Philippines Industrial Gases Market Report: Trends, Growth and Forecast (2026-2032)

Gas Type (Nitrogen Gas, Oxygen Gas, Carbon Dioxide Gas, Argon Gas, Helium Gas, Hydrogen Gas, Other), Supply Mode (Cylinders, Bulk, On-Site Production, Captive, Other), Application (Combustion and Process Oxygen, Welding and Metal Fabrication, Inerting Blanketing and Heat Treating, Cryogenics and liquefaction, Chemical Synthesis and Hydrogenation, Purging and Purifications, Analytical and Calibration), End User Industry (General Manufacturing, Food, Metallurgy, Chemicals, Healthcare, Electronics, Refining & Energy, Glass, Pulp & Paper, Others)

- Energy & Power

- Jan 2026

- VI0744

- 115

-

Philippines Industrial Gases Market Statistics and Insights, 2026

- Market Size Statistics

- Industrial gases in Philippines is estimated at USD 230 million in 2025.

- The market size is expected to grow to USD 290 million by 2032.

- Market to register a cagr of around 3.37% during 2026-32.

- Gas Type Shares

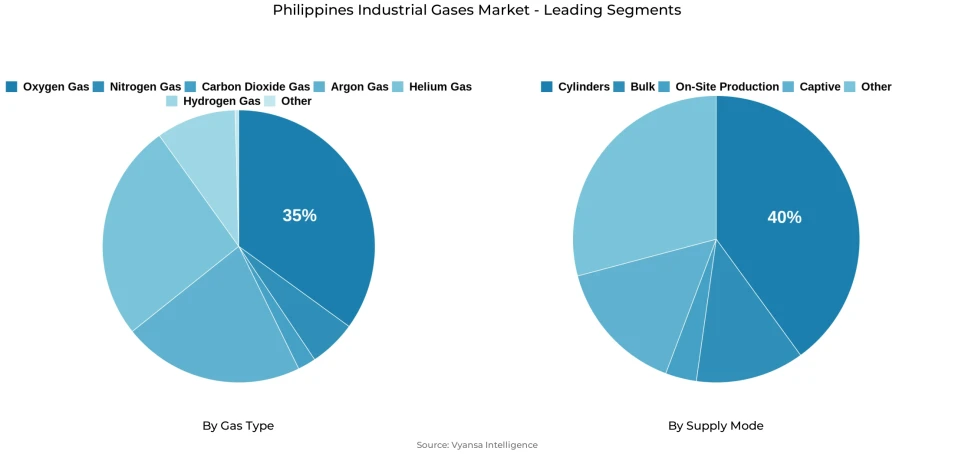

- Oxygen gas grabbed market share of 35%.

- Competition

- More than 10 companies are actively engaged in producing industrial gases in Philippines.

- Top 5 companies acquired around 70% of the market share.

- Iwatani; BASF; Pilipinas Trade Gas (Tomoe Group); Linde; Air Liquide etc., are few of the top companies.

- Supply Mode

- Cylinders grabbed 40% of the market.

Philippines Industrial Gases Market Outlook

The Philippines Industrial Gases Market will grow consistently over the years 2026-2032, driven by growing demands in the healthcare sector and a gradual revival in industries. The market is projected to reach approximately USD 290 million in 2032 from an estimated USD 230 million in 2025, with a CAGR of approximately 3.37%. The market is majorly driven by the healthcare space, where poor air quality is increasing respiratory and cardiovascular diseases. With PM2.5 levels being significantly higher than standards and a very high incidence of premature deaths due to poor air quality, healthcare institutions are increasingly relying on medical oxygen for continuous respiratory support assistance in both metropolitan and provincial areas.

