North America Industrial Gases Market Report: Trends, Growth and Forecast (2026-2032)

Gas (Nitrogen Gas, Oxygen Gas, Carbon dioxide Gas, Argon Gas, Hydrogen Gas, Helium Gas, Acetylene Gas, Others), Application (Combustion and Process Oxygen, Welding and Metal Fabrication, Inerting Blanketing and Heat Treating, Cryogenics and liquefaction, Chemical Synthesis and Hydrogenation, Purging and Purifications, Analytical and Calibration), Supply Mode (Packaged Gas Supply (Merchant Sales), Bulk or Liquid Gas Supply, Onsite Generation or Pipeline Supply, Gas-as-a-Service Model), End User Industry (Oil and Gas, Petrochemicals and Chemicals, Power and Energy, Mining, Steelmaking, Metals, Healthcare, Food and Beverages, Fertilizers, Others), Country (United States, Canada, Mexico, Rest of North America)

- Energy & Power

- Dec 2025

- VI0612

- 165

-

North America Industrial Gases Market Statistics and Insights, 2026

- Market Size Statistics

- North america industrial gases market is estimated at USD 25 billion.

- The market size is expected to grow to USD 37 billion by 2032.

- Market to register a cagr of around 5.76% during 2026-32.

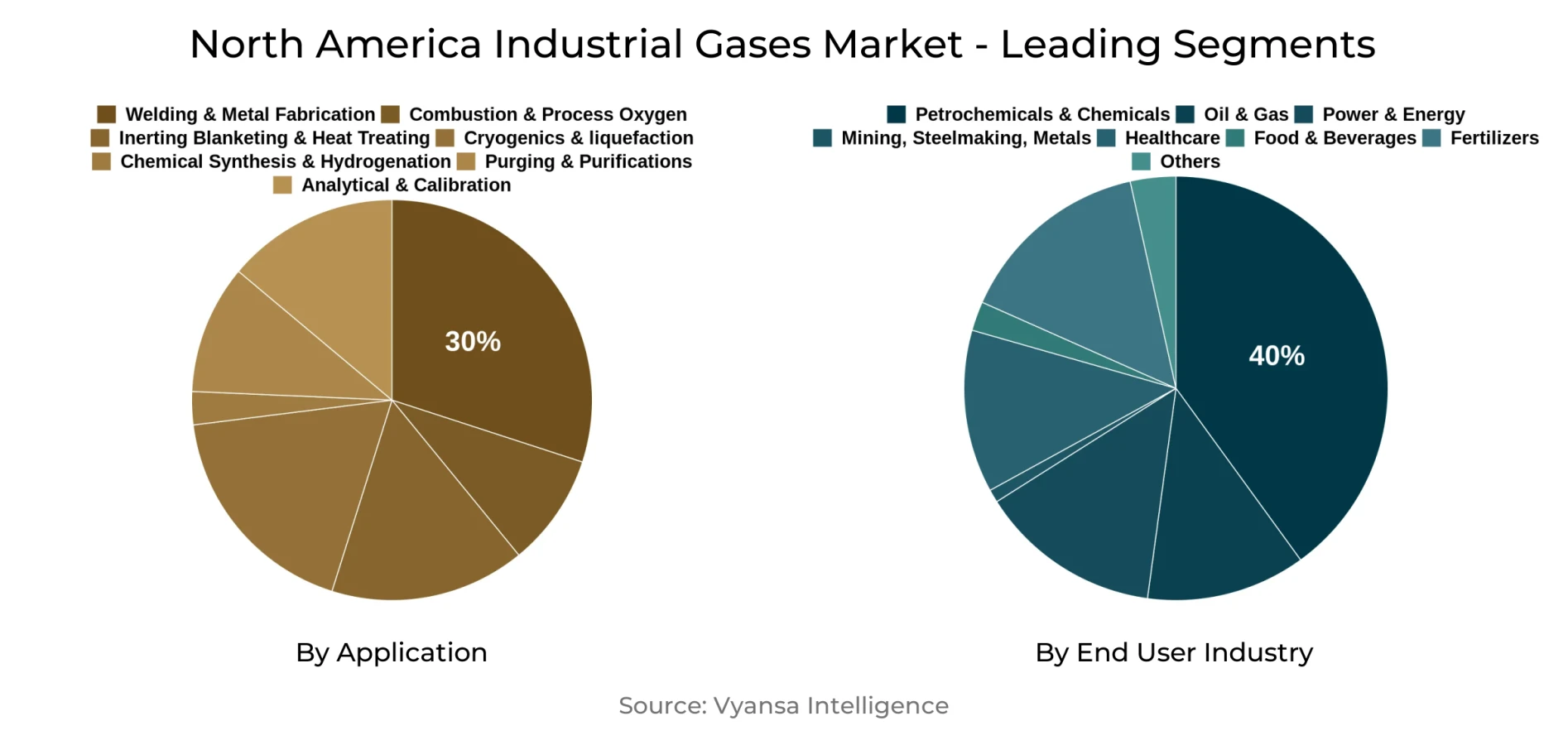

- Application Shares

- Welding and metal fabrication grabbed market share of 30%.

