United Kingdom Direct Energy Weapon Research Market Report: Trends, Growth and Forecast (2026-2032)

By Platform (Land-Based, Airborne, Naval, Space-Based), By Lethality (Lethal Direct Energy Weapons, Non-Lethal Direct Energy Weapons), By Power Class (Less Than 50 kW, 51 to 150kW, Above 150 kW), By End User (Military, Homeland Security, Others)

- Aerospace & Defense

- Oct 2025

- VI0443

- 130

-

United Kingdom Direct Energy Weapon Research Market Statistics and Insights, 2026

- Market Size Statistics

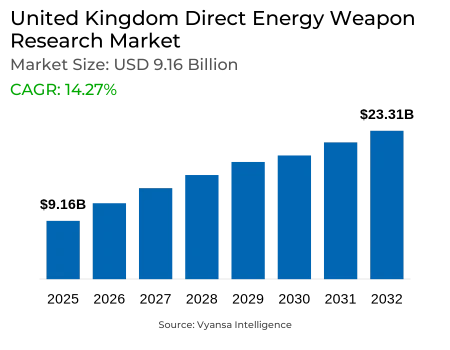

- Direct Energy Weapon Research in United Kingdom is estimated at $ 9.16 Billion.

- The market size is expected to grow to $ 23.31 Billion by 2032.

- Market to register a CAGR of around 14.27% during 2026-32.

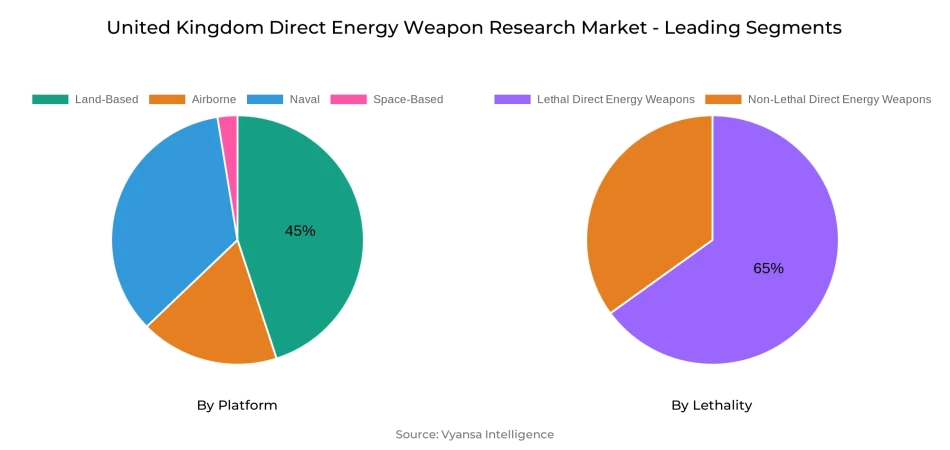

- Platform Shares

- Land-Based grabbed market share of 45%.

- Competition

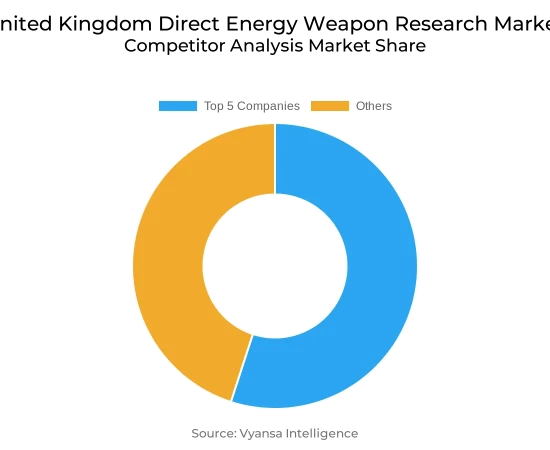

- More than 10 companies are actively engaged in producing Direct Energy Weapon Research in United Kingdom.

- Top 5 companies acquired 55% of the market share.

- Raytheon UK, Lockheed Martin UK, Northrop Grumman UK, BAE Systems, MBDA UK etc., are few of the top companies.

- Lethality

- Lethal Direct Energy Weapons grabbed 65% of the market.

United Kingdom Direct Energy Weapon Research Market Outlook

The United Kingdom Directed Energy Weapons (DEW) market for research is growing at a rapid pace, fueled by the country's emphasis on developing defense technologies and the growing necessity to neutralize contemporary threats. The market stands at an estimated USD 9.16 billion in 2025, indicated by substantial investments in both defense and security use. Breakthroughs, including the successful tests of the Radiofrequency Directed Energy Weapon (RF-DEW) and the ongoing DragonFire laser project, underscore the UK's focus on upgrading its defense capabilities against swarms of drones, missiles, and other novel threats.