The oxygen segment continues to be the most important gas species, with a total market share of approximately 35%. The major demand for this gas is being used in medical and other industrial sectors. Hospitals have a huge requirement for this gas in emergency rooms, intensive care units, surgeries, and other respiratory department operations. In addition, medical oxygen is used in food processing, metalworking, machinery, and transport sectors for cutting, burning, and processing purposes. Nitrogen is considered to be the second most important gas species.

Supply-wise, cylinder-based distribution dominates with a share of approximately 40%. Cylinders are the most preferred choice for smes in industries and healthcare institutions in distant regions because of their flexibility and simpler infrastructure requirement. Bulk delivery and generation in cylinders are getting increasingly popular with large healthcare institutions and industries because of reliable and efficient gas delivery.

Although under operational pressure due to energy cost volatility and fluctuations in industrial demand, with renewed growth in the manufacturing sector and increasing investments in public healthcare, stability is achieved in the long term. Increasing expenditures in healthcare, expansion of healthcare infrastructure, and modernization of industries will promote balanced growth in the Philippines Industrial Gases Market during 2032.

Philippines Industrial Gases Market Growth DriverExpanding Healthcare Burden from Air Pollution Intensifying Industrial Gas Requirements

Ambient air pollution continues to raise demand for industrial gases in the Philippines, particularly medical oxygen used across hospitals and primary care facilities. With an estimated 66,230 premature deaths annually due to polluted air, about 32% of which are related to cardiovascular diseases like stroke and ischemic heart disease, health systems in the country increasingly depend on oxygen-based respiratory support. WHO estimates show that PM2.5 levels in the Philippines are almost five times higher than guideline levels, further increasing the incidences of respiratory complications requiring continuous oxygen therapy. This continuous disease burden points directly to the need for medical oxygen within healthcare infrastructures in both urban and provincial areas.

Government expansion of healthcare facilities further amplifies this need. Health expenditure was 5.5% of GDP in 2022, and public spending accounted for 44.2% of the total expenditure. Improving primary care networks along with an increase in the capacity of treatment facilities across the country increases demand for oxygen generation systems and centralized distribution lines. With deepening healthcare infrastructure across the nation, medical oxygen becomes a fundamental cornerstone of clinical preparedness, emergency care, and respiratory treatment delivery, thereby making it indispensable within the Philippines industrial gases market.

Philippines Industrial Gases Market ChallengeSupply Chain Pressures and Energy Constraints Limiting Manufacturing Stability

The manufacturing sector of the Philippines faces operational pressures affecting industrial gas demand consistency. Growth in 2023 slowed to 0.5% due to electronics export weakness and declining external demand. By Q4 2023, the industry sector's growth contribution fell to 1.0 percentage point, reflecting export-oriented subsector volatility. Suppliers must manage unstable purchase trends from end-users relying on precision gases for welding, fabrication, and electronics manufacturing.

Energy cost pressures now dominate the supply landscape. Since 2020, domestic natural gas production has halved to 2 billion cubic meters, with the Malampaya field projected to run dry by 2027. Growing LNG reliance-projected to increase 508% between 2025-2029 will triple annual import costs from USD 348.2 million to USD 1.12 billion, directly raising electricity costs for gas manufacturers' equipment. Since industrial activity accounts for 19.2% of total final energy consumption, energy price volatility cascades into production costs, threatening supply reliability and cost-efficiency nationwide.

Philippines Industrial Gases Market TrendManufacturing Sector Expansion Strengthening Multi-Sector Gas Utilization Patterns

Renewed momentum in the manufacturing sector of the Philippines accelerates the usage of industrial gases within food processing, machinery, and advanced production industries. Manufacturing expanded by 3.6% in 2024, with food processing alone making up almost half of the total output, and it relies heavily on nitrogen for preservation and controlled atmosphere applications. Parallel growth in machinery and equipment manufacturing, reported by the Asian Development Bank in early 2025, further supports increased consumption of nitrogen and oxygen for fabrication, cutting, and metal treatment processes. Further growth in transport equipment, computer production, and electrical appliances increases argon and high-purity gas demand in precision manufacturing environments.

