United Kingdom UAVs and Autonomous Naval Systems Market Report: Trends, Growth and Forecast (2026-2032)

By Propulsion Type (Fully-Electric, Conventional, Hybrid), By Vehicle Type (Frigates and Destroyers, Submarines, Patrol and Mine Countermeasure Vessels, Autonomous Surface and Underwater Vehicles, Others), By Payload (Weaponised Systems, Sensors and Surveillance Systems, Communication and Networking Modules, Logistics and Transport Modules), By Application (Surveillance and Reconnaissance, Combat and Strike Operations, Logistics & Supply Support, Environmental and Scientific Monitoring, Mine Countermeasure and Security), By End User (Defence Forces, Coastguard and Homeland Security, Research Institutions, Environmental Agencies)

- Aerospace & Defense

- Dec 2025

- VI0445

- 130

-

United Kingdom UAVs and Autonomous Naval Systems Market Statistics and Insights, 2026

- Market Size Statistics

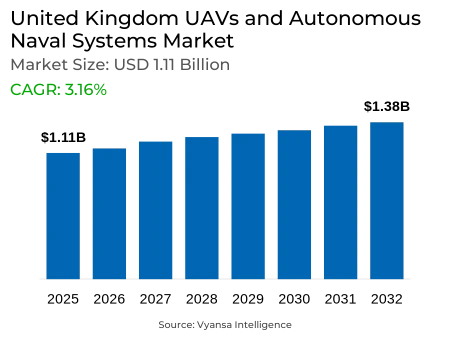

- UAVs and Autonomous Naval Systems in United Kingdom is estimated at $ 1.11 Billion.

- The market size is expected to grow to $ 1.38 Billion by 2032.

- Market to register a CAGR of around 3.16% during 2026-32.

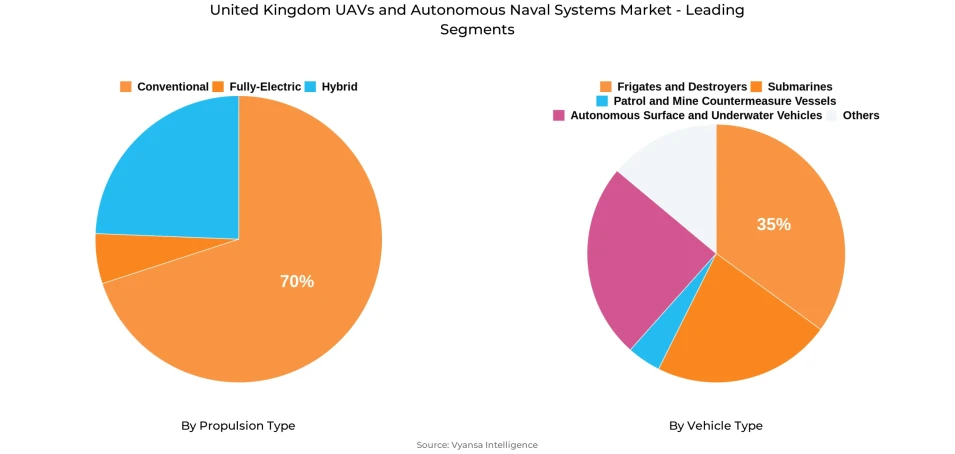

- Propulsion Type Shares

- Conventional grabbed market share of 70%.

