South America Fire Pump Market Report: Trends, Growth and Forecast (2026-2032)

Pump Type (Centrifugal Pumps (Overhung Pumps (Vertical Inline, Horizontal End Suction), Split Case Pumps (Single/Two Stage, Multi Stage)), Positive Displacement Pumps (Diaphragm Pumps, Piston Pumps)), Mode of Operation (Diesel Fire Pump, Electric Fire Pump, Others), End-User (Residential, Commercial, Industrial), Country (Brazil, Argentina, Chile, Peru, Rest of South America)

- Energy & Power

- Dec 2025

- VI0708

- 155

-

South America Fire Pump Market Statistics and Insights, 2026

- Market Size Statistics

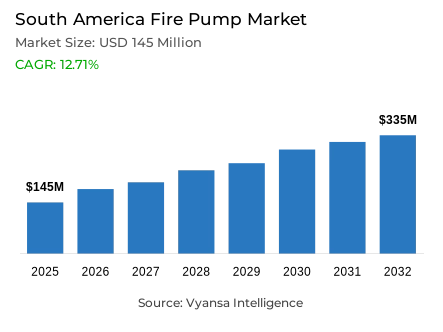

- South America fire pump market is estimated at USD 145 million in 2025.

- The market size is expected to grow to USD 335 million by 2032.

- Market to register a cagr of around 12.71% during 2026-32.

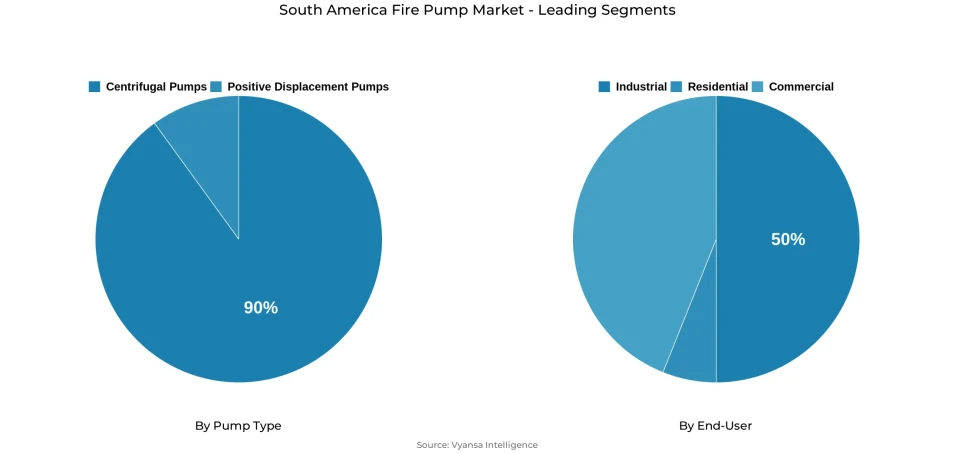

- Pump Type Shares

- Centrifugal pumps grabbed market share of 90%.

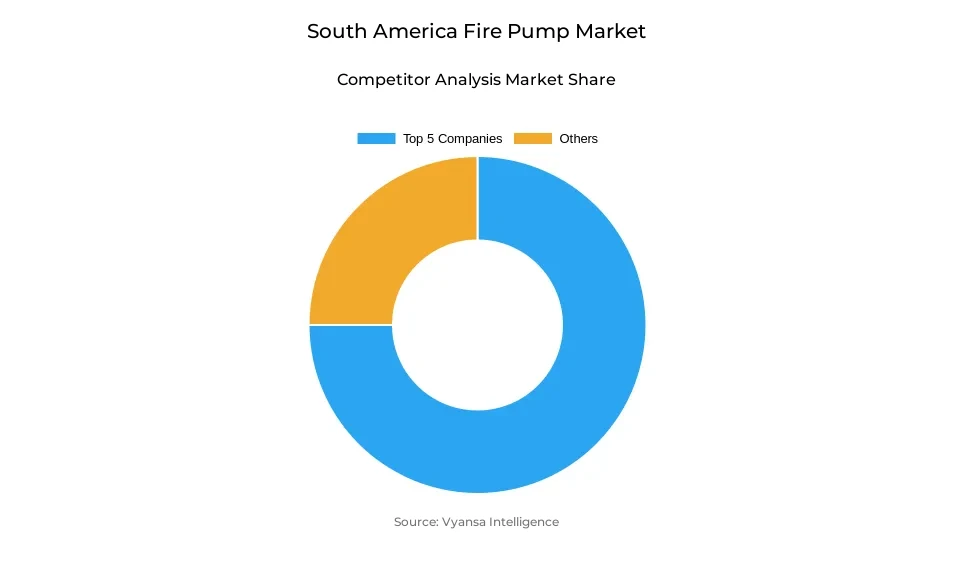

- Competition

- More than 10 companies are actively engaged in producing fire pump in South America.

