Russia Industrial Gases Market Report: Trends, Growth and Forecast (2026-2032)

By Gas Type (Nitrogen Gas, Oxygen Gas, Carbon Dioxide Gas, Argon Gas, Helium Gas, Hydrogen Gas, Others), By Supply Mode (Cylinders, Bulk, On-Site Production, Captive, Others), By Application (Combustion and Process Oxygen, Welding and Metal Fabrication, Inerting Blanketing and Heat Treating, Cryogenics and liquefaction, Chemical Synthesis and Hydrogenation, Purging and Purifications, Analytical and Calibration), By End User Industry (General Manufacturing, Food, Metallurgy, Chemicals, Healthcare, Electronics, Refining & Energy, Glass, Pulp & Paper, Others)

- Energy & Power

- Jan 2026

- VI0755

- 125

-

Russia Industrial Gases Market Statistics and Insights, 2026

- Market Size Statistics

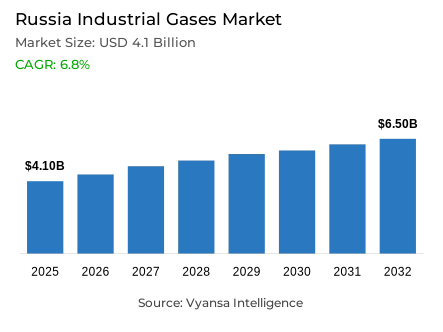

- Industrial gases in Russia is estimated at USD 4.1 billion in 2025.

- The market size is expected to grow to USD 6.5 billion by 2032.

- Market to register a cagr of around 6.8% during 2026-32.

- Gas Type Shares

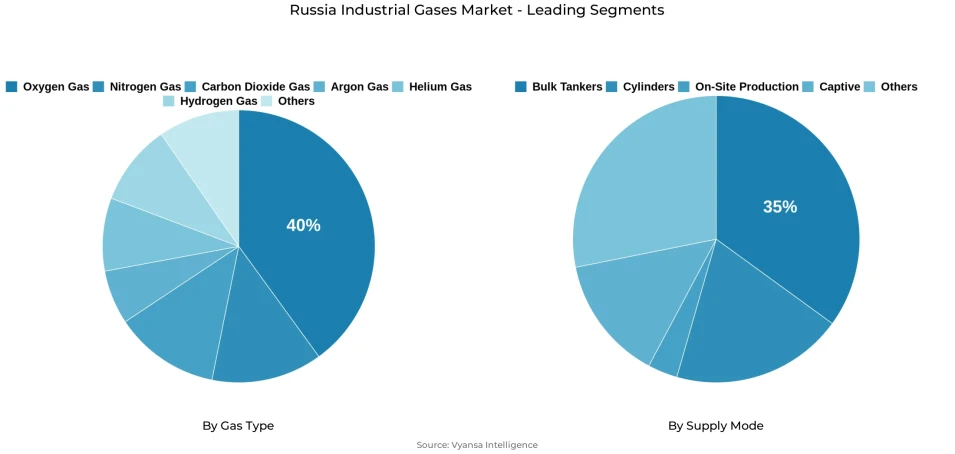

- Oxygen gas grabbed market share of 40%.

