US Ice Cream Market Report: Trends, Growth and Forecast (2025-2030)

By Category (Frozen Yoghurt, Impulse Ice Cream, Plant-based Ice Cream, Take-Home Ice Cream), By Leading Flavours (Chocolate, Vanilla, Strawberry, Cookies & Cream, Caramel, Mango, Pralines & Cream, Kulfi), By Format (Cup, Stick, Cone, Brick), By Sales Channel (Retail Offline, Retail E-Commerce)

- Food & Beverage

- Dec 2025

- VI0008

- 121

-

US Ice Cream Market Statistics and Insights, 2025

- Market Size Statistics

- Ice Cream in US is estimated at $ 21.91 Billion.

- The market size is expected to grow to $ 24 Billion by 2030.

- Market to register a CAGR of around 1.53% during 2025-30.

- Product Shares Shares

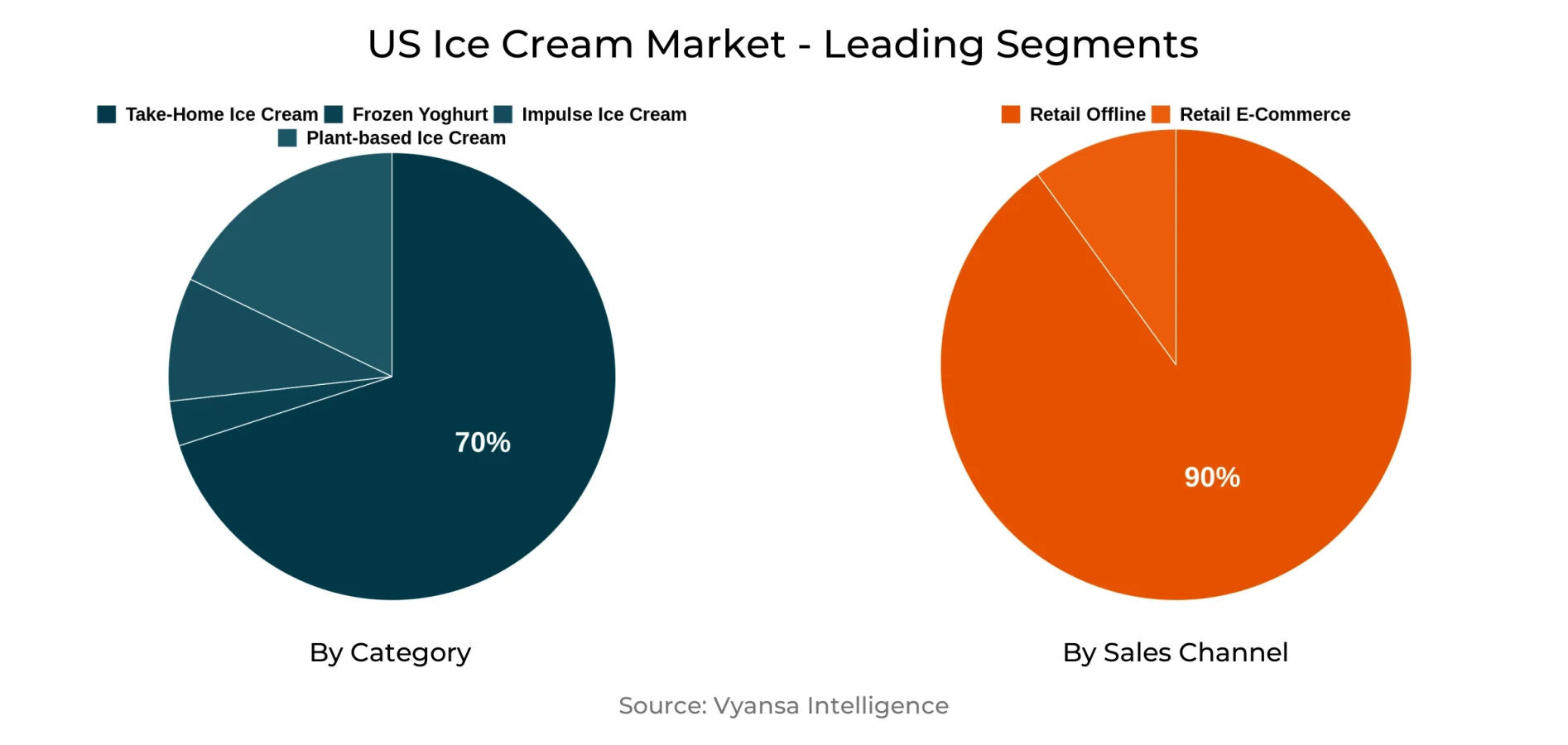

- Take-Home Ice Cream grabbed market share of 70%.

