Indonesia Bottled Water Market Report: Trends, Growth and Forecast (2026-2032)

By Type of Water (Carbonated Bottled Water, Flavoured Bottled Water, Functional Bottled Water, Still Bottled Water (Purified Water, Mineral Water, Spring Water, Plain Water)), By Packaging Material (Plastic Bottles, Glass Bottles, Metal Cans, Others (Tetra Pack Cartons, Bioplastics, etc.)), By Price Point (Mass, Premium), By Sales Channel (On Trade, Off Trade (Retail Offline, Retail Online)), By Region (Sumatra, Java, Kalimantan, Sulawesi, Others)

- FMCG

- Feb 2026

- VI0978

- 125

-

Indonesia Bottled Water Market Statistics and Insights, 2026

- Market Size Statistics

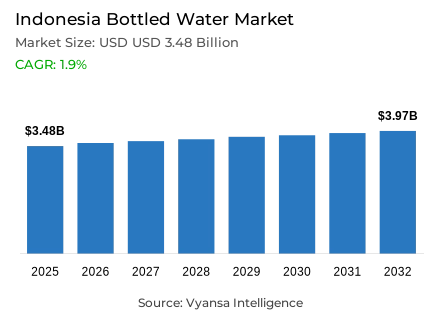

- Bottled water in Indonesia is estimated at USD 3.48 billion in 2025.

- The market size is expected to grow to USD 3.97 billion by 2032.

- Market to register a cagr of around 1.9% during 2026-32.

- Type of Water Shares

- Still bottled water grabbed market share of 95%.

- Competition

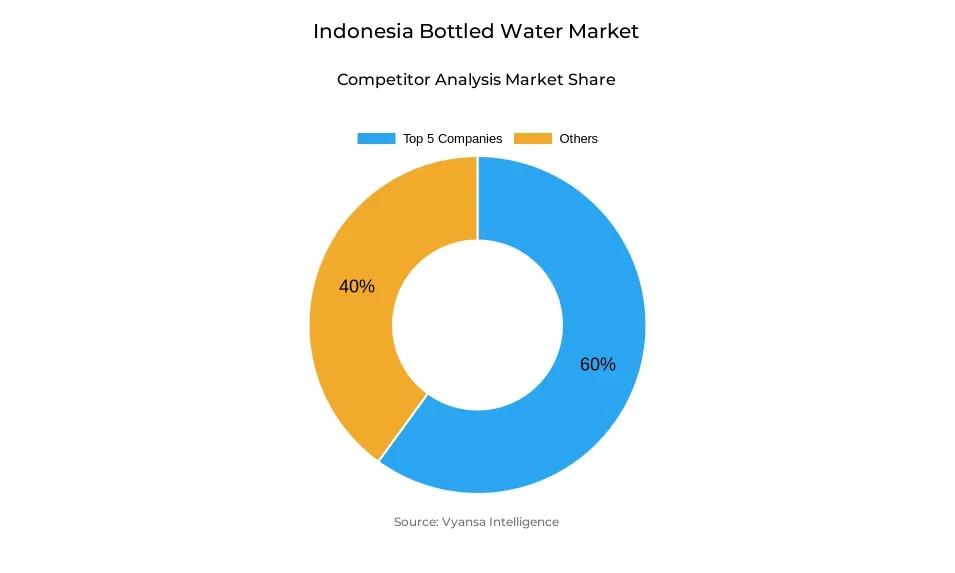

- Bottled water in Indonesia is currently being catered to by more than 10 companies.

- Top 5 companies acquired around 60% of the market share.

- Oasis Waters International PT; Akasha Wira International Tbk PT; Garudafood Group; Danone Aqua PT; Tirta Fresindo Jaya PT etc., are few of the top companies.

- Sales Channel

- Off trade grabbed 85% of the market.

Indonesia Bottled Water Market Outlook

The Indonesia bottled water market is estimated at USD 3.48 billion in 2025 and is expected to grow to about USD 3.97 billion in 2032, which represents a relatively low compound annual growth rate of about 1.9% in the 2026-2032. The growth is not fast but stable, which indicates a developed consumption base and the growing impact of sustainability factors on daily hydration decisions. Bottled water is a product that is vital across the archipelago, with extensive supply and its contribution to the daily drinking-water requirements of households in both urban and rural settings.

The issue of single-use plastic waste is changing the way consumers interact with bottled water. Increased awareness of plastic pollution has promoted a slow transition of small single-serve PET bottles to reusable containers and larger bulk packaging that is viewed to produce less waste. The sustainability discussion in the public has brought environmental impact into the visible aspect of purchase decisions, particularly among urban and educated consumers, and this has impacted the way brands position products and packaging formats in the market.

This shift is strengthened by regulatory cues, including the prohibition of bottled water under one litre in single-use plastic in Bali, which highlights the policy emphasis on waste minimization. Although this makes producers face compliance and cost issues, it also hastens the shift in packaging strategies and product formats. The need to balance environmental responsibility and affordability is still relevant, especially in a market where price sensitivity still defines demand.

