Global Fire Pump Market Report: Trends, Growth and Forecast (2026-2032)

Pump Type (Centrifugal Pumps (Overhung Pumps (Vertical Inline, Horizontal End Suction), Split Case Pumps (Single/Two Stage, Multi Stage)), Positive Displacement Pumps (Diaphragm Pumps, Piston Pumps)), Mode of Operation (Diesel Fire Pump, Electric Fire Pump, Others), End-User (Residential, Commercial, Industrial), Region (North America, South America, Europe, Middle East & Africa, Asia-Pacific)

- Energy & Power

- Jan 2026

- VI0741

- 215

-

Global Fire Pump Market Statistics and Insights, 2026

- Market Size Statistics

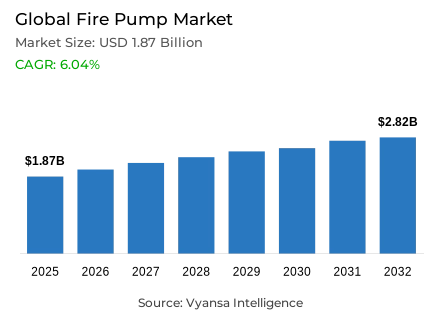

- Global fire pump market is estimated at USD 1.87 billion in 2025.

- The market size is expected to grow to USD 2.82 billion by 2032.

- Market to register a CAGR of around 6.04% during 2026-32.

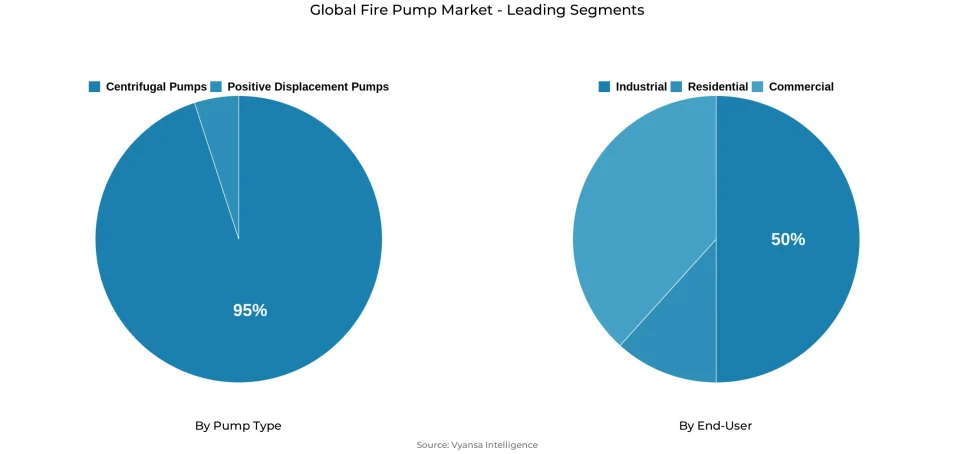

- Pump Type Shares

- Centrifugal pumps grabbed market share of 95%.