The market is expected to grow to USD 23.31 billion by 2032, reflecting speedy uptake and technological innovation in the industry. The market is dominated by the top five players holding a total of 55% of the market, reflecting a fragmented competitive structure led by a dominant group of large players, while the rest of the share is controlled by small players and new players targeting niche DEW applications.

With regard to product characteristics, deadly DEWs dominate the largest segment with about 65% of the market. These systems are developed to annihilate or neutralize threats with high accuracy and speedy response, thus being the first option for military operations. Non-lethal systems provide fillers for the segment by providing solutions for civilian protection, perimeter security, and crowd management.

Overall, the UK DEW research market is poised to continue growth with technological advancement, strategic defense planning, and government assistance as leading drivers. Firms are investing more in AI-facilitated targeting, integration across land, naval, and air platforms, and broadening applications into military and civilian domains, resulting in a dynamic and foresighted market outlook for 2026–2032.

United Kingdom Direct Energy Weapon Research Market Growth Driver

Geopolitical Instability Driving Demand

Geopolitical uncertainty has emerged as a major impetus for the research market of Directed Energy Weapons in the United Kingdom, prompting the country to improve its defense systems. The strategic move by the UK to counteract future threats like drone swarms and missile attacks has led to massive investments in cutting-edge technology. In 2025, the UK Ministry of Defence invested £400 million in the development of DEWs, which highlights the complexities of upgrading defense systems amid global uncertainties.

One of the most exemplary cases of this project is the successful test of the Radiofrequency Directed Energy Weapon (RF-DEW) in April 2025, when British troops incapacitated a swarm of more than 100 drones with the use of the "RapidDestroyer" system. This success showcased the efficiency of DEWs in defeating new airborne threats with precision and at an economical cost. Moreover, the UK also aims to fit four Royal Navy destroyers with the DragonFire laser weapon by 2027, marking another milestone in highlighting the strategic significance of DEWs in national defense.

United Kingdom Direct Energy Weapon Research Market Challenge

High Development and Integration Costs impeding Growth

Extremely high research and integration expenses pose a considerable threat to the United Kingdom's Directed Energy Weapons (DEW) research industry. The Ministry of Defence (MOD) has spent more than USD 46.96 million on the development of the Radiofrequency Directed Energy Weapon (RF DEW), sustaining 135 high-skilled jobs in Northern Ireland and the South-East of England. Likewise, the DragonFire laser weapon system has cost over USD 117 million in development costs, on top of which two pre-production units have been allocated USD 281.76 million.

These heavy financial outlays are required to address technical issues and achieve the operational effectiveness of DEWs. Integrating such technologies into existing military systems involves critical testing, regrouping, and training, adding to the costs. Although the cost per shot to operate systems varies around RF DEW, ranging around USD 0.12, the initial investment and integration costs can be heavy on defense budgets, possibly slowing the large-scale induction of DEWs.

United Kingdom Direct Energy Weapon Research Market Trend

Development of Artificial Intelligence-Enhanced Directed Energy Systems

The use of Artificial Intelligence (AI) in Directed Energy Weapons (DEWs) is a key trend within the United Kingdom's defense industry, boosting the accuracy and effectiveness of the systems. AI allows DEWs to analyze immense amounts of information in real-time, making it possible for threats like swarms of drones to be quickly identified, targeted, and disarmed. Such ability is vital in contemporary warfare due to the rise in the number of threats. For example, the UK's Radiofrequency Directed Energy Weapon (RF-DEW) project under Project Ealing uses AI algorithms to independently detect and strike multiple targets at the same time, illustrating the real-world utility of AI in improving DEW capability.

To take advantage of this trend, UK defense manufacturers are actively including AI in their DEW systems. The DragonFire laser weapon system, developed in partnership between MBDA UK, Leonardo UK, and QinetiQ, combines state-of-the-art AI-based targeting and control systems to enhance the accuracy and responsiveness of the weapon. These AI upgrades are part of the larger plan to upgrade the UK's defense, and the Ministry of Defence invested USD 5.87 billion in drone and laser weapon systems, including AI-equipped systems. It highlights the critical role of AI in the future of directed energy warfare.

United Kingdom Direct Energy Weapon Research Market Opportunity

Expansion into Civilian Security Applications offering Lucrative Opportunity

The United Kingdom's Directed Energy Weapons (DEWs) research market is investigating substantial opportunities in civilian security uses, especially in drone defense. The spread of unmanned aerial vehicles (UAVs) has created concern regarding their potential abuse in cities, and thus, sophisticated technologies for curbing them are required. DEWs like the Radiofrequency Directed Energy Weapon (RF-DEW) designed under Project Ealing have shown effectiveness in countering drone swarms by discharging high-frequency radio waves, disrupting their electronics. This feature makes DEWs a plausible option for securing cities, protecting airports, and guarding strategic infrastructure.