- Top 5 companies acquired the maximum share of the market.

- WILO SE; Ebara Corporation; ITT Goulds Pumps; Flowserve Corporation; Pentair PLC etc., are few of the top companies.

- End-User

- Industrial grabbed 50% of the market.

- Country

- Brazil leads with a 35% share of the South America market.

South America Fire Pump Market Outlook

The South America Fire Pump Market was valued at USD 145 million in 2025 and is expected to grow to about USD 335 million by 2032 at a CAGR rate of around 12.71% between 2026-2032. Market expansion is favorably underpinned by stringent regulatory requirements and rising investments in infrastructure and industrial growth throughout the region. Governments have enforced stricter building codes requiring sprinkler systems in new buildings, especially in hospitals, shopping malls, and high-rise buildings, driving consistent demand for fire pumps.

Brazil continues to be the regional leader in terms of market, with approximately 35% of total revenue derived from its robust industrial sector, busy construction industry, and forward-thinking fire safety laws. Continued programs such as the National Policy for Integrated Fire Management have greatly diminished the number of wildfire cases while enhancing compliance with sophisticated protection systems among public and private developments.

Centrifugal pumps cover about 90% of the overall market, thanks to their efficiency, reliability, and versatility in commercial, residential, and industrial settings. Their universal availability, minimal maintenance needs, and tried-and-tested reliability ensure that they are the most desirable choice for mass deployment in large fire protection systems. Industrial customers spearhead demand for the market by claiming a 50% share, spurred by the high numbers of chemical, automotive, and steel plants with an urgent need for heavy-duty fire protection applications.

Growing investments in renewable power, transport, and industrial infrastructure continue to offer substantial opportunities for fire pump suppliers. Increasingly, as modernization initiatives gain traction throughout South America, the use of smart, networked fire pump solutions should further augment operational safety and efficiency throughout the continent.

South America Fire Pump Market Growth DriverEnhanced Regulatory Standards Driving Market Expansion

Brazil recorded approximately 278,299 forest fires in 2024, up 46.5% from the year before and leading the government to finalize the National Policy for Integrated Fire Management. As of the first eight months of 2025, wildfire reports fell to 30,000—the lowest in twelve years—showing the effect of intensified fire prevention campaigns. Regional studies show that all South American countries, except Mexico, mandate sprinkler systems in new buildings, particularly for hospitals and shopping centers, underscoring growing compliance efforts.

These regulatory advancements are fueling sustained demand for fire pumps as facilities modernize their protection systems to comply with strict safety standards. The enforcement of mandatory sprinkler installations in buildings exceeding 23 meters across much of South America creates significant market potential. Brazil continues to lead these developments, setting benchmarks through comprehensive fire safety codes that influence standards throughout the continent.

South America Fire Pump Market ChallengeConstruction Costs and Supply Chain Constraints

Brazil's construction industry is subject to ongoing cost pressures, with the National Index of Civil Construction (SINAPI) recording a 0.46% rise in April 2025 and a 4.74% year-over-year increase. Per-square-meter costs hit R$1,818.64, comprising R$1,046.66 in materials and R$771.98 in labor, as inflation is maintained. Labor costs increased by 0.68% in April 2025 because of collective labor contracts, adding to developer budgets and schedules.

These inflationary forces make it more difficult to procure for fire pump installations since developers encounter increasing material and labor costs. Supply chain inefficiencies and skilled labor availability delay completion of projects, while increasing costs limit flexibility in choosing fire protection equipment. As a result, developers and contractors have to implement more strategic sourcing and installation planning in order to balance compliance demands with cost-effectiveness throughout the construction industry.

South America Fire Pump Market TrendIntegration of Smart Fire Protection Technologies

Brazil has deployed cutting-edge real-time forest fire monitoring systems based on IoT sensors, weather APIs, and satellite imagery with 92% detection accuracy. The National Institute for Space Research (INPE) utilises advanced satellite systems to monitor vegetation and fire incidents via the BDQueimadas platform, lowering the rate of occurrences by 46.36% during the first half of 2025 compared to the first half of 2024. Such technological advancements illustrate the way data-driven monitoring enhances emergency response and the allocation of resources.

