Middle East & Africa Centrifugal Pump Market Report: Trends, Growth and Forecast (2026-2032)

Pump Type (Overhung Pumps (Vertical Line, Horizontal End Suction), Split Case Pumps (Single/Two Stage, Multi Stage), Vertical Pumps (Turbine (Solid Handling, Non-Solid Handling), Axial, Mixed Flow), Submersible Pumps (Solid Handling, Non-Solid Handling)), Operation Type (Electrical, Hydraulic, Air Driven), End User (Residential, Commercial, Agriculture & Irrigation, Industrial), Country (Saudi Arabia, UAE, Nigeria, South Africa, Morocco, Rest of Middle East & Africa)

- Energy & Power

- Jan 2026

- VI0624

- 170

-

Middle East & Africa Centrifugal Pump Market Statistics and Insights, 2026

- Market Size Statistics

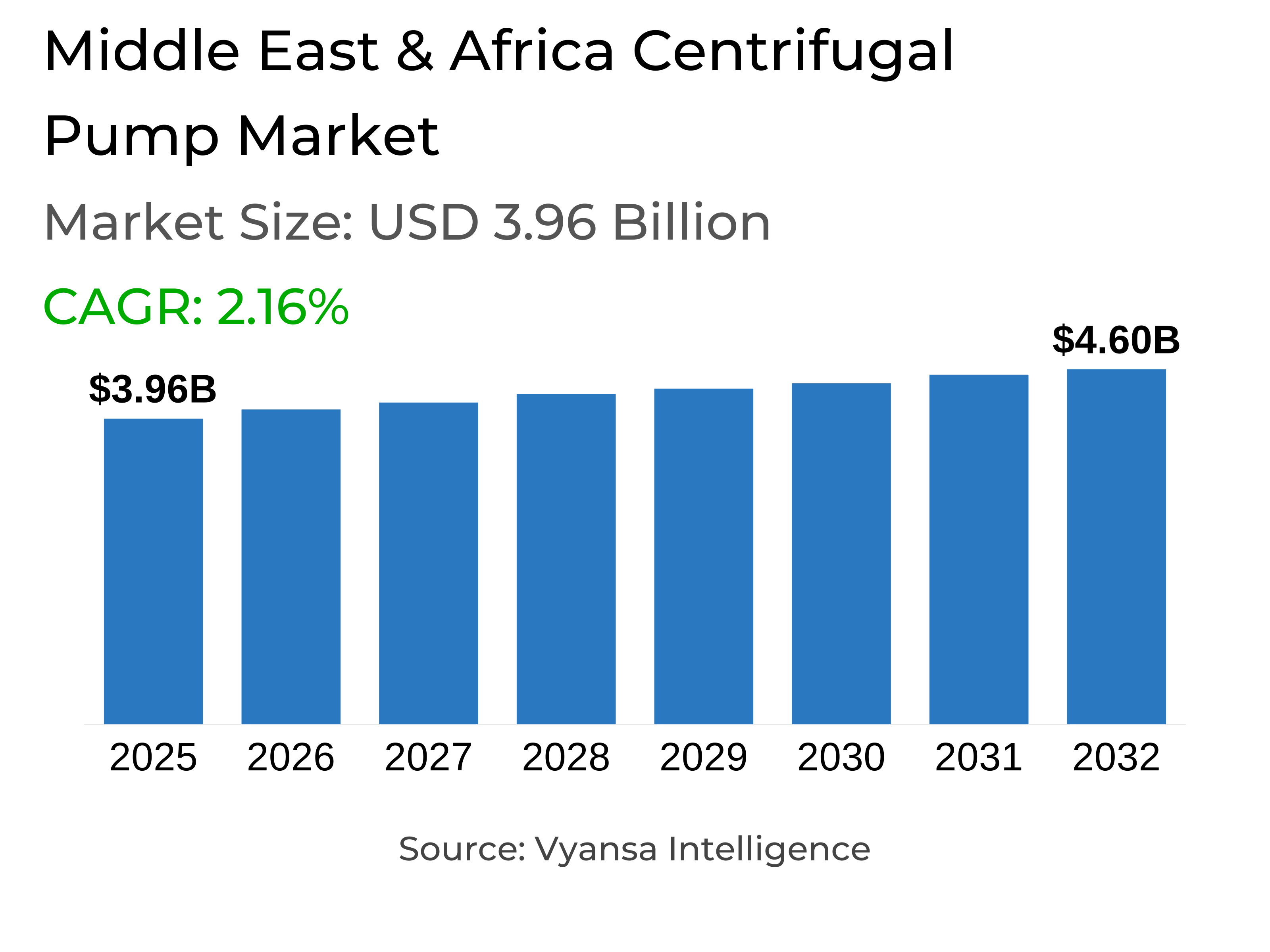

- Middle East & Africa centrifugal pump market is estimated at USD 3.96 billion.

- The market size is expected to grow to USD 4.6 billion by 2032.

- Market to register a cagr of around 2.16% during 2026-32.

- Pump Type Shares

- Overhung pumps grabbed market share of 35%.

- Competition

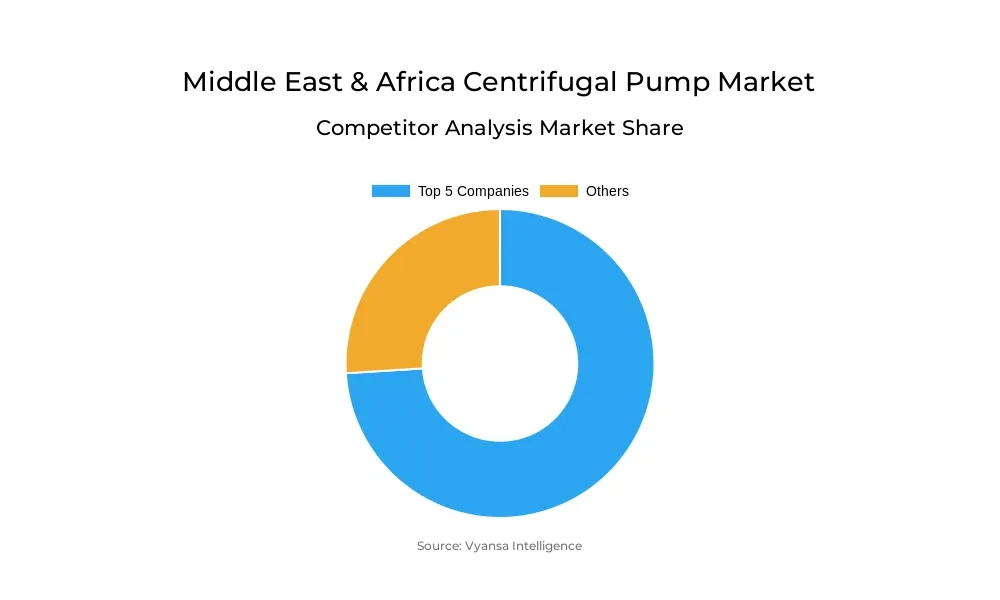

- More than 10 companies are actively engaged in producing centrifugal pump in Middle East & Africa.

- Top 5 companies acquired the maximum share of the market.

- Kirloskar Brothers Limited (KBL), KSB SE & Co. KGaA, SPX FLOW, Inc., PSG Dover, Ebara Corporation etc., are few of the top companies.

- End User

- Industrial grabbed 45% of the market.

- Country

- Saudi arabia leads with a 20% share of the Middle East & Africa market.

Middle East & Africa Centrifugal Pump Market Outlook

The Middle East & Africa centrifugal pump market is estimated at USD 3.96 billion in 2025 and is expected to attain USD 4.6 billion by 2032, growing at a CAGR of about 2.16% during 2026-2032. Indeed, massive investments in water and industrial infrastructure are transforming the region, in line with national development goals and economic diversification plans. As stated by the World Bank, MENA has the world's lowest per capita water availability, which initiates large-scale spending on desalination, wastewater, and municipal water supply systems. These projects are driving continuous demand for centrifugal pumps that offer efficient and reliable fluid transport across critical sectors.