- Competition

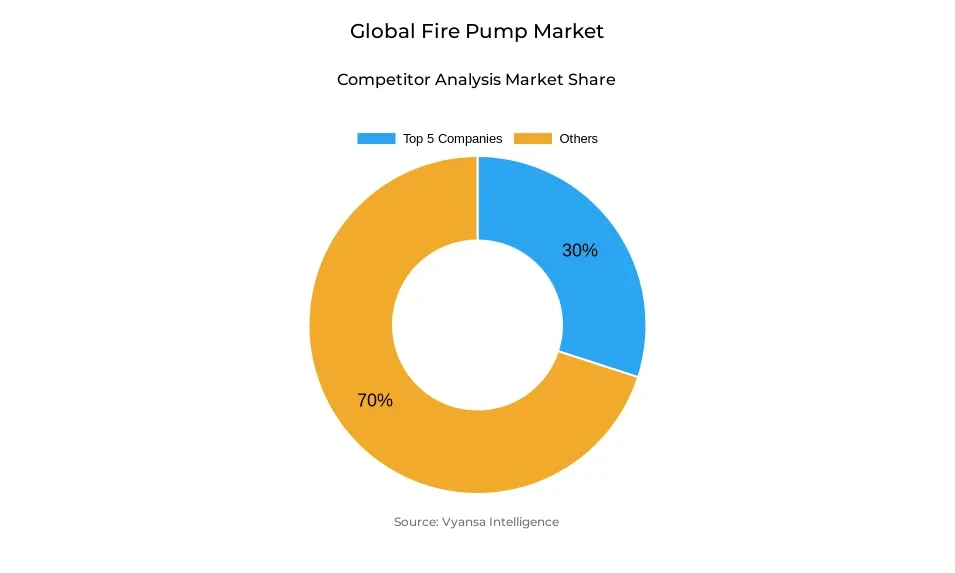

- More than 30 companies are actively engaged in producing fire pump.

- Top 5 companies acquired around 30% of the market share.

- WILO SE; Ebara Corporation; ITT Goulds Pumps; Flowserve Corporation; Pentair PLC etc., are few of the top companies.

- End-User

- Industrial grabbed 50% of the market.

- Region

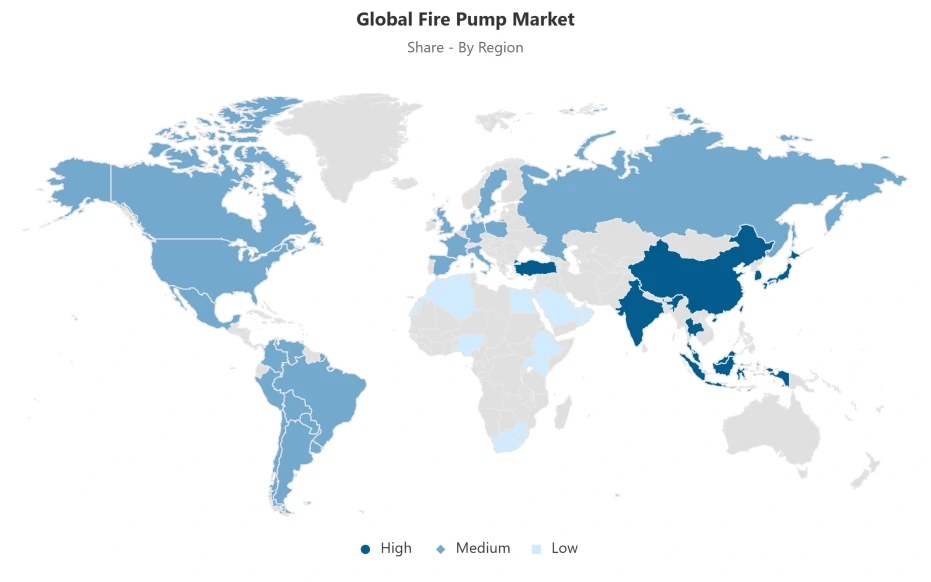

- Asia Pacific leads with a 35% share of the global market.

Global Fire Pump Market Outlook

The global Fire Pump Market is estimated to grow from USD 1.87 billion in 2025 to USD 2.82 billion by 2032, at a CAGR of 6.04%, driven by strict fire safety regulations and rapidly expanding infrastructure globally. These factors are forcing governments across various developing and developed nations to implement advanced fire protection standards, hence widely installing fire pump units. The Federal Emergency Management Agency has made the installation of fire pumps necessary in commercial buildings in the United States.

Additionally, the growing cases of fires across countries like India have raised awareness for the proper implementation of fire suppression systems. Almost 60% of total installations come from the industrial end users, showing an increase in demand for reliable fire protection systems in high-hazard industries. Despite this momentum, high installation and maintenance costs are still a major stumbling block to large-scale adoption, particularly in developing economies. Maintenance costs for electric pumps averaged about USD 1,200 annually, whereas diesel systems can reach as high as USD 7,800, making advanced systems less accessible to smaller enterprises. Inflationary pressures and changing certification requirements, such as those under the European union's construction Products Regulation, have further increased production expenses and compliance costs.