To cash in on this potential, British defense contractors are modifying DEW weapons for non-military applications. The USD 1.17 billion spent by the Ministry of Defence on directed energy weapons, as part of a larger USD 5.87 billion package of technology, speaks to the priority placed on developing these systems for both civilian and military use. Cooperation between the Defence Science and Technology Laboratory (DSTL) and industry is focused on optimizing DEW systems for use in urban environments, making them compliant with safety and regulatory requirements. This represents a strategic effort to incorporate DEWs into civilian security systems in response to growing threats through creative solutions.

United Kingdom Direct Energy Weapon Research Market Segmentation Analysis

By Platform

- Land-Based

- Airborne

- Naval

- Space-Based

The highest revenue segment with the highest market share among the platform segment is land-based directed energy weapons, which accounts for approximately 45% of the United Kingdom's market. They are taking over because they are versatile and simple to integrate with current military infrastructure like army bases, vehicle-mounted platforms, and ground defense units. Land-based DEWs are highly effective for targeting air-based targets such as drones and missiles with quick response times and affordable per-shot operations compared to traditional kinetic weapons. Such widespread application forms the land-based segment into the largest research market contributor in the UK DEW market.

Following land platforms, naval platforms occupy around 25% of the market with shipborne laser and radiofrequency systems for naval defence. Airborne platforms occupy 20%, focusing on counter-UAV and tactical airborne missions, while space-based platforms occupy 10%, with a focus on initial investigation for satellite defence and high-altitude threat preemption. Together, these segments account for the platform-based division of the UK DEW research market for 2026–2032.

By Lethality

- Lethal Direct Energy Weapons

- Non-Lethal Direct Energy Weapons

The biggest market share under the lethality category belongs to lethal directed energy weapons, which hold around 65% of the United Kingdom market. These types of systems are engineered to destroy or incapacitate targets efficiently and are the most sought-after for military uses such as counter-drone missions, missile defense, and vehicle-mounted combat platforms. Their high accuracy, fast response, and operational effectiveness are factors that make them the leader in the DEW research market.

The non-lethal segment takes up the other 35% of the market, targeting applications that incapacitate or disable targets without inflicting permanent damage. Non-lethal DEWs are being used more and more in civilian security, perimeter defense, and crowd control, providing a complementary function to lethal systems. Combined, these segments offer a distinct understanding of how lethality dictates market share and strategic use of DEWs in the UK through 2026–2032.

Top Companies in United Kingdom Direct Energy Weapon Research Market

The top companies operating in the market include Raytheon UK, Lockheed Martin UK, Northrop Grumman UK, BAE Systems, MBDA UK, QinetiQ, Thales UK, Leonardo UK, Rheinmetall UK, Leonardo DRS, etc., are the top players operating in the United Kingdom Direct Energy Weapon Research Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. United Kingdom Directed Energy Weapons Research Market Policies, Regulations, and Standards

4. United Kingdom Directed Energy Weapons Research Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. United Kingdom Directed Energy Weapons Research Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Platform

5.2.1.1. Land-Based- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Airborne- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Naval- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Space-Based- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Lethality

5.2.2.1. Lethal Direct Energy Weapons- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Non-Lethal Direct Energy Weapons- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Power Class

5.2.3.1. Less Than 50 kW- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. 51 to 150kW - Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Above 150 kW- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By End User

5.2.4.1. Military- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Homeland Security- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

1.1.1.1. Competition Characteristics

1.1.1.2. Market Share & Analysis

6. United Kingdom Land-Based Directed Energy Weapons Research Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Lethality- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Power Class- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. United Kingdom Airborne Directed Energy Weapons Research Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Lethality- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Power Class- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. United Kingdom Naval Directed Energy Weapons Research Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Lethality- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Power Class- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

9. United Kingdom Space-Based Directed Energy Weapons Research Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Lethality- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Power Class- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1.Company Profiles

10.1.1. BAE Systems

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. MBDA UK

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. QinetiQ

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Thales UK

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Leonardo UK

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Raytheon UK

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Lockheed Martin UK

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Northrop Grumman UK

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Rheinmetall UK

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Leonardo DRS

10.1.10.1. Business Description

10.1.10.2. Product Portfolio

10.1.10.3. Collaborations & Alliances

10.1.10.4. Recent Developments

10.1.10.5. Financial Details

10.1.10.6. Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Platform |

|

| By Lethality |

|

| By Power Class |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.