United States Cardiovascular Devices Market Report: Trends, Growth and Forecast (2026-2032)

By Device Type (Diagnostic and Monitoring, Therapeutic and Surgical), By Technology (Minimally Invasive and Transcatheter Technologies, Wearable Devices, Artificial Intelligence and Machine Learning, Robotic-Assisted Surgery), By Application (Coronary Artery Disease, Cardiac Arrhythmia, Heart Failure, Others), By End Users (Hospitals, Speciality Clinics, Ambulatory Surgical Centers, Home Care Settings)

- Healthcare

- Dec 2025

- VI0446

- 125

-

United States Cardiovascular Devices Market Statistics and Insights, 2026

- Market Size Statistics

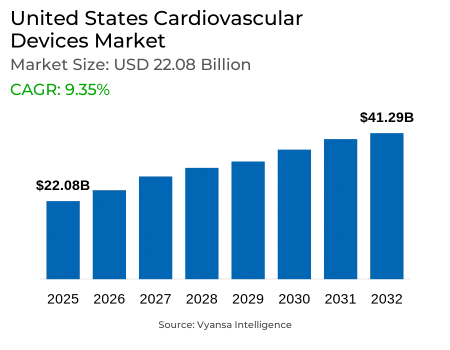

- Cardiovascular Devices in United States is estimated at $ 22.08 Billion.

- The market size is expected to grow to $ 41.29 Billion by 2032.

- Market to register a CAGR of around 9.35% during 2026-32.

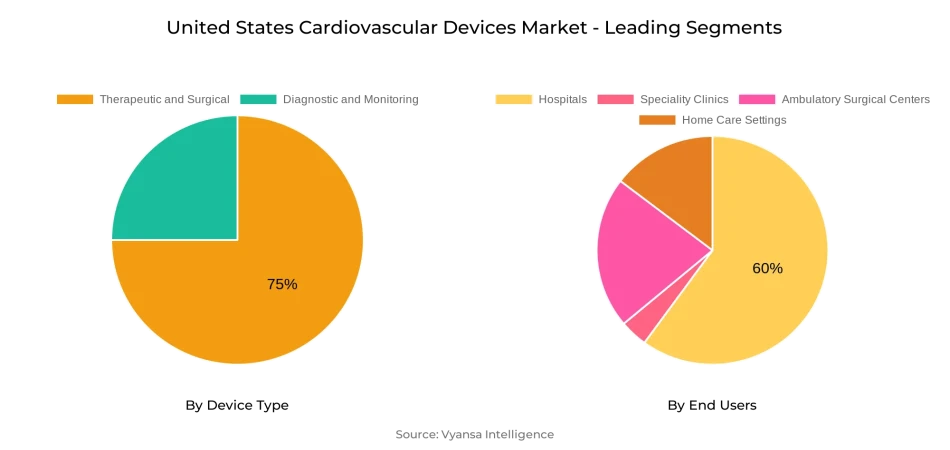

- Device Type Shares

- Therapeutic and Surgical grabbed market share of 75%.

- Competition

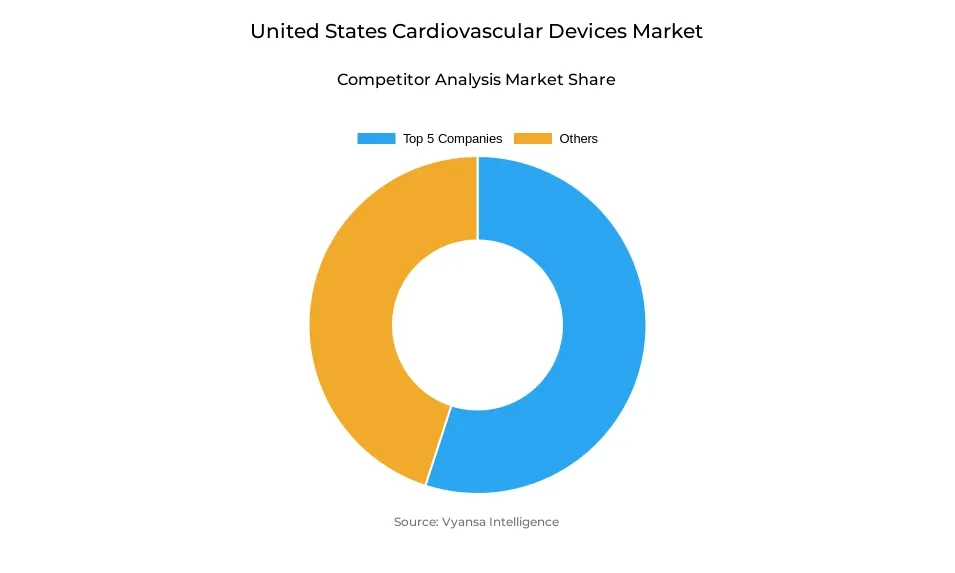

- More than 10 companies are actively engaged in producing Cardiovascular Devices in United States.