- Competition

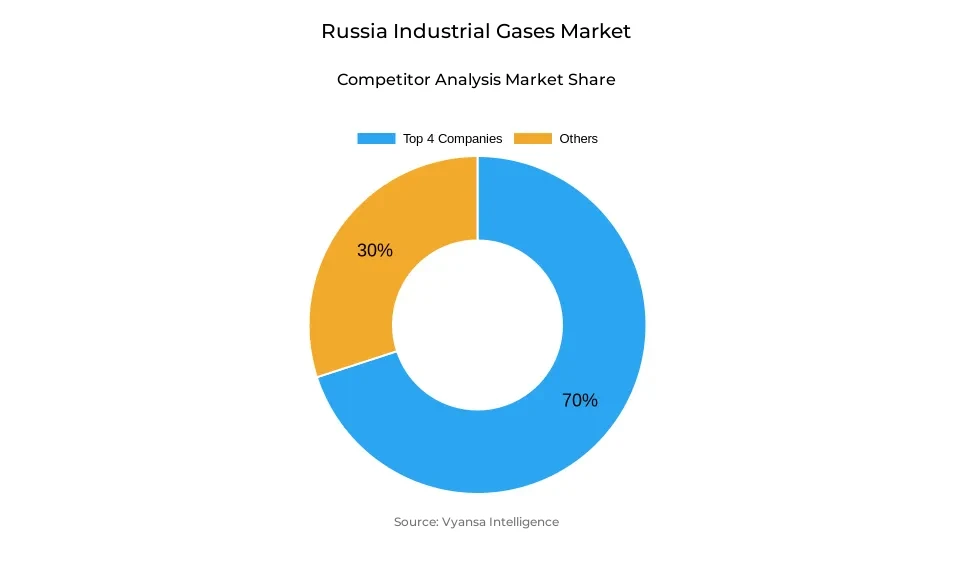

- Industrial gases in Russia is currently being catered to by more than 5 companies.

- Top 4 companies acquired around 70% of the market share.

- Linde plc; Air Liquide etc., are few of the top companies.

- Supply Mode

- Bulk tankers grabbed 35% of the market.

Russia Industrial Gases Market Outlook

The Russian industrial gases market is predicted to develop from $4.1 billion in 2025 to $6.5 billion in 2032, at a CAGR of approximately 6.8% from 2026 to 2032. The consistent level of activity in the country’s steel production, chemical industry, metalworking, and oil refineries remains a solid foundation for oxygen and nitrogen consumer demand. The increase of 8.5% in the country’s overall manufacturing production in 2024, as well as a further increase of 3% in 2025, leads to a significant increase in the use of industrial gases in high-temperature processing, combustion support, and chemical synthesis in large industries.

Despite this, the existence of challenges in the market affecting the suppliers’ operation is evident. This includes disruptions in supply chain, which lowered the suppliers’ capacity to increase deliveries amid rising demand, with delivery delays for the inputs used in manufacturing reaching a nine-month high in late 2025. Additionally, labor shortages of 2.6 million people by the end of 2024 impact highly skilled people required in gas production and distribution. Import availability is also limited.

On the other side, the growing hydrogen economy in Russia is also giving rise to new uses for nitrogen and specialty gases. The country has 33 approved hydrogen projects, with production plans set to reach a total of 550,000 tonnes per year in the early 2030s, which is expected to see increased use of gases that are used in electrolysis, cooling, inerting, or system protection. The move to hydrogen-based steel production and hydrogen hubs is also set to drive demand for specialty gas mixes.

Oxygen still leads with a market share of 40%, thanks to the vital application in the production of steel. Nitrogen is still used in a host of industrial applications such as inerting and controlled atmosphere. In terms of modes of supply, bulk carriers continue to lead with a share of 35%, thanks to the high demand from giant Russian steel plants, refineries, and chemical plants that demand a continuous supply.

Russia Industrial Gases Market Growth Driver

Expanding Industrial Output Sustains Core Demand

The Russian manufacturing sector remains a driving force behind the use of industrial gases, with significant activity in the areas of steel production, chemicals, metalworking, and oil refining; the sector is set to see a growth of 8.5% in 2024, with a further growth of 3% in 2025, thereby securing the use of oxygen and nitrogen in high-performance processing, combustion enhancement, and chemical synthesis.

Refining activities to maintain 2024 growth further underpins the stable use of oxygen and nitrogen in catalytic, pressure, and feed handling applications. The following are the factors that are driving the growth of the Russian industrial gas industry: Despite a capacity utilization rate of about 81%, there is still potential for growth that would result in a corresponding increase in the use of industrial gases. The sector's activity in metal cutting, welding, and fabrication indicates the importance of oxygen, although nitrogen is still essential as an inert gas. The sector's activity in steel production, chemical processing, and refining indicates a stable base demand for industrial gases with transportation via bulk tanks and cylinders.

