US Fire Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (Overhung Pumps, Vertical Inline, Horizontal End Suction), Split Case Pumps (Single/Two Stage, Multi Stage)), Positive Displacement Pumps (Diaphragm Pumps, Piston Pumps), By Mode of Operation (Diesel Fire Pump, Electric Fire Pump, Others), By End-User (Residential, Commercial, Industrial)

- Energy & Power

- Feb 2026

- VI0513

- 120

-

US Fire Pump Market Statistics and Insights, 2026

- Market Size Statistics

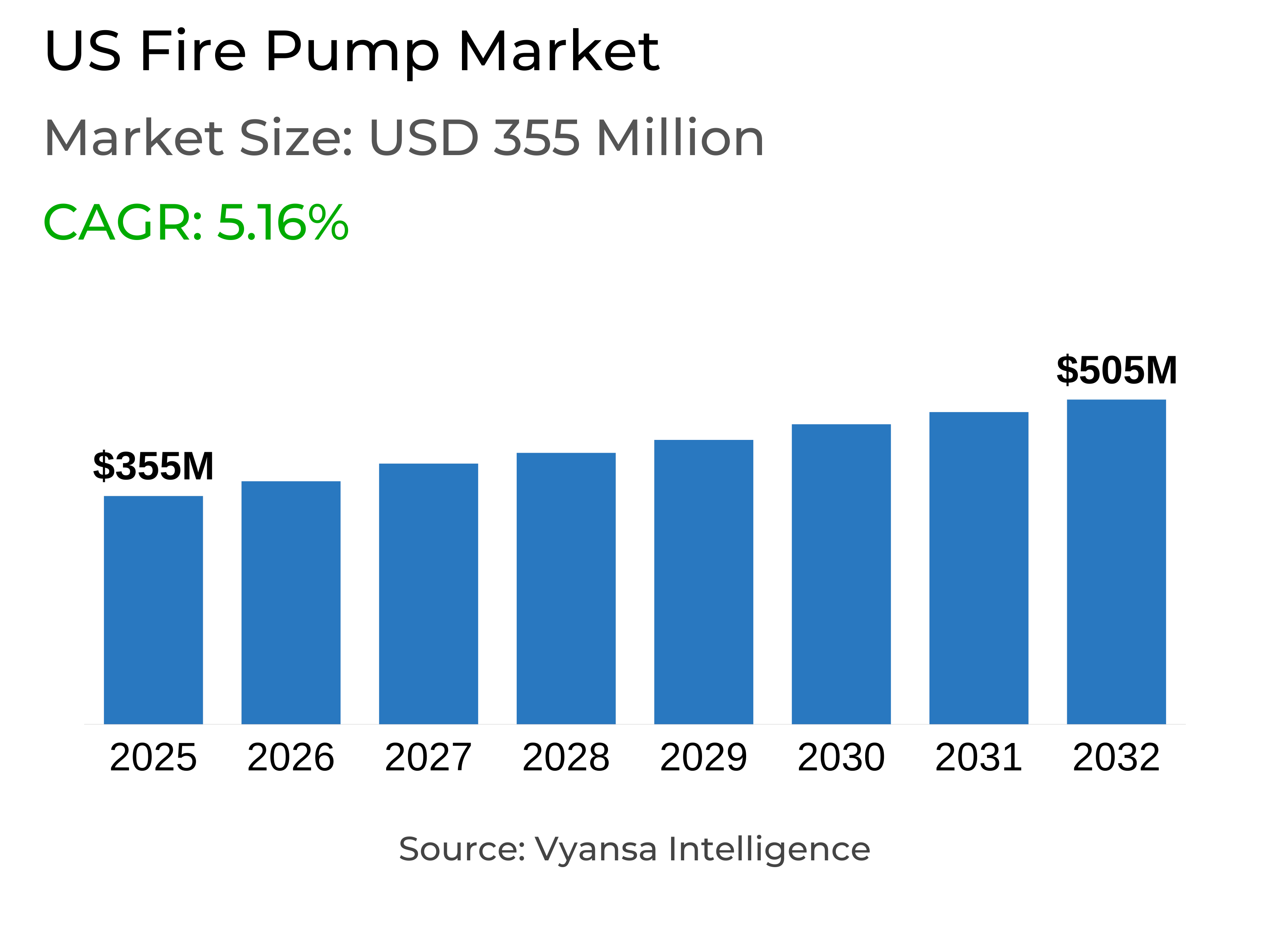

- Fire Pump in US is estimated at $ 355 Million.