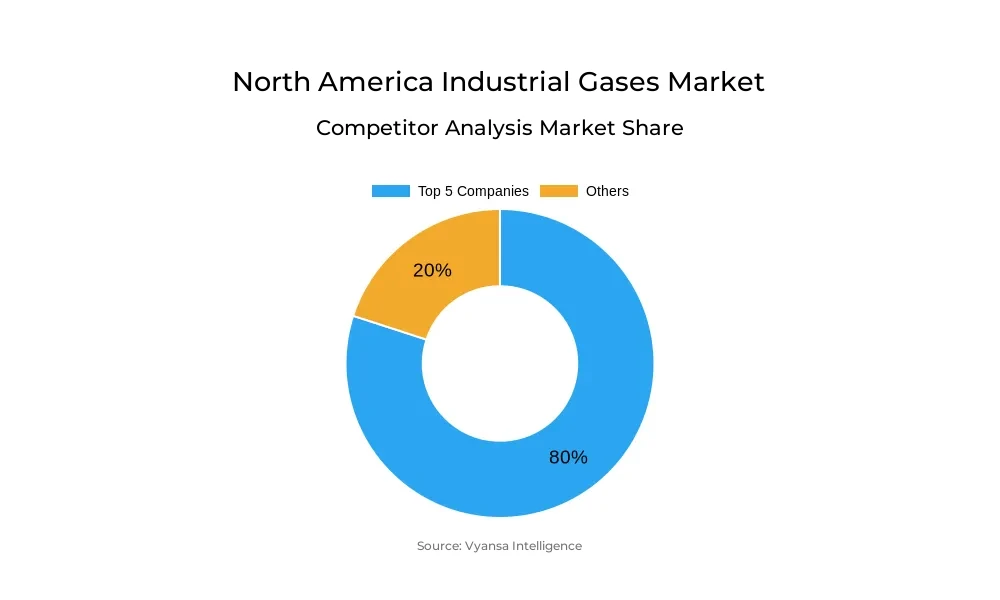

- Competition

- More than 10 companies are actively engaged in producing industrial gases in north america.

- Top 5 companies acquired around 80% of the market share.

- Matheson Tri-Gas, Messer Americas, Praxair, Air Liquide, Airgas etc., are few of the top companies.

- End User Industry

- Petrochemicals and chemicals grabbed 40% of the market.

- Country

- US leads with a 90% share of the north america market.

North America Industrial Gases Market Outlook

The North America industrial gases Market was valued at approximately USD 25 billion in 2025 and is expected to reach nearly USD 37 billion by 2032, growing at a CAGR of about 5.76% during 2026-2032. Industrial production across the region continues to expand as manufacturers modernize operations and enhance efficiency. Steel manufacturing alone accounts for 65% of domestic oxygen consumption, reflecting strong demand across heavy industries. The increasing requirement for oxygen, nitrogen, and specialty gases in the chemical, electronic, and food and beverage industries is driving consistent market growth, supported by more than 110 active oxygen production facilities across the United States.

Applications related to welding and metal fabrication dominate close to 30% of the total market demand, due to growing infrastructure, automotive, and construction industries requiring shielding gases like argon and oxygen in huge amounts. Advancements in automated welding and robotics are further raising consumption, thus keeping this segment in its leading position till 2032.

Together, the petrochemical and chemical industries account for around 40% of the market, as both rely heavily on hydrogen, oxygen, and nitrogen in refining and synthesis applications. With over 385 active petrochemical complexes, mostly in the U.S. Gulf Coast region, the volume of industrial gas usage is sustained by huge production outputs and the increasing drive toward cleaner, more efficient processes.

The regional market is dominated by the United States, which holds a share of about 90%, due to its vast industrial base, advanced technological infrastructure, and widespread gas production capacity. Canada and Mexico provide secondary growth on the back of their expanding petrochemical and automotive industries. In summary, a strong manufacturing base, clean hydrogen, and industrial modernization continue to anchor solid growth in the North America industrial gases Market through 2032.

North America Industrial Gases Market Growth Driver

Strengthening Industrial Output Across the Region

Industrial production in North America has been increasing steadily as manufacturers directing resources into facility upgrades and improving production efficiency. The U.S. Environmental Protection Agency cites that steel manufacturing represents approximately 65% of domestic oxygen use, a statistic that provides meaningful context to the overall scale of industrial gas demand in heavy manufacturing. Chemical, electrical, and food and beverage manufacturing are growing areas of production that increasingly demand oxygen, nitrogen, and other specialty gases essential to productivity and improvement of the process of production. They provide significant support to precision manufacturing and enhance combustion efficiency, which is aligned with the regional sustainability agenda for cleaner production processes.