Cleaner and more efficient industrial operations also mark the shifting trend in gas consumption. National renewable energy targets, reaching 35% of power generation from renewables by 2030, will go a long way toward securing the long-term viability of on-site generation systems powered by renewable electricity. The wider diffusion of Industry 4.0 technologies-including AI-enabled automation and advanced processing systems-requires a steady supply of high-quality industrial gases. These are the factors that strengthen the crucial position of nitrogen, oxygen, and specialty gases within modernized manufacturing scenarios and contribute to multisector demand growth.

Philippines Industrial Gases Market OpportunityExpanding Healthcare Expenditure Creating Strong Growth Potential for Medical Oxygen Infrastructure

The accelerating healthcare investment landscape of the Philippines presents one of the most compelling opportunity areas in the Philippines industrial gases market. Public health expenditure surged 29.5% in 2024 to P643.12 billion, while total health expenditure rose to P1.56 trillion or 5.9% of GDP. For the 2026 Budget, the Department of Health is allocated P320.5 billion, representing a 29% increase over the appropriation for 2025. Large allocations for state-run hospitals in Metro Manila amount to P27.7 billion, while regional medical centers will obtain P99.5 billion to fast-track the upgrading of treatment capacity. Strategic funding commitments to support these regional upgrades enable broader installation of medical oxygen pipelines, on-site generation plants, and emergency storage systems across healthcare facilities.

With the enhancement of surgical, emergency, and respiratory treatment capabilities in hospitals and primary care centers, demands for high-purity medical oxygen grow in tandem. The expansion of modern facilities stands in need of reliable oxygen supply for critical units such as ICUs, operation theaters, neonatal care, and casualty departments. This expanding healthcare footprint creates a long-term opportunity for industrial gas suppliers to establish long-term supply relations with public and private institutions that make oxygen reliability a core infrastructure priority. The structural and sustained opportunity segment through the forecast period comes with rising national expenditure and continuous capital apportioning for the modernization of facilities.

Philippines Industrial Gases Market Segmentation Analysis

By Gas Type

- Nitrogen Gas

- Oxygen Gas

- Carbon Dioxide Gas

- Argon Gas

- Helium Gas

- Hydrogen Gas

- Other

The oxygen segment accounts for approximately 35% of the Philippines Industrial Gases Market, maintaining its position as the largest gas type due to extensive use across industrial and medical applications. Healthcare facilities increasingly rely on medical oxygen to treat respiratory and cardiovascular complications linked to air pollution, while manufacturing sectors depend on oxygen for thermal cutting, combustion, oxidation, and steel processing. Expanding activity in food processing, machinery production, and transport equipment manufacturing reinforces demand across industrial operations. This wide application base ensures oxygen retains a dominant role throughout the forecast period.

Nitrogen remains the second-largest gas type, essential for semiconductor manufacturing, electronics assembly, metal fabrication, and food preservation. Its role in controlled environments and inerting processes makes it indispensable across high-precision industries. Argon, hydrogen, and specialty gases hold smaller shares but serve critical applications in electronics, pharmaceuticals, and advanced manufacturing. Together, these segments support diverse industrial needs, enabling robust demand across metalworking, chemical synthesis, food production, and healthcare operations.

By Supply Mode

- Cylinders

- Bulk

- On-Site Production

- Captive

- Other

Cylinder-based distribution holds the largest share at approximately 40%, reflecting its entrenched role in supplying small and medium-sized facilities across welding, metalworking, construction, and dispersed industrial operations. Cylinders also remain essential for healthcare institutions in remote or provincial regions where pipeline networks and bulk storage systems are less accessible. Their flexibility, portability, and relatively low capital requirements make them the preferred mode for end users with variable consumption patterns or geographically dispersed operations.

