Israel Bottled Water Market Report: Trends, Growth and Forecast (2026-2032)

By Type of Water (Carbonated Bottled Water, Flavoured Bottled Water, Functional Bottled Water, Still Bottled Water (Purified Water, Mineral Water, Spring Water, Plain Water)), By Packaging Material (Plastic Bottles, Glass Bottles, Metal Cans, Others (Tetra Pack Cartons, Bioplastics, etc.)), By Price Point (Mass, Premium), By Sales Channel (On Trade, Off Trade (Retail Offline, Retail Online))

- FMCG

- Feb 2026

- VI0980

- 115

-

Israel Bottled Water Market Statistics and Insights, 2026

- Market Size Statistics

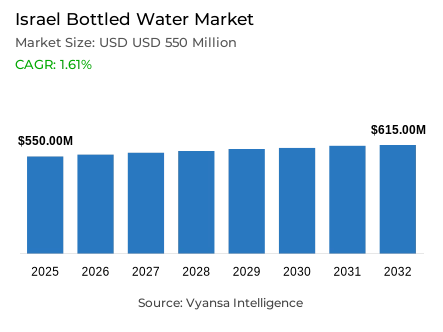

- Bottled water in Israel is estimated at USD 550 million in 2025.

- The market size is expected to grow to USD 615 million by 2032.

- Market to register a cagr of around 1.61% during 2026-32.

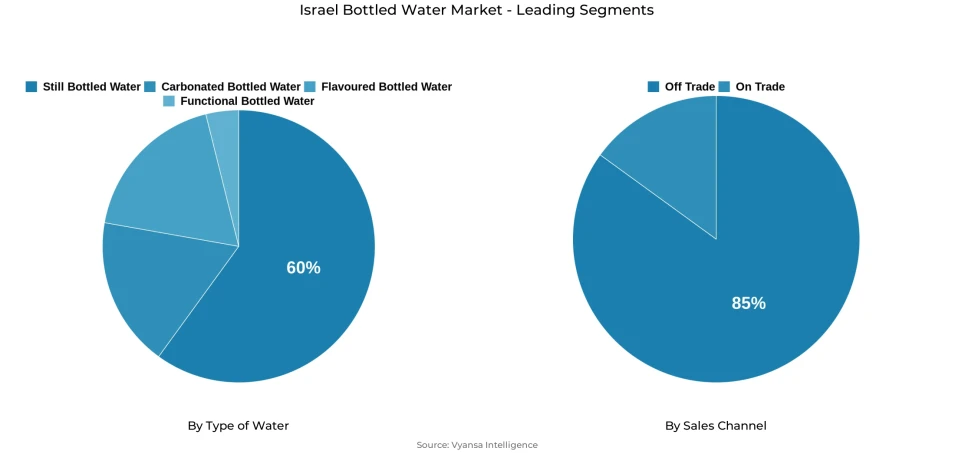

- Type of Water Shares

- Still bottled water grabbed market share of 60%.

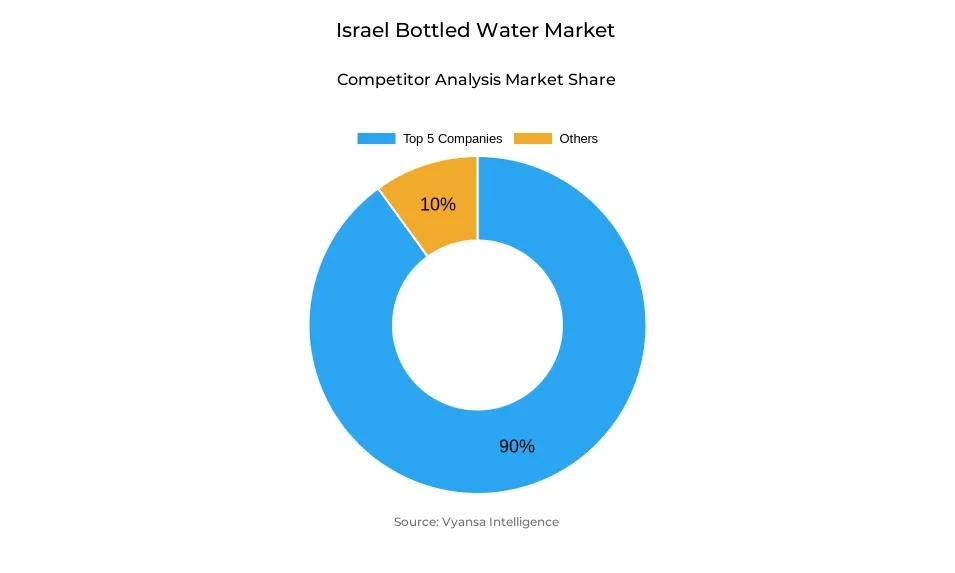

- Competition

- Bottled water in Israel is currently being catered to by more than 5 companies.