- Competition

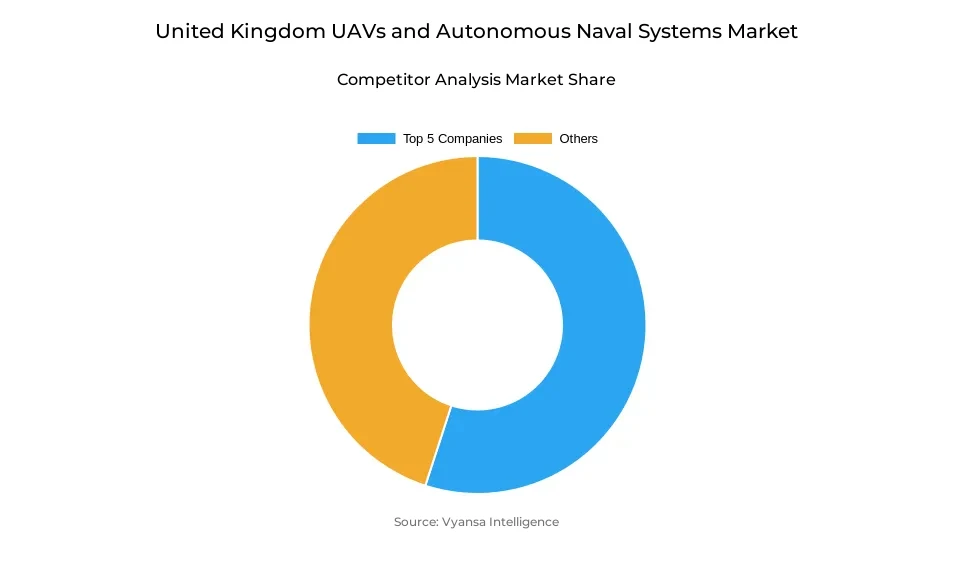

- More than 10 companies are actively engaged in producing UAVs and Autonomous Naval Systems in United Kingdom.

- Top 5 companies acquired 55% of the market share.

- MBDA UK, ASV Global, MSubs Ltd, BAE Systems, Thales UK etc., are few of the top companies.

- Vehicle Type

- Frigates and Destroyers grabbed 35% of the market.

United Kingdom UAVs and Autonomous Naval Systems Market Outlook

The United Kingdom UAVs and Autonomous Naval Systems market is valued at USD 1.11 billion and projects to expand to USD 1.38 billion by 2032, capturing incremental investment in autonomous and unmanned platforms. The expansion is fueled by the Royal Navy's necessity to improve maritime surveillance, intelligence collection, and operational effectiveness in expansive maritime areas. UAVs and autonomous naval platforms are being used more and more to augment conventional naval vessels, offering persistent surveillance capability and lowering the risk to personnel.

Under vehicle type segmentation, frigates and destroyers constitute the most dominant share at 35% of the market. These ships continue to be the core of the UK naval strategy as multi-role platforms for the integration of autonomous systems like unmanned aerial and underwater vehicles. Their high operational value and integration with emerging technologies guarantee they lead procurement expenditure in the autonomous naval systems segment.

The top players have grown concentrated in the market, with the leading five companies holding 55% of the market share. Major defence contractors, such as BAE Systems, Thales UK, Babcock International, QinetiQ, and Leonardo UK, are seriously designing and providing UAVs and autonomous systems. Their leadership indicates technological capability as well as long-established ties with the Ministry of Defence, which values reliability as well as readiness for operation.

Generally, the market forecast calls for sustained expansion as the UK prioritizes independence and ISR strength in its naval fleet. Spending will be directed toward expanding platform interoperability, mission adaptability, and enduring maritime domain awareness to make UAVs and autonomous systems increasingly core to the nation's defense efforts.

United Kingdom UAVs and Autonomous Naval Systems Market Growth Driver

Rising ISR and Maritime Security Needs Driving Demand

Growing ISR and naval security needs are a fundamental demand driver for UAVs and autonomous naval platforms in the UK as they directly influence operational requirements and investment decisions. The Royal Navy and Royal Air Force must cover increasingly diverse maritime spaces, ranging from the North Atlantic, the High North, to the English Channel, where persistent observation is vital. Conventional crewed ships are constrained by manpower expense and endurance, while unmanned aerial and underwater systems can offer long-duration patrols, operate in danger areas, and provide high-resolution real-time intelligence. According to the UK Ministry of Defence, more than two-thirds of the Royal Navy's operational days in 2023 were devoted to patrol, deterrence, and surveillance, which illustrates how central ISR mission tasks have become in naval planning.

This operational imperative finds its way into procurement decisions. Recent government-funded initiatives like the Royal Navy's mine countermeasures USVs, the "Ariadne" unmanned vessel delivery, and UAV swarm trials enabled by Dstl demonstrate how ISR operations are leading to actual investment in autonomy. These systems take the strain off traditional frigates and destroyers, enhance surveillance coverage at reduced cost, and enhance NATO commitments in contested seas where enemy submarine activity has risen. Thus, ISR and naval security needs are not only tactical demands but structural imperatives that force the UK to invest more in UAVs and autonomous naval systems as a long-term reality.