Bulk supply and on-site generation continue expanding as larger-scale facilities invest in more efficient and reliable delivery models. Bulk supply via tanker trucks and pipelines serves major manufacturing plants, refineries, and top-tier hospitals in urban and industrial clusters. On-site generation using pressure swing adsorption and cryogenic technologies represents the fastest-growing option, particularly among semiconductor manufacturers, pharmaceutical producers, and steel plants seeking consistent, high-purity gas availability. As manufacturing output grows and energy efficiency becomes a strategic priority, adoption of on-site systems is expected to increase considerably.

List of Companies Covered in Philippines Industrial Gases Market

The companies listed below are highly influential in the Philippines industrial gases market, with a significant market share and a strong impact on industry developments.

- Iwatani

- BASF

- Pilipinas Trade Gas (Tomoe Group)

- Linde

- Air Liquide

- Air Products

- Taiyo Nippon Sanso (Ingasco)

- Messer

- Caloocan Gas Corporation

- Greatwest Industrial Gases

Market News & Updates

- Taiyo Nippon Sanso (Ingasco), 2025:

Signed landmark renewable energy partnership with First Gen Corporation (April 2, 2025) to power its Tagoloan manufacturing facility in Misamis Oriental with 100% geothermal electricity (2.6 MW) from Mindanao Geothermal Power Plant; agreement aligns with Nippon Sanso Group's 2050 carbon neutrality goal and marks significant sustainability milestone in Philippine industrial gas production.

- Messer, 2025:

Continued expansion in the Philippines as part of ASEAN growth strategy with investments in on-site production capacities and end-market diversification across food processing, electronics, and healthcare sectors; Messer generated €0.1 billion sales in ASEAN region in 2024 with strong growth momentum in Vietnam and strategic focus on establishing manufacturing footprint in the Philippines following 2023 government investment roadshow engagement with Philippine Department of Trade and Industry.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Philippines Industrial Gases Market Policies, Regulations, and Standards

4. Philippines Industrial Gases Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Philippines Industrial Gases Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Gas Type

5.2.1.1. Nitrogen Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Oxygen Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Carbon Dioxide Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Argon Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Helium Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Hydrogen Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Supply Mode

5.2.2.1. Cylinders- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Bulk- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. On-Site Production- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Captive- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Application

5.2.3.1. Combustion and Process Oxygen- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Welding and Metal Fabrication- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Inerting Blanketing and Heat Treating- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Cryogenics and liquefaction- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Chemical Synthesis and Hydrogenation- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Purging and Purifications- Market Insights and Forecast 2022-2032, USD Million

5.2.3.7. Analytical and Calibration- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By End User Industry

5.2.4.1. General Manufacturing- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Food- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metallurgy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Chemicals- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Healthcare- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Electronics- Market Insights and Forecast 2022-2032, USD Million

5.2.4.7. Refining & Energy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.8. Glass- Market Insights and Forecast 2022-2032, USD Million

5.2.4.9. Pulp & Paper- Market Insights and Forecast 2022-2032, USD Million

5.2.4.10. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Philippines Nitrogen Gas Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million

7. Philippines Oxygen Gas Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million

8. Philippines Carbon Dioxide Gas Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million

9. Philippines Argon Gas Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million

10. Philippines Helium Gas Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By End User Industry- Market Insights and Forecast 2022-2032, USD Million

11. Philippines Hydrogen Gas Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By End User Industry- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Linde

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Air Liquide

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Air Products

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Taiyo Nippon Sanso (Ingasco)

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Messer

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Iwatani

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. BASF

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Pilipinas Trade Gas (Tomoe Group)

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Caloocan Gas Corporation

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Greatwest Industrial Gases

12.1.10.1.Business Description

12.1.10.2.Product Portfolio

12.1.10.3.Collaborations & Alliances

12.1.10.4.Recent Developments

12.1.10.5.Financial Details

12.1.10.6.Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Gas Type |

|

| By Supply Mode |

|

| By Application |

|

| By End User Industry |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.