US Bath & Shower Products Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Bath Soaps, Body Wash/Shower Gels, Bath Additives, Body Powder, Hand Sanitisers, Intimate Hygiene), By Product Form (Solid, Gels & Jellies, Liquid, Powder), By Ingredient (Conventional/Synthetic, Natural/Organic), By Price Point (Premium, Mass), By End User (Women, Men, Kids/Children), By Sales Channel (Online, Offline)

- FMCG

- Dec 2025

- VI0060

- 122

-

US Bath & Shower Products Market Statistics, 2025

- Market Size Statistics

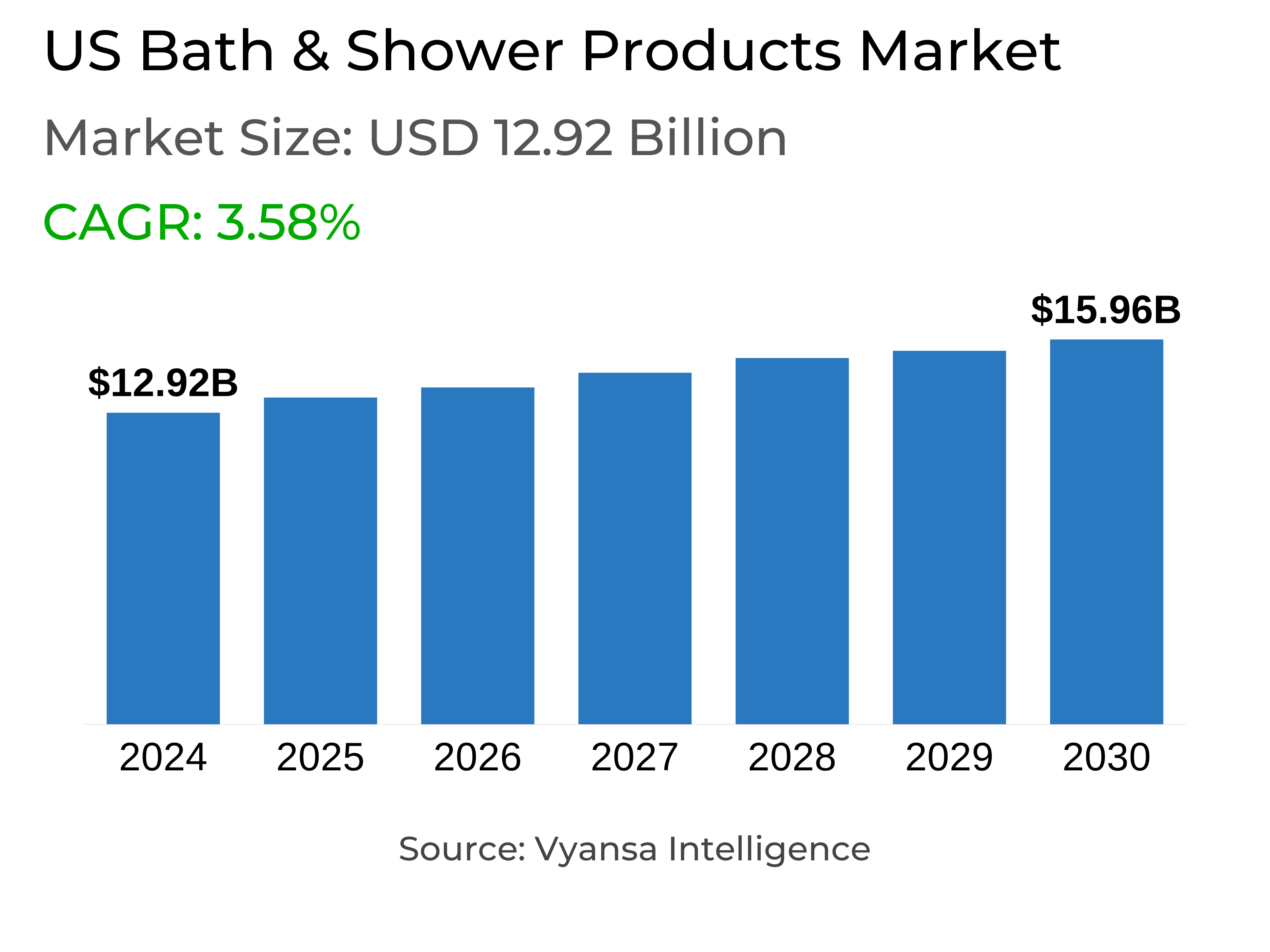

- Bath & Shower Products in US is estimated at $ 12.92 Billion.

- The market size is expected to grow to $ 15.96 Billion by 2030.