Russia Industrial Gases Market Challenge

Structural Supply Constraints Restrict Market Growth

The suppliers of industrial gases to the Russian market are constrained in their business to a great extent because of the challenges in the supply chain as well as a shortage of labor force. The length of delivery times for inputs used in manufacturing has been at the highest level in the past nine months as of November 2025. This is a sign that there are challenges in the supply chain, which affects the suppliers’ capacity to increase production even with the rising demand in industrial uses.

The shortage of labor further hampers the situation, with a shortage of approximately 2.6 million labor force members at the end of 2024, reflecting a 17% increase from the previous year, which affects highly technical labor necessary for gas production and distribution. The geopolitical factors that limited the-import of technology and equipment from abroad, commencing from 2022, further affect capacity expansion within the power sector, making it even more difficult for the market to absorb the increased demand in the given period of 2026-32.

Russia Industrial Gases Market Trend

Expansion of Hydrogen Initiatives Shapes New Demand Patterns

The Russian hydrogen economy is undergoing development, thereby offering novel uses for industrial gases such as nitrogen and specialty gases used in electrolysis, reforming, and storage solutions. The government’s endorsement of 33 hydrogen projects in 18 regions, besides Rosatom’s pilot plans for 2024 & 2025, is thereby fuelling the demand for gases used in inerting, cooling, and protection solutions. The growth of hydrogen production, targeted at a maximum of 550,000 tons per annum by the early 2030s, with a potential increase to 2 million tons by 2035, is thereby creating a diverse and technology-driven base of demand for industrial gases.

The transition technologies in the steel industry, namely hydrogen-based direct reduction and electric arc furnances, continue to drive changes in the technical specifications of gas blends. The development of hydrogen clusters in the northwestern, Eastern, and Arctic regions is gradually contributing to the establishment of local demand hubs for specialty gases. Although the current demand is still in the infancy stage, the growing uses of hydrogen are set to make gas a vital enabler of the hydrogen transition in the Russian Federation.

Russia Industrial Gases Market Opportunity

Infrastructure Expansion and Downstream Industries

The stabilized refining and energy sector in the Russian market in 2025 establishes a solid base for the growth of the industrial gas sector, in which oxygen and nitrogen are fundamental components in the support of combustion, pressure, and feed processing tasks within these sectors. The reliance on a stable supply of gas for maintenance, safety, and efficiency within the energy sectors underpins the predictability of growth in the demand for industrial gas, with which growth in purchases is expected in line with upgrading of systems.

The downstream chemical and petrochemical sectors are other growth areas, thanks to 3% growth rates experienced in chemical production in 2024. Oxygen is still used in oxidation reactions in the production of hydrogen peroxide, ethylene oxide, ethylene derivatives, and nitric acid, while nitrogen is pivotal in synthesis, inertization, and protection. The enhancement of large gas procurements in the chemical and petrochemical sectors is taking place because of the growth of the downstream sector, geared towards dependable bulk gas supply to end-users.

Russia Industrial Gases Market Segmentation Analysis

By Gas Type

- Nitrogen Gas

- Oxygen Gas

- Carbon Dioxide Gas

- Argon Gas

- Helium Gas

- Hydrogen Gas

- Others

Oxygen holds a dominant 40% market share in the Russia Industrial Gases Market, reflecting its critical role across steelmaking, chemical synthesis, and metal fabrication processes. Steel production of 70.7 million tonnes in 2024 underscores oxygen’s importance in basic oxygen furnace operations, combustion enhancement, and high-temperature treatment. The chemical industry’s extensive reliance on oxygen for producing hydrogen peroxide, ethylene derivatives, and specialty chemicals further reinforces sustained high-volume demand. Even in the medical sector, oxygen usage continues to grow, supported by heightened awareness of respiratory care and healthcare preparedness.

