North America Centrifugal Pump Market Report: Trends, Growth and Forecast (2026-2032)

Pump Type (Overhung Pumps (Vertical Line, Horizontal End Suction), Split Case Pumps (Single/Two Stage, Multi Stage), Vertical Pumps (Turbine (Solid Handling, Non-Solid Handling), Axial, Mixed Flow), Submersible Pumps (Solid Handling, Non-Solid Handling)), Operation Type (Electrical, Hydraulic, Air Driven), End User (Residential, Commercial, Agriculture & Irrigation, Industrial), Country (US, Canada, Mexico, Rest of North America)

- Energy & Power

- Dec 2025

- VI0707

- 150

-

North America Centrifugal Pump Market Statistics and Insights, 2026

- Market Size Statistics

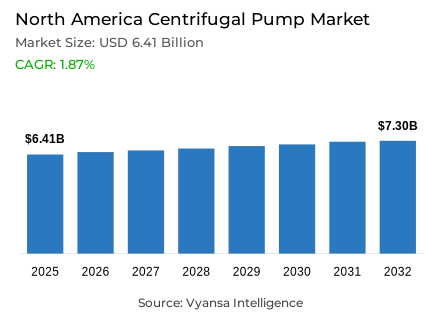

- North America centrifugal pump market is estimated at USD 6.41 billion in 2025.

- The market size is expected to grow to USD 7.3 billion by 2032.

- Market to register a cagr of around 1.87% during 2026-32.

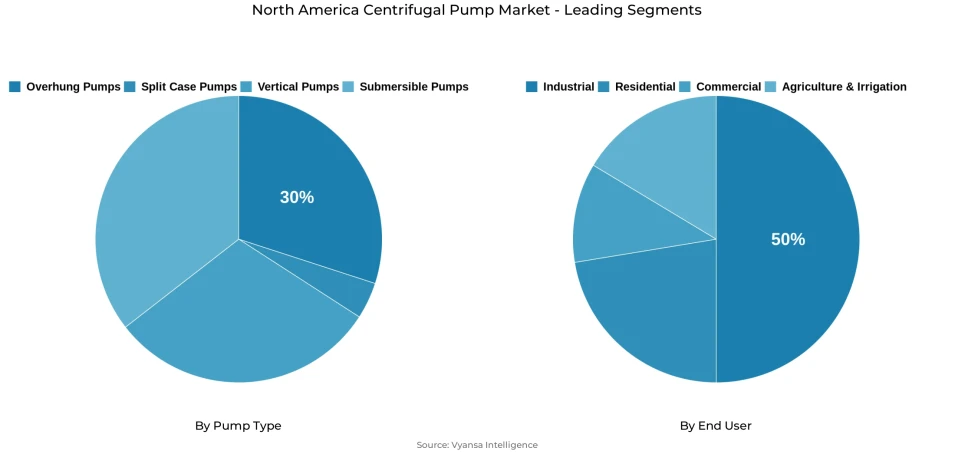

- Pump Type Shares

- Overhung pumps grabbed market share of 30%.

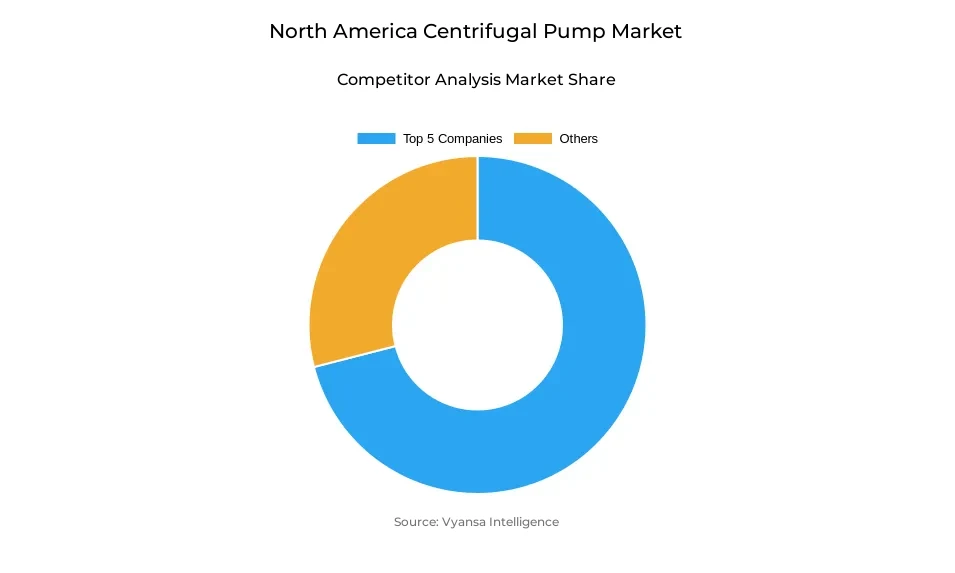

- Competition

- More than 10 companies are actively engaged in producing centrifugal pump in North America.

- Top 5 companies acquired the maximum share of the market.