- Market to register a CAGR of around 3.58% during 2025-30.

- Product Shares

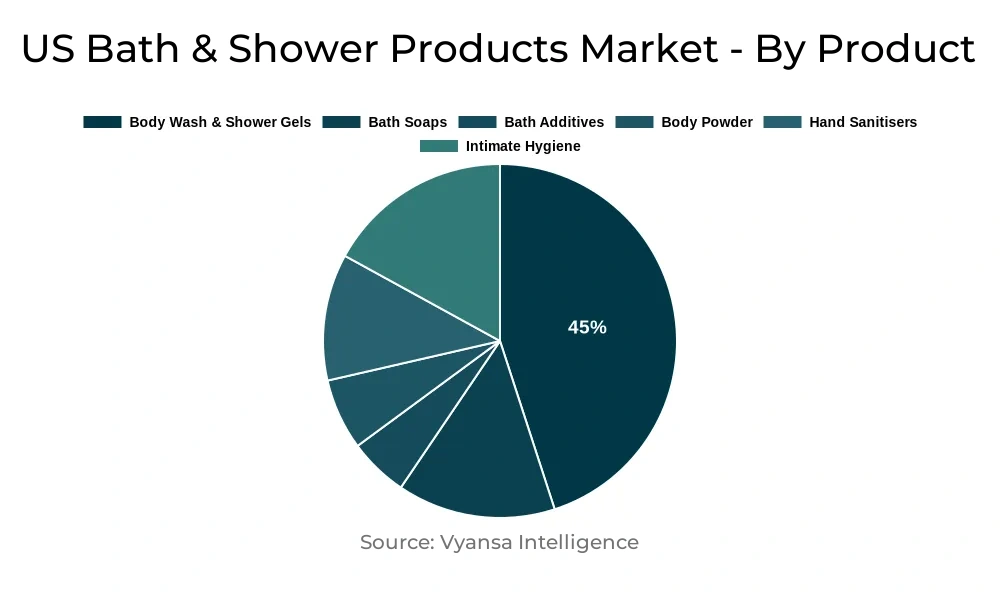

- Body Wash/Shower Gel grabbed market share of 45%.

- Competition

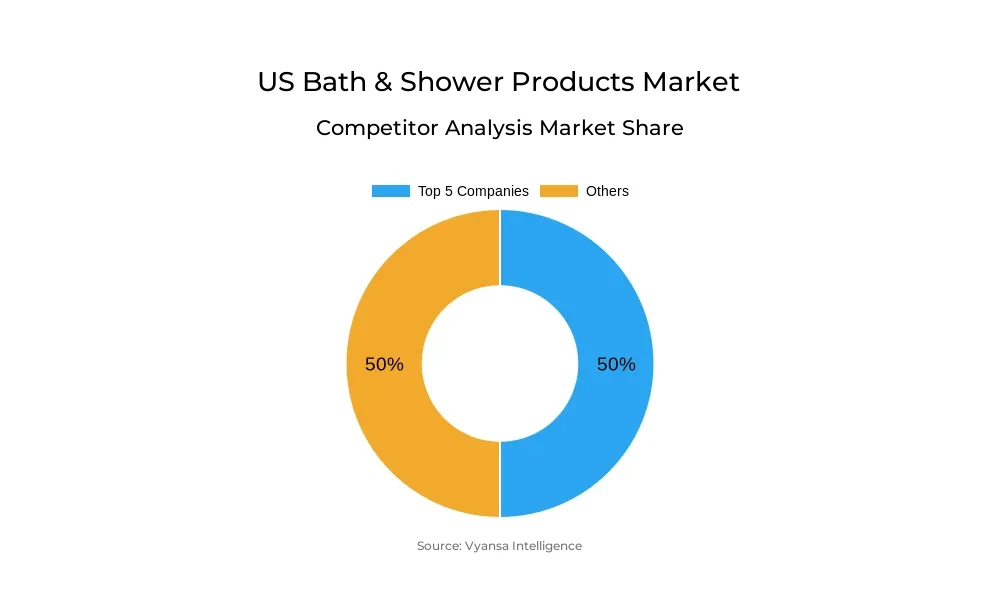

- More than 20 companies are actively engaged in producing Bath & Shower Products in US.

- Top 5 companies acquired 50% of the market share.

- Johnson & Johnson Consumer Products Inc, Elida Beauty Group, Suave Brands Co LLC, Unilever Home & Personal Care USA, Bath & Body Works Inc etc., are few of the top companies.