- The market size is expected to grow to $ 505 Million by 2032.

- Market to register a CAGR of around 5.16% during 2026-32.

- Pump Type Segment

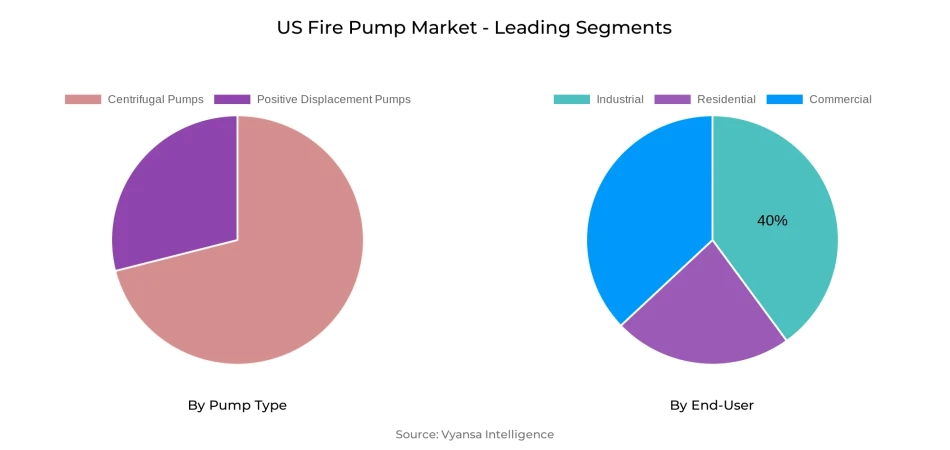

- Centrifugal Pumps continues to dominate the market.

- Competition

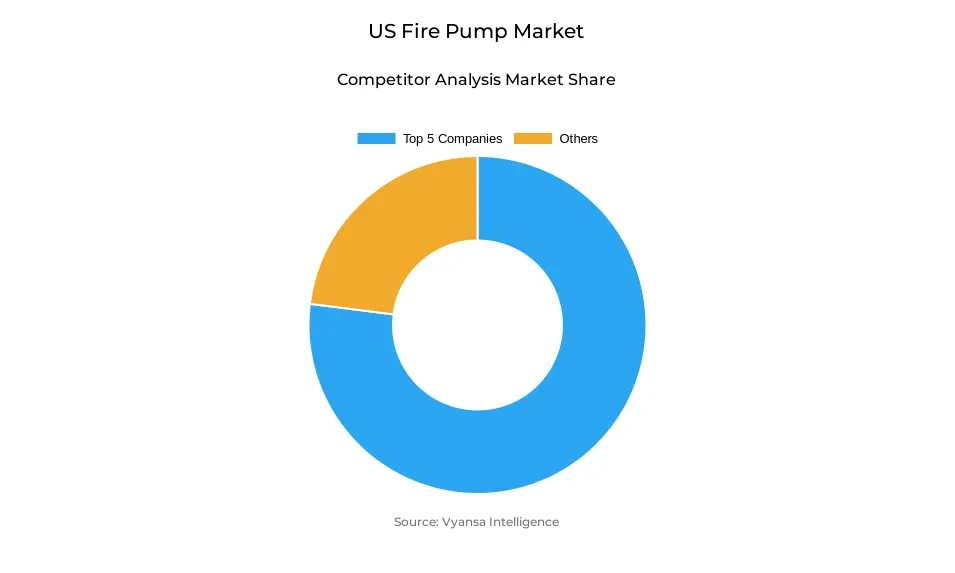

- More than 10 companies are actively engaged in producing Fire Pump in US.

- Top 5 companies acquired the maximum share of the market.

- WILO SE, Ebara Corporation, ITT Goulds Pumps, Flowserve Corporation, Pentair PLC etc., are few of the top companies.

- End-User

- Industrial grabbed 40% of the market.