Continuous water scarcity is driving the adoption of high-performance pumping systems at an accelerating rate. Saudi Arabia has revealed an investment plan of USD 14.58 billion in water projects under its National Transformation Program, while Egypt and Morocco have lined up expansion plans for desalination and water infrastructure capacities. These are applications that require continuous-duty, high-pressure centrifugal pumps that can keep regional water supply and treatment networks stable.

Industrial expansion further accelerates the growth of the market, while the oil and gas, power generation, and petrochemical industries account for approximately 45% of the demand. Among the types of pumps, overhung pumps top the chart with a share of about 35% due to their compact design, energy efficiency, and versatility in both industrial and municipal applications. Their easy maintenance and reliable operation allow them to be used in applications that involve heavy-duty services in the region.

Geographically, Saudi Arabia leads with a 20% share of the regional market, driven by major water infrastructure and industrial projects under Vision 2030. In addition to the UAE, Egypt, and Morocco, the large investment programs of the Kingdom are supporting long-term prospects for manufacturers of centrifugal pumps across the region.

Middle East & Africa Centrifugal Pump Market Growth Driver

Expanding Infrastructure and Industrial Development Across the Region

With national development programs and economic diversification on full throttle, massive investments into water and industrial infrastructure are reshaping the Middle East & Africa landscape. According to the World Bank, MENA has the world's lowest annual water availability per person at 480 cubic meters in 2023, thereby increasing demand for advanced fluid handling systems. The National Transformation Program of Saudi Arabia has apportioned USD 14.58 billion for projects on water, while Morocco has allocated USD 4.2 billion toward water infrastructure in its 2025 budget. Egypt, in its long-term strategy, targets desalination capacity of 8.85 million cubic meters per day by 2050, with initial phases completing by 2025. These initiatives collectively fuel demand for centrifugal pumps across the desalination, wastewater, and municipal water supply networks.

Industrial infrastructure growth is also causing a parallel increase in pump demand. The IEA projects regional electricity demand to surge by 50% by 2035, driven largely by desalination and cooling needs. More than 300 gigawatts of power capacity will be added between 2025 and 2035. Centrifugal pumps play a crucial role in supporting oil and gas platforms, petrochemical plants, and power plants. As industrial production increases owing to economic diversification programs, there is an increased requirement for reliable pumping systems that offer superior fluid management and energy efficiency in the industrial and infrastructure ecosystem across the region.

Middle East & Africa Centrifugal Pump Market Challenge

Intensifying Water Scarcity and Supply Chain Limitations

Institutions that have been accredited by the appropriate accrediting agency may issue a second credential to an applicant who currently or previously held a valid administrator credential.Persistent water shortage remains one of the most critical barriers to sustainable development in the Middle East & Africa region. The World Bank estimates that regional per capita water availability accounts for only about 10% of the world's average, and prospects are worsening: dry-season water resources may decrease by half by 2040 for some countries. Morocco has been experiencing long-term drought conditions that reduce the capacity of dams to approximately 29.8% as of late 2024. Egypt continues to suffer from a seven-billion-cubic-meter annual water deficit. These shortages have accelerated urgent investments in desalination and wastewater treatment facilities further, subsequently driving demand for centrifugal pumping systems capable of operating under high pressure and without interruptions.

Meanwhile, water scarcity and increased climatic volatility continue to exacerbate supply chain disruptions. According to the World Bank, global water infrastructure will require investment of USD 7 trillion by 2030, whereas developing countries are investing merely USD 164.6 billion per year. Very low logistics capacity and delays in project timelines are two of the factors driving up procurement costs related to special application centrifugal pumps. In Morocco, the emergency water highway project aptly demonstrated the challenge to meet accelerated deployment schedules, with manufacturers being required to customize products while incurring higher freight costs to serve rapid-response infrastructure goals.

