and self-expression, which directly increases the number of times they use make-up on a daily basis.

This is enhanced by digital influence, According to the data provided by the Ministry of Information and Communications and ITU, Vietnam has internet penetration of over 77% and over 70 million social-media users. Social media like Tik Tok and Facebook are significant platforms of beauty inspiration, tutorials, and product discovery. New shades, textures, or forms are quickly turned into mass trends by viral content, which promotes frequent buying and experimentation.

Vietnam Colour Cosmetics Market ChallengePrice Sensitivity and Income Gaps.

Vietnam is a price-sensitive market, even with the increasing incomes. The GDP per capita remains below USD 5,000, which restricts the spending on high-quality colour cosmetics by a significant portion of the population. As a result, end users tend to trade down, wait till they get discounts or switch to local and affordable brands, thus exerting pressure on international and premium players.

Market expansion is also influenced by income disparity between urban and rural regions. Although the major cities like Ho Chi Minh and Hanoi are showing high levels of premium and hybrid make-up, the rural areas still dwell on low-cost necessities. This gap causes uneven demand and makes nationwide expansion more complex and expensive to brands that depend on modern retail and beauty-specialist formats.

Vietnam Colour Cosmetics Market TrendTrend Skinification of Make-Up.

Vietnam end user are becoming more associated with beauty and skin health. WHO and regional health surveys indicate increased awareness of UV damage and skin protection in tropical climates. The UV exposure in Vietnam is high throughout the year, which promotes the demand of foundations, BB/CC creams, and cushions with SPF and moisturizing properties.

This is called skinification, where colour cosmetics borrow ingredients and claims of skin-care products. Recipes with hyaluronic acid, niacinamide, vitamin C, and SPF are popular, particularly in facial make-up. End users have come to expect make-up to not only beautify but also to hydrate, protect and improve the skin condition in the long run.

Vietnam Colour Cosmetics Market OpportunityRising Middle Class and Urbanisation.

The rapidly expanding middle class in Vietnam presents strong future growth potential for the market. The World Bank reports that urbanisation has been on the rise, with more than 38% of the population currently residing in urban centres, compared to about 30% in 2010. Urban end users have more exposure to beauty trends around the world, access to more beauty experts and have higher purchasing power.

This trend has good prospects to brands that provide trend-based but low-cost products, especially in hybrid facial make-up and lip products. With the increase in incomes, end users tend to purchase less and better, which means that they prefer multifunctional products that save time and provide value. The most suitable brands to tap into this emerging urban middle-class market are those that offer trendiness, skin-care advantages, and affordable prices.

Vietnam Colour Cosmetics Market Segmentation Analysis

By Category

- Eye Make-Up

- Eye Liner/Pencil

- Eye Shadow

- Mascara

- Others

- Facial Make-Up

- BB/CC Creams

- Blusher/Bronzer/Highlighter

- Foundation/Concealer

- Powder

- Others

- Lip Products

- Lip Gloss

- Lip Liner/Pencil

- Lipstick

- Others

- Nail Products

- Nail Polish

- Nail Treatments/Strengthener

- Polish Remover

- Others

- Colour Cosmetics Sets/Kits

The segment with the highest share is under the Category, where Lip Products hold around 40% market share. This leadership is driven by frequent usage, affordability, and strong influence from social media trends. Lipsticks, tints, and glosses are seen as easy, low-risk ways to experiment with new looks, encouraging end users to own multiple shades and finishes.

Lip products benefit from constant innovation in textures such as matte, jelly, glossy, and oil-based formats. They are also easier to promote through short-form videos and influencer content. Because lip products are relatively affordable, they remain popular even during periods of budget pressure, helping them maintain their dominant position in Vietnam’s colour cosmetics market.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under the Sales Channel is Retail Offline, with about 75% market share. Beauty specialists and department stores dominate because Vietnam end users prefer to test products physically before buying, especially for foundation, concealer, and shades that must match skin tone.

Retail offline also provide consultation, demonstrations, and sampling, which build trust in a market where new brands and products are launched frequently. Although e-commerce is growing fast through livestreams and discounts, offline retail remains the backbone of the market due to habit, trust, and the importance of physical trial in colour cosmetics purchasing.

List of Companies Covered in Vietnam Colour Cosmetics Market

The companies listed below are highly influential in the Vietnam colour cosmetics market, with a significant market share and a strong impact on industry developments.

- AmorePacific Vietnam JSC

- LG Vina Cosmetics Co Ltd

- DM&C Co Ltd

- L'Oréal Vietnam Co Ltd

- C-Store Vietnam Co Ltd

- Unicorn Trading & Services JSC

- iFamily SC Co Ltd

- Estée Lauder Vietnam Co Ltd

- Shiseido Cosmetics Vietnam Co Ltd

- MOI Cosmetics Co Ltd

Competitive Landscape

Vietnam colour cosmetics market is highly competitive, shaped by strong international leaders, fast-rising regional brands, and increasingly influential local players. L’Oréal leads the market, supported by a broad portfolio spanning mass and premium segments and an aggressive social media strategy using influencers, livestreaming, and viral trends. Korean brands under AmorePacific, such as Innisfree and Laneige, gained strong traction through TikTok-driven promotions and sampling campaigns. Regional brands like Rom&nd and Merzy also expanded rapidly by targeting young consumers with trend-led launches. Meanwhile, Vietnamese brands such as MOI Cosmetics and Lemonade are strengthening their positions by offering humidity-resistant formulas and shades suited to local skin tones, intensifying competition across price segments.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Vietnam Colour Cosmetics Market Policies, Regulations, and Standards

4. Vietnam Colour Cosmetics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Vietnam Colour Cosmetics Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Eye Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Eye Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Eye Shadow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Mascara- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Facial Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. BB/CC Creams- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Blusher/Bronzer/Highlighter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Foundation/Concealer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Lip Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Lip Gloss- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Lip Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lipstick- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Nail Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Nail Polish- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Nail Treatments/Strengthener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Polish Remover- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Price

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Packaging Type

5.2.4.1. Travel/Mini Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Standard Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Professional/Salon Size- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Form

5.2.5.1. Creams/Gels- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Lotions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Sprays- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Solid- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Nature

5.2.6.1. Organic- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Inorganic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Vietnam Eye Make-Up Colour Cosmetics Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Vietnam Facial Make-Up Colour Cosmetics Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Vietnam Lip Products Colour Cosmetics Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Vietnam Nail Products Colour Cosmetics Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Vietnam Colour Cosmetics Sets/Kits Colour Cosmetics Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Price- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Gender- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. L’Oréal Vietnam Co Ltd

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. C-Store Vietnam Co Ltd

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Unicorn Trading & Services JSC

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. iFamily Sc Co Ltd

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Estée Lauder Vietnam Co Ltd

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. AmorePacific Vietnam JSC

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. LG Vina Cosmetics Co Ltd

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. DM&C Co Ltd

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Shiseido Cosmetics Vietnam Co Ltd

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. MOI Cosmetics Co Ltd

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Price |

|

| By Gender |

|

| By Packaging Type |

|

| By Form |

|

| By Nature |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.