Nitrogen remains the secondary yet vital gas type, serving diverse applications requiring inert atmospheric conditions and contamination-free processing environments. Its use spans metal processing, food preservation, pharmaceutical production, semiconductor manufacturing, and hydrogen-related activities, reflecting varied technical requirements. Industrial gas exports of 1.8 million tons in 2024, with nitrogen comprising a significant share, highlight strong international demand. Nitrogen’s role in sensitive, high-precision industries sustains its relevance, providing stable growth prospects alongside oxygen’s dominant market position.

By Supply Mode

- Cylinders

- Bulk

- On-Site Production

- Captive

- Others

Bulk tankers hold the highest share at 35% within the supply mode segmentation, reflecting their suitability for Russia’s large industrial facilities such as steel plants, refineries, chemical complexes, and high-volume manufacturing units. Bulk delivery allows efficient transportation of hundreds of cubic meters per shipment, meeting the continuous and predictable supply requirements of major end users. Extensive fleet networks and dedicated infrastructure have enabled suppliers to maintain reliable logistics across geographically dispersed industrial clusters, reinforcing bulk tanker dominance in high-throughput applications.

Moreover, Cylinder distribution and on-site generation serve complementary demand segments, meeting the needs of medium-scale workshops, metal fabrication units, medical facilities, and specialized service providers. Cylinders offer flexibility, portability, and ease of procurement for operations with variable consumption patterns or limited storage capacity. On-site generation supports applications where uninterrupted supply or transportation cost optimization is critical. These alternative modes strengthen supplier reach, enabling broader market coverage while bulk tankers retain leadership due to Russia’s concentration of heavy industries and high-volume operational requirements.

List of Companies Covered in Russia Industrial Gases Market

The companies listed below are highly influential in the Russia industrial gases market, with a significant market share and a strong impact on industry developments.

- Linde plc

- Air Liquide

- Messer SE & Co. KGaA

- Taiyo Nippon Sanso Corporation

Market News & Updates

- Linde PLC, 2025:

Linde experienced significant operational disruption and capital loss in the Russian market following the 2022 invasion of Ukraine and implementation of international sanctions, culminating in complete market exit by 2025. Russian courts ordered seizure of 13 ISO containers for liquid helium in November 2023 and froze approximately €1 billion in company assets through RusKhimAlyans (Gazprom subsidiary), with a February 2024 Russian court ruling declaring Linde's compliance with EU sanctions as illegal activity. Despite initial commitments to suspend new Russian projects, the company fulfilled existing Arctic LNG 2 contracts through June 2022, shipping 1,500 tons of equipment to Russia's Ust-Luga gas processing complex before sanctions prevented further participation. This represents a complete strategic withdrawal from Russian operations with all activities halted and historical agreements with Gazprom rendered unexecutable due to geopolitical circumstances and the international sanctions environment.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Russia Industrial Gases Market Policies, Regulations, and Standards

4. Russia Industrial Gases Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Russia Industrial Gases Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Quantity Sold in Million Tons