Concurrently with these developments, intelligent fire pump solutions are increasingly incorporating wireless and cloud-based monitoring technologies. These technologies facilitate remote diagnostics, predictive maintenance, and automatic emergency coordination, allowing for rapid response and lowered downtime. The deployment of connected technologies signifies a revolutionary change in fire protection management, enhancing safety performance and operational reliability for industrial and commercial users in South America.

South America Fire Pump Market OpportunityRising Infrastructure Investments Supporting Market Growth

Brazil's construction sector saw a 3% real-term growth in 2024, led by fresh investments in infrastructure and industrial growth. The government has allocated BRL110 billion ($22 billion) for road and lane upgrades by 2026 and will auction 22 port terminal projects worth BRL8.7 billion ($1.7 billion) in 2025. The efforts towards making renewable energy's share grow from 16% in 2021 to 45% by the year 2030 also continued to spur construction and energy-driven development.

These massive investments are driving demand for fire pump systems in fresh industrial, commercial, and public infrastructure. In response to government and private investors prioritizing modernization and sustainability, fire protection solutions now play a key role in project planning. The expanding pipeline of renewable energy, transport, and industrial projects across South America offers consistent growth opportunities for fire pump suppliers looking for long-term involvement in regional infrastructure growth.

South America Fire Pump Market Country Analysis

By Country

- Brazil

- Argentina

- Chile

- Peru

- Rest of South America

Brazil dominates 35% of the South America Fire Pump Market, remaining the largest and most developed market for fire protection equipment in the region. Its market dominance is rooted in a strong construction industry, a wide industrial base, and enforcing progressive fire safety regulations on both commercial and residential projects.

The nation's proactive regulatory system, coupled with initiatives such as the National Policy for Integrated Fire Management, continues to propel uptake of innovative fire pump technologies. Urban centers like São Paulo and Rio de Janeiro are the principal hubs of consumption, echoing both population density and industrialization. Brazil's leadership is the standard for other neighboring markets, shaping regional standards and reinforcing its position as the epicenter of compliance and innovation within South America's fire safety ecosystem.

South America Fire Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pumps

Centrifugal pumps has the highest share of around the 90% under the pump type segment in South America's fire pump market, with their efficiency, longevity, and versatility across differing building and industrial environments. Their ability to sustain stable operation under fluctuating pressure conditions renders them the ideal choice for high-rise building and factory-sized fire suppression systems.

The market's strong inclination towards centrifugal pumps is a testament to their technological superiority and ubiquity. Established distribution networks and support infrastructure allow for seamless access to spare parts and maintenance services. Contractors and facility managers alike routinely choose these pumps for their long-term reliability of operation, economy, and established performance record, making centrifugal models the linchpin of South America's fire protection industry.

By End-User

- Residential

- Commercial

- Industrial

This overwhelming share reflects the high manufacturing base of this region, especially in Brazil, where industrial activity keeps on increasing with mining and heavy engineering. Industrial fire pumps are characterized by high capacity, special materials, and secured control systems in order to achieve safety regulations. With industrialization increasing, demand for tailored fire protection systems keeps on growing, fueling continuous technological refinements and market growth in this sector.

Various Market Players in South America Fire Pump Market

The companies mentioned below are highly active in the South America fire pump market, occupying a considerable portion of the market and shaping industry progress.

- WILO SE

- Ebara Corporation

- ITT Goulds Pumps

- Flowserve Corporation

- Pentair PLC

- Sulzer Limited

- Grundfos Holding A/S

- KSB SE & Co. KGaA

- Patterson (Gorman Rupp)

- Armstrong

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. South America Fire Pump Market Policies, Regulations, and Standards

4. South America Fire Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. South America Fire Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Overhung Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.1. Vertical Inline- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.2. Horizontal End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.1. Single/Two Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.2. Multi Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Diaphragm Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Piston Pumps - Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Mode of Operation

5.2.2.1. Diesel Fire Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Electric Fire Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End-User

5.2.3.1. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Commercial- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Industrial- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Country

5.2.4.1. Brazil

5.2.4.2. Argentina

5.2.4.3. Chile

5.2.4.4. Peru

5.2.4.5. Rest of South America

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Brazil Fire Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

7. Argentina Fire Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

8. Chile Fire Pump Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

9. Peru Fire Pump Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Flowserve Corporation

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Pentair PLC

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Sulzer Limited

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Grundfos Holding A/S

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. KSB SE & Co. KGaA

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. WILO SE

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Ebara Corporation

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. ITT Goulds Pumps

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Patterson (Gorman Rupp)

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Armstrong

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Mode of Operation |

|

| By End-User |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.