The market landscape continues to change with advanced technological developments, especially in IoT-enabled monitoring systems and intelligent fire pump controllers. These intelligent systems allow for real-time performance tracking, predictive maintenance, and energy efficiency, further improving safety and operational reliability. Additional features like variable frequency drives and automation continue to attract industrial and commercial end users seeking low-maintenance, data-driven fire protection solutions.

The Industrial sector leads the market with a 50% share, driven by stringent safety mandates across industries such as manufacturing, oil and gas, and power generation. Asia-Pacific retains its lead as the regional epicenter with 35% of global demand, driven by rapid urbanization and infrastructure development in China, India, and Southeast Asia. This trend of modernization and implementation of safety standards is expected to keep the market steadily growing until 2032.

Global Fire Pump Market Growth Driver

Stringent Regulations Elevate Investment in Fire Protection Systems

Stricter fire safety regulations by governments of developed and emerging economies are driving investments in advanced fire protection infrastructure. In the United States, for instance, the Federal Emergency Management Agency made the installation of fire pumps mandatory in all commercial buildings; more than 25,000 were installed in the country by 2023. Fire outbreaks have been on the rise, and the 7,435 deaths reported in India in 2022 are a part of the devastating statistics that demand the use of reliable fire suppression systems. Building codes are becoming more comprehensive, and thus the demand for fire pumps is on a continuous surge across industries and commercial sectors to ensure adherence to evolving building safety codes.

Additionally, the U.S. Department of Commerce estimated an annual production of 50,000 fire pumps as of 2023, a result of strict mandates. Fire pumps installed in industrial end users are close to 60% of total installations, emphasizing the need for dependable and code-compliant fire protection systems. The ongoing reinforcement of fire safety standards is driving the market, which has seen steady expansion, particularly in high-risk sectors.

Global Fire Pump Market Challenge

High Installation and Maintenance Expenses Limit Broader Adoption

The cost-related issues are one of the challenges for large-scale adoption of advanced fire pump systems, primarily within the developing world. High costs of installation and maintenance make the adoption of advanced fire pump systems unaffordable for smaller enterprises and residential developments. Annual maintenance costs are in the range of USD 1,200 for electric units to USD 7,800 for diesel systems. Moreover, the replacement parts may require an additional USD 2,000-3,000. Installation costs are higher: on average, USD 1.50-3.00 per square foot in new constructions and USD 2.00-7.00 per square foot in case of retrofits.

According to the U.S. International Trade Commission, 2024, supply chain disruptions along with inflation growth restricted world market growth at 5.5% in 2024. Further, the compliance cost due to varying regional standards like the European Union's Construction Products Regulation surged the certification cost by 12% annually. These create financial barriers to growth in cost-sensitive markets, whereby limited budgets are the key inhibitors in investment in overall fire protection systems amidst the growing regulatory awareness.

Global Fire Pump Market Trend

Integration of Smart Technologies Reshapes Fire Safety Management

The use of IoT-enabled systems and intelligent monitoring has brought fire safety management into the modern era. In 2024, the global market for fire pump controllers with IoT monitoring systems have real-time analytics that enable operators to identify anomalies, act with predictive maintenance, and avoid costly shutdowns. Smart pump networks provide important insights into performance, contributing to improved reliability and operational efficiency for key infrastructure.

The implementation of additional features like variable frequency drives and multi-sensors in detection systems further improves fire safety standards. Furthermore, enhanced thermal imaging coupled with advanced automation reduces false alarms and ensures speedy responses during emergencies. The fire pump room IoT monitoring segment to see growth as more end users shift toward data-driven, energy-efficient, and low-maintenance fire protection solutions for industrial and commercial facilities.

Global Fire Pump Market Opportunity

Rapid Urbanization Unlocks Expansion Potential

Rapid urbanization, coupled with an extension of modern infrastructure in developing economies, presents tremendous opportunities to manufacturers of fire pumps. For instance, India's office leasing in the commercial real estate segment stood at almost 67 million square feet in 2023, while Grade A offices in China achieved a 72% occupancy rate, indicating an increased demand for technologically advanced fire protection systems. Built-up areas in low- and middle-income countries have recorded a 300% increase over the past four decades, further justifying the requirement for an effective fire safety system.