US Fire Pump Market Outlook

The US Fire Pump Market is anticipated to grow steadily, from an estimated USD 355 million in 2025 to approximately USD 505 million by 2032, representing a CAGR of almost 5.16% from 2026 to 2032. Growth is being driven by the widespread occurrence of fire emergencies—1,389,000 incidents occurring in 2023 alone—and increasingly stringent fire protection codes requiring dependable pumping solutions for residential and commercial buildings. Stationary centrifugal pumps, UL 448 certified, remain the core of installations with their uninterrupted water supply to varied occupancy types.

While this is happening, changes like NFPA 20 are influencing market preference. Restrictions on pump room design, series installation, and mandatory testing for maintenance increase costs, but they guarantee performance reliability. This has prompted the development of digitally enabled, remotely monitored pumps that assist in mitigating operational risk and enhancing compliance. Cloud-based dashboards, predictive maintenance, and IoT-enabled controllers are being widely implemented to keep pace with quick code changes and the requirement for real-time performance observation.

Of pump types, centrifugal pumps are the market leaders due to their versatility, proven performance standards, and suitability for both electric and diesel drivers. Their technological benefits and compliance with regulations make them the most desirable choice for residential, commercial, and industrial projects with minimal competition from positive-displacement pumps that cater to specialty applications.

On the supply side, industrial customers command the lion's share, holding approximately 40% of the market in 2025. Factories and warehouses are at high risk of fires, with more than 140,000 non-residential fires reported each year, of which 1,508 were warehouse-related alone. As insurers and regulators are focusing on compliance, industrial facilities increasingly spend on several centrifugal units, jockey pumps, and diesel backup systems, further solidifying their status as the dominant end-user category through 2032.

US Fire Pump Market Growth Driver

Escalating Fire Incidents and Regulatory Standards Driving Market Expansion

The US fire pump market is being driven by an increased frequency of fire incidents and the intensification of fire protection codes. In 2023, US fire services attended to 1,389,000 fires—one per 23 seconds—causing 3,670 civilian fatalities. Such a large number emphasizes the requirement for dependable pumping solutions able to maintain sprinkler flow in a variety of environments, ranging from warehouses to high-rise residential towers. Stationary fire pumps are thus considered to be the key assets to provide continuous water supply in emergency situations.

In addition, changing regulations are supporting adoption. NFPA 20 currently restricts series installations to three pumps in the same room, precluding cascading failures in sophisticated high-rise systems. Manufacturers are meeting the challenge with UL 448-certified centrifugal pumps, the accepted standard for UL-listed stationary fire-protection equipment. The intersection of high-fire incidence and strict engineering requirements makes centrifugal technology the foundation of pump installations, increasingly propelling demand across various occupancy types throughout 2032.

US Fire Pump Market Challenge

Complex Compliance Requirements and Rising Operational Costs

Whereas demand is increasing, compliance costs are still a major roadblock in the US Fire Pump Market. NFPA 20 mandates pump rooms that are in one- or two-hour fire-rated enclosures, uncluttered with unnecessary equipment, and kept above 4 °C (40 °F) to avoid freezing. Retrofitting of older structures with climate-conditioned enclosures, ventilation, and drainage systems increases initial costs, typically beyond typical sprinkler budgets and deterring broad-based adoption in smaller facilities.

Maintenance requirements further tax resources. NFPA calls for yearly controller, alarm, and flow tests under NFPA 70E arc-flash safe practices, necessitating comprehensive protective gear and extensive energy analysis. Diesel-fuel quality and generator exercises further contribute to lifecycle costs. These resource-intensive maintenance demands considerably elevate operating costs, inducing reluctance among end users with cost concerns. Accordingly, complexity of compliance and cost are most likely to remain the most enduring limitations on broader pump usage.

US Fire Pump Market Trend

Advancements in Digital Monitoring and Regulatory Adaptation

Technological change is transforming the US Fire Pump Market as digital monitoring is being embraced. Annex C in NFPA 20-2019 acknowledged cyber-secure and remotely monitored controllers. This gave credibility to cloud-based dashboards monitoring suction pressure, alarm history, and pump performance in real-time. Such systems decrease site visits, enable predictive maintenance, and give insurers better operational records, making digital integration a more common feature in fire pump systems.

