Europe Centrifugal Pump Market Report: Trends, Growth and Forecast (2026-2032)

Pump Type (Overhung Pumps (Vertical Line, Horizontal End Suction), Split Case Pumps (Single/Two Stage, Multi Stage), Vertical Pumps (Turbine (Solid Handling, Non-Solid Handling), Axial, Mixed Flow), Submersible Pumps (Solid Handling, Non-Solid Handling)), Operation Type (Electrical, Hydraulic, Air Driven), End User (Residential, Commercial, Agriculture & Irrigation, Industrial), Country (UK, Germany, France, Rest Of Europe)

- Energy & Power

- Dec 2025

- VI0618

- 155

-

Europe Centrifugal Pump Market Statistics and Insights, 2026

- Market Size Statistics

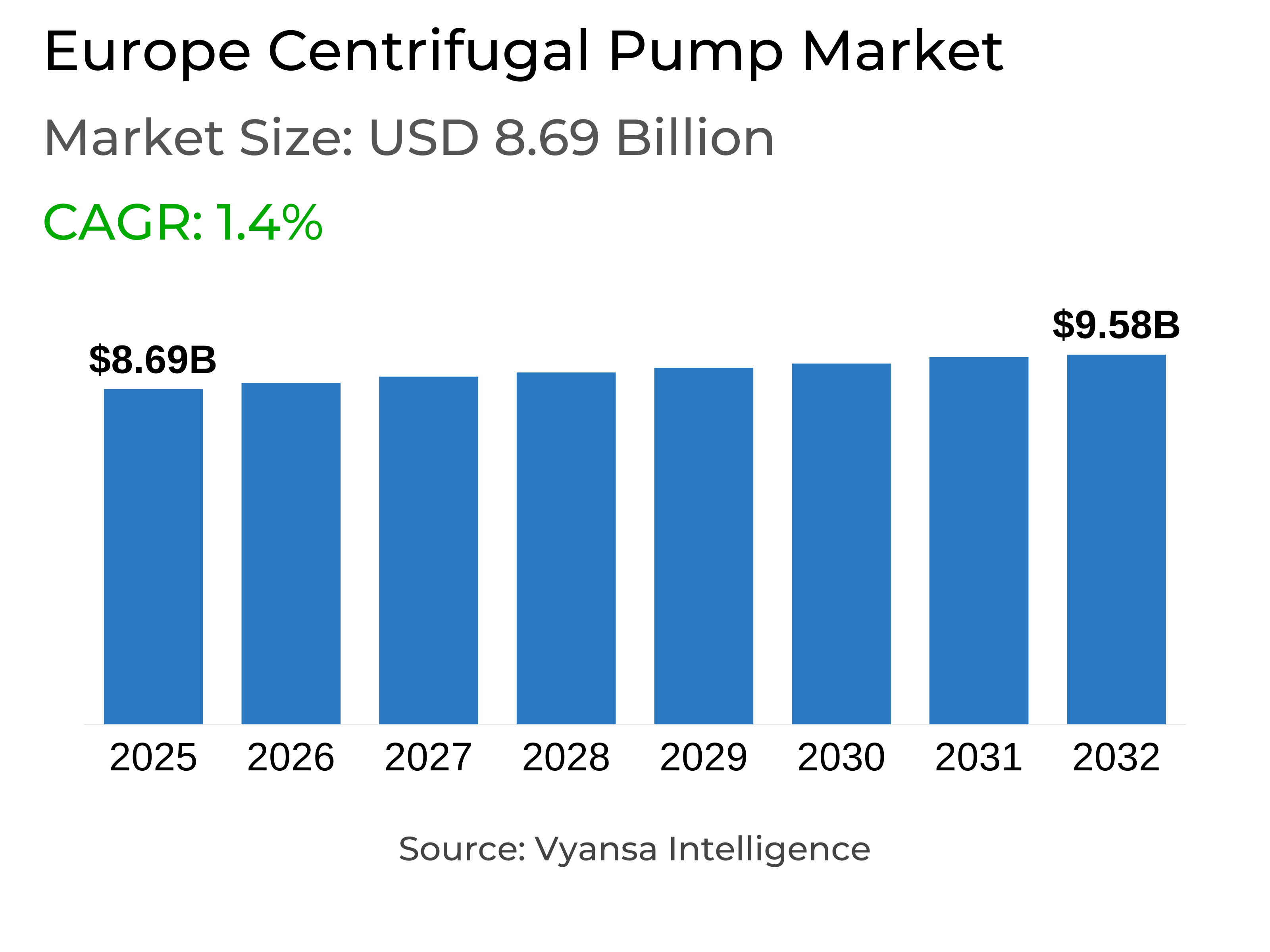

- Europe centrifugal pump market is estimated at USD 8.69 billion.