Projects consisting of smart cities, industrial clusters, and high-end infrastructure are being prioritized in terms of fire safety compliance. Governments and developers are opting for globally accepted standards to mitigate risks. Such developments are opening up long-term expansion opportunities for fire pump providers, with growing urban populations and increasing safety requirements.

Global Fire Pump Market Regional Analysis

By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific

Asia-Pacific accounted for around 35% of the global demand in 2025 and is expected to remain the dominant regional market. China, India, and Southeast Asia continue to note rapid urbanization, thus installing fire pump systems within high-rise buildings, commercial complexes, and industrial facilities. Most governments are implementing modern building codes and inspection standards that make fire safety compliance mandatory, thereby further improving system deployment rates across new infrastructure projects.

China and India are the leading demand generators within the region due to extensive investments in modern fire protection networks for safeguarding their expanding industrial and urban zones. Other countries like Vietnam and Indonesia are aligning their safety frameworks with global standards, reinforcing the established positioning of the Asia-Pacific as the hub for innovation and manufacturing related to fire pump solutions. Strong construction activity and ongoing industrial expansion continue to make the region the focal point for sustained market growth.

Global Fire Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pumps

Centrifugal Pumps dominate the market, accounting for 95% of total global fire pump sales. Their technical reliability, cost efficiency, and consistent high-pressure performance make them the preferred choice for commercial, municipal, and industrial applications. These pumps are particularly valued for their ability to deliver uniform water flow during emergencies, ensuring rapid response in large-scale fire events. Their design simplicity and proven durability enable minimal maintenance while maintaining continuous operation.

The strong market position of centrifugal pumps reflects widespread regulatory approval and industry acceptance. They outperform positive displacement pumps in terms of scalability, efficiency, and cost-effectiveness, making them indispensable in multi-story buildings and industrial complexes. As fire protection standards tighten globally, centrifugal pumps remain the benchmark technology for dependable and compliant fire suppression systems, ensuring dominance across all major end-use categories.

By End-User

- Residential

- Commercial

- Industrial

This segment is also growing at the fastest CAGR of 8.68% through 2032. Advances in facility upgradation and smart monitoring technologies are improving operational safety across the industrial zones. Intensified industrialization in developing economies and the trend towards automation of industries have consolidated the requirement for large-capacity, efficient fire pumps, thereby ensuring continued growth in the segment.

Market Players in Global Fire Pump Market

These market players maintain a significant presence in the Global fire pump market sector and contribute to its ongoing evolution.

- WILO SE

- Ebara Corporation

- ITT Goulds Pumps

- Flowserve Corporation

- Pentair PLC

- Sulzer Limited

- Grundfos Holding A/S

- KSB SE & Co. KGaA

- Patterson (Gorman Rupp)

- Armstrong

- IDEX

- Roserbauer

- Waterous

- Shibaura

- CET Fire Pumps Mfg. Inc

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Fire Pump Market Policies, Regulations, and Standards

4. Global Fire Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Fire Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Overhung Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.1. Vertical Inline- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.2. Horizontal End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.1. Single/Two Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.2. Multi Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Diaphragm Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Piston Pumps - Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Mode of Operation

5.2.2.1. Diesel Fire Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Electric Fire Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End-User

5.2.3.1. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Commercial- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Industrial- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Region

5.2.4.1. North America

5.2.4.2. South America

5.2.4.3. Europe

5.2.4.4. Middle East & Africa

5.2.4.5. Asia-Pacific

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. North America Fire Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Country

6.2.4.1. The US

6.2.4.2. Canada

6.2.4.3. Mexico

6.3. The US Fire Pump Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in US$ Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Fire Pump Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in US$ Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Fire Pump Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in US$ Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

7. South America Fire Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Country

7.2.4.1. Brazil

7.2.4.2. Argentina

7.2.4.3. Rest of South America

7.3. Brazil Fire Pump Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in US$ Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

