United Kingdom Long-Rage Precision Strike Missiles Market Report: Trends, Growth and Forecast (2026-2032)

By Platform (Land-Based, Naval, Air-Launched), By Missile Type (Cruise Missile, Ballistic Missile, Hypersonic Missile, Others), By Guidance (GPS/INS, Satellite-Guided, Multi-Mode Seekers), By Application (Strategic Strike, Offensive Operations, Deterrence, Others)

- Aerospace & Defense

- Oct 2025

- VI0444

- 115

-

United Kingdom Long-Rage Precision Strike Missiles Market Statistics and Insights, 2026

- Market Size Statistics

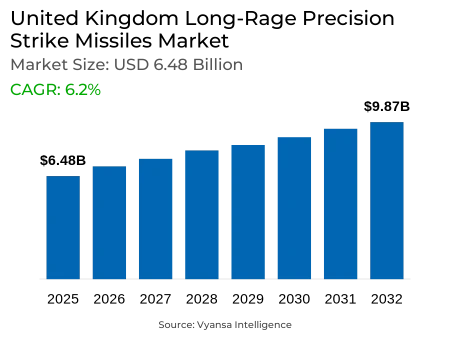

- Long-Rage Precision Strike Missiles in United Kingdom is estimated at $ 6.48 Billion.

- The market size is expected to grow to $ 9.87 Billion by 2032.

- Market to register a CAGR of around 6.2% during 2026-32.

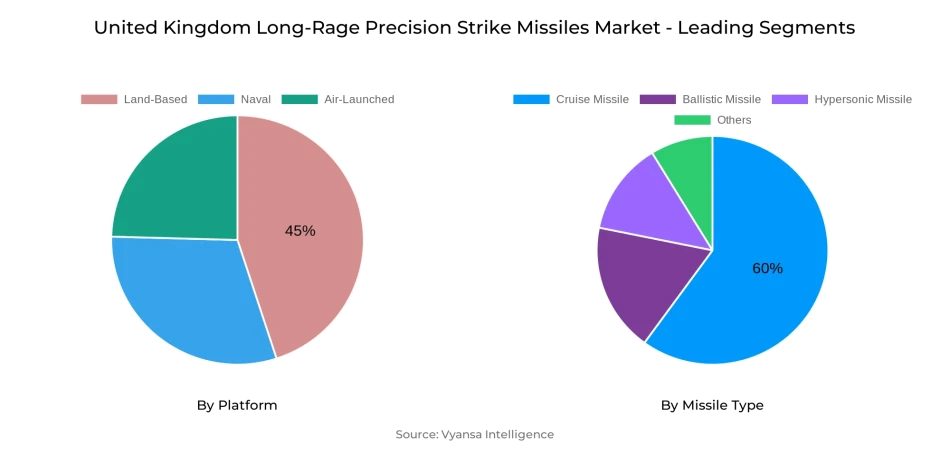

- Platform Shares

- Land-Based grabbed market share of 45%.

- Competition

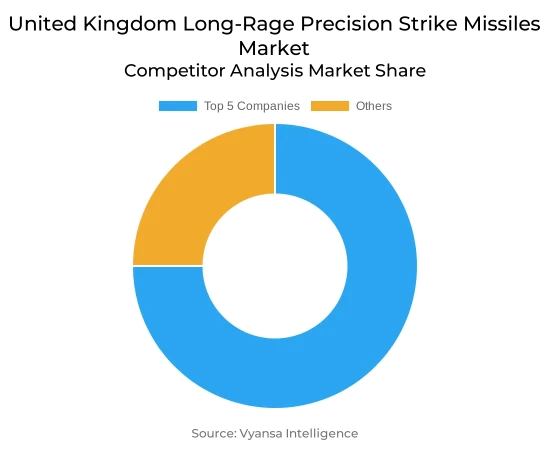

- More than 10 companies are actively engaged in producing Long-Rage Precision Strike Missiles in United Kingdom.

- Top 5 companies acquired 75% of the market share.

- Thales Group, Leonardo S.p.A., Kongsberg Gruppen, MBDA UK, Lockheed Martin etc., are few of the top companies.

- Missile Type

- Cruise Missiles grabbed 60% of the market.