- The market size is expected to grow to USD 9.58 billion by 2032.

- Market to register a cagr of around 1.4% during 2026-32.

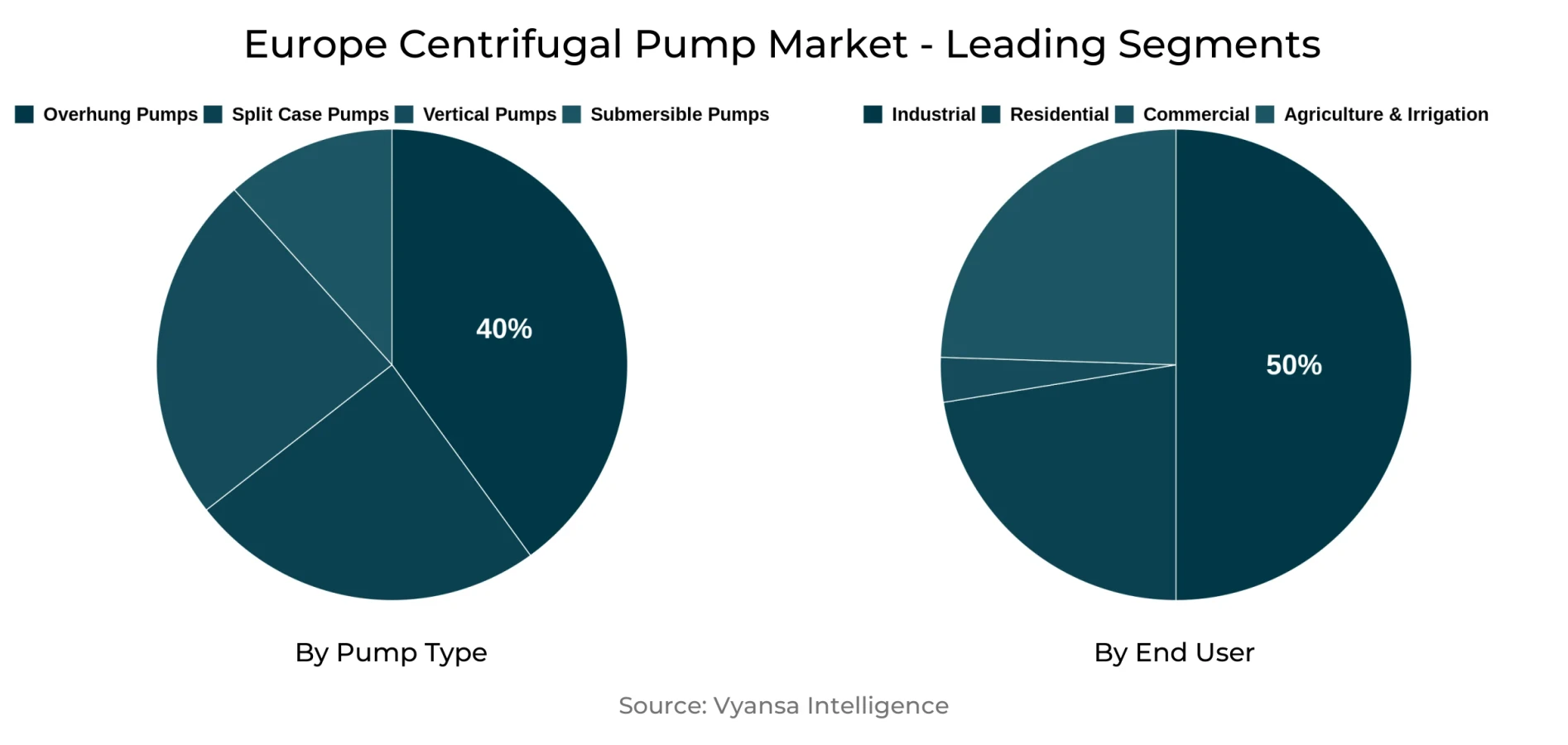

- Pump Type Shares

- Overhung pumps grabbed market share of 40%.