7.4. Argentina Fire Pump Market Statistics, 2022-2032F

7.4.1.Market Size & Growth Outlook

7.4.1.1. By Revenues in US$ Million

7.4.2.Market Segmentation & Growth Outlook

7.4.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.4.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

8. Europe Fire Pump Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Country

8.2.4.1. Germany

8.2.4.2. The UK

8.2.4.3. France

8.2.4.4. Spain

8.2.4.5. Italy

8.2.4.6. Rest of Europe

8.3. Germany Fire Pump Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in US$ Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

8.4. France Fire Pump Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in US$ Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

8.5. The UK Fire Pump Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in US$ Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

8.6. Spain Fire Pump Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in US$ Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

8.7. Italy Fire Pump Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in US$ Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

9. Middle East & Africa Fire Pump Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Country

9.2.4.1. The UAE

9.2.4.2. Saudi Arabia

9.2.4.3. South Africa

9.2.4.4. Rest of the Middle East & Africa

9.3. The UAE Fire Pump Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in US$ Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

9.4. Saudi Arabia Fire Pump Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in US$ Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

9.5. South Africa Fire Pump Market Statistics, 2022-2032F

9.5.1.Market Size & Growth Outlook

9.5.1.1. By Revenues in US$ Million

9.5.2.Market Segmentation & Growth Outlook

9.5.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.5.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

10. Asia-Pacific Fire Pump Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By End-User- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Country

10.2.4.1. China

10.2.4.2. India

10.2.4.3. Japan

10.2.4.4. South Korea

10.2.4.5. Australia

10.2.4.6. Rest of Asia-Pacific

10.3. China Fire Pump Market Statistics, 2022-2032F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in US$ Million

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.3.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

10.4. India Fire Pump Market Statistics, 2022-2032F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in US$ Million

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.4.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

10.5. Japan Fire Pump Market Statistics, 2022-2032F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in US$ Million

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.5.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

10.6. South Korea Fire Pump Market Statistics, 2022-2032F

10.6.1. Market Size & Growth Outlook

10.6.1.1. By Revenues in US$ Million

10.6.2. Market Segmentation & Growth Outlook

10.6.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.6.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

10.7. Australia Fire Pump Market Statistics, 2022-2032F

10.7.1. Market Size & Growth Outlook

10.7.1.1. By Revenues in US$ Million

10.7.2. Market Segmentation & Growth Outlook

10.7.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.7.2.2. By End-User- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Flowserve Corporation

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Pentair PLC

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Sulzer Limited

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Grundfos Holding A/S

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. KSB SE & Co. KGaA

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. WILO SE

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Ebara Corporation

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. ITT Goulds Pumps

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Patterson (Gorman Rupp)

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Armstrong

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

11.1.11. IDEX

11.1.11.1.Business Description

11.1.11.2.Product Portfolio

11.1.11.3.Collaborations & Alliances

11.1.11.4.Recent Developments

11.1.11.5.Financial Details

11.1.11.6.Others

11.1.12. Roserbauer

11.1.12.1.Business Description

11.1.12.2.Product Portfolio

11.1.12.3.Collaborations & Alliances

11.1.12.4.Recent Developments

11.1.12.5.Financial Details

11.1.12.6.Others

11.1.13. Waterous

11.1.13.1.Business Description

11.1.13.2.Product Portfolio

11.1.13.3.Collaborations & Alliances

11.1.13.4.Recent Developments

11.1.13.5.Financial Details

11.1.13.6.Others

11.1.14. Shibaura

11.1.14.1.Business Description

11.1.14.2.Product Portfolio

11.1.14.3.Collaborations & Alliances

11.1.14.4.Recent Developments

11.1.14.5.Financial Details

11.1.14.6.Others

11.1.15. CET Fire Pumps Mfg. Inc

11.1.15.1.Business Description

11.1.15.2.Product Portfolio

11.1.15.3.Collaborations & Alliances

11.1.15.4.Recent Developments

11.1.15.5.Financial Details

11.1.15.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Mode of Operation |

|

| By End-User |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.