- Top 5 companies acquired 55% of the market share.

- GE Healthcare, Siemens Healthineers, Stryker Corporation, Medtronic plc, Abbott Laboratories etc., are few of the top companies.

- End Users

- Hospitals grabbed 60% of the market.

United States Cardiovascular Devices Market Outlook

The United States market for cardiovascular devices is a valuable part of the country's healthcare sector, worth an estimated $22.08 billion. Demand for cardiovascular devices is fueled by the rising incidence of cardiovascular diseases, which are still the main cause of death in the United States. Hospitals and cardiac centers keep depending on sophisticated devices like pacemakers, stents, and implantable cardioverter-defibrillators (ICDs) to manage conditions such as coronary artery disease, arrhythmias, and heart failure.

The market will continue to grow steadily and reach $41.29 billion by 2032. Growth indicates the steady demand for cutting-edge therapeutic and surgical equipment for better patient outcomes and for supporting minimally invasive treatments. The significant use of such devices in hospitals, covering 60% of the end-user segment, supports the dominance of institutional demand in propelling the market forward.

The market is competitive, and over 10 organizations are involved in the manufacture of cardiovascular devices within the United States. The top five players in the industry dominate the market with a market share of 55%, indicating a moderately consolidated market where dominant players have an impact on innovation, product quality, and availability.

Overall, the United States cardiovascular devices market will continue its growth trend up to 2032. Hospitals are the main end users and maintain stable demand, while several manufacturers provide contributions to technology development and device differentiation. Such a setting presents a robust platform for the continued development and use of cardiovascular devices nationwide.

United States Cardiovascular Devices Market Growth Driver

Rising Prevalence of Cardiovascular Diseases Creating Demand

The rising incidence of cardiovascular diseases (CVDs) in the United States is one of the major drivers for the need for cardiovascular devices. Cardiovascular disease led to over 683,037 deaths, representing one in every three mortality cases in the nation in 2024. This high death rate highlights the critical need for sophisticated monitoring and therapeutic devices to treat and manage heart conditions efficiently. The increasing prevalence of disorders like coronary artery disease, heart failure, and arrhythmias in the geriatric population further highlights the need for these medical devices. With an increasing number of individuals being diagnosed with CVDs, there is a growing demand for devices like pacemakers, ICDs, stents, and other cardiac implants.

The increasing number of patients needing interventions and long-term care directly drives the use of devices. For instance, more than 240,000 pacemakers and ICD implants were implanted in the US in 2024, indicating the mounting demand for cardiovascular devices to manage patients with heart disease. With such increasing occurrences, an even larger portion of the aging population, coupled with unhealthy lifestyles, the demand for such devices will remain on the rise.

United States Cardiovascular Devices Market Challenge

Growing Number of Device Recalls Affecting Supply

The frequency of cardiovascular device recalls is on the rise and presents a key challenge to the U.S. cardiovascular device market. A total of 1,059 medical device recall events were reported in the U.S. by the Food and Drug Administration in 2024, registering an 8.6% increase compared to the previous year. Most remarkably, the number of affected units rose to 440.4 million, almost doubling from 283.4 million in 2023. Cardiovascular devices such as pacemakers, stents, and ventricular assist devices have been the most commonly recalled. For example, Abbott recalled 66,390 Impella heart pumps in 2024 because they posed a risk of left ventricular perforation, which might result in life-threatening injuries or death. These recalls not only threaten the supply chain but also undermine confidence in the safety and reliability of cardiovascular devices among the public.

The effects of such recalls have far-reaching consequences beyond direct patient safety issues. Healthcare professionals are presented with functional dilemmas as they have to detect and recall the suspect devices from service, mostly resulting in treatment delays and added expense. The need for replacement or repair further taxes hospital resources and supply chain management. Moreover, reputational loss for manufacturers with repeated recalls can result in reduced market share and financial loss. The aggregate impact of these disruptions reflects the imperative necessity for strict regulation and enhanced quality control interventions in the manufacture and distribution of cardiovascular devices to protect patient safety and preserve market stability.

United States Cardiovascular Devices Market Trend

Surge in Wearable and Remote Cardiac Monitoring Shaping Market Dynamics

Wearable and remote cardiac monitor device adoption is seeing high growth in the United States, fueled by the growing incidence of cardiovascular disease and patient monitoring needs. As of 2024, about 50 million Americans have used RPM devices, and the predictions say that over 71 million Americans will utilize RPM services by 2025. The devices allow healthcare professionals to remotely observe patients' heart conditions in real time, allowing for early detection of possible problems and decreasing the need for routine face-to-face visits.

Market participants are riding on this trend by creating sophisticated wearable and remote monitoring technologies. For example, Samsung Galaxy Watches have introduced features that can identify Left Ventricular Systolic Dysfunction, a condition that accounts for about 50% of heart failure in the US. Companies such as Medtronic and iRhythm have wearable cardiac monitors that relay real-time information to healthcare professionals, making it possible to intervene in time and enhance patient outcomes. These technologies not only promote patient participation and satisfaction but also concur with the increasing focus on preventive care and individualized medicine in the United States.