United Kingdom Long-Rage Precision Strike Missiles Market Outlook

The United Kingdom long-range precision strike missile (LRPSM) market stands at an estimated $6.48 billion and is forecasted to grow to $9.87 billion by 2032, as there is significant demand for sophisticated missile capabilities. Cruise missiles lead the market and occupy 60% of the market share because they are long-range, platform-adaptable, and capable of hitting high-value targets accurately. Their capability to hit targets from land, air, and naval platforms makes them a favorite of the UK Armed Forces.

The market is extremely consolidated, with the leading five firms dominating 75% of the market. This concentration proves that key players like MBDA UK, BAE Systems, and Lockheed Martin (UK operations) are dominant in developing, manufacturing, and deploying LRPSMs. Their technological competence and robust government contracts drive market growth and provide ongoing improvement in missile capabilities.

New trends like integration with UAVs and autonomous platforms are creating new opportunities for operational flexibility and strategic reach. Ground-based platforms are still the most significant ones, taking 45% of the platform share, given their cost advantage, simplicity of use, and aptness for high-intensity operations.

With continued investment in advanced missile systems, collaborative efforts with allied countries, and a next-generation technology focus, the UK LRPSM market will enjoy steady growth. The strategic value of precision strike capabilities maintains the momentum for procurement and innovation, making the UK a front-runner in long-range missile technology through 2032.

United Kingdom Long-Rage Precision Strike Missiles Market Growth Driver

Rising Geopolitical Tensions and NATO Initiatives Driving Demand

Escalating geopolitical tensions and NATO efforts are key enablers driving the UK's long-range precision strike missile (LRPSM) market. In anticipation of increasing threats, most notably from Russia, the UK government has pledged to develop as many as 7,000 long-range missiles under the 2025 Strategic Defence Review. The decision reflects a strategic shift towards improving deterrence and defense capabilities. Furthermore, the UK and Germany have launched a collaborative effort to create a deep precision strike missile with a longer range than 2,000 kilometers to strengthen European defense and keep NATO ahead technologically.

These efforts are complemented by NATO's focus on integrated air and missile defense. The UK's engagement in multinational exercises and cooperation, as evidenced by the recent introduction of the Naval Strike Missile during Exercise Aegir 25, illustrates its resolve to improve interoperability across the alliance. This cooperative strategy not only enhances collective defense but also fuels the demand for sophisticated LRPSMs, making the UK a central figure in NATO's strategic landscape. As such, these geopolitical factors and NATO's strategic projects play a pivotal role in influencing the UK's LRPSM market path.

United Kingdom Long-Rage Precision Strike Missiles Market Challenge

Escalating Costs of Next-Generation Missiles Impeding Growth

UK development of next-generation long-range precision strike missiles is constrained by massive cost issues. The Ministry of Defence's Project Nightfall, for example, seeks to deliver low-cost tactical missiles at a unit price of USD 6,72,795, not counting warheads and launchers. This target price is ambitious, given the technological complexities involved in the development of cutting-edge missile technologies. This has also been the case with the UK F-35 fighter program, where increasing costs and delivery schedules have compromised its operational effectiveness.

In addition, collaborative ventures such as the UK-Germany deep precision strike missile program, which targets 2,000 km away and beyond, are also prone to cost overrun. Similar projects, including the U.S. Precision Strike Missile, have had costs estimated at USD 7 billion from now until 2030. Such pressures can result in delays in delivery and lower procurement volumes, thus hindering the development of the UK's long-range precision strike missile market.

United Kingdom Long-Rage Precision Strike Missiles Market Trend

Growing Focus on The Development of Hypersonic Missiles

The United Kingdom is stepping up its hypersonic missile development efforts to boost its defence capabilities. In April 2025, the UK and the US hit a milestone when they carried out hundreds of successful tests of an air-breathing engine that can accelerate a cruise missile at hypersonic velocity. The achievement is part of the overall strategy of developing a hypersonic weapon technology demonstrator by 2030 under the Ministry of Defence's Team Hypersonics (UK) programme.

Market participants are actively benefiting from this phenomenon by investing in collaborative projects. MBDA UK is, for example, driving the HYDIS² consortium that involves defense groups, institutions, SMEs, mid-caps, and universities in the development of hypersonic defense interceptors. The project fits the financing priorities of the European Commission and concerns several European countries such as France, Germany, Italy, and the Netherlands. Moreover, the UK Ministry of Defence has chosen 90 industry and academic organizations to compete for a USD 1.18 billion program focused on developing hypersonic missile capabilities. These moves reflect the UK's determination to develop hypersonic missile technology and demonstrate the involvement of market participants in defining the future of defense capabilities.