Moreover, industrial growth is reinforced by reliability of supply and advancements in technology related to gas delivery systems. The U.S. has initiated more than 110 oxygen production facilities to date, ensuring extensive regional availability and eliminating significant supply vulnerability. Enhanced capability of air separation units and on-site generation technologies provide manufactories the ability to manage their costs while maintaining consistent operations. With a solid supply infrastructure in place, industrial gas suppliers are equipped to cost effectively service growing end-user markets in North America through 2032.

North America Industrial Gases Market Challenge

Persistent Distribution Challenges and Transportation Limitations

Industrial gas distribution in North America continues to be disrupted, despite gradual recovery from pandemic-era constraints. Liquid oxygen and other products have to be transported by certified equipment handled by trained personnel, as the logistics bottleneck curbs timely delivery. Certification standards, along with limited availability of specialized transport vehicles, contribute to persistent inefficiencies. Distribution issues have periodically resulted in regional supply shortages, even when production capacity remained adequate.

Transportation infrastructure limitations further raise the level of vulnerability within the supply chain. Industrial gases must use refrigerated trucks, special containers, and temperature-controlled logistics, which add to the operational cost compared to conventional chemicals. Certain constraints have resulted in short-term delivery disruptions during periods of high demand, particularly in healthcare emergencies. These challenges must be addressed by further investing in fleet capacity, driver certification, and multimodal delivery solutions that would help strengthen the resilience within industrial gas supply networks throughout the region up to 2026-2032.

North America Industrial Gases Market Trend

Transition Toward Clean Hydrogen and Energy Decarbonization

The structural transformation of North America's industrial gases market is powered by clean hydrogen initiatives and energy transition goals. The U.S. Department of Energy invested $8 billion to establish seven multistate hubs under the Regional Clean Hydrogen Hubs Program to support production and distribution infrastructure. An additional $750 million in federal funding was allocated in 2024 to extend the capacity for using hydrogen, with the national aim of achieving 10 million tonnes of clean hydrogen annually produced by 2030. These large-scale investments are now fundamentally changing industrial gas applications across energy, manufacturing, and transport sectors.

Hydrogen's rise as a central decarbonization vector is reworking demand for companion gases like oxygen and nitrogen associated with electrolysis, storage, and fuel applications. Electrolyzer capacity is expanding from a few to 10 gigawatts per year-a key inflection point in scalable hydrogen production. As green hydrogen takes hold, industrial gas suppliers are well-positioned to seize tremendous opportunities throughout refineries, power generation, and advanced manufacturing-positions that give them a strategic role to play in attaining net-zero outcomes in North America.

North America Industrial Gases Market Opportunity

Expanding Opportunities in Advanced Manufacturing and Semiconductor Production

The continued proliferation of semiconductor manufacturing and other sophisticated industrial processes creates significant opportunities for suppliers of industrial gases. For example, the semiconductor industry utilizes ultra-pure forms of these gases in plasma etching, chemical vapor deposition, and contamination-free environments. Demand for specialty gases with tight purity specifications has been accelerating with the construction of next-generation fabrication facilities across North America. In this connection, there is a growing need for strategic partnerships among gas suppliers and chip manufacturers to enhance the quality and reliability of high-precision production in both fabrication and assembly.

Beyond semiconductors, gas utilization is growing for advanced industrial applications such as precision welding, laser cutting, and aerospace fabrication. Additionally, the increasing controlled-environment agriculture sector, including hydroponics and vertical farming, contributes to the demand for carbon dioxide and oxygen enrichment. This expanding array of applications makes industrial gases one of the most vital enablers in innovation, efficiency, and sustainability in manufacturing, energy, and agricultural ecosystems across the region.

North America Industrial Gases Market Country Analysis

The US dominates the North America industrial gases Market, contributing around 90% of its share, owing to its vast manufacturing base, well-developed chemical infrastructure, and strong healthcare and technology sectors. The existence of 110 oxygen production plants in the country helps in regional supply with reduced logistics vulnerability. Such a scenario has resulted from the densest industrial activities, such as petrochemicals, steel, and semiconductor fabrication industries, which have been continuously sustaining gas demand in the region. Smaller markets like Canada and Mexico contribute to growth through the petrochemical and automotive manufacturing sectors, respectively.

The structure of the regional market reflects underlying economic and industrial disparities. With a lead in research, advanced production, and innovation, the U.S. consumes gas in disproportional quantities relative to regional peers. Resource-based industries in Canada and the manufacturing exports of Mexico offer secondary growth avenues that complement U.S. leadership. Up to 2032, this geographic concentration will continue to shape North America's industrial gases market, with the United States anchoring regional supply chains and technological progress.