- Top 5 companies acquired around 90% of the market share.

- Jafora-Tabori Ltd; Central Beverage Co Ltd; The Eurostandart Ltd; Tempo Beverages Ltd; Neviot-Teva Hagalil Ltd etc., are few of the top companies.

- Sales Channel

- Off trade grabbed 85% of the market.

Israel Bottled Water Market Outlook

The bottled water market in Israel is estimated at USD 550 million in 2025 and is expected to grow to about USD 615 million by 2032, with a CAGR of about 1.61% in the period 2026-2032. This small increase indicates that the product is a necessity good and not a luxury. The hot, dry climate, frequent heatwaves, and the lack of rainfall during the non-winter months reinforce demand by increasing the hydration needs of consumers. As a result, bottled water is seen as a reliable and convenient way of everyday hydration in homes.

Purchasing behaviour outside of routine consumption is also affected by climate-related stress. Long summers and increasing heat extremes increase the need to have access to safe drinking water, which supports the idea that bottled water is a functional need. Furthermore, emergency preparedness has become a prominent issue since the end of 2023, as households are advised to keep water stocks. This has continued to drive the need to have bulk bottled water formats that are utilized in stockpiling, thus maintaining market stability even in times of wider economic or geopolitical uncertainty.

Bottled water is still the most popular among consumers, with about 60% of the market. Its flavorlessness, ability to be consumed on a daily basis, and perceived trustworthiness make it the choice when it comes to regular hydration and emergency storage. In addition, bottled water is also in line with the health and wellness agenda, with consumers shifting towards less complex hydration products, such as sugary or carbonated drinks.

In terms of sales channels, off-trade stores contribute to about 85% of the total sales. The traditional retail stores, convenience stores, and supermarkets remain at the center of the stage because of their availability and the ability to make purchases regularly and in large quantities. These channels are supplementary to the household buying patterns that focus on value, convenience, and readiness. Altogether, the market perspective is stable, which is supported by climate-related need and resilience-oriented consumption trends.

Israel Bottled Water Market Growth DriverClimate Stress and Emergency Preparedness Reinforce Essential Hydration Demand

Increased climatic stress and emergency preparedness have ensured that bottled water becomes a vital category in the daily hydration environment in Israel. Long and dry summers, increasing heatwaves, and the lack of rainfall outside the winter season increase the baseline hydration needs of consumers, particularly in extended high-temperature seasons. The climatic profile of Israel, which is structurally water-scarce, as identified by the World Bank, strengthens the need to rely on easily available drinking-water formats that can facilitate regular hydration in extreme weather conditions. Such environmental factors make bottled water not just a convenience product, but a functional need within households.

This perception has been strengthened by emergency preparedness behaviour since late 2023, when official guidance advised households to have sufficient water reserves. The hoarding of bulk bottled-water packs is a sign of preparedness-based buying, as opposed to discretionary drinking. To consumers, bottled water offers a sense of security in terms of supply and safety in times of infrastructure stress or disruption, thus anchoring long-term demand based on climatic exposure and resilience-based household planning.

Israel Bottled Water Market ChallengeStructural Water Stress and Supply Reliability Concerns

The endemic structural water stress is a significant limitation that defines the dynamics of bottled-water in Israel. Although there is almost universal access to safely managed drinking-water services, World Bank and FAO statistics show that national water withdrawals are greater than renewable freshwater supplies, and Israel is ranked among the most water-stressed nations in the world. This disproportion increases the vulnerability to drought cycles, heat waves, and operational pressures in desalination and distribution systems, especially during peak summer periods.

To the consumers, the perception of supply weakness or quality fluctuation in extreme circumstances affects the use of bottled water as a source of regular and emergency consumption. Although bottled formats provide short-term stability, systemic water stress constrains larger supply resilience and creates cost and logistics burdens along the value chain. These institutional limitations highlight the way climatic and resource realities still confront long-term stability in traditional water provision.

Israel Bottled Water Market TrendHealth-Oriented Hydration Choices Reshaping Beverage Preferences

Health and wellness is becoming a factor that is influencing the daily hydration decisions of consumers in Israel. Lifestyle changes towards preventive health and less sugar consumption are promising to replace carbonated and high sugar content soft drinks as a high-income economy. The World Health Organization has always advocated water as the main source of hydration, which supports the use of bottled water in the daily consumption habits of the population.

In this environment, still and lightly flavoured bottled-water products enjoy the advantage of being associated with low-calorie, additive-reduced tastes. Consumers are becoming more and more associated with water as a functional wellness, long-lasting energy, and heat resistance as opposed to indulgence. This change helps to maintain a consistent volume demand during economic or geopolitical uncertainty because hydration is a higher priority than discretionary drinks.