US Bath & Shower Products Market Outlook

The US bath and shower market is likely to sustain its favorable growth trend between 2025 and 2030, riding on the strong pace set in 2024. As consumers become more interested in products that merge function with emotional and sensory value, the market will continue to gain from innovation. Major players will increasingly pursue wellness-driven functionalities and skin-nourishing ingredients like exfoliants, moisturizers, and natural oils. The focus on showering routines, with complementary fragrances in body wash, lotions, and mists, is also likely to become stronger, as shoppers demand value and pampering in daily use products.

Nostalgic product lines and limited-edition launches will be an important driver of engaging younger consumers, particularly via TikTok. Dove, Native, and Method are expected to grow scent ranges and design-led products to build an emotional connection with consumers. Luxury liquid soaps and body washes with ingredients that support "glowy" skin and luxury wellness trends are expected to capture more market share, providing consumers with an at-home luxury feel at a cost-affordable price.

Natural and health-led innovations can anticipate fast-growing demand. Gynaecologist-accepted, pH-balanced intimate products and gendered ranges, particularly men's grooming and women's health, will also be growth categories. Dr Bronner's, Dr Squatch, and The Honey Pot are the kind of brands poised to prosper as consumers increasingly look out for ingredients and want tried-and-tested claims and natural ingredients.

Retail alliances, boutique collections, and worldwide influences—like South Korea's fermented skincare—will contribute to the market's vibrancy. As existing boutique brands increase their presence and more foreign players join the fray, the US bath and shower market will witness diversified products and steady growth through 2030.

US Bath & Shower Products Market Trend

US younger consumers are being increasingly attracted to bath and shower items that convey wellbeing and emotional bonding. Manufacturers are reacting by bringing out launches that marry colour, fragrance, and packaging to create a pleasing, thoughtful experience. Method's Good Karma body wash range, which is available only at Target, is a perfect example of this trend with bottles styled to induce different moods. In 2024, the company extended its iconic pill-shaped portfolio with Dream Foam body washes, featuring 80% recycled plastic, for eco-friendly, experience-seeking users.

Aside from body wash, this wellness emphasis is also reflected in the success of hand sanitiser brand Touchland, popular for its vibrant, tech-packaged products and social media trendiness. With its higher-end price position and fun, fragranced packaging options, the brand commands very significant appeal among tweens and teenagers. In the future, limited-series releases and fermented ingredient products are set to define the market, particularly as Korean beauty strength increases through Olive Young's US expansion.

US Bath & Shower Products Market Opportunity

The increased consumer aspiration to enjoy the luxury experience at home is creating demand for high-end liquid soaps. In 2024, while mass body wash/shower gel increased on the back of multifunctionality and wellness appeal, premium liquid soaps also gained traction. Consumers are increasingly looking for sophisticated hand washing experiences, frequently developed on the back of luxury fragrances such as tomato leaves. Products such as Loewe’s Tomato Leaves Liquid Soap and Flamingo Estate’s Roma Heirloom Tomato Hand Soap attracted attention, particularly in trendy urban spaces and on social media.

This has further boosted innovation, with companies such as Mrs. Meyer's releasing inexpensive but premium-scented hand soaps such as Tomato Vine, and Blueland releasing eco-friendly, plastic-free hand soap refills at Whole Foods. Boutique and luxury skincare companies such as Aesop and Malin+Goetz are also increasing their retail strength to accommodate this growing demand, signaling a strong premium and botanical-driven product opportunity in the next few years.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 12.92 Billion |

| USD Value 2030 | $ 15.96 Billion |

| CAGR 2025-2030 | 3.58% |

| Largest Category | Body Wash/Shower Gel segment leads with 45% market share |

| Top Trends | Growing Emphasis on Mind-Body Wellness and Youth-Centric Innovations |

| Top Opportunities | Rising Appeal of Premium and Botanical Hand Soaps |

| Key Players | Johnson & Johnson Consumer Products Inc, Elida Beauty Group, Suave Brands Co LLC, Unilever Home & Personal Care USA, Bath & Body Works Inc, Procter & Gamble Co, The, Colgate-Palmolive Co, Dial Corp, The, PDC Brands, SC Johnson & Son Inc and Others. |

US Bath & Shower Products Market Segmentation

The most successful segment in the US Bath & Shower Products Market in 2025–30 is body wash/shower gel. The category has continued to outgrow others in value terms, fueled by demand from consumers for both sensory and functional benefits. One-off brand launches and the fast growth of newer brands over the last five years have served to inject innovation into this erstwhile static category, increasing its appeal and excitement for consumers.