United Kingdom UAVs and Autonomous Naval Systems Market Challenge

Rising Cybersecurity Threats Impeding Growth

Increasingly sophisticated cybersecurity threats are a tremendous challenge to the United Kingdom's UAVs and autonomous naval systems due to their heavy dependence on networked communication, remote control, and AI-based decision-making. Unmanned aerial vehicles, autonomous surface vessels, and underwater systems have sensitive data, such as real-time sensor feeds, positioning, and mission-critical commands, being transmitted and can be intercepted or jammed by hostile actors. The UK Ministry of Defence indicated growing efforts to breach military networks, while a 2023 National Cyber Security Centre (NCSC) guidance noted that autonomous systems are especially vulnerable to jamming, spoofing, and malware infections. One successful attack would be enough to cause mission failure, loss of valuable intelligence, or physical asset exposure, which would make cybersecurity both an operational and a strategic issue.

This threat situation places limitations on market expansion since manufacturers and system integrators have to spend heavily on secure communications, encrypted data links, and robust control software. These extra technical demands lengthen development periods and procurement expenses while adding hurdles for smaller UK defence suppliers wanting to enter the autonomy market. In addition, the requirement to meet rigorous cyber laws and protect interoperability with NATO systems can impede adoption of sophisticated autonomous technologies, confining the overall rate at which UAVs and unmanned naval systems are rolled out to UK fleets.

United Kingdom UAVs and Autonomous Naval Systems Market Trend

Swarming UAV Concept Shaping Market Dynamics

The creation of swarming UAV concepts is proving to be an important trend transforming the United Kingdom's UAV and autonomous naval systems market because it significantly alters the manner in which unmanned platforms are utilized in surveillance and combat operations. Swarming allows a group of drones to work in unison under one command system, pooling sensor information and coordinating maneuvers to saturate enemy defenses or sweep large areas economically. The UK Ministry of Defence has funded Dstl-assisted projects like the "Mosquito" swarm UAV trials, which have proven that these systems can carry out reconnaissance, target designation, and electronic warfare missions at lower risk to personnel. The trend is one of a strategic move toward distributed, networked capabilities that achieve maximum operational effect with minimal individual platform losses, thus rendering swarming an increasingly viable method for future naval and air operations.

Market participants are actively leveraging this trend. QinetiQ has incorporated swarm algorithms onto UAV platforms to improve cooperative behavior and resilience, and Thales UK is working on swarm-enabled communication and navigation systems to enable interoperability with manned and unmanned fleets. Tekever and BAE Systems are also exploring modular payloads for swarm UAVs, enabling rapid mission-specific adaptation. By investing in swarming tech, these firms are putting themselves at the forefront of autonomous innovation, effectively aligning their product offerings with the newest UK defence priorities.

United Kingdom UAVs and Autonomous Naval Systems Market Opportunity

Next-Gen Subsea Systems Offering Lucrative Opportunity

Next-generation subsea systems offer a great opportunity for the United Kingdom's autonomous naval systems and UAVs market because they widen the operational envelope of underwater surveillance, reconnaissance, and mine countermeasure operations. The Royal Navy is increasingly challenged by the monitoring of intricate undersea environments, such as submarine activity in the North Atlantic and the protection of vital offshore infrastructure. Autonomous underwater vehicles (AUVs) and unmanned submarines with sophisticated sensors, sonar mapping, and real-time communication links enable persistent, high-resolution observation with no risk to personnel. UK defence programmes, such as Dstl-sponsored trials and the incorporation of long-endurance AUVs for intelligence collection and seabed cartography, recognize the strategic value of these systems in maintaining maritime domain awareness.

Some players in the market are taking advantage of this. BAE Systems and QinetiQ are creating AUV platforms with modular payloads and autonomous navigation, while Ocean Infinity uses commercial subsea knowledge to offer dual-use autonomous solutions for the Royal Navy. Babcock International is advancing mine-countermeasure operations using the combination of unmanned surface and underwater vehicles, closing capability gaps. With the development of such next-generation subsea systems, businesses are keeping abreast of the UK's strategic emphasis on unmanned, risk-reducing, and persistent undersea surveillance capabilities.