Middle East & Africa Centrifugal Pump Market Trend

Rising Role of Renewable Energy and Desalination Technology Upgrades

Thus, the regional industrial scenario of centrifugal pump deployment is being reshaped by the rapid growth in renewable energy. The IEA reports that renewable capacity in MENA will increase from 6% in 2024 to 25% by 2035, driven by Saudi Arabia's target for 130 gigawatts of renewables and the growing number of solar desalination projects. Advanced centrifugal pumps are designed for brine transfer, variable load conditions, and energy efficiency, which makes them a basic component of solar-powered desalination facilities. Systems of this kind are core to achieving water sustainability and power generation efficiency within hybrid energy frameworks.

Technological advances in desalination continue to support pump demand, especially as systems increasingly shift toward reverse osmosis. More than 53% of the world's desalination capacity lies in the region, with Saudi Arabia set to increase its current capacity from 2.54 million to 7.5 million cubic meters per day by 2027. Egypt's projects currently under implementation will add a further 3.35 million m³/day by 2025. Such large-scale developments require robust centrifugal pumps with superior corrosion resistance, precision control, and compatibility with automation technologies-qualities essential for sustaining performance under the harsh conditions of high-salinity environments.

Middle East & Africa Centrifugal Pump Market Opportunity

Expanding Investments in Water Security and Industrial Growth

Regional markets continue to observe active procurement activity, prompted by commitments to water security and industrial diversification. According to the World Bank, the Arab Fund for Economic and Social Development has granted financing to 149 water projects worth USD 8.1 billion, extending wastewater networks capable of treating more than 6 million cubic meters per day. Saudi Arabia's Private Sector Participation Roadmap targets the production of 8.1 million cubic meters per day of desalinated water from private developers by 2032-a development that will present a key opportunity for centrifugal pump suppliers. These projects illustrate how public-private collaboration for sustainable infrastructure development fuels demand for efficient pumping solutions.

While this is happening, the structure of demand in manufacturing and processing is simultaneously being reshaped by industrial policy initiatives. The UAE’s Operation 300bn program aims to double the industrial share of GDP by 2031, while Morocco intends to build 20 desalination plants and 179 dams by 2027. According to development institutions, up to USD 500 billion in financing is available under green bonds and public-private partnership frameworks for regional water infrastructure. An expanding financial ecosystem allows for the modernization of existing facilities, as well as the advancement of large projects, creating continuous requirements for centrifugal pumps in both new installations and long-term infrastructure renewal programs.

Middle East & Africa Centrifugal Pump Market Country Analysis

At 20% of the regional centrifugal pump market, Saudi Arabia has a commanding share driven by its extensive investment in water and industrial infrastructure under the auspices of Vision 2030. The National Water Company’s programs include new desalination projects, transmission pipelines, and upgrading of wastewater networks, reflecting a systematic approach toward water resilience and efficiency. These require very large volumes of centrifugal pumps for transportation, treatment, and reuse purposes, making Saudi Arabia the most powerful market in the region for pump deployment.

Beyond Saudi Arabia, strong growth is emerging from national investment agendas. Morocco's USD 4.2 billion commitment to 2025 water infrastructure, Egypt's desalination expansion targeting 8.85 million m³/day by 2050, and the UAE's Operation 300bn program further anchor industrial diversification and growth in infrastructure. The rising GCC electricity demand to as high as 4.8% annually through 2027, according to forecasts by the IEA, further drives demand for centrifugal pumps within desalination and energy industries. Similarly, growing projects in Qatar and Oman are further bolstering regional participation, ensuring a diversified yet interconnected landscape of growth throughout the region.

