Italy Childrenswear Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Apparel (Baby and Toddler Wear, Boys Apparel, Girls Apparel), Footwear (Boys Footwear, Girls Footwear), Accessories (Boys Accessories, Girls Accessories), Others), Age Group (Infant/Toddler (Below 2 years), Kids/Children (2 - 14 years)), Price Category (Mass, Premium), Sales Channel (Retail Offline, Retail Online)

- FMCG

- Feb 2026

- VI0981

- 115

-

Italy Childrenswear Market Statistics and Insights, 2026

- Market Size Statistics

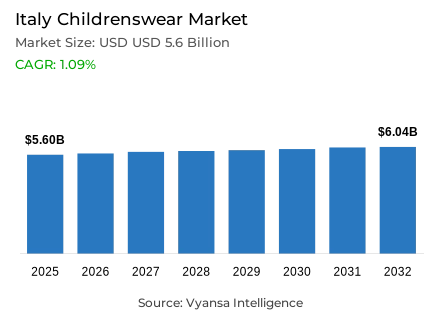

- Childrenswear in Italy is estimated at USD 5.6 billion in 2025.

- The market size is expected to grow to USD 6.04 billion by 2032.

- Market to register a cagr of around 1.09% during 2026-32.

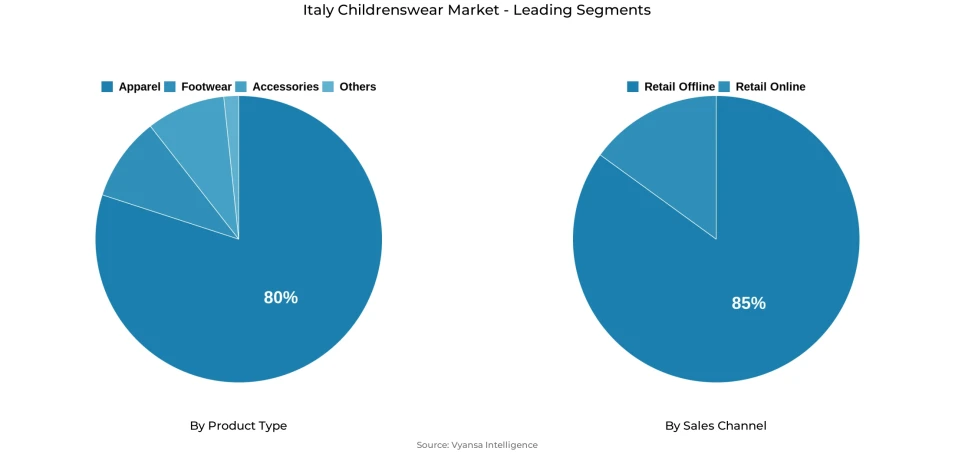

- Product Type Shares

- Apparel grabbed market share of 80%.

- Competition

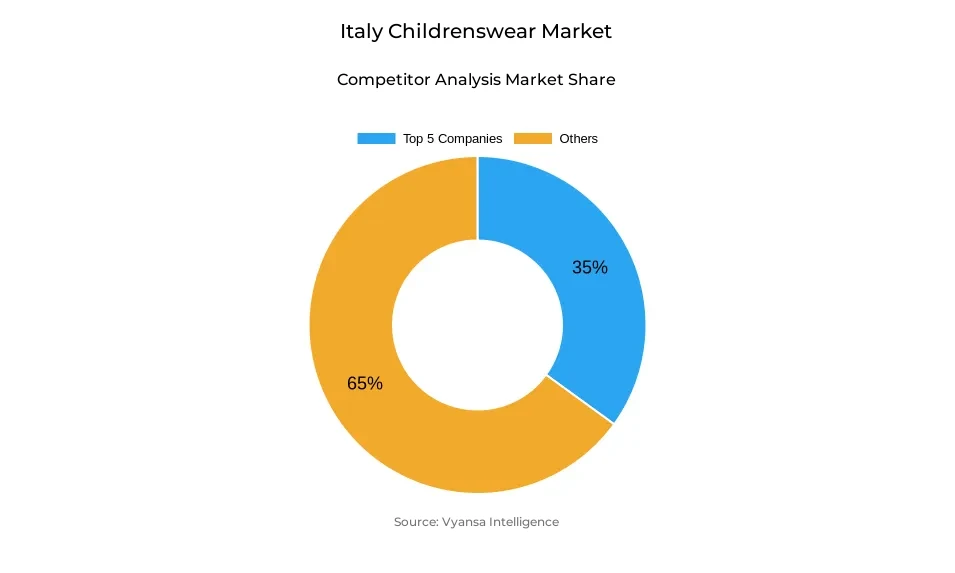

- More than 20 companies are actively engaged in producing childrenswear in Italy.

