Japan Baby and Child-Specific Products Market Report: Trends, Growth and Forecast (2026-2032)

By Product (Hair Care, Skin Care, Sun Care, Toiletries, Baby Wipes, Diapers, Medicated), By Category (Premium, Mass), By Sales Channel (Retail Online, Retail Offline)

- FMCG

- Feb 2026

- VI0982

- 125

-

Japan Baby and Child-Specific Products Market Statistics and Insights, 2026

- Market Size Statistics

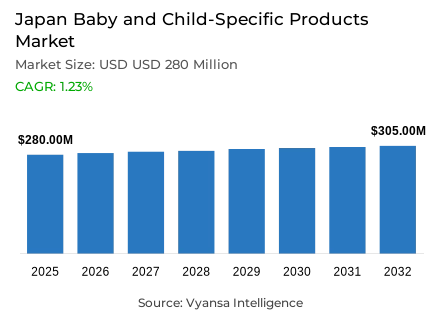

- Baby and child-specific products in Japan is estimated at USD 280 million in 2025.

- The market size is expected to grow to USD 305 million by 2032.

- Market to register a cagr of around 1.23% during 2026-32.

- Product Shares

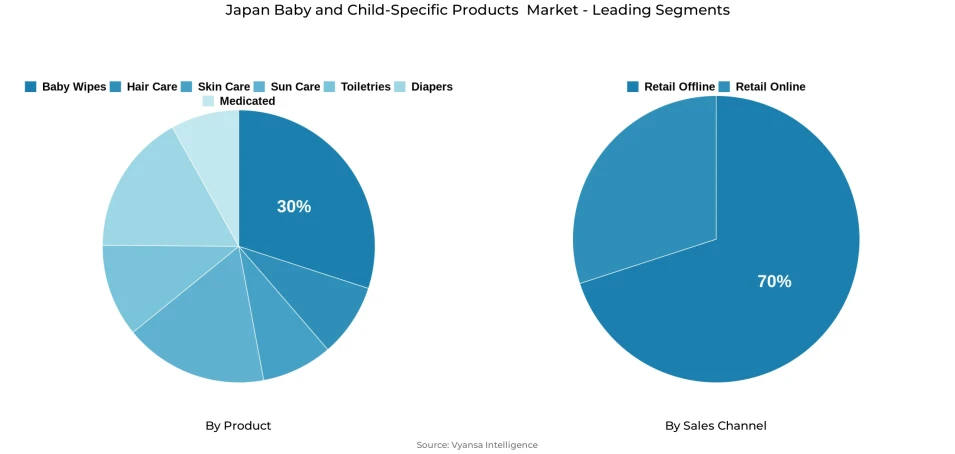

- Baby wipes grabbed market share of 30%.

- Competition

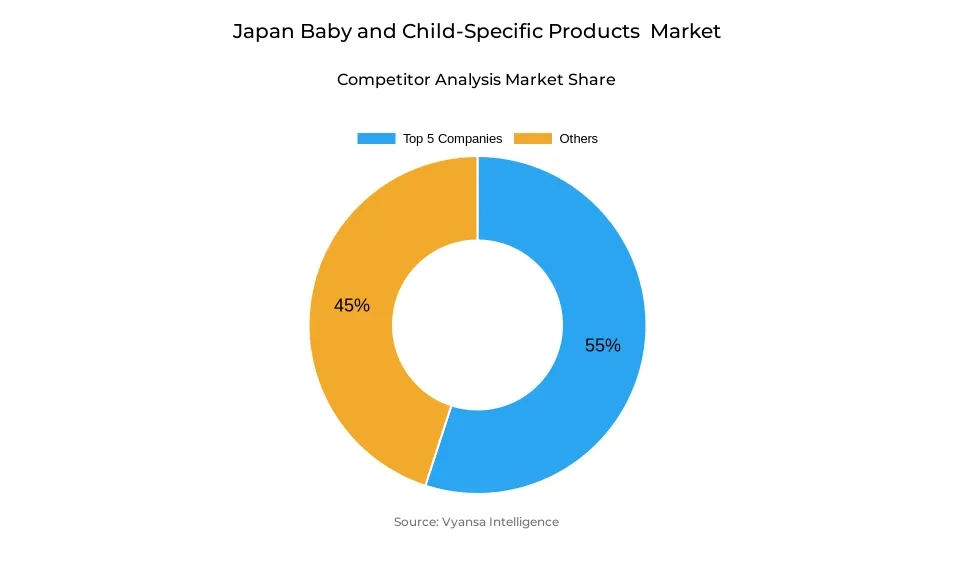

- More than 20 companies are actively engaged in producing baby and child-specific products in Japan.

- Top 5 companies acquired around 55% of the market share.