Israel Bottled Water Market OpportunityClimate-Adaptive and Preparedness-Led Product Positioning Potential

Climate adaptation and preparedness behaviour product strategies are a viable growth opportunity in the Israeli bottled-water market. Hot summers, increasing frequency of heat-events, and emergency-readiness standards create demand on formats based on high-temperature hydration and household resilience. The bigger multi-pack bottles, the tougher containers, and the convenient bulk formats are direct responses to the needs of consumers to use it on a daily basis and to have it in case of emergency.

Placing bottled water in the context of functional reliability, long-lasting hydration, and preparedness in extreme situations enhances the perceived value beyond simple refreshment. Climate-realities, heat-safety, and preparedness messaging would appeal to households who want practical solutions, not premiumisation. With environmental stress becoming a long-term characteristic and not a shock, brands that match offerings with these structural requirements can enhance loyalty and relevance.

Israel Bottled Water Market Segmentation Analysis

By Type of Water

- Carbonated Bottled Water

- Flavoured Bottled Water

- Functional Bottled Water

- Still Bottled Water

- Purified Water

- Mineral Water

- Spring Water

- Plain Water

Still bottled water accounts for approximately 60% of the Israel bottled water market, reflecting its position as the primary hydration choice for end users. Daily consumption patterns favour uncomplicated, neutral-taste formats perceived as safe, reliable, and suitable for regular intake across all age groups. Still water’s dominance aligns with health-led preferences and routine hydration needs intensified by hot climatic conditions.

Its leadership also extends to preparedness behaviour, where simplicity, shelf stability, and versatility are prioritised for household stockpiling. End users selecting bottled water for emergency reserves consistently favour still varieties due to their universal acceptance and ease of use. As hydration remains framed as a necessity rather than an occasional beverage choice, still bottled water continues to anchor demand.

By Sales Channel

- On Trade

- Off Trade

- Retail Offline

- Retail Online

Off Trade channels hold around 85% of total sales within the Israel bottled water market, underscoring their central role in meeting routine and preparedness-driven demand. Supermarkets, convenience stores, and traditional retail outlets offer the accessibility and pricing efficiency required for frequent purchases and bulk stockpiling by end users. These channels align closely with household purchasing habits focused on convenience and volume availability.

For emergency readiness and regular home consumption, Off-Trade outlets remain the preferred route due to their geographic reach and capacity to support larger pack sizes. While e-commerce and alternative channels are expanding, they primarily complement established retail rather than displacing it. The continued dominance of Off-Trade reflects the essential nature of bottled water purchases.

List of Companies Covered in Israel Bottled Water Market

The companies listed below are highly influential in the Israel bottled water market, with a significant market share and a strong impact on industry developments.

- Jafora-Tabori Ltd

- Central Beverage Co Ltd

- The Eurostandart Ltd

- Tempo Beverages Ltd

- Neviot-Teva Hagalil Ltd

- Priniv Ltd

Competitive Landscape

Israel’s bottled water market in 2025 was reshaped by Tempo Beverages, which emerged as the clear leader in off-trade volume terms after assuming distribution rights for the Eden brand from Jafora-Tabori. This transition enabled Tempo to more than double its market share year-on-year, supported by its broad portfolio that also includes Aqua Nova, San Benedetto, S.Pellegrino, and Perrier. Eden further strengthened its leadership through expanded multi-channel distribution, entry into carbonated natural mineral water, refreshed brand positioning, and the launch of the Eden Extra Club loyalty programme. Strong social engagement initiatives and brand visibility helped sustain consumer loyalty despite price increases, reinforcing competitive intensity in the market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Israel Bottled Water Market Policies, Regulations, and Standards

4. Israel Bottled Water Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Israel Bottled Water Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Volume (Million Litres)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Type of Water

5.2.1.1. Carbonated Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Flavoured Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Functional Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Still Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Purified Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Mineral Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Spring Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Plain Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Packaging Material

5.2.2.1. Plastic Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Glass Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Metal Cans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Others (Tetra Pack Cartons, Bioplastics, etc.)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Point

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. On Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Off Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Israel Carbonated Bottled Water Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Volume (Million Litres)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Israel Flavoured Bottled Water Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Volume (Million Litres)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Israel Functional Bottled Water Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Volume (Million Litres)

8.2. Market Segmentation & Growth Outlook

8.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Israel Still Bottled Water Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Volume (Million Litres)

9.2. Market Segmentation & Growth Outlook

9.2.1.By Type of Water- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Price Point- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Tempo Beverages Ltd

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Neviot-Teva Hagalil Ltd

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Jafora-Tabori Ltd

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Central Beverage Co Ltd

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. The Eurostandart Ltd

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Priniv Ltd

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Type of Water |

|

| By Packaging Material |

|

| By Price Point |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.