- Magnatex Pumps Inc.; Titan Manufacturing Inc.; Hayward Flow Control; Xylem Inc.; Schlumberger Limited etc., are few of the top companies.

- End User

- Industrial grabbed 50% of the market.

- Country

- US leads with a 90% share of the North America market.

North America Centrifugal Pump Market Outlook

The North America centrifugal pump market was valued at USD 6.41 billion in 2025 and is expected to reach approximately USD 7.3 billion by 2032, at a CAGR of approximately 1.87% during 2026-2032. Growth is supported by extensive federal funding for water infrastructure, including the U.S. Environmental Protection Agency's $6.2 billion allocation under the Bipartisan Infrastructure Law. Such investments are helping modernize aging water systems and bridge the growing gap between infrastructure needs and available spending, creating steady demand for centrifugal pumps used in large-scale municipal and industrial projects.

Replacement of old water networks continues to be a key market driver, as approximately 19.4% of water mains in the U.S. and Canada are beyond their service life. Approximately 9 million lead service lines are expected to be replaced, which in turn will drive the procurement of advanced pumping systems. Increasing investments in data centers and semiconductor manufacturing are bolstering the demand for pumps used in cooling and process water applications, thereby solidifying the growth in the industrial sector of the region.

The market is being reshaped toward more sustainable operations through various regulatory measures on energy-efficient pump technologies by the U.S. Department of Energy. Manufacturers are investing in pumps with advanced motor systems and variable-frequency drives to be able to achieve these standards. Overhung pumps accounted for around 30% of total pump-type demand, owing to their compact design and efficiency in a wide variety of applications.

By end-user, the industrial sector leads with a 50% share of the market, driven by the strong demand within the manufacturing, power generation, and processing industries. The United States leads the regional market with 90% share, driven by large-scale infrastructure renewal programs and a robust industrial base in the country, which ensures its continued leadership in the North America centrifugal pump market through 2032.

North America Centrifugal Pump Market Growth DriverStrengthening Infrastructure Resilience through Federal Funding Support

Extensive federal funding initiatives are reinforcing the resilience of North America’s water infrastructure, significantly driving centrifugal pump deployment across municipal and industrial applications. The U.S. Environmental Protection Agency’s $6.2 billion investment under the Bipartisan Infrastructure Law for fiscal year 2025 forms part of a $50 billion five-year allocation, marking the largest federal water infrastructure commitment in history. This sustained infusion addresses the widening gap between water infrastructure needs and spending-projected to rise from $91 billion in 2024 to $146 billion by 2043-creating consistent demand for pumping systems essential to large-scale modernization and rehabilitation projects.

Complementary initiatives include the Water Infrastructure Finance and Innovation Act, which provides $7.5 billion in funding for 2024, reinforcing long-term market stability. Through these programs, ongoing investment momentum is derived from continuous market development beyond initial appropriations, allowing equipment manufacturers and service providers to align with evolving modernization priorities among water utilities and regional authorities focused on system resilience and sustainability.

North America Centrifugal Pump Market ChallengeAging Infrastructure and Intensifying Replacement Requirements

Aging water infrastructure is a constant concern throughout the U.S. and Canada, with an estimated 260,000 water main breaks per year and $2.6 billion spent maintaining them. About 19.4% of the total mains-452,000 miles-have exceeded their operational life, underlining a replacement need of $452 billion. Furthermore, 33% of the network that is more than 50 years old is also closing in on its 75-100-year limit and nearing infrastructure renewal; thus, this scenario increases demand for the centrifugal pumps essential to water distribution, wastewater treatment, and system modernization projects.

Replacement activities are expected to peak around 2035, when the Environmental Protection Agency anticipates 16,000-20,000 miles of mains being replaced annually. With more than 9 million lead service lines requiring removal, municipalities and utilities are accelerating procurement of advanced pumping systems to support infrastructure replacement. These sustained technical requirements create enduring opportunities for centrifugal pump manufacturers across municipal and regional networks.

North America Centrifugal Pump Market TrendDigital Infrastructure Integration Transforming Pump System Management

Across North America, water utilities and industrial facilities are experiencing a profound digital transformation as automation and real-time observation become central to operational strategies. The movement toward intelligent monitoring and control solutions is speeding up as motor-driven systems including centrifugal pumps account for about 50% of industrial electricity consumption according to the International Energy Agency. A top national program, the NIST National Cybersecurity Center of Excellence (NCCoE), is facilitating this change by developing secure frameworks for remote access to water and wastewater operational systems, encouraging greater adoption of connected infrastructure by utilities of all sizes.

The increasing use of real-time dashboards, predictive analytics, and GIS-based asset management platforms are a key transition in pump operations. Digital twins are becoming an increasing part of the utility’s operational strategy enabling the utilities to simulate performance, provide insights for operational efficiency and maintenance needs ahead of the failure. The consistency observed in the movement away from conventional fixed-speed pump designs to a connected digital ecosystem is a definitive trend in the market that will change the design, operation, and maintenance of centrifugal pump systems within the forecast period.