United States Cardiovascular Devices Market Opportunity

Rising Demand for Minimally Invasive and Ambulatory Procedures offering Lucrative Opportunity

The increasing demand for ambulatory and minimally invasive cardiovascular procedures is providing a huge opportunity for the market of cardiovascular devices in the U.S. During 2024, Transcatheter Aortic Valve Replacement (TAVR), percutaneous coronary interventions, and robotic-assisted procedures were performed more often in outpatient or ambulatory centers. Patients are choosing these procedures because they reduce recovery time, minimize infection risk, and shorten hospital stays. This generates demand for precision cardiovascular devices specifically made to ensure precision, efficiency, and safety when performing minimally invasive and ambulatory procedures.

Players in the market are taking advantage of this trend by launching sophisticated devices that are specific to these treatments. Medtronic and Abbott are among the companies that are designing dedicated catheters, stents, and robotic systems that enable advanced intervention in outpatient environments. Through supplying hospitals and surgical facilities with these devices, manufacturers can address the increasing demand for quicker, safer, and more effective cardiovascular treatment while asserting their presence in the changing U.S. device market.

United States Cardiovascular Devices Market Segmentation Analysis

By Device Type

- Diagnostic and Monitoring

- Therapeutic and Surgical

The most dominant segment in the device type category is Therapeutic and Surgical devices, which accounted for 75% of the U.S. cardiovascular device market. This segment features major devices like stents, pacemakers, implantable cardioverter-defibrillators (ICDs), and catheters, which are highly utilized in hospitals and specialized cardiac facilities. Dominance in this category mirrors the pivotal position these devices occupy in treating heart diseases such as coronary artery disease, arrhythmias, and heart failure, where complex interventions become necessary for patient care and survival.

In the Therapeutic and Surgical segment, the demand is also bolstered by the growing use of minimally invasive interventions, such as percutaneous coronary interventions and catheter-based therapy. Hospitals and heart centers continue to depend on these devices for necessary therapeutic and surgical interventions, in order to ensure patient safety and procedural efficacy. The intensive use and continued need for these devices solidify the segment's top position in the U.S. market for cardiovascular devices.

By End Users

- Hospitals

- Speciality Clinics

- Ambulatory Surgical Centers

- Home Care Settings

The highest market-share segment within the end-user category is hospitals, which represented 60% of the U.S. cardiovascular device market. Hospitals remain the market leaders because they perform the majority of cardiovascular procedures, such as interventions, surgeries, and critical care. Their use of cutting-edge and durable products like stents, pacemakers, and implantable cardioverter-defibrillators (ICDs) makes treatment of patients with coronary artery disease, arrhythmias, and heart failure cost-effective. High patient volumes and the presence of specialized cardiac centers in hospitals further support their predominant position among end users.

Other end-user sectors, such as outpatient clinics and specialty cardiac centers, account for the rest of the share but depend significantly on hospitals for referrals and complicated procedures. Hospitals' widespread infrastructure, experienced personnel, and access to cutting-edge technology place them at the forefront of the buying of cardiovascular devices, emphasizing their focal point in the provision of cardiovascular care throughout the United States.

Top Companies in United States Cardiovascular Devices Market

The top companies operating in the market include GE Healthcare, Siemens Healthineers, Stryker Corporation, Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, Edwards Lifesciences Corporation, Johnson & Johnson MedTech, Philips Healthcare, Terumo Corporation, etc., are the top players operating in the United States Cardiovascular Devices Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. United States Cardiovascular Devices Market Policies, Regulations, and Standards

4. United States Cardiovascular Devices Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. United States Cardiovascular Devices Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Device Type

5.2.1.1. Diagnostic and Monitoring- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Therapeutic and Surgical- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Technology

5.2.2.1. Minimally Invasive and Transcatheter Technologies- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wearable Devices- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Artificial Intelligence and Machine Learning- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Robotic-Assisted Surgery- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Application

5.2.3.1. Coronary Artery Disease- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Cardiac Arrhythmia- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Heart Failure- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By End Users

5.2.4.1. Hospitals- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Speciality Clinics- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Ambulatory Surgical Centers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Home Care Settings- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

1.1.1.1. Competition Characteristics

1.1.1.2. Market Share & Analysis

6. United States Diagnostics and Monitoring Cardiovascular Devices Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Technology- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End Users- Market Insights and Forecast 2022-2032, USD Million

7. United States Therapeutic and Surgical Cardiovascular Devices Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By End Users- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Medtronic plc

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Abbott Laboratories

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Boston Scientific Corporation

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Edwards Lifesciences Corporation

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Johnson & Johnson MedTech

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.GE Healthcare

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Siemens Healthineers

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Stryker Corporation

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Philips Healthcare

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Terumo Corporation

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Device Type |

|

| By Technology |

|

| By Application |

|

| By End Users |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.