- Take-Home Ice Cream to witness a volume CAGR of around 0.94%.

- Competition

- More than 15 companies are actively engaged in producing Ice Cream in US.

- Top 5 companies acquired 45% of the market share.

- Mars Inc, Tilamook CCA, Rich Products Corp, Dreyer's Grand Ice Cream Holdings Inc, Unilever Ice Cream etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 90% of the market.

US Ice Cream Market Outlook

The US Ice Cream market is witnessing a split in climbing retail value sales and falling volume sales. This split is primarily pushed by high inflation and changing consumer tendencies. While the pandemic first fueled a surge in volume sales during 2020, restoration to pre-pandemic habits and financial pressure have brought about persistent volume decline from 2024. Multi-pack and bulk dairy ice cream categories have levelled off, with impulse purchasing experiencing the most severe decline as a result of high unit prices and a growing emphasis on value by consumers.

Against this backdrop, ice cream desserts have been a beacon of optimism, with sustained volume growth fueled by their association with celebratory and social family moments. Consumers are increasingly choosing ice cream cakes as value indulgences, underpinning steady demand in this category.

Distribution geography has steadied in the post-pandemic world, with the proportion of retail e-commerce pulling back marginally to 8% in 2023 as offline channels reclaim lost ground. In contrast, sustainability pressures—such as increased costs for cooling with record temperatures and escalating demand for sustainable packaging—represent cost pressures but also innovation opportunities, like energy-saving freezers.

There is a polarisation in customer expenditure patterns, where families prefer value and private label products, while smaller families are buying premium products although less often. This trend puts mid-range products under threat but also presents opportunities for innovation in variety and limited edition formats. Additionally, ongoing trends for health and wellness keep driving consumer demand, with natural ingredients and clean-label claims increasingly popular. Brands that openly communicate these qualities are able to command higher prices and establish loyalty in a more discerning marketplace.

US Ice Cream Market Challenge

The retail value sales is on the rise while selling volumes are declining. It is driven by post-pandemic normalisation and high inflation. The end consumers are cutting down on discretionary spend, leading to a trend towards seeking value behaviour. Impulse products are facing drastic declines, while multi-pack and bulk dairy ice cream volumes are stagnant. Furthermore, market polarisation is narrowing the mid-priced category. It is because of the fact that households are trading down to private labels and purchasing bulk commodities and individual families are purchasing premium versions but they are purchasing less frequently relatively. The twin squeeze of rising costs and altering end users behavior has made volume growth more challenging.

US Ice Cream Market Trend

The end consumers are turning health conscious. It is driving the demand towards wellness and health trends. The end consumers are worrying about the conventional ice creams with respect to the fat and sugar levels and are oriented towards clean labels and ingredient transparency. It is being driven by growing demand for gluten free, no artificial flavours or colours, hormone free milk etc. The trend is also reflective of a broader shift towards minimally processed foods which exactly tracks the changing health priorities (nutrient and production centered). Additionally, the brands can afford premium positioning and fortify brand stance if the final consumers further opt for the trend. Thus boosting the overall market demand and share in the forecast period.

US Ice Cream Market Opportunity

The increasing emphasis on the sustainability. It is being driven by the 2023 being the hottest year ever in the northern hemisphere. It offers a significant opportunity for The US's overall ice cream market. As the weather becomes warmer, cooling and energy costs along the way of production, distribution, and sales are bound to rise, and therefore a demand for innovative solutions emerges. Under such a type of challenge, the market is experiencing a shift towards sustainable packaging and energy-saving technology. As much as it is, current sustainable packaging solutions still fall short in guaranteeing cold chain food safety, thus leaving space for research and development. For example, the development by Unilever of low-energy freezers that run at a higher temperature. These types of innovations are intended to lower long-term costs and encourage sustainability. The individuals who invested in the developments are well-placed to reap the early benefits of how the market is evolving, it aids in gaining the competitive advantage because they are reacting to growing end user interest in environmentally sustainable solutions.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 21.91 Billion |