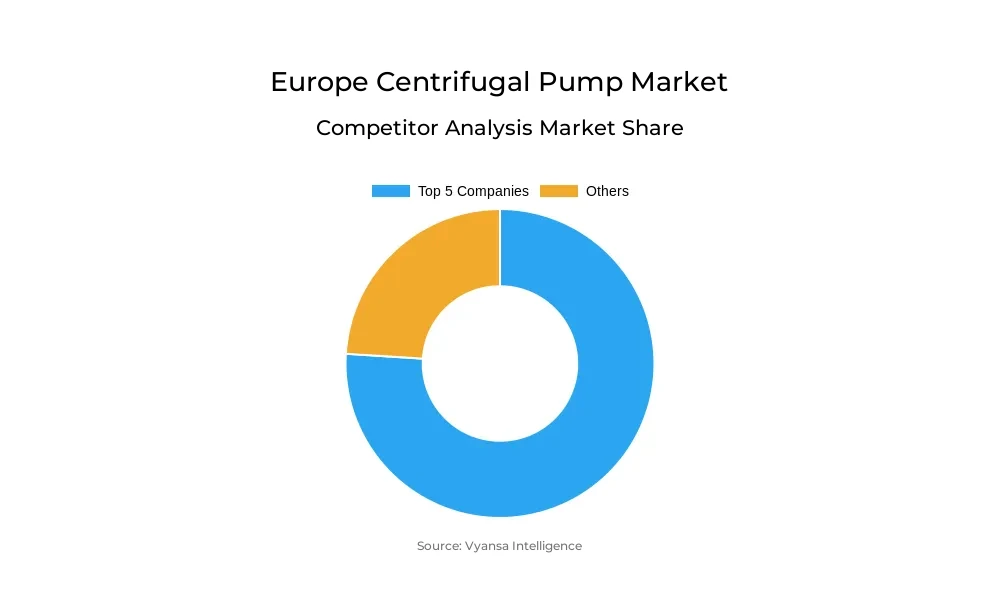

- Competition

- More than 10 companies are actively engaged in producing centrifugal pump in europe.

- Top 5 companies acquired the maximum share of the market.

- Ebara Corporation, Edur Pumpenfabrik Eduard Redlien GmbH & Co., KSB Se & Co. KGaA, Baker Hughes Company, Dover Corporation etc., are few of the top companies.

- End User

- Industrial grabbed 50% of the market.

- Country

- Germany leads with a 30% share of the europe market.

Europe Centrifugal Pump Market Outlook

The Europe Centrifugal Pump Market is valued at USD 8.69 billion in 2025 and is projected to reach USD 9.58 billion by 2032, growing at a CAGR of around 1.4% during 2026-2032. The market is primarily attributed to accelerating investment in Europe's water infrastructure as governments act upon growing water stress linked to urbanization and climate change. With approximately 30% of Europe's population facing water stress every year, large initiatives such as the cohesion policy from the European Commission and the EU's Water Resilience Strategy channel billions into overhauling water collection, treatment, and distribution systems, boosting centrifugal pump deployment across utilities.

Industrial activities remain one of the important pillars of growth, accounting for approximately 50% of the total market. The manufacturing sectors, such as chemicals, petrochemicals, food and beverages, and pharmaceuticals, heavily rely on centrifugal pumps for operational reliability and energy efficiency. The transition toward greener and more energy-efficient methods of production continues to strengthen steady demand from industrial end-users, especially in the modernization efforts of factories to meet the environmental targets set by the EU.

Among pump types, the market share of overhung pumps stands at around 40% due to their compact design and low maintenance requirements. Their ability to give better performance in limited space makes them a preferred choice for water treatment and manufacturing facilities across Europe.

Germany leads the regional outlook, contributing nearly 30% to the overall market. Its leading position is supported by its strong industrial base, advanced wastewater facilities, and significant infrastructure investments. On account of ongoing modernization projects and strict energy efficiency standards, Germany will continue acting as an anchor for overall growth in the European centrifugal pump market through 2032.