Body wash/shower gel further enhances consumers' need for a comprehensive and coordinated body care regime. It is now possible to have matching scents in body wash, lotion, and mist from many brands, promoting brand loyalty. Body wash also offers value for money and an improved bathing experience. From mood-enhancing scents and colors to functional benefits in terms of exfoliation and moisturization, body wash is regarded as a multi-product that brings emotional and physical wellbeing, and thus contributes to a body "glow."

Top Companies in US Bath & Shower Products Market

The top companies operating in the market include Johnson & Johnson Consumer Products Inc, Elida Beauty Group, Suave Brands Co LLC, Unilever Home & Personal Care USA, Bath & Body Works Inc, Procter & Gamble Co, The, Colgate-Palmolive Co, Dial Corp, The, PDC Brands, SC Johnson & Son Inc, etc., are the top players operating in the US Bath & Shower Products Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. US Bath and Shower Product Market Policies, Regulations, and Standards

4. US Bath and Shower Product Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. US Bath and Shower Product Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Bath Soaps- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Body Wash/Shower Gels- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Bath Additives- Market Insights and Forecast 2020-2030, USD Million

5.2.1.4. Body Powder- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5. Hand Sanitisers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.6. Intimate Hygiene- Market Insights and Forecast 2020-2030, USD Million

5.2.1.6.1. Intimate Washes- Market Insights and Forecast 2020-2030, USD Million

5.2.1.6.2. Intimate Wipes- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Product Form

5.2.2.1. Solid- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Gels & Jellies- Market Insights and Forecast 2020-2030, USD Million

5.2.2.3. Liquid- Market Insights and Forecast 2020-2030, USD Million

5.2.2.4. Powder- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Ingredient

5.2.3.1. Conventional/Synthetic- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Natural/Organic- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By Price Point

5.2.4.1. Premium- Market Insights and Forecast 2020-2030, USD Million

5.2.4.2. Mass- Market Insights and Forecast 2020-2030, USD Million

5.2.5.By End User

5.2.5.1. Women- Market Insights and Forecast 2020-2030, USD Million

5.2.5.2. Men- Market Insights and Forecast 2020-2030, USD Million

5.2.5.3. Kids/Children- Market Insights and Forecast 2020-2030, USD Million

5.2.6.By Sales Channel

5.2.6.1. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.6.2. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. US Bath Soaps Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product Form- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By Ingredient- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Price Point- Market Insights and Forecast 2020-2030, USD Million

6.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

6.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. US Body Wash/Shower Gels Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Form- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Ingredient- Market Insights and Forecast 2020-2030, USD Million

7.2.3.By Price Point- Market Insights and Forecast 2020-2030, USD Million

7.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

7.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. US Bath Additives Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Form- Market Insights and Forecast 2020-2030, USD Million

8.2.2.By Ingredient- Market Insights and Forecast 2020-2030, USD Million

8.2.3.By Price Point- Market Insights and Forecast 2020-2030, USD Million

8.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

8.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. US Body Powder Market Statistics, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Product Form- Market Insights and Forecast 2020-2030, USD Million

9.2.2.By Ingredient- Market Insights and Forecast 2020-2030, USD Million

9.2.3.By Price Point- Market Insights and Forecast 2020-2030, USD Million

9.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

9.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

10. US Hand Sanitisers Market Statistics, 2020-2030F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Product Form- Market Insights and Forecast 2020-2030, USD Million

10.2.2. By Ingredient- Market Insights and Forecast 2020-2030, USD Million

10.2.3. By Price Point- Market Insights and Forecast 2020-2030, USD Million

10.2.4. By End User- Market Insights and Forecast 2020-2030, USD Million

10.2.5. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

11. US Intimate Hygiene Market Statistics, 2020-2030F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Product- Market Insights and Forecast 2020-2030, USD Million

11.2.2. By Product Form- Market Insights and Forecast 2020-2030, USD Million

11.2.3. By Ingredient- Market Insights and Forecast 2020-2030, USD Million

11.2.4. By Price Point- Market Insights and Forecast 2020-2030, USD Million

11.2.5. By End User- Market Insights and Forecast 2020-2030, USD Million

11.2.6. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Unilever Home & Personal Care USA

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Bath & Body Works Inc

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Procter & Gamble Co, The

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Colgate-Palmolive Co

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Dial Corp, The

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Johnson & Johnson Consumer Products Inc

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Elida Beauty Group

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Suave Brands Co LLC

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. PDC Brands

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. SC Johnson & Son Inc

12.1.10.1.Business Description

12.1.10.2.Product Portfolio

12.1.10.3.Collaborations & Alliances

12.1.10.4.Recent Developments

12.1.10.5.Financial Details

12.1.10.6.Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Product Form |

|

| By Ingredient |

|

| By Price Point |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.