France Neurodegenerative Disease Devices Market Report: Trends, Growth and Forecast (2026-2032)

Device Type (Neurostimulation Devices, Diagnostic & Imaging Devices, Interventional Neurology Devices, Surgical Navigation & Support Systems, CSF Management Devices, Monitoring & Wearable Devices, Assistive & Rehabilitation Devices), Indication (Parkinsons Disease, Alzheimers Disease, Multiple Sclerosis, Amyotrophic Lateral Sclerosis, Huntingtons Disease, Epilepsy, Stroke, Others), Technology Platform (Implantable Devices, External / Non-Invasive Devices, Wearable & Portable Technology, AI-Integrated & Closed-Loop Systems, Sensor-Based Technology, Robotic & Automated Systems), End User (Hospitals & Specialty Neurology Centers, Ambulatory Surgery Centers, Neurology & Movement Disorder Clinics, Rehabilitation Centers, Home Care & Remote Monitoring Settings, Long-Term Care Facilities, Research & Academic Institutions), Sales Channel (Offline, Online), Price Range (Premium Devices, Mid-Range Devices, Budget Devices)

- Healthcare

- Dec 2025

- VI0650

- 110

-

France Neurodegenerative Disease Devices Market Statistics and Insights, 2026

- Market Size Statistics

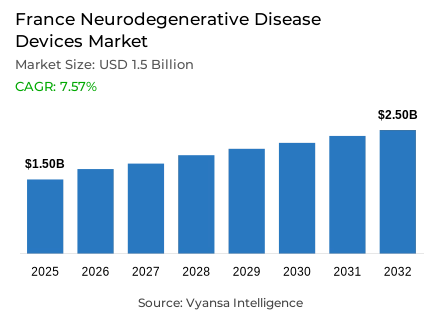

- Neurodegenerative disease devices in France is estimated at USD 1.5 billion.

- The market size is expected to grow to USD 2.5 billion by 2032.

- Market to register a cagr of around 7.57% during 2026-32.

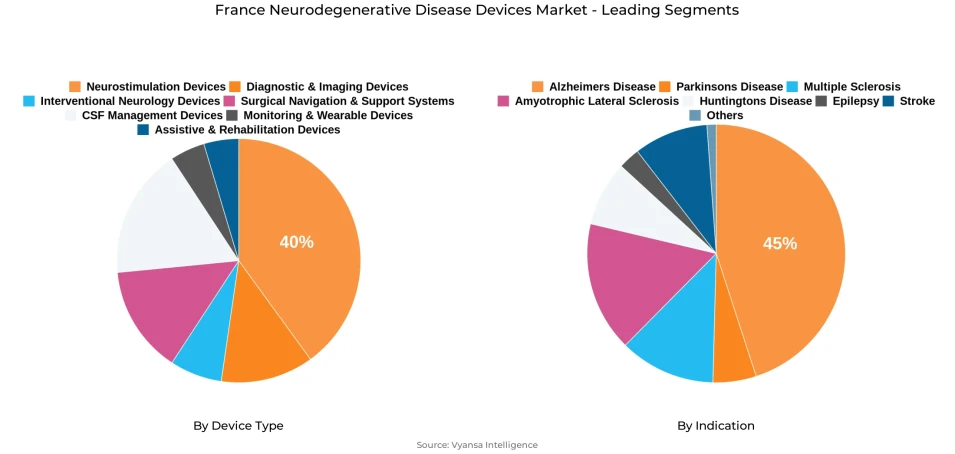

- Device Type Shares

- Neurostimulation devices grabbed market share of 40%.