Europe Centrifugal Pump Market Growth DriverExpanding Water Infrastructure Investments Strengthening Market Demand

Accelerating investment in Europe's water infrastructure is reinforcing demand for centrifugal pumps as water management systems face mounting pressure from urbanization and climate change. About 30% of the population of Europe experiences water stress annually, nudging governments toward efficient fluid transport systems across all public water supply and treatment facilities. The 2021-2027 Cohesion Policy of the European Commission has allocated resources amounting to a total of €392 billion, with clear focus on water resilience and infrastructure modernization. This funding framework underpins sustained deployment of centrifugal pumps across collection, treatment, and distribution systems in support of Europe's long-term environmental sustainability agenda.

Additionally, urban concentration exacerbates the demand for water infrastructure, this cities taking up only 3.6% of Europe's land area but house almost 39% of the population. Utilities are expected to increase water and wastewater infrastructure capital expenditure from €55 billion to €69 billion annually between 2024 and 2030, which will further lead to stable growth in the installations of centrifugal pumps across all treatment and distribution facilities within the region.

Europe Centrifugal Pump Market ChallengeInfrastructure Limitations and Fragmented Investment Frameworks

Centrifugal pumps in Europe have some specific operational and efficiency issues that are still presented by aging infrastructure and high rates of water loss. According to estimates from the European Commission, nearly 25% of urban water is lost through leakage, while several regions have losses in excess of 40%. This kind of inefficiency is forcing utilities to commit to modernization and replacement pumps, but progress remains slow because many of their priorities are bound by cost and service continuity. The result is that there has been a reactive replacement cycle instead of comprehensive infrastructure renewal.

The regional disparity further exacerbates these constraints, as Denmark invests close to €1,830 per capita in water infrastructure every year, while Spain and Italy invest around €23 and less than €60, respectively. Fragmentation across approximately 61,000 service providers prevents the use of unified procurement strategies, thus creating diverse standards and uneven demand for centrifugal pumps. This lack of harmonization restricts economies of scale and complicates supply coordination for pump manufacturers operating in multiple European markets.

Europe Centrifugal Pump Market TrendDigital Transformation Reshaping Water Infrastructure Management

Fast-tracking digitalization has reshaped the way European utilities manage water infrastructure, driving adoption of smart centrifugal pumping systems. Utilities across Southern Europe-particularly those supported by funding provided by the European Union and the European Investment Bank-are integrating real-time monitoring and automation tools to improve energy efficiency and minimize operational costs. Rising energy prices have strengthened demand recently for digitally enabled pumps that lower power consumption while optimizing asset performance.

IoT sensors and predictive analytics integrated into centrifugal pump systems are redefining the way maintenance strategies are carried out-from reactive to predictive. Pump manufacturers are working on connected solutions compatible with data platforms in line with the Water Resilience Strategy of the European Commission. This transformation brings greater visibility into performance, while sustainability goals and the rollout of energy-efficient centrifugal pumps within Europe's water and wastewater infrastructure are hastened.

Europe Centrifugal Pump Market OpportunityClimate Adaptation and Policy-Driven Growth Opportunities

The European Union's Water Resilience Strategy is introduced in 2025, this unlocks remarkable growth avenues for the centrifugal pump manufacturing sector. This initiative, aiming at water investments of €255 billion by 2030 in an effort toward greater water security and climate resilience, focuses on restoring natural systems and strengthening freshwater management. Driven to meet EU sustainability goals, utilities and industries are likely to see a sharp surge in demand for centrifugal pumps involved in processes like collection, treatment, and distribution, as 38% of the EU's population faces water scarcity.

The growing industrial sectors, which require consistent water supply like energy and manufacturing, will continue creating new demand for pumps. Overall, 36% of EU water abstraction is attributed to electricity generation for cooling, while agriculture accounts for 29%, public water supply accounts for 19%, and manufacturing accounts for 14%. As industries move towards water-efficient production and renewable energy systems, centrifugal pump demand will grow across hydropower facilities, geothermal plants, and process water recycling operations throughout Europe.