| USD Value 2030 | $ 24 Billion |

| CAGR 2025-2030 | 1.53% |

| Largest Category | Take-Home Ice Cream segment leads with 70% market share |

| Top Challenges | Volume Pressure Amid Inflation and Changing Consumer Spending Patterns |

| Top Trends | Health-Conscious Shifts Driving Clean Label and Nutrient-Centric Preferences |

| Top Opportunities | Sustainability-Driven Innovation in Packaging and Energy Efficiency |

| Key Players | Mars Inc, Tilamook CCA, Rich Products Corp, Dreyer's Grand Ice Cream Holdings Inc, Unilever Ice Cream, Ben & Jerry's Homemade Ltd, Blue Bell Creameries Inc, Wells Enterprises Inc, Yasso Inc, Talenti and Others. |

US Ice Cream Market Segmentation Analysis

Take-Home Ice Cream is the largest segment under the Category, with a share of approximately 70%. The demand is prompted by the value-driven indulgence from end users in response to inflation and increasing living expenses. As the unit price of ingredients like sugar, milk, cocoa rise etc. Therefore, in order to get around the situation, the end users are moving towards purchasing dairy items in bulk in order to obtain improved value per serving. Additionally, the 'buying less but buying well' trend has driven the demand for the Take-Home ice cream format. The format enables the end consumers to effectively control the budget and simultaneously indulge in the premium product at home. The idea is predominantly applied by single households. In addition, take-home ice cream form is inexpensive and long-lasting, and thus it is a first preference for the end consumers as a source of comfort during difficult economic situations.

Top Companies in US Ice Cream Market

The top companies operating in the market include Mars Inc, Tilamook CCA, Rich Products Corp, Dreyer's Grand Ice Cream Holdings Inc, Unilever Ice Cream, Ben & Jerry's Homemade Ltd, Blue Bell Creameries Inc, Wells Enterprises Inc, Yasso Inc, Talenti, etc., are the top players operating in the US Ice Cream Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. US Ice Cream Market Policies, Regulations, and Standards

4. US Ice Cream Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. US Ice Cream Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.1.2.By Volume in Million Litres

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Frozen Yoghurt- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.2. Impulse Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.2.1. Single Portion Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.2.2. Single Portion Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.3. Plant-based Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4. Take-Home Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.1. Take-Home Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.1.1. Bulk Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.1.2. Multi-Pack Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.2. Take-Home Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.2.1. Bulk Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.2.2. Multi-Pack Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.By Leading Flavours

5.2.2.1. Chocolate- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.2. Vanilla- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.3. Strawberry- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.4. Cookies & Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.5. Caramel- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.6. Mango- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.7. Pralines & Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.8. Kulfi- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.By Format

5.2.3.1. Cup- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.2. Stick- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.3. Cone- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.4. Brick- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.5. Others (Sandwich, Tub, etc.)- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1. Grocery Retailers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.1. Convenience Retailers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.1.1. Convenience Stores- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.1.2. Forecourt Retailers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.2. Supermarkets- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.3. Hypermarkets- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.4. Food & Drink Specialists- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.5. Small Local Grocers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.2. Retail E-Commerce- Market Insights and Forecast, 2020-2030, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. US Frozen Yoghurt Ice Cream Market Outlook, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Volume in Million Litres

6.2. Market Segmentation & Growth Outlook

6.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

6.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

7. US Impulse Ice Cream Market Outlook, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.1.2.By Volume in Million Litres

7.2. Market Segmentation & Growth Outlook

7.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

7.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

8. US Plant-based Ice Cream Market Outlook, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.1.2.By Volume in Million Litres

8.2. Market Segmentation & Growth Outlook

8.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

8.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

9. US Take-Home Ice Cream Market Outlook, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.1.2.By Volume in Million Litres

9.2. Market Segmentation & Growth Outlook

9.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

9.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Mars Inc

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Tilamook CCA

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Rich Products Corp

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Dreyer's Grand Ice Cream Holdings Inc

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Unilever Ice Cream

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Ben & Jerry's Homemade Ltd

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Blue Bell Creameries Inc

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Wells Enterprises Inc

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Yasso Inc

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Talenti

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Leading Flavours |

|

| By Format |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.