- Top 5 companies acquired around 35% of the market share.

- adidas Italy SpA; Imac SpA; ID Kids Italy Srl; OVS SpA; Itx Italia Srl etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Italy Childrenswear Market Outlook

Italy childrenswear market is estimated to be USD 5.6 billion in 2025, which will grow to USD 6.04 billion in 2032, with a CAGR of about 1.09% in 2026-2032. The market faces mixed opportunities, even though the growth is modest, due to the decreasing birth rate in the country and the increased economic cautiousness of households. Boys and girls apparel categories are also doing relatively well, as they require regular wardrobe changes as children grow. On the other hand, the baby and toddler wear will be affected negatively by the declining birth rates. The relaxation of inflationary pressures should help in a modest recovery in expenditure, especially by middle-income families.

The market is dominated by apparel which accounts to about 80% of the total childrenswear sales. Brands are working on providing sustainable, comfortable, and durable clothing that is affordable and of quality. New competitors like Tezenis Kids are increasing their physical store outlets, and they are providing good value and practical designs to suit the changing needs of parents. In the meantime, the domestic brands such as Miniconf are becoming stronger with their eco-friendly collections and environmentally conscious production processes, which is a general market trend towards sustainable consumption.

Sustainability is one of the key trends that influence the market perspective. The Made Green in Italy certification will likely spread among the local players, allowing them to stand out with proven eco-friendly credentials. Manufacturers that focus on the minimization of CO₂ emissions, recyclable packaging, and support of local production will probably win the trust of end users, especially as the level of environmental awareness increases throughout Italy.

In 2024, retail offline is still the dominant distribution channel, with almost 85% of sales, but retail online is growing at a very fast pace as families demand convenience and competitive prices. The next stage of market development is likely to be characterized by the increasing integration of omnichannel retailing, which is the combination of physical stores and effective online platforms. Those retailers who are able to deliver a smooth digital and in-store experience will be in the best position to reap the benefits of future growth.

Italy Childrenswear Market Growth DriverRecovery in Social Lifestyles and Children's Apparel Demand

The Italy childrenswear market is still enjoying the recovery of the post-pandemic social and extracurricular activities. As schools, sports clubs, and events like weddings and birthday parties get back to regular schedules, parents are buying more clothing to wear on daily and formal events. According to the World Bank , the growth in the private consumption expenditure in Italy is more than 1.2% which indicates the increase in the household confidence. Girls and boys apparel categories perform better because children grow out of clothes fast and need new clothes and wardrobes regularly.

Simultaneously, the reduction of inflation gives families a bit more financial freedom. ISTAT notes that the inflation rate in Italy decreases to approximately 1.7%, which contributes to stabilizing the cost of living and discretionary spending. As life becomes normal, parents are more concerned with comfort and quality, choosing practical but fashionable clothes. This restoration of everyday life, combined with a rise in purchasing power, remains the foundation of the stable increase in childrenswear sales in Italy.

Italy Childrenswear Market ChallengeDeclining Birth Rate Weakening Core Market Base

A persistent decline in the national birth rate is steadily narrowing the end-user base for baby and toddler wear, thereby limiting the natural expansion of this segment. According to ISTAT , the fertility rate in Italy is 1.20 births per woman, which is among the lowest in Europe. This population shift lowers the long-term demand, especially of infant clothes, which has the lowest growth of childrenswear categories in 2024. The decline in new births also makes brands shift their attention to older children and lifestyle-based collections instead of early-age clothes.

This is further complicated by economic uncertainty. The increase in prices makes second-hand markets a cheaper and more sustainable alternative to many Italian families. A survey has shown that the rate of household savings is less than 6%, which means that there is limited disposable income. With sustainability and affordability influencing end-user choices, numerous brands are struggling to sustain sales volumes and balance ethical sourcing and cost-efficiency in a price-sensitive market.

Italy Childrenswear Market TrendSustainability and Second-Hand Fashion Transforming Childrenswear

Growing emphasis on sustainability is reshaping product design and retail practices, positioning eco-conscious development as a defining trend in the market. The growing concern about the environment makes second-hand clothes more popular, and nowadays many parents consider them not only cost-effective but also environmentally friendly. A survey revealed that more than 45% of Italian customers believe that sustainability is one of the most important aspects of fashion shopping. The retailers react by launching environmentally friendly packaging, circular fashion designs, and less-emission logistics solutions to attract conscious end users.