Europe Centrifugal Pump Market Country Analysis

Germany represents the largest centrifugal pump market in Europe, accounting for roughly 30% of the total regional demand. This is underpinned by its strong industrial base, with machinery, chemical processing, automotive, and advanced manufacturing industries that require intensive pump usage. In 2022, Germany contributed €33.2 billion in value-added from water supply and sewerage, equating to nearly 30% of the EU total, reinforcing its capacity for infrastructure investment and technological advancement in pump systems.

Comprehensive wastewater networks, robust industrial capabilities, and strict energy efficiency regulations support market leadership in Germany. The country has been promoting modernization in its municipal infrastructure and industrial facilities, which will cause continuous adoption of centrifugal pumps. Dense industrial clusters, along with advanced engineering expertise, have amplified the role of the nation as a manufacturing hub and innovation center for pump technology in Western Germany, ensuring its continued prominence within the European centrifugal pump landscape.

Europe Centrifugal Pump Market Segmentation Analysis

By Pump Type

- Overhung Pumps

- Split Case Pumps

- Vertical Pumps

- Submersible Pumps

Overhung pumps dominate Europe's centrifugal pump market share, holding around 40% of the pump type segment. The compact design of overhung pumps offers great convenience in terms of installation and easy maintenance, which has made these pumps perfectly suitable for industries requiring space optimization and operational reliability. These pumps are greatly deployed in water treatment, wastewater processing, and industrial manufacturing on account of their efficiency and cost-effectiveness, thus holding their position as the most preferred configuration among European end users.

Continuous development in the design of the pump and its material durability is further strengthening the competitiveness of overhung pumps. Overhung pump manufacturers work on engineering enhancements to improve performance, extend operational life, and reduce energy consumption. Industrial end users still prefer overhung pumps for their balance of efficiency, simplicity, and long-term reliability-factors that collectively reinforce the segment’s leading market share and continued adoption across a wide array of industrial applications.

By End User

- Residential

- Commercial

- Agriculture & Irrigation

- Industrial

Industrial end user segment account for about 50% of the centrifugal pump market in Europe, which itself reflects the prime importance of the segment for the growth of the market. Various manufacturing sectors like chemical, petrochemical, food and beverages, and pharmaceuticals require centrifugal pumps for a range of applications pertaining to cooling, material conveyance, and process water recirculation. All these industries depend on smooth operation for their production processes; this guarantees investment in machinery replacement, renovation, and energy efficiency.

The industrial end-user focuses on flow rate, pressure performance, and durability in choosing a pump solution. Long capital planning cycles within manufacturing and energy industries lead to stable demand within the centrifugal pump landscape in Europe. As industries pursue process optimization and environmental compliance, centrifugal pumps with increased energy efficiency and operational resilience keep dominating procurement decisions, ensuring steady growth in the market across all European industrial ecosystems.

Top Companies in Europe Centrifugal Pump Market

The top companies operating in the market include Ebara Corporation, Edur Pumpenfabrik Eduard Redlien GmbH & Co., KSB Se & Co. KGaA, Baker Hughes Company, Dover Corporation, Flowserve Corporation, Sulzer Ltd, Weir Group PLC, Ruhrpumpen Group, Schlumberger Ltd, etc., are the top players operating in the Europe Centrifugal Pump Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Europe Centrifugal Pump Market Policies, Regulations, and Standards

4. Europe Centrifugal Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Europe Centrifugal Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Overhung Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Vertical Line- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Horizontal End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Split Case Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Single/Two Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Multi Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Vertical Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.1. Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.2. Non-Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Axial- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Mixed Flow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Submersible Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Non-Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Operation Type

5.2.2.1. Electrical- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Hydraulic- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Air Driven- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End User

5.2.3.1. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Commercial- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Agriculture & Irrigation- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Industrial- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Country

5.2.4.1. UK

5.2.4.2. Germany

5.2.4.3. France

5.2.4.4. Rest Of Europe

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. UK Centrifugal Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Operation Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Germany Centrifugal Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Operation Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. France Centrifugal Pump Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Operation Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Baker Hughes Company

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Dover Corporation

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Flowserve Corporation

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Sulzer Ltd

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Weir Group PLC

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Ebara Corporation

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Edur Pumpenfabrik Eduard Redlien GmbH & Co.

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.KSB Se & Co. KGaA

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Ruhrpumpen Group

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Schlumberger Ltd

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Operation Type |

|

| By End User |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.