- P&G Japan GK; Oshimatsubaki Co Ltd; Asahi Group Foods Ltd; Pigeon Corp; Unicharm Corp etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

Japan Baby and Child-Specific Products Market Outlook

Japan Baby and Child-Specific Products Market is characterized by slight, but still strong growth potential, as the market is currently valued around USD 280 million in 2025, and the growth rate is expected to climb to USD 305 million in 2032. With the CAGR of about 1.23% over the years 2026–2032. Though the market faces current demographic headwinds due to the shrinking population of Japan, it is showing continuous growth prospects that can be attributed to changing category maturity and planned initiatives of demand generation through systematic market forces. By comparison with other health-conscious consumer groups, multi-skilled awareness campaigns, consumer education courses, and promotional campaigns placed at the right time and place have proved to be effective in refreshing waning market segments, as well as renewing the interest of end users.

Among the product portfolio mix, baby wipes take the largest market dominance of 30% with focus on the preference of parents towards convenient and routine-oriented hygiene solutions. The general market environment is becoming progressively defined by consumer preference for products that have health and safety attributes in accordance with the growing societal focus on wellness. The tendency of Japan end users to be more focused on nutrition, hygiene, and overall wellbeing attributes shows an increase in demand for products oriented to babies and children in particular and viewed as soft, safe, and conducive to healthy developmental outcomes.

The trend in product innovation adopts value-addition and functional differentiation. Similar to tendencies in related categories, products with certain functional claims, such as sleep enhancement, stress reduction, or overall support to wellbeing, have attracted a great deal of consumer interest. This trend is likely to trickle down into the baby and child-specific products segment, as parents are more and more insisting on products and services which are beyond simple utility to an ancillary product and service offering of comfort, health, or convenience add-on in daily life. This business shift to functional and value-added product design is expected to form one of the major growth drivers in the course of the forecast period.

In terms of distribution, retail offline channels effect about 70% of the total sales volume, with the highest percentage of the sales volume being contributed by supermarket activities by taking advantage of their placement as the main point of first-time household purchase. The value proposition of consolidated shopping experiences is supported by current lifestyle trends, which focus on time-saving, thus confirming the competitive advantage of large-format retail outlets. At the same time, the health and beauty specialty retailers are evolving as the most dynamic channel of distribution and this is enabled by the breadth of the network of stores and increased product assortment. The slow realization of increasing environmental awareness of Japan end users is likely to bring further category support because products of the baby and child category get more and more aligned with perceptions of safer and more responsible consumption choices.

Japan Baby and Child-Specific Products Market Growth DriverFocus on Daily Care and Child Comfort

The Japan parental demographics are highly concerned with hygiene, comfort, and safety factors of the infants and young children. Stable demand of products targeting babies and children as part of the everyday care activities is maintained by this behavioral orientation. Products that cater to cleaning, care maintenance, and comfort provision are used on a number of occasions daily, hence undergoing active replenishment cycles. These products are necessities and not luxury goods and thus demand would remain intact regardless of the smaller household sizes. Additionally, the preference of parents to products that have ease of use and versatility in both domestic and mobile settings strengthens the maintained purchasing behaviours.

The modern family has been more discriminative in terms of product quality features. The criteria of selection are becoming more focused on tactile softness, safety guarantee, and reliability. Although the rate of fertility is decreasing leading to reduced family sizes, the allocation of per-child expenditure has a positive trend. Instead of being forced to downgrade to economy-level products, a large percentage of parents are choosing high-end-positioned products that can offer a higher level of comfort and psychological assurance. This purchasing behavior which is quality-based is a major demand stabilization mechanism to the market.

Japan Baby and Child-Specific Products Market ChallengeLimited Growth from a Small Child Population

The market faces inherent constraints of growth because of the infant and early childhood population stagnation or decrease rates. With limited growth in the number of addressable end users, the potential volume of aggregate product growth is limited in nature. This population fact creates natural ceiling effects on the growth rate of the market. Although the reduction in the number of children in population groups aged 6 to 18 is partially corrected by per-capita expenditure, such corrections cannot be used to entirely counteract the adverse effect of decreased cohorts of children.

The small number of users adds competition to the existing brands. The product offerings often tend to show functional and utility convergence, making differentiation hard work. The high demands on investment in building trust and brand equity and design innovation put manufacturers under high pressure to ensure consumer loyalty. Without proper product differentiation behaviour, parental switching intensifies and hence denies provision of sustainable growth.

Japan Baby and Child-Specific Products Market TrendPreference for Convenient and Gentle Products

The demographics of parents are becoming more and more inclined towards products that enable them to have an easier time with child care without exposing them to stressful situations. The element of convenience has taken over price sensitivity as a dominant factor in purchase. The products with ready-to-use format, soft tactile characteristics, and mild formulation exhibit higher conformity to the current lifestyle needs of a family. This change of preference is skewed towards services that maximize time-saving and minimize the amount of effort expended in cleaning, feeding, and cursory care services.