Structurally, bottled water still controls the Type of Water segment with about 95% of the market, thus highlighting its position as a simple, low-cost hydration choice. Distribution wise, the Off-Trade channels have approximately 85% of the share, which is led by supermarkets, convenience stores, and traditional grocers that facilitate regular, daily purchases. Collectively, these aspects constitute a stable perspective that is characterised by slow growth, sustainability-based changes, and a high dependency on the existing types of products and retailing channels.

Indonesia Bottled Water Market Growth DriverEnvironmental Sustainability Driving Shifts in Packaging Preferences

One of the key drivers that are transforming the bottled water market in Indonesia is the growing alarm over environmental effects of single-use plastic waste. This issue is becoming a growing concern in consumer behaviour and policy orientation. Indonesia produced an estimated 4.22 million tonnes of plastic waste in 2023, with almost 44% of it being mismanaged, highlighting the extent of plastic pollution in the archipelago. As a result, reusable containers and larger bulk formats that reduce waste are increasingly becoming the priority of urban and educated consumers, replacing the traditional single-serve PET bottles. The sustainability has become a fundamental factor in hydration decisions due to the public discussion of plastic pollution, and brands have begun to reevaluate their packaging policies to meet environmental demands.

On the regional level, policy responses also support this change for instance in 2025, Bali passed a ban on the manufacture of bottled water less than one litre in single-use plastic. These regulatory cues increase sustainability as a major market driver, promoting investment in alternative materials and reuse-based solutions that appeal to environmentally conscious end users. This trend is pushing the market out of small traditional bottles into formats that are viewed as less polluting and more aligned with the overall environmental goals.

Indonesia Bottled Water Market ChallengeRegulatory and Waste Management Barriers Limiting Expansion

The bottled water market in Indonesia is heavily limited due to sustainability-oriented policies and the ongoing waste-management issues that make it difficult to expand. The sheer amount of plastic waste, which in 2023 amounted to more than 4.22 million tonnes, of which almost 44% is not properly disposed of, has led to a renewed focus on single-use packaging, such as PET bottles. The lack of proper waste collection and recycling facilities increases the environmental impact of traditional bottles, which is why policymakers have implemented strict policies. These sustainability requirements impose cost burdens on beverage firms as they manoeuvre compliance and operational efficiency. An example of this trend is local regulatory measures; in particular, the prohibition of single-use plastic bottled water less than one litre in Bali forces brands to consider alternative materials and reuse systems.

Nevertheless, the shift to sustainable packaging is logistically and financially difficult, especially to smaller manufacturers with less capital. The trade-off between environmental compliance and affordability among price-sensitive consumers has continued to be a limiting factor, delaying the wider use of environmentally friendly formats and limiting the growth of traditional bottle sales in areas where the single-serve PET products are most relied upon.

Indonesia Bottled Water Market TrendRising Environmental Awareness Influencing Consumption Behaviour

One of the most noticeable tendencies in the Indonesian bottled water market is the rising awareness of the population about plastic pollution and its effects on the environment, which is increasingly influencing consumer buying behaviour. Indonesia is one of the nations where the mismanaged plastic waste is the most prevalent, and the presence of pollution in the marine and urban areas has increased the sustainability of daily decision-making. Families, especially in urbanised areas, are shifting to reusable drinkware and bigger multi-serve water containers to decrease the use of small single-use bottles, which is a change towards more environmentally friendly decisions.

Grassroots recycling and reuse movements support this trend by promoting bulk packaging or refillable containers by retailers and consumers. Retailers are reacting by increasing the number of options that contribute to sustainability, and communication about environmental impact strengthens the choice of lower-waste hydration. These changing consumption trends are slowly transforming market demand to move beyond the traditional small PET bottles to other alternatives that are seen to be more sustainable, and this is an indication of a significant change in preferences of the environmentally conscious consumers in Indonesia.

Indonesia Bottled Water Market OpportunityInnovation in Sustainable Packaging and Circular Solutions

The emerging environmental issue is a great opportunity to the industry players in the Indonesian bottled water market to be innovative in sustainable packaging and circular economy solutions. Faced with massive amounts of poorly handled plastic waste, there is a growing demand of bottles produced with recycled materials, biodegradable substances and reusable designs. Green consumers are becoming more open to products that offer a balance between lower environmental performance and functional performance, which provides a competitive edge to brands that can offer sustainability without sacrificing quality or price. This transition is further supported by government waste-reduction policies and longer producer responsibility models, which promote investment in circular systems that improve material recovery and reuse.

Those companies that manage to introduce recyclable PET, refill stations, or biodegradable options will be able to stand out and establish a more robust trust with sustainability-minded consumers. Partnerships with waste-management programs and open reporting on environmental performance can enhance market positioning, aligning the product offerings with national objectives to curb plastic pollution. This congruency forms a fertile environment to develop segments that promote responsible hydration solutions.

