Poland Attack and Utility Helicopters Market Report: Trends, Growth and Forecast (2026-2032)

Helicopter Type (Attack Helicopters (Multi-Mission Helicopter (Below 8 tons, Above 8 tons), Transport Helicopter (Below 8 tons, Above 8 tons), Others), Utility Helicopters (Light (up to 3,000 lbs), Medium (3,001 to 8,000 lbs), Heavy (above 8,000 lbs))), Engine Type (Single Engine, Twin Engine), Technology Type (Conventional Helicopters, Fly-by-Wire Helicopters, Other), Application (Search and Rescue (Combat and Close Air Support, Troop Transport, Humanitarian and Disaster Relief, Pilot Training, Reconnaissance & Patrol), Medical Evacuation, Law Enforcement, Firefighting, Transport Services, Missions and Support Operations), End User (Government and Military (Army Aviation, Air Force, Naval/Marine Corps Aviation, Joint/Special Operations, Paramilitary and Coast Guard), Commercial and Civil, Agriculture, Construction, Tourism and Transport Services), Design Configuration (Single Rotor Helicopters, Tandem Rotor Helicopters, Others)

- Aerospace & Defense

- Dec 2025

- VI0691

- 120

-

Poland Attack and Utility Helicopters Market Statistics and Insights, 2026

- Market Size Statistics

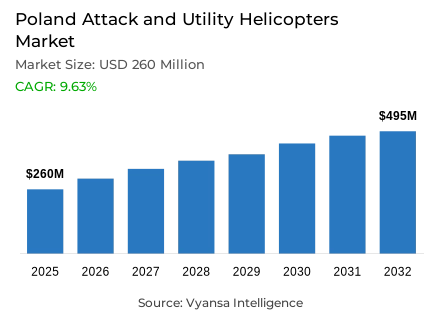

- Attack and utility helicopters in Poland is estimated at USD 260 million.

- The market size is expected to grow to USD 495 million by 2032.

- Market to register a cagr of around 9.63% during 2026-32.

- Helicopter Type Shares

- Attack helicopters grabbed market share of 70%.

- Competition

- More than 10 companies are actively engaged in producing attack and utility helicopters in Poland.

- Top 5 companies acquired around 80% of the market share.

- Bell Textron; Raytheon Technologies; Safran S.A.; Boeing Company; Leonardo S.p.A. etc., are few of the top companies.

- Engine Type

- Twin engine grabbed 80% of the market.

Poland Attack and Utility Helicopters Market Outlook

Poland's attack and utility helicopter markets are growing rapidly due to record amounts of defense spending and modernization programs at the strategic level. In 2025, analysts believe the helicopter market will be worth $260 million due to the Polish government allocating more than $45 billion to the military. The total amount spent on defense in Poland will account for 4.7% of GDP, and with an anticipated increase in the defense budget to approximately 4.8% of GDP in 2026, Poland is continuing to emphasize acquiring advanced helicopter platforms to improve its soldiers' ability to conduct operations and be interoperable with NATO.

The AH-64E Apache Guardian helicopter will play a large role in the growth of Poland's helicopter market, as it is the largest order of attack helicopters in Europe. Attack helicopters comprise approximately 70% of the total market, further demonstrating how Poland is focused on purchasing combat-ready helicopters that have advanced targeting, reconnaissance, and firepower capabilities. Interim training will be conducted using AH-64D helicopters to ensure that Polish pilots and maintenance personnel are fully trained and prepared for seamless operational efficiency upon the nation's receipt of the full AH-64E helicopter fleet beginning in 2028.

Twin-engine helicopters comprise the majority of Poland's rotorcraft fleet, accounting for 80% of the operational hours of the helicopter fleet. The twin-engine configuration provides 100% reliability, a higher payload capacity than single-engine helicopters, and substantial safety advantages when conducting complex missions over extended periods of time. The twin-engine aircraft also meet the operational requirements that end-users view as essential for supporting NATO operations and remain in a constantly engaged state in tactical (land) operations and through multi-domain integrated defense platforms.

Through complementary initiatives that include utility helicopters and potential acquisitions of the CH-47F Chinook helicopter, the Polish helicopter market is anticipated to continue its strong growth and ultimately expand to approximately $495 million by 2032. This increase represents a CAGR of approximately 9.63% for the 2026-2032 period and indicates the ongoing demand for technologically advanced attack and utility helicopters. The modernization programs, the location of Poland, and the continued emphasis on high-performance rotorcraft position Poland to be the premier market for helicopter products in Europe.