Middle East & Africa Centrifugal Pump Market Segmentation Analysis

By Pump Type

- Overhung Pumps

- Split Case Pumps

- Vertical Pumps

- Submersible Pumps

Under the pump type segment overhung pumps dominate the market, holding around 35% share due to thei high efficiency, compact structure, and adaptability across various applications. Such flexibility in operation and ease of maintenance make overhung pumps vital components in desalination, wastewater, and industrial fluid processing systems. These reasons make them easy to install in both horizontal and vertical positions, satisfying the high flow and pressure in energy and manufacturing plants. The cost-performance ratio has positioned these pumps at the forefront of regional centrifugal pump portfolios.

Their dominance also reflects alignment with regional sustainability goals and water security programs. Overhung pumps offer energy-efficient operation with reduced lifecycle costs, key for large-scale infrastructure projects that prioritize low environmental impact. As governments of the MENA region continue expanding desalination capacity and wastewater treatment infrastructure, these pumps provide dependable performance in handling continuous operations. Their compatibility with automation systems and robust design further consolidate their leading position in a wide array of industrial and municipal applications, reinforcing their role as the preferred solution for high-demand environments.

By End User

- Residential

- Commercial

- Agriculture & Irrigation

- Industrial

Industrial operations take around 45% of the entire market activity and, thus, show their central role in regional centrifugal pump deployment. Centrifugal systems are used for high-volume fluid handling and continuous processing by end users in oil and gas, power generation, and chemical manufacturing. Their efficiency at high temperature and in abrasive conditions makes them indispensable in refining, petrochemical manufacturing, and energy production. The need for durable and efficient centrifugal pumping systems keeps on rising as industrial projects under national transformation initiatives go on expanding.

Integration of automation further cements the leading position of the industrial sector. According to Baker Hughes, rig activity in the Middle East increased 16.3% from 2021 to 2022, indicating continued investment in oil and gas. Smart monitoring and control solutions further improve energy management, predictive maintenance, and system reliability in industrial facilities. Egypt's desalination plants and Saudi Arabia's mega water infrastructure development projects are a few examples of stable demand for heavy-duty centrifugal pumps that can operate under stringent performance conditions and ensure continued dominance by the industrial sector among regional end-user categories.

Top Companies in Middle East & Africa Centrifugal Pump Market

The top companies operating in the market include Kirloskar Brothers Limited (KBL), KSB SE & Co. KGaA, SPX FLOW, Inc., PSG Dover, Ebara Corporation, Flowserve Corporation, Grundfos Gulf Distribution FZE, ITT Inc., Sulzer Management Ltd., Torishima Pump MFG. Co. LTD., Baker Hughes Company, WILO SE, etc., are the top players operating in the Middle East & Africa centrifugal pump Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Middle East & Africa Centrifugal Pump Market Policies, Regulations, and Standards

4. Middle East & Africa Centrifugal Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Middle East & Africa Centrifugal Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Overhung Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Vertical Line- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Horizontal End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Split Case Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Single/Two Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Multi Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Vertical Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.1. Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.2. Non-Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Axial- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Mixed Flow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Submersible Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Non-Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Operation Type

5.2.2.1. Electrical- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Hydraulic- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Air Driven- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End User

5.2.3.1. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Commercial- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Agriculture & Irrigation- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Industrial- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Country

5.2.4.1. Saudi Arabia

5.2.4.2. UAE

5.2.4.3. Nigeria

5.2.4.4. South Africa

5.2.4.5. Morocco

5.2.4.6. Rest of Middle East & Africa

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Saudi Arabia Centrifugal Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Operation Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. UAE Centrifugal Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Operation Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Nigeria Centrifugal Pump Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Operation Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

9. South Africa Centrifugal Pump Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Operation Type- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

10. Morocco Centrifugal Pump Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Operation Type- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By End User- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. PSG Dover

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Ebara Corporation

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Flowserve Corporation

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Grundfos Gulf Distribution FZE

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. ITT Inc.

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Kirloskar Brothers Limited (KBL)

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. KSB SE & Co. KGaA

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. SPX FLOW Inc.

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Sulzer Management Ltd.

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Torishima Pump MFG. Co. LTD.

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Operation Type |

|

| By End User |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.