- Competition

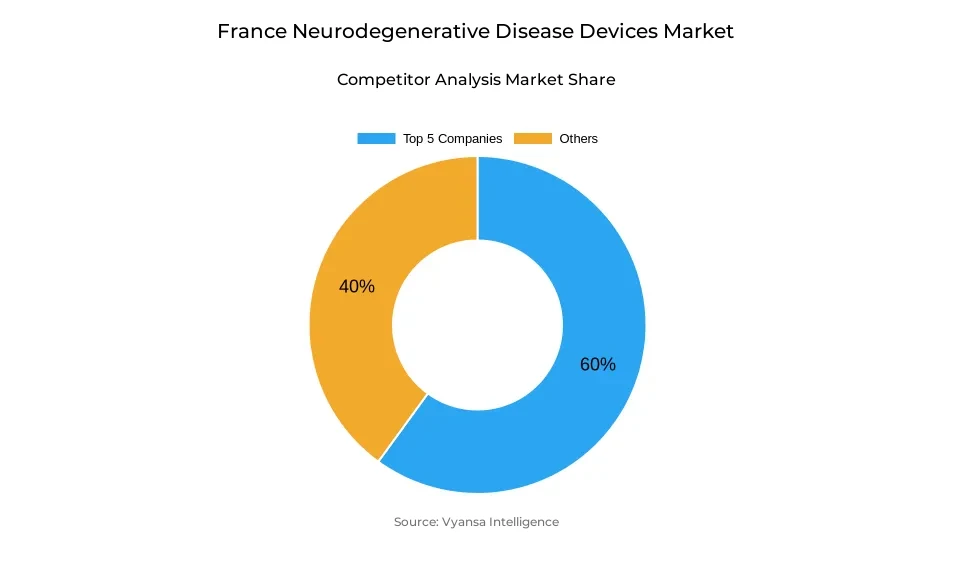

- More than 10 companies are actively engaged in producing neurodegenerative disease devices in France.

- Top 5 companies acquired around 60% of the market share.

- Johnson & Johnson; Smith & Nephew; Philips Healthcare; Boston Scientific; Medtronic etc., are few of the top companies.

- Indication

- Alzheimers disease grabbed 45% of the market.

France Neurodegenerative Disease Devices Market Outlook

France is seeing sharp increase in neurodegenerative illnesses as its population continues to age at a rapid rate. Currently, around 1.5 million individuals live with diseases such as Alzheimer's, Parkinson's, and multiple sclerosis, with over 900,000 people living with Alzheimer's alone. With the increase in neurodegenerative disease burden, neurological disorders have become the largest component of illness and disability. As a result, there is considerable demand for advanced diagnostic, monitoring, and neurostimulation devices. The neurodegenerative disease device market is valued at USD 1.5 billion in 2025 and is expected to reach around USD 2.5 billion by 2032, at a CAGR of about 7.57% between 2026 and 2032 driven by increasing elderly population.

However, barriers to access healthcare continue to limit device usage. Almost three-fourths of older adults in France say they have difficulties accessing timely care due to various factors that include geographical variation, bureaucratic delays and high treatment costs. Access challenges are especially pronounced in rural areas with limited access to neurologists and costly infrastructure that delay diagnosis and the implementation of advanced devices in hospitals and clinics.

Additionally, national strategies promote digital and AI-driven care. The French roadmap for digital healthcare 2023-2027 and the National Neurodegenerative Diseases Strategy 2025-2030 enhance telemedicine, remote monitoring, and AI-based diagnostic imaging. Public investments by the country and research programs within the EU contribute to achieving better early detection and disease management while promoting innovation in medical devices.

Under the device type, neurostimulation systems dominate the market, holding around 40% share, thanks to their extensively documented benefits in the management of Parkinson's and related conditions. The dominant indication is Alzheimer's disease, making up nearly 45% of device use, supported through government-backed efforts to enhance early diagnosis and patient outcomes throughout French healthcare institutions.

France Neurodegenerative Disease Devices Market Growth Driver

Rising Incidence of Neurodegenerative Diseases Among France’s Aging Population

There has been a considerable increase of neurodegenerative diseases in France due to the rapid aging of the population. Approximately 1.5 million people are affected by neurological diseases, such as Alzheimer’s, Parkinson’s, and multiple sclerosis, including over 900,000 patients and 225,000 new cases a year who suffer from Alzheimer’s disease, alone. The World Health Organization’s Global Burden of Disease 2021 report confirms that neurological disorders have become the leading cause and disability cause of illness, which emphasizes the clinical and economic urgency for medical devices. The number of people aged 85 and older continues to increase with the disease prevalence expected to double by 2050. This generates strong demand for early diagnosis and treatment solutions that improve end-user outcomes in France.

This increase due to the demographics emphasizes the growing healthcare needs of France’s aging population, which will rely on neurostimulation, diagnostic imaging, and monitoring devices. With hospitals and clinics adopting more of these technologies to slow disease progression and to improve patient quality of life, they will maintain continued device user engagement throughout the forecast period.