Poland Attack and Utility Helicopters Market Growth DriverStrategic Expansion of Defense Funding Strengthens Military Modernization

In recent years, Poland has enjoyed strong growth in the defense investment sector, as evidenced by record amounts of government funding allocated for enhancing the capabilities of its armed forces. In 2025, defense spending equated to PLN 186.6 billion (approximately $45 billion), which represented an increase of PLN 28.6 billion over 2024 and was equal to 4.7% of the country's gross domestic product (GDP). By 2026, it is projected that Poland's defense spending will represent 4.8% of GDP - the largest percentage among NATO allies. This level of funding supports numerous procurement programs as well as increases in both existing and new infrastructure needed to support them, establishing Poland as one of the leading defense entities in the region.

Helicopter aviation - especially attack helicopters - plays an important role in Poland's modernization strategy, as evidenced by the signing of a $10 billion contract to procure 96 AH-64E Apache Guardian attack helicopters, the largest order of its kind made by any European nation. The first 15 helicopters will be delivered during the first year of a planned four-year delivery schedule. During that same timeframe, Poland will conduct interim pilot and crew training with eight lease AH-64D helicopters, allowing for an efficient transition to the full fleet of 96 Apache Guardian helicopters while ensuring operational capability as part of NATO.

Poland Attack and Utility Helicopters Market ChallengeProblems in Establishing Helicopter Maintenance and Operational Readiness

The expanded helicopter fleet will require supporting infrastructure, technical expertise, and support capabilities commensurate with NATO standards, particularly for maintenance requirements. Supporting 96 AH-64E Apache helicopters will require dedicated facilities, trained personnel, and effective supply chains associated with spare parts. Boeing's offset programs will include providing composite repair labs and engine repair facilities at Military Aviation Plant No.Poland is developing helicopters that will operate from bases in Łódź and Dęblin, and it also will develop local technical and workforce training capabilities to enable Poland to achieve independent operation capability.

New conditions exist to be able to support the Apache helicopter with those currently being used. In Poland, there are significant efforts currently required to expand the existing helicopter operators and maintenance capabilities. Within that, Babcock and WZL 1 recently announced a joint project to establish a sustainment center to help create many more local experts before deliveries of Apache helicopters are expected in 2028. Building these new capabilities in conjunction with deliveries of helicopters is necessary to ensure Poland can take full advantage of the Apache fleet and operate at optimal operational capabilities from 2026 to 2032, including the best outcome from its fleet throughout the entire 2026-2032 forecast period.

Poland Attack and Utility Helicopters Market TrendIntegration of Advanced Combat Helicopters Enhances Operational Capability

Poland is upgrading its entire inventory of combat helicopter fleet to utilize advanced Next Generation System (NGS) technologies to enhance combat capabilities and ensure interoperability with NATO Nations. The AH-64E Apache Guardian has advanced avionics and sensor technologies, in addition to advanced battlefield management capabilities, and is a major step improvement over the previously leased AH-64D helicopter. The interim training is completing by developing the right skill levels and establishing operational capability with the pilot and maintenance teams, thus enabling the APACHE fleet to maximize operational efficiency through total delivery.

By deploying advanced helicopters, Poland can extend its operational reach and enable it to employ coordinated defense operations with its NATO partners, primarily between the US and Poland. Poland will best utilize its precision attack capability and predictability advantages from sensors during tactical and operational planning, thereby allowing for improved rate of success. In addition, the Apache Guardian system's high tech capabilities further enhance other Polish modernization efforts, such as the F-35 fighter and Patriot Missile System procurements, creating a multi-domain modernised defence and providing Poland with a state-of-the-art defence portfolio that will be able to respond directly to changing regional threats.

Poland Attack and Utility Helicopters Market OpportunityHelicopter Procurement Expansion Supported by Strategic Defense Allocations

Poland has a strategically important geographical location as a NATO frontline, and the commitment to provide record defence spending creates a huge need for modern helicopters. The 2025 defence spending is projected to be 4.7% of Poland's gross domestic product (GDP) and 4.8% of GDP in 2026, positioning Poland as the largest defence investor by GDP within NATO. The procurement of the AH-64E Apache Helicopter establishes Poland as the largest operator of AH-64Es outside of the United States, and Poland is able to leverage this position to create significant market opportunities for helicopter products as well as related systems and services.

Momentum continues to build within Poland for the procurement of complementary platforms and training solutions, and discussions are underway for CH-47F Chinook Block II heavy lift helicopters. With these additional acquisitions along with the link between multinational training exercises and interoperability requirements, Poland sets the benchmark for European helicopter procurement strategies. Multiple platforms and the training solutions will create a significant market for attack and utility helicopters throughout the 2026-2032 period, and this strategy reinforces Poland's role in regional military modernisation.