North America Industrial Gases Market Segmentation Analysis

By Application

- Combustion and Process Oxygen

- Welding and Metal Fabrication

- Inerting Blanketing and Heat Treating

- Cryogenics and liquefaction

- Chemical Synthesis and Hydrogenation

- Purging and Purifications

- Analytical and Calibration

Welding and metal fabrication constitute the largest application segment in the North America industrial gases Market, accounting for around 30% of total demand. This is reaffirmed by sustained activity pertaining to infrastructure development, automotive production, shipbuilding, and construction, all of which require consistent shielding gas supply. Argon-based shielding gases, oxygen, and specialized blends offer advanced welding processes that are structurally sound and productive across industries.

Modernization in manufacturing and infrastructure spending also supports this demand. Heavy machinery, vehicle parts, and construction require industrial gases to perform smooth joining and cutting operations. The demand for welding gases is thus expected to continue leading the industrial gases market until 2032, with industrial standards increasingly requiring high precision and durability. Major developments in automatic welding and robotics will further establish this segment in the core position within the landscape of the industrial gases market.

By End User Industry

- Oil and Gas

- Petrochemicals and Chemicals

- Power and Energy

- Mining

- Steelmaking

- Metals

- Healthcare

- Food and Beverages

- Fertilizers

- Others

The petrochemical and chemical industries have the largest share of consumption in North America, at around 40% of the total demand. These industries greatly rely on hydrogen for hydrogenation, oxygen for oxidation, and nitrogen for inerting-a rather crucial process in refining and chemical synthesis. Overall, 385 active petrochemical complexes are present in North America, mainly in the United States of America, which demands continuous volumes. The U.S. Gulf Coast represents the epicenter for gas-intensive refining and chemical manufacturing, maintaining consistent industrial gas demand across the interconnected facilities.

High-capacity operations underline the extent to which this segment influences the growth of the market. In 2023, the lifecycle emissions for the petrochemical sector were between 306 and 343 million metric tons of CO₂, reflecting intensive gas usage in large-scale processing environments. Average chemical production volumes surpassing 0.46 billion pounds per site have underlined the importance of reliable gas supply for continuous production. Stability and potential for further expansion make this sector the most valuable end-user category for industrial gas suppliers through 2032.

Top Companies in North America Industrial Gases Market

The top companies operating in the market include Matheson Tri-Gas, Messer Americas, Praxair, Air Liquide, Airgas, Air Products and Chemicals, Chart Industries, Linde, Taylor-Wharton, Universal Industrial Gases, etc., are the top players operating in the North America Industrial Gases Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. North America Industrial Gases Market Policies, Regulations, and Standards

4. North America Industrial Gases Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. North America Industrial Gases Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Volume Sold (Million Cubic Meters)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Gas

5.2.1.1. Nitrogen Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Oxygen Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Carbon dioxide Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Argon Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Hydrogen Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Helium Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Acetylene Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Combustion and Process Oxygen- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Welding and Metal Fabrication- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Inerting Blanketing and Heat Treating- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Cryogenics and liquefaction- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Chemical Synthesis and Hydrogenation- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Purging and Purifications- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Analytical and Calibration- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Supply Mode

5.2.3.1. Packaged Gas Supply (Merchant Sales)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Bulk or Liquid Gas Supply- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Onsite Generation or Pipeline Supply- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Gas-as-a-Service Model- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By End User Industry

5.2.4.1. Oil and Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Petrochemicals and Chemicals- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Power and Energy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Mining, Steelmaking, Metals- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Healthcare- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Food and Beverages- Market Insights and Forecast 2022-2032, USD Million

5.2.4.7. Fertilizers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Country

5.2.5.1. United States

5.2.5.2. Canada

5.2.5.3. Mexico

5.2.5.4. Rest of North America

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. United States Industrial Gases Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Volume Sold (Million Cubic Meters)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Gas- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By End User Industry- Market Insights and Forecast 2022-2032, USD Million

7. Canada Industrial Gases Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Volume Sold (Million Cubic Meters)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Gas- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By End User Industry- Market Insights and Forecast 2022-2032, USD Million

8. Mexico Industrial Gases Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Volume Sold (Million Cubic Meters)

8.2. Market Segmentation & Growth Outlook

8.2.1.By Gas- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By End User Industry- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Air Liquide

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Airgas

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Air Products and Chemicals

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Chart Industries

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Linde

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Matheson Tri-Gas

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Messer Americas

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Praxair

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Taylor-Wharton

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Universal Industrial Gases

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Gas |

|

| By Application |

|

| By Supply Mode |

|

| By End User Industry |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.