Concurrently, the tempo of regulation modification is accelerating. A 2023 survey by Consulting-Specifying Engineer discovered that 58% of fire-protection engineers utilize NFPA 20 on a regular basis, but 79% spot clarity gaps and 59% want significant revisions every two to three years. This input is encouraging manufacturers to introduce IoT-capable pumps with firmware for over-the-air updates, allowing them to stay current with quickly changing codes. These advances are establishing digital monitoring and adaptable design as prevailing trends until 2032.

US Fire Pump Market Opportunity

Expanding Demand Across Industrial Applications

The industrial segment is a very prospective growth area for the US Fire Pump Market. NFPA studies point to a mean of 1,508 warehouse building fires per year, with $323 million in direct losses. Hot-work activities introduce additional danger, causing almost 3,400 building fires a year and $292 million in losses. These figures indicate enormous weaknesses in manufacturing and storage environments, where flammable stock and ongoing activity introduce increased exposure.

Suppliers are in a good position to address this need with UL-listed centrifugal pumps that engage automatically upon pressure reductions. Large-capacity diesel-powered systems, which can keep operations going during grid blackouts, offer extra resilience. By facilitating compliance with NFPA audits and minimizing downtime, such systems are becoming more appealing to industrial end users as well as to insurers. Due to the ongoing scope of industrial dangers, retrofitting old facilities with modern fire pumps is the most evident revenue channel for manufacturers and installers from 2026 through 2032.

US Fire Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pumps

Centrifugal pumps have the maximum market share in the Pump Type segment of the US Fire Pump Market. Under the regulation of UL 448, the final standard for stationary fire-protection centrifugal pumps, these pumps lead conventional installations. NFPA 20 prescribes centrifugal or vertical-turbine pumps for normal sprinkler and hydrant service, with positive-displacement pumps still being limited to specialized water-mist and foam use, confining their acceptance to niche environments.

Their technical benefits solidify centrifugal pumps' dominance in the market. They have to pass performance tests at rated flow with 150% of rated flow at at least 65% pressure, guaranteeing dependable operation in all situations. Their compatibility with both diesel and electric drivers, along with extensive impeller choices, makes them highly adaptable for commercial, residential, and industrial applications. This adaptation of regulatory qualification, operational adaptability, and extensive applicability guarantees centrifugal pumps will continue their dominance up to 2032.

By End-User

- Residential

- Commercial

- Industrial

Industrial end users comprise the most significant market share sector in the US Fire Pump Market due to the extent of fire exposure within manufacturing and logistics centers. The fire departments reported responding to 140,000 non-residential building fires in 2022, and merely the warehouse category reported 1,508 incidents per year. The frequency of fires within these settings highlights the need for strong fire suppression systems specific to industrial hazards.

Factories and warehouses are motivated by continuous operations, flammable inventories, and potential downtime expenses to seek redundancy. This involves implementing multiple centrifugal pumps with backup jockey units and diesel engines to ensure continuous service. Hot-work alone is responsible for an estimated 3,400 structure fires every year, further encouraging insurers to require NFPA-approved pumps and monitoring systems prior to issuing a policy. Such operational and regulatory requirements support industrial end users as the leading market segment during 2032.

Top Companies in US Fire Pump Market

The top companies operating in the market include WILO SE, Ebara Corporation, ITT Goulds Pumps, Flowserve Corporation, Pentair PLC, Sulzer Limited, Grundfos Holding A/S, KSB SE & Co. KGaA, Patterson (Gorman Rupp), Armstrong, etc., are the top players operating in the US Fire Pump Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. US Fire Pump Market Policies, Regulations, and Standards

4. US Fire Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. US Fire Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.1. Overhung Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.2. Vertical Inline- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.3. Horizontal End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.1. Single/Two Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.2. Multi Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Diaphragm Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Piston Pumps - Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Mode of Operation

5.2.2.1. Diesel Fire Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Electric Fire Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End-User

5.2.3.1. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Commercial- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Industrial- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. US Centrifugal Fire Pump Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

7. US Positive Displacement Fire Pump Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Flowserve Corporation

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Pentair PLC

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Sulzer Limited

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Grundfos Holding A/S

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.KSB SE & Co. KGaA

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.WILO SE

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Ebara Corporation

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.ITT Goulds Pumps

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Patterson (Gorman Rupp)

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Armstrong

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Mode of Operation |

|

| By End-User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.