Poland Attack and Utility Helicopters Market Segmentation Analysis

By Helicopter Type

- Attack Helicopters

- Utility Helicopters

Attack helicopters capture 70% of the Poland’s attack and utility helicopter market segment, reflecting strategic prioritization of dedicated combat platforms for tactical operations. The AH-64E Apache Guardian exemplifies this focus, offering advanced targeting systems, superior firepower, and reconnaissance capabilities essential for modern defense. End users benefit from specialized combat platforms that enhance battlefield effectiveness while supporting NATO operational standards.

Investment in attack helicopters underscores Poland’s commitment to deploying technologically sophisticated equipment, strengthening interoperability with allied forces. This procurement approach ensures sustained demand for attack helicopter systems throughout the 2026-2032 forecast period, reinforcing the centrality of combat-focused rotorcraft within the country’s integrated military strategy.

By Engine Type

- Single Engine

- Twin Engine

Twin-engine helicopters dominate Poland’s attack and utility helicopter market, accounting for 80% of operational platforms. The AH-64E Apache Guardian utilizes twin turboshaft engines, providing enhanced reliability, power redundancy, and superior operational performance for complex missions. This configuration meets end-user requirements for extended mission duration, higher payloads, and improved safety in challenging operational environments.

The emphasis on twin-engine platforms ensures consistency with NATO operational standards and enhances interoperability across allied forces. Superior survivability, greater speed, and high-altitude performance make twin-engine helicopters the preferred choice for Poland’s modernization program. Their continued prevalence throughout the 2026-2032 forecast period highlights the country’s prioritization of advanced propulsion technology and operational resilience within its military helicopter fleet.

List of Companies Covered in Poland Attack and Utility Helicopters Market

The companies listed below are highly influential in the Poland attack and utility helicopters market, with a significant market share and a strong impact on industry developments.

- Bell Textron

- Raytheon Technologies

- Safran S.A.

- Boeing Company

- Leonardo S.p.A.

- Lockheed Martin Corporation (Sikorsky Division)

- Airbus Helicopters

- General Electric

- Rolls-Royce plc

- Northrop Grumman Corporation

Market News & Updates

- Boeing Company, 2025:

Leased eight AH-64D Apaches for interim capability and secured orders for first AH-64E units from Poland’s record 96-helicopter order, with scheduled deliveries beginning in 2028.

- Airbus Helicopters, 2025:

Signed an LOI with WZL-1 for H145M assembly, support, and integration and proposed 24 H145M trainers for the SW-4 replacement program.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Poland Attack and Utility Helicopters Market Policies, Regulations, and Standards

4. Poland Attack and Utility Helicopters Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Poland Attack and Utility Helicopters Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Helicopter Type

5.2.1.1. Attack Helicopters- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Multi-Mission Helicopter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.1. Below 8 tons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.2. Above 8 tons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Transport Helicopter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.1. Below 8 tons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.2. Above 8 tons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Utility Helicopters- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Light (up to 3,000 lbs)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Medium (3,001 to 8,000 lbs)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Heavy (above 8,000 lbs)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Engine Type

5.2.2.1. Single Engine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Twin Engine- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Technology Type

5.2.3.1. Conventional Helicopters- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Fly-by-Wire Helicopters- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Application

5.2.4.1. Search and Rescue- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.1. Combat and Close Air Support- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.2. Troop Transport- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.3. Humanitarian and Disaster Relief- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.4. Pilot Training- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.5. Reconnaissance & Patrol- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Medical Evacuation- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Law Enforcement- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Firefighting- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Transport Services- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Missions and Support Operations- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By End User

5.2.5.1. Government and Military- Market Insights and Forecast 2022-2032, USD Million

5.2.5.1.1. Army Aviation- Market Insights and Forecast 2022-2032, USD Million

5.2.5.1.2. Air Force- Market Insights and Forecast 2022-2032, USD Million

5.2.5.1.3. Naval/Marine Corps Aviation- Market Insights and Forecast 2022-2032, USD Million

5.2.5.1.4. Joint/Special Operations- Market Insights and Forecast 2022-2032, USD Million

5.2.5.1.5. Paramilitary and Coast Guard- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Commercial and Civil- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Agriculture- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Construction- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Tourism and Transport Services- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Design Configuration

5.2.6.1. Single Rotor Helicopters- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Tandem Rotor Helicopters- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Poland Attack Helicopters Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Helicopter Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Engine Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Technology Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Design Configuration- Market Insights and Forecast 2022-2032, USD Million

7. Poland Utility Helicopters Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Helicopter Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Engine Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Technology Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Design Configuration- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Boeing Company

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Leonardo S.p.A.

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Lockheed Martin Corporation (Sikorsky Division)

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Airbus Helicopters

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.General Electric

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Bell Textron

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Raytheon Technologies

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Safran S.A.

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Rolls-Royce plc

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Northrop Grumman Corporation

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Helicopter Type |

|

| By Engine Type |

|

| By Technology Type |

|

| By Application |

|

| By End User |

|

| By Design Configuration |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.