Equivalent development is being made in design sophistication and packaging innovation. Parental end users show great appreciation for products with portability optimization, ease of opening, and the ability to operate with one hand. Practical design considerations have even become equal in value with functional performance as value drivers. This tendency makes manufacturers focus on comfort addition, usability improvement, and smart packaging solutions instead of traditional functionality delivery.

Japan Baby and Child-Specific Products Market OpportunityGrowth Through Better Product Value

Future growth will be supported by business ventures that strengthen their value proposition, even as population growth remains relatively modest. Parents show readiness to pay high price tags for products that provide proven advantages in terms of comfort, hygiene, or convenience in using. This movement leaves business room for higher design performance and considerate product development focusing on practical activities of daily use.

There is a huge opportunity in products that are customized to modern lifestyle needs. In the contemporary family, solutions that are fast, easy, and dependable are very much on the agenda. By focusing on strategic aspects of quality improvement, design, and practical utility optimization, brands are able to increase the levels of per-child spending. This will allow market value to be expanded regardless of absolute stability of the pediatric population.

Japan Baby and Child-Specific Products Market Segmentation Analysis

By Product

- Hair Care

- Skin Care

- Sun Care

- Toiletries

- Baby Wipes

- Diapers

- Medicated

Baby wipes constitute the dominant segment within the product, commanding approximately 30% of total market share. The category leadership position reflects daily-use requirements across diaper-changing procedures, post-feeding cleaning, and outdoor mobility scenarios, establishing baby wipes as an essential parental consumption item. Sustained demand drivers include convenience prioritization, hygiene maintenance imperatives, and gentle care requirements, particularly among working-parent demographics favoring user-friendly and portable solutions.

Prospectively, baby wipes are positioned to maintain segment leadership as parental consciousness regarding dermal safety and cleanliness intensifies. Products featuring soft texture profiles, alcohol-free formulations, and suitability for sensitive skin applications are anticipated to achieve enhanced market acceptance. As parental focus on health optimization and comfort assurance deepens, baby wipes will sustain their position as the primary product preference within the baby and child-specific products category throughout the 2026–2032 forecast period.

By Sales Channel

- Retail Online

- Retail Offline

Retail offline channels maintain dominant positioning within the sales channel segmentation, accounting for approximately 70% of market volume. Physical retail formats including supermarkets, pharmacies, and specialized baby product retailers continue to function as primary procurement venues for parental end users. The one-stop shopping paradigm retains substantial importance within the Japan retail context, as time-constrained families exhibit strong preference for consolidated baby product acquisition alongside routine grocery purchases within unified retail environments.

Retail offline channels are projected to sustain dominance throughout the 2026–2032 forecast period, driven by parental preference for direct product examination and comparative evaluation prior to purchase commitment, particularly for infant-related merchandise. Trust in retail personnel expertise, enhanced product visibility, and convenient accessibility within residential proximity will preserve retail offline channel strength, notwithstanding gradual online sales channel penetration gains.

List of Companies Covered in Japan Baby and Child-Specific Products Market

The companies listed below are highly influential in the Japan baby and child-specific products market, with a significant market share and a strong impact on industry developments.

- P&G Japan GK

- Oshimatsubaki Co Ltd

- Asahi Group Foods Ltd

- Pigeon Corp

- Unicharm Corp

- Johnson & Johnson KK

- Kao Corp

- Tampei Pharmaceutical Co Ltd

- Cow Brand Soap Kyoshinsha Co Ltd

- Ikeda Mohando Co Ltd

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Japan Baby and Child-Specific Product Market Policies, Regulations, and Standards

4. Japan Baby and Child-Specific Product Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Japan Baby and Child-Specific Product Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Hair Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Skin Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Sun Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Toiletries- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Baby Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Diapers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Medicated- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Category

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Sales Channel

5.2.3.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Japan Baby and Child-Specific Hair Care Product Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Japan Baby and Child-Specific Skin Care Product Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Japan Baby and Child-Specific Sun Care Product Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Japan Baby and Child-Specific Toiletries Product Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Japan Baby and Child-Specific Baby Wipes Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Japan Baby and Child-Specific Diapers Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Japan Baby and Child-Specific Medicated Product Market Statistics, 2022-2032F

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in US$ Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. Pigeon Corp

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. Unicharm Corp

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Johnson & Johnson KK

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Kao Corp

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. Tampei Pharmaceutical Co Ltd

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. P&G Japan GK

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. Oshimatsubaki Co Ltd

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Asahi Group Foods Ltd

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Cow Brand Soap Kyoshinsha Co Ltd

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Ikeda Mohando Co Ltd

13.1.10.1.Business Description

13.1.10.2.Product Portfolio

13.1.10.3.Collaborations & Alliances

13.1.10.4.Recent Developments

13.1.10.5.Financial Details

13.1.10.6.Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.