France Neurodegenerative Disease Devices Market Challenge

Healthcare Accessibility Barriers and Resource Limitations Hindering Market Growth

Accessibility to care remains a serious issue in France, where close to three-quarters of the elderly report difficulty getting medical care in a timely manner. Differences between regions, complexity of the administrative processes, high out-of-pocket costs-all contribute to delaying diagnosis and treatment for neurodegenerative conditions. Aging continues to put pressure on the system: by the year 2030, those aged 65 and over will make up 27% of the French population, as compared with 21% today, driving healthcare expenditure up by approximately €16 billion. This creates financial pressure on hospitals and slows the rate at which advanced devices are adopted.

The shortage of neurology specialists and uneven distribution of health resources further restrain timely intervention, especially in rural areas. Hospitals in under-resourced settings are struggling to procure or maintain high-cost systems for neuroimaging and stimulation. Infrastructural and fiscal constraints thus become tangible barriers to large-scale market growth, despite clinical needs for diagnostic and therapeutic devices remaining high.

France Neurodegenerative Disease Devices Market Trend

Expansion of Digital Health and Remote Monitoring in Neurology Care

France is undergoing a structural shift toward digital integration in neurological care through its 2023-2027 Digital Healthcare Roadmap. This initiative prioritizes telemedicine, remote patient monitoring, and digital therapeutics as key pillars of equitable healthcare access, especially for geographically isolated regions. In 2023, France became the first European nation to establish dedicated reimbursement for digital medical devices, covering clinically validated telemonitoring products for neurological conditions. This policy transformation has accelerated investment in connected devices that support early detection and continuous disease management.

Meanwhile, the National Neurodegenerative Diseases Strategy 2025-2030 provides financing of €119 million every year for the training of 500,000 healthcare professionals in AI and data-driven care. This indeed furthers the adoption of AI-enabled diagnostic-imaging tools, wearable sensors, and digital monitoring platforms. Collectively, these are rebalancing the way neurological conditions are managed and building up significant momentum for solutions with integrated digital and AI devices across French healthcare institutions.

France Neurodegenerative Disease Devices Market Opportunity

Research Investment and Strategic Collaboration Strengthening Market Prospects

France's National Neurodegenerative Diseases Strategy 2025-2030 does indeed make for a policy shift in prioritizing research excellence and innovation. Supported by the Ministries of Health, Autonomy, Disability, and Higher Education, this strategy lays down 37 priority measures aimed at strengthening care pathways, supporting patients, and enhancing research capabilities. This is aimed at placing France in a leading position on neurodegenerative research through stronger integration between public institutions and private device manufacturers.

Complementing national efforts, the participation of the Paris Brain Institute in the European alliance CURE-ND, which gathers more than 2,000 researchers, is another example of cross-border collaboration. Moreover, the EU Joint Programme on Neurodegenerative Disease Research (JPND) has invested €18 million in 2024 for disease mechanism studies and progression monitoring. Such investments create an enabling ecosystem toward medical device innovation, accelerating clinical translation and allowing new diagnostic, monitoring, and therapeutic options to reach the French market by 2032.

France Neurodegenerative Disease Devices Market Segmentation Analysis

By Device Type

- Neurostimulation Devices

- Diagnostic & Imaging Devices

- Interventional Neurology Devices

- Surgical Navigation & Support Systems

- CSF Management Devices

- Monitoring & Wearable Devices

- Assistive & Rehabilitation Devices

Neurostimulation devices represent the largest segment of the neurodegenerative disease devices market in France, holding about 40% market share. The segment includes DBS systems, mainly utilized in the management of Parkinson's disease, and the VNS and TMS technologies that address epilepsy and cognitive impairment. Clinical efficacy in mitigating motor and behavioral symptoms has further entrenched confidence in these devices among healthcare institutions and end users seeking improved quality of life.

Strong reimbursement frameworks, along with long-term safety and effectiveness data, provide support for the sustained adoption of neurostimulation systems within French hospitals. Advances in miniaturization, adaptive stimulation algorithms, and wireless programming continue to enhance procedural efficiency and improve patient outcomes. Neurostimulation remains the therapeutic cornerstone of neuromodulation treatments, maintaining its leading role in market growth and clinical integration.

By Indication

- Parkinsons Disease

- Alzheimers Disease

- Multiple Sclerosis

- Amyotrophic Lateral Sclerosis

- Huntingtons Disease

- Epilepsy

- Stroke

- Others

Alzheimer's dominates the neurodegenerative disease devices market in France, with the market shere accounting for aound 45% under the indication segment. As a major current healthcare priority, with over 900,000 people affected and 225,000 new cases annually, there is an increasing utilization of emerging neuroimaging systems, biomarker-based diagnostics, and cognitive monitoring platforms that allow for early intervention and more effective tracking of disease progression. This also corresponds to the early diagnosis emphasis in France's strategy within its 2025-2030 national plan.