5.2. Market Segmentation & Growth Outlook

5.2.1.By Gas Type

5.2.1.1. Nitrogen Gas- Market Size 2022-2032, Million Tons

5.2.1.2. Oxygen Gas- Market Size 2022-2032, Million Tons

5.2.1.3. Carbon Dioxide Gas- Market Size 2022-2032, Million Tons

5.2.1.4. Argon Gas- Market Size 2022-2032, Million Tons

5.2.1.5. Helium Gas- Market Size 2022-2032, Million Tons

5.2.1.6. Hydrogen Gas- Market Size 2022-2032, Million Tons

5.2.1.7. Others- Market Size 2022-2032, Million Tons

5.2.2.By Supply Mode

5.2.2.1. Cylinders- Market Size 2022-2032, Million Tons

5.2.2.2. Bulk- Market Size 2022-2032, Million Tons

5.2.2.3. On-Site Production- Market Size 2022-2032, Million Tons

5.2.2.4. Captive- Market Size 2022-2032, Million Tons

5.2.2.5. Others- Market Size 2022-2032, Million Tons

5.2.3.By Application

5.2.3.1. Combustion and Process Oxygen- Market Size 2022-2032, Million Tons

5.2.3.2. Welding and Metal Fabrication- Market Size 2022-2032, Million Tons

5.2.3.3. Inerting Blanketing and Heat Treating- Market Size 2022-2032, Million Tons

5.2.3.4. Cryogenics and liquefaction- Market Size 2022-2032, Million Tons

5.2.3.5. Chemical Synthesis and Hydrogenation- Market Size 2022-2032, Million Tons

5.2.3.6. Purging and Purifications- Market Size 2022-2032, Million Tons

5.2.3.7. Analytical and Calibration- Market Size 2022-2032, Million Tons

5.2.4.By End User Industry

5.2.4.1. General Manufacturing- Market Size 2022-2032, Million Tons

5.2.4.2. Food- Market Size 2022-2032, Million Tons

5.2.4.3. Metallurgy- Market Size 2022-2032, Million Tons

5.2.4.4. Chemicals- Market Size 2022-2032, Million Tons

5.2.4.5. Healthcare- Market Size 2022-2032, Million Tons

5.2.4.6. Electronics- Market Size 2022-2032, Million Tons

5.2.4.7. Refining & Energy- Market Size 2022-2032, Million Tons

5.2.4.8. Glass- Market Size 2022-2032, Million Tons

5.2.4.9. Pulp & Paper- Market Size 2022-2032, Million Tons

5.2.4.10. Others- Market Size 2022-2032, Million Tons

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Russia Nitrogen Gas Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Quantity Sold in Million Tons

6.2. Market Segmentation & Growth Outlook

6.2.1.By Supply Mode- Market Size 2022-2032, Million Tons

6.2.2.By Application- Market Size 2022-2032, Million Tons

6.2.3.By End User Industry- Market Size 2022-2032, Million Tons

7. Russia Oxygen Gas Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Quantity Sold in Million Tons

7.2. Market Segmentation & Growth Outlook

7.2.1.By Supply Mode- Market Size 2022-2032, Million Tons

7.2.2.By Application- Market Size 2022-2032, Million Tons

7.2.3.By End User Industry- Market Size 2022-2032, Million Tons

8. Russia Carbon Dioxide Gas Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Quantity Sold in Million Tons

8.2. Market Segmentation & Growth Outlook

8.2.1.By Supply Mode- Market Size 2022-2032, Million Tons

8.2.2.By Application- Market Size 2022-2032, Million Tons

8.2.3.By End User Industry- Market Size 2022-2032, Million Tons

9. Russia Argon Gas Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Quantity Sold in Million Tons

9.2. Market Segmentation & Growth Outlook

9.2.1.By Supply Mode- Market Size 2022-2032, Million Tons

9.2.2.By Application- Market Size 2022-2032, Million Tons

9.2.3.By End User Industry- Market Size 2022-2032, Million Tons

10. Russia Helium Gas Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.1.2. By Quantity Sold in Million Tons

10.2. Market Segmentation & Growth Outlook

10.2.1. By Supply Mode- Market Size 2022-2032, Million Tons

10.2.2. By Application- Market Size 2022-2032, Million Tons

10.2.3. By End User Industry- Market Size 2022-2032, Million Tons

11. Russia Hydrogen Gas Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.1.2. By Quantity Sold in Million Tons

11.2. Market Segmentation & Growth Outlook

11.2.1. By Supply Mode- Market Size 2022-2032, Million Tons

11.2.2. By Application- Market Size 2022-2032, Million Tons

11.2.3. By End User Industry- Market Size 2022-2032, Million Tons

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Linde plc

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. KrioGaz

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Kislorod

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Volgograd Oxygen Factory

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Cryogenmash

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Gas Type |

|

| By Supply Mode |

|

| By Application |

|

| By End User Industry |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.