United Kingdom UAVs and Autonomous Naval Systems Market Segmentation Analysis

By Propulsion Type

- Fully-Electric

- Conventional

- Hybrid

The most popular market segment in the United Kingdom UAVs and Autonomous Naval Systems Market by propulsion type is Conventional and had a market share of 70%. Conventional propulsion is still leading the market since it is used across most naval ships, including frigates, destroyers, and submarines. These platforms are the backbone of the operational capability of the Royal Navy and are critical for long-range patrol missions, anti-submarine warfare, and persistent maritime surveillance. Their proven reliability, high power density, and connection to legacy systems make them the choice for today's naval operations.

On the other side, Hybrid and Fully-Electric systems hold smaller shares of the market, mainly in patrol craft, unmanned surface vessels, and autonomous underwater systems. These markets are slowly expanding as the MOD allocates funding towards more energy-efficient technologies for longer missions with less expense. The market as a whole is heavily driven by strategic naval requirements with conventional propulsion holding a solid lead while hybrid and electric present opportunities for future use.

By Vehicle Type

- Frigates and Destroyers

- Submarines

- Patrol and Mine Countermeasure Vessels

- Autonomous Surface and Underwater Vehicles

- Others

The vehicle type with the largest market share in the United Kingdom UAVs and Autonomous Naval Systems Market is Frigates and Destroyers, which represent 35% of the market. These ships have a dominant share of procurement expenditure because of their multi-role nature, encompassing anti-submarine warfare, air defence, and long-range maritime reconnaissance. Their top per-unit price and pivotal position in the Royal Navy fleet modernization strategy make them the key target for defense expenditure. Frigates and destroyers are also prime platforms for autonomous system integration, including unmanned air and underwater vehicles, to increase operational flexibility and force extension.

These other types of vehicles, such as submarines, patrol and mine countermeasure ships, and autonomous surface and underwater vehicles, account for the remaining share of the market. Submarines offer strategic undersea presence, whereas patrol and mine countermeasure ships respond to coastal defense and specific missions. Autonomous surface and underwater vehicles are increasingly used to enable surveillance and mine-clearing operations, a sign of increased technological advancements in the industry and supplementing conventional naval vessels.

Top Companies in United Kingdom UAVs and Autonomous Naval Systems Market

The top companies operating in the market include MBDA UK, ASV Global, MSubs Ltd, BAE Systems, Thales UK, Babcock International, QinetiQ, Leonardo UK, Atlas Elektronik UK, Tekever, etc., are the top players operating in the United Kingdom UAVs and Autonomous Naval Systems Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. United Kingdom UAVs and Autonomous Naval Systems Market Policies, Regulations, and Standards

4. United Kingdom UAVs and Autonomous Naval Systems Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. United Kingdom UAVs and Autonomous Naval Systems Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Propulsion Type

5.2.1.1. Fully-Electric- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Conventional- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Hybrid- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Vehicle Type

5.2.2.1. Frigates and Destroyers- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Submarines- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Patrol and Mine Countermeasure Vessels- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Autonomous Surface and Underwater Vehicles - Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Payload

5.2.3.1. Weaponised Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Sensors and Surveillance Systems - Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Communication and Networking Modules- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Logistics and Transport Modules- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Application

5.2.4.1. Surveillance and Reconnaissance- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Combat and Strike Operations- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Logistics & Supply Support- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Environmental and Scientific Monitoring- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Mine Countermeasure and Security- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By End User

5.2.5.1. Defence Forces- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Coastguard and Homeland Security- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Research Institutions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Environmental Agencies- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Competitors

1.1.1.1. Competition Characteristics

1.1.1.2. Market Share & Analysis

6. United Kingdom Fully-Electric UAVs and Autonomous Naval Systems Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Vehicle Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Payload- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

7. United Kingdom Conventional UAVs and Autonomous Naval Systems Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Vehicle Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Payload- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

8. United Kingdom Hybrid UAVs and Autonomous Naval Systems Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Vehicle Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Payload- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.BAE Systems

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Thales UK

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Babcock International

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.QinetiQ

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Leonardo UK

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.MBDA UK

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.ASV Global

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.MSubs Ltd

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Atlas Elektronik UK

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Tekever

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

9.2. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Propulsion Type |

|

| By Vehicle Type |

|

| By Payload |

|

| By Application |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.