North America Centrifugal Pump Market OpportunityEnergy Efficiency Mandates Accelerating Equipment Modernization

Accelerating industrial investment across North America, especially in high-tech industry sectors, is reinforcing centrifugal pump demand. Data centers and semiconductor manufacturing have emerged as major growth segments owing to rising demands for efficient cooling and process water management. These capital-intensive industries depend on advanced pumping systems that ensure precision control, thermal stability, and reliable performance, underscoring the expanding role of centrifugal pumps in supporting technologically advanced production environments.

Hyperscale data centers of Microsoft, Google, and Amazon are increasingly installing liquid cooling systems that support AI workloads and high-density computing infrastructure. This is an industrial transformation in water usage and opens excellent prospects for the manufacturers of specialized centrifugal pumps that are highly reliable and efficient. As the semiconductor and process industries continue to grow, such developments create significant opportunities for centrifugal pump suppliers across the region through 2032.

North America Centrifugal Pump Market Country Analysis

By Country

- US

- Canada

- Mexico

- Rest of North America

The US market controls around 90% (leading segment) of the North American centrifugal pump market, reflecting its strong industrial ecosystem, large-scale water infrastructure, and high investment capacity. Federal initiatives for rehabilitation and modernization of infrastructure are stimulating consistent procurement of advanced pumping equipment at utilities and industrial facilities. Mature water systems and aging distribution networks create regular replacement opportunities, joined by ongoing development in oil and gas, chemicals, and food processing industries.

Additionally, regulatory initiatives, infrastructure grants, and the expansion of high-tech industries further establish leadership for the country. By comparison, smaller but emerging markets are represented by Canada and Mexico. The U.S. provides the main impetus for growth, setting technological standards and investment benchmarks, through 2032, which dictates the overall centrifugal pump outlook for North America.

North America Centrifugal Pump Market Segmentation Analysis

By Pump Type

- Overhung Pumps

- Split Case Pumps

- Vertical Pumps

- Submersible Pumps

The overhung pump is the largest segment to North America's centrifugal pump market, accounting for around 30% of the total demand. Compact design, cost-effectiveness, and less frequent maintenance needs dictate their dominance in serving water treatment plants, HVAC systems, and industrial applications. These pumps have impellers mounted on a shaft supported from one side by bearings, which facilitates easy access to seals and impellers during routine maintenance and reduces operational losses during plant shutdowns. Their adaptability to water management, oil and gas, and chemical processing applications underlines their strong presence both in regional infrastructure and industrial fluid handling systems.

The preference for overhung pumps indicates that these pumps work exceptionally well in low-to-moderate pressure and high-flow applications with simple fluid transfer requirements. Other categories, like between-bearing and vertically suspended pumps, can address specialized or high-pressure applications; however, their greater complexity and costs restrict broader adoption outside of a few industrial niches. Overhung pumps remain far ahead because of their simplicity in design, ease of installation, and overall lower lifecycle costs, making them the preferred option for end users focused on reliability and operational efficiency across a wide array of industries in 2026-2032.

By End User

- Residential

- Commercial

- Agriculture & Irrigation

- Industrial

Increasing investments in semiconductor manufacturing, data centers, and advanced production facilities further solidify industrial end-user dominance. High-performance centrifugal pumps support cooling, pressure management, and effluent treatment across diverse operations, which helps underpin North America's industrial competitiveness. The growing alignment between industrial water management requirements and energy-efficient pumping technologies ensures long-term procurement momentum, securing the industrial sector as the mainstay of regional centrifugal pump demand through 2032.

Various Market Players in North America Centrifugal Pump Market

The companies mentioned below are highly active in the North America centrifugal pump market, occupying a considerable portion of the market and shaping industry progress.

- Magnatex Pumps Inc.

- Titan Manufacturing Inc.

- Hayward Flow Control

- Xylem Inc.

- Schlumberger Limited

- Flowserve Corporation

- ITT Inc.

- Iwaki America Inc.

- Finish Thompson Inc.

- Zoeller Company Inc.

- Premier Fluid Systems Inc.

- John Blue Company

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. North America Centrifugal Pump Market Policies, Regulations, and Standards

4. North America Centrifugal Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. North America Centrifugal Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Overhung Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Vertical Line- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Horizontal End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Split Case Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Single/Two Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Multi Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Vertical Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.1. Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.2. Non-Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Axial- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Mixed Flow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Submersible Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Non-Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Operation Type

5.2.2.1. Electrical- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Hydraulic- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Air Driven- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End User

5.2.3.1. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Commercial- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Agriculture & Irrigation- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Industrial- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Country

5.2.4.1. US

5.2.4.2. Canada

5.2.4.3. Mexico

5.2.4.4. Rest of North America

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. US Centrifugal Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Operation Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Canada Centrifugal Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Operation Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Mexico Centrifugal Pump Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Operation Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Xylem, Inc.

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Schlumberger Limited

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Flowserve Corporation

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.ITT Inc.

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Iwaki America Inc.

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Magnatex Pumps Inc.

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Titan Manufacturing Inc.

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Hayward Flow Control

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Finish Thompson, Inc.

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Zoeller Company, Inc.

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Operation Type |

|

| By End User |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.