The intense governmental focus on Alzheimer's has catalyzed targeted research and reimbursement discussions that will encourage the adoption of next-generation devices. Hospitals and memory clinics continue to expand diagnostic capacity via AI-powered imaging and digital cognitive assessment tools. As a result Alzheimer's disease remains the main driver of medical device development and clinical implementation in the increasing use of neurodegenerative devices

List of Companies Covered in France Neurodegenerative Disease Devices Market

The companies listed below are highly influential in the France neurodegenerative disease devices market, with a significant market share and a strong impact on industry developments.

- Johnson & Johnson

- Smith & Nephew

- Philips Healthcare

- Boston Scientific

- Medtronic

- Stryker

- Abbott Laboratories

- B. Braun SE

- GE Healthcare

- Siemens Healthineers

Market News & Updates

- Medtronic, 2025:

Received CE Mark approval for BrainSense™ Adaptive DBS, the first closed-loop system offering real-time, self-adjusting brain stimulation for Parkinson’s disease.

- Stryker, 2025:

Expanded partnership with Siemens Healthineers to develop robotic systems for stroke and aneurysm interventions across Western Europe.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France Neurodegenerative Disease Devices Market Policies, Regulations, and Standards

4. France Neurodegenerative Disease Devices Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France Neurodegenerative Disease Devices Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Device Type

5.2.1.1. Neurostimulation Devices- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Diagnostic & Imaging Devices- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Interventional Neurology Devices- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Surgical Navigation & Support Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. CSF Management Devices- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Monitoring & Wearable Devices- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Assistive & Rehabilitation Devices- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Indication

5.2.2.1. Parkinsons Disease- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Alzheimers Disease- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Multiple Sclerosis- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Amyotrophic Lateral Sclerosis- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Huntingtons Disease- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Epilepsy- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Stroke- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Technology Platform

5.2.3.1. Implantable Devices- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. External / Non-Invasive Devices- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Wearable & Portable Technology- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. AI-Integrated & Closed-Loop Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Sensor-Based Technology- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Robotic & Automated Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By End User

5.2.4.1. Hospitals & Specialty Neurology Centers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Ambulatory Surgery Centers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Neurology & Movement Disorder Clinics- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Rehabilitation Centers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Home Care & Remote Monitoring Settings- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Long-Term Care Facilities- Market Insights and Forecast 2022-2032, USD Million

5.2.4.7. Research & Academic Institutions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Price Range

5.2.6.1. Premium Devices- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Mid-Range Devices- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Budget Devices- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. France Neurostimulation Devices Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Indication- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Technology Platform- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Price Range- Market Insights and Forecast 2022-2032, USD Million

7. France Diagnostic & Imaging Devices Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Indication- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Technology Platform- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Price Range- Market Insights and Forecast 2022-2032, USD Million

8. France Interventional Neurology Devices Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Indication- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Technology Platform- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Price Range- Market Insights and Forecast 2022-2032, USD Million

9. France Surgical Navigation & Support Systems Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Indication- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Technology Platform- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Price Range- Market Insights and Forecast 2022-2032, USD Million

10. France CSF Management Devices Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Indication- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Technology Platform- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Price Range- Market Insights and Forecast 2022-2032, USD Million

11. France Monitoring & Wearable Devices Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Indication- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Technology Platform- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By Price Range- Market Insights and Forecast 2022-2032, USD Million

12. France Assistive & Rehabilitation Devices Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Indication- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Technology Platform- Market Insights and Forecast 2022-2032, USD Million

12.2.3. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By Price Range- Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. Boston Scientific

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. Medtronic

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Stryker

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Abbott Laboratories

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. B. Braun SE

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. Johnson & Johnson

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. Smith & Nephew

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Philips Healthcare

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. GE Healthcare

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Siemens Healthineers

13.1.10.1.Business Description

13.1.10.2.Product Portfolio

13.1.10.3.Collaborations & Alliances

13.1.10.4.Recent Developments

13.1.10.5.Financial Details

13.1.10.6.Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Device Type |

|

| By Indication |

|

| By Technology Platform |

|

| By End User |

|

| By Sales Channel |

|

| By Price Range |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.