Indonesia Bottled Water Market Segmentation Analysis

By Type of Water

- Carbonated Bottled Water

- Flavoured Bottled Water

- Functional Bottled Water

- Still Bottled Water

- Purified Water

- Mineral Water

- Spring Water

- Plain Water

In the Indonesia bottled water market, still bottled water holds the predominant share under the Type of Water segmentation, accounting for approximately 95% of the market. This dominant position reflects the fundamental role of still water in everyday hydration needs across urban and rural areas, particularly where access to reliable alternative water sources, such as filtration systems, may be inconsistent. The simplicity, affordability, and widespread distribution of still bottled water ensure its continued relevance for routine consumption occasions among diverse end user groups throughout the archipelago.

The limited differentiation within the routine drinking water category further supports the high market share of still water, as it satisfies basic hydration without the need for premium positioning or specialised functional claims. Price sensitivity among many end users reinforces this preference, as still bottled water provides a cost-effective and accessible solution for daily hydration. Retail availability across modern and traditional outlets ensures that still bottled water remains the foundational product type in Indonesia’s hydration landscape, maintaining broad appeal despite sustainability concerns driving interest in alternative formats.

By Sales Channel

- On Trade

- Off Trade

- Retail Offline

- Retail Online

Under the Sales Channel segmentation for the Indonesia bottled water market, Off Trade channels maintain a dominant position, accounting for around 85% of bottled water sales. Off-Trade outlets-including supermarkets, convenience stores, and traditional grocers—serve as the primary points of purchase for end users seeking bottled water for home consumption and everyday use. These channels offer extensive geographic coverage and frequent restocking opportunities, enabling end users to replenish hydration supplies with convenience and reliability.

The continued dominance of Off-Trade underscores its central role in meeting routine hydration needs, supported by strong distribution networks and competitive pricing strategies that resonate with price-sensitive end users. While e-commerce and on-trade venues are growing as complementary channels, they remain secondary in overall distribution reach. Traditional grocery shops and modern retail formats collectively drive Off-Trade sales, ensuring that bottled water remains readily accessible across both urban and rural markets.

List of Companies Covered in Indonesia Bottled Water Market

The companies listed below are highly influential in the Indonesia bottled water market, with a significant market share and a strong impact on industry developments.

- Oasis Waters International PT

- Akasha Wira International Tbk PT

- Garudafood Group

- Danone Aqua PT

- Tirta Fresindo Jaya PT

- Sariguna Primatirta Tbk PT

- Tirta Sukses Perkasa PT

- Sinar Sosro PT

- Amerta Indah Otsuka PT

- Coca-Cola Indonesia PT

Competitive Landscape

Indonesia’s bottled water market remains highly competitive, led by Danone Aqua PT, which retains clear leadership through strong brand equity, nationwide availability, and aggressive pricing, especially in 600 ml and 1,500 ml packs supported by large-scale promotions. Functional water has emerged as a key competitive arena, with Garudafood Group gaining strong momentum through its Super O2 brand, which differentiates via high oxygen content and sporty, UV-protective packaging. In still spring water, Sariguna Primatirta Tbk PT maintains dominance through wide distribution across modern retail and small grocers, supported by diverse pack sizes and community-focused activities such as running events. Competition is increasingly shaped by branding strength, functional positioning, distribution depth, and lifestyle-driven marketing.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Indonesia Bottled Water Market Policies, Regulations, and Standards

4. Indonesia Bottled Water Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Indonesia Bottled Water Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Volume (Million Litres)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Type of Water

5.2.1.1. Carbonated Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Flavoured Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Functional Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Still Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Purified Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Mineral Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Spring Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Plain Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Packaging Material

5.2.2.1. Plastic Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Glass Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Metal Cans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Others (Tetra Pack Cartons, Bioplastics, etc.)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Point

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. On Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Off Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Region

5.2.5.1. Sumatra

5.2.5.2. Java

5.2.5.3. Kalimantan

5.2.5.4. Sulawesi

5.2.5.5. Others

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Indonesia Carbonated Bottled Water Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Volume (Million Litres)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Region- Market Insights and Forecast 2022-2032, USD Million

7. Indonesia Flavoured Bottled Water Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Volume (Million Litres)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Region- Market Insights and Forecast 2022-2032, USD Million

8. Indonesia Functional Bottled Water Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Volume (Million Litres)

8.2. Market Segmentation & Growth Outlook

8.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Region- Market Insights and Forecast 2022-2032, USD Million

9. Indonesia Still Bottled Water Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Volume (Million Litres)

9.2. Market Segmentation & Growth Outlook

9.2.1.By Type of Water- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Price Point- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Region- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Danone Aqua PT

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Tirta Fresindo Jaya PT

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Sariguna Primatirta Tbk PT

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Tirta Sukses Perkasa PT

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Sinar Sosro PT

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Oasis Waters International PT

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Akasha Wira International Tbk PT

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Garudafood Group

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Amerta Indah Otsuka PT

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Coca-Cola Indonesia PT

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Type of Water |

|

| By Packaging Material |

|

| By Price Point |

|

| By Sales Channel |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.