An example of this shift is domestic brands like Miniconf, which focus on long-lasting, safe, and sustainable design. The sustainability efforts of the company, such as the early release of its sustainability report, are indicative of the increased focus on green fashion. As the textile recycling rate in Italy has already surpassed 60% (ISPRA, 2024), end users are increasingly choosing clothes that are eco-friendly. The emergence of sustainable fabrics and open production processes makes childrenswear a values-based rather than a style-based segment.

Italy Childrenswear Market OpportunityGrowth Potential through Made Green in Italy Certification

The Italy childrenswear market will have a high future potential due to the growth of eco-certified and Made Green in Italy lines of apparel. This is a government-approved certification, which is based on the EU Recommendation 2013/179/EU, and evaluates the environmental performance of products throughout their life cycle. Firms that receive this certification will enjoy increased credibility, end user confidence, and EU green procurement programs. The report by ISPRA (2025) indicates that the number of certified textile manufacturers will increase by more than 28% in two years, which underscores the increasing trend of sustainable production.

With Italian brands combining national identity and environmental responsibility, Made Green in Italy labeling will enhance local pride and competitiveness in exports. The project is also in line with the wider 2030 Circular Economy Strategy of Italy, which is backed by the Ministry of Environment and Energy Security. Local manufacturers investing in traceability, CO₂ reduction and waste minimization are likely to increase sales over the forecast period. The certification will provide a route through which Italian childrenswear can realize long-term development based on sustainability and authenticity.

Italy Childrenswear Market Segmentation Analysis

By Product Type

- Apparel

- Footwear

- Accessories

- Others

The segment with the highest share under the product type category in the Italy Childrenswear Market is Apparel, accounting for around 80% of the market. Apparel dominates the market as Italian parents continue to prioritise stylish, high-quality clothing for their children, reflecting the country’s strong fashion culture. Subcategories such as boys’ and girls’ apparel are key contributors, as children frequently outgrow their clothes, creating consistent demand for wardrobe updates. The resurgence of social gatherings, school events, and outdoor activities has also strengthened this segment’s position, driving higher replacement rates and sales volumes.

Moreover, Italian brands’ emphasis on design, comfort, and sustainability has helped apparel maintain its leadership. Companies like Miniconf are setting benchmarks by offering eco-friendly and durable clothing that aligns with Italy’s growing environmental awareness. With trends like “mini-me” fashion and sustainable fabrics gaining traction, apparel will continue to anchor market growth through the forecast period

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under the sales channel category in the Italy Childrenswear Market is Retail Offline, which captured around 85% of the market. Physical retail remains the preferred mode of purchase among Italian parents who value the tactile experience of assessing fabric quality, fit, and style before buying. Boutiques, department stores, and specialised childrenswear shops dominate this channel, offering curated collections and personalised service that resonate with Italian shopping habits.

Major domestic brands such as Miniconf and new entrants like Tezenis Kids continue to strengthen their brick-and-mortar presence, expanding networks across Italy to reach more families. Seasonal collections, exclusive in-store promotions, and premium-quality offerings further drive foot traffic and sales. With Italy’s deep-rooted fashion traditions and preference for in-person shopping experiences, the Retail Offline segment is expected to sustain its leadership in the coming years.

List of Companies Covered in Italy Childrenswear Market

The companies listed below are highly influential in the Italy childrenswear market, with a significant market share and a strong impact on industry developments.

- adidas Italy SpA

- Imac SpA

- ID Kids Italy Srl

- OVS SpA

- Itx Italia Srl

- Benetton Group Srl

- Original Marines SpA

- Hennes & Mauritz Srl

- Artsana SpA

- Primark Italy Srl

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Italy Childrenswear Market Policies, Regulations, and Standards

4. Italy Childrenswear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Italy Childrenswear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Baby and Toddler Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Boys Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Girls Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Boys Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Girls Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Boys Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Girls Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Age Group

5.2.2.1. Infant/Toddler (Below 2 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Kids/Children (2 - 14 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Category

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Italy Apparel Childrenswear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Italy Footwear Childrenswear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Italy Accessories Childrenswear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.OVS SpA

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Itx Italia Srl

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Benetton Group Srl

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Original Marines SpA

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Hennes & Mauritz Srl

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.adidas Italy SpA

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Imac SpA

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.ID Kids Italy Srl

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Primark Italy Srl

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Roadget Business Pte Ltd

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Age Group |

|

| By Price Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.