United Kingdom Long-Rage Precision Strike Missiles Market Opportunity

Integration with Emerging Platforms Offering Lucrative Opportunity

The market is progressively gaining from the merging of missile systems with new platforms like unmanned aerial vehicles (UAVs), autonomous surface vessels, and optionally manned aircraft. The merging enables the UK to increase operational flexibility, extend the range of precision strikes, and perform operations in risky or contested environments without putting personnel at risk. Initiatives like MBDA UK's trial of SPEAR launched off a UAV and FCAS demonstrators' collaborative projects demonstrate the strategic move towards autonomous or semi-autonomous deployment. The market players are taking advantage of this by creating LRPSMs that are compatible with UAVs and autonomous platforms.

For instance, MBDA UK is currently developing modular missile systems that have the potential to be fired from both aerial drones and autonomous surface-based systems, offering flexibility and instant deployment capacities. Not only do these programs improve the operational capacities of the UK, but they also create possible export markets, setting up local defense firms at the center of merging missiles with new platforms for future warfare.

United Kingdom Long-Rage Precision Strike Missiles Market Segmentation Analysis

By Platform

- Land-Based

- Naval

- Air-Launched

The most dominant segment in the platform category with the largest market share is land-based long-range precision strike missiles, which held 45% of the United Kingdom market share. Ground launch systems such as mobile launchers and fixed sites are chiefly deployed to fire these missiles, offering strategic flexibility for the UK Armed Forces. Land-based platforms are favored for their operational capability in delivering long-range precision strikes across different terrain types while remaining operationally ready in high-threat environments.

With regards to other segments, naval and air-based platforms add to the rest of the market share, facilitating the delivery of long-range precision strike missiles from air platforms such as the F-35B and ships. Ground systems remain in the majority based on cost-effectiveness, easy integration with current military infrastructure, and the capacity to facilitate new operational concepts like autonomous and hybrid targeting. This renders the land-based platform segment the major force driving market activity during 2026-2032.

By Missile Type

- Cruise Missile

- Ballistic Missile

- Hypersonic Missile

- Others

The leading market segment under the category of missile types is cruise missiles, with a market share of 60% in the United Kingdom long-range precision strike missiles market. Cruise missiles are preferred for their accuracy, long-range accuracy, and ability to target high-value targets. They can be launched from different platforms such as land, air, and sea and are therefore a flexible weapon system that can be utilized by the UK Armed Forces in various situations. Their low-altitude flight and capability to trace intricate flight patterns increase survivability and efficiency in contemporary combat operations.

The remaining share of the market is occupied by other types of missiles, such as ballistic and tactical missiles, for supporting specialized attack missions. Cruise missiles have the largest share because of their versatility across platforms, suitability with upcoming technologies such as integration with UAVs, and strategic value in deterrence missions. This makes cruise missiles the biggest driver for the growth of the UK market during 2026-2032.

Top Companies in United Kingdom Long-Rage Precision Strike Missiles Market

The top companies operating in the market include Thales Group, Leonardo S.p.A., Kongsberg Gruppen, MBDA UK, Lockheed Martin, Raytheon Technologies, BAE Systems, Northrop Grumman, Israel Aerospace Industries, Rohde & Schwarz, etc., are the top players operating in the United Kingdom Long-Rage Precision Strike Missiles Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. United Kingdom Long-Range Precision Strike Missiles Market Policies, Regulations, and Standards

4. United Kingdom Long-Range Precision Strike Missiles Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. United Kingdom Long-Range Precision Strike Missiles Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Platform

5.2.1.1. Land-Based- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Naval- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Air-Launched- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Missile Type

5.2.2.1. Cruise Missile- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Ballistic Missile- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Hypersonic Missile- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Guidance

5.2.3.1. GPS/INS- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Satellite-Guided- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Multi-Mode Seekers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Application

5.2.4.1. Strategic Strike- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Offensive Operations- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Deterrence- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

1.1.1.1. Competition Characteristics

1.1.1.2. Market Share & Analysis

6. United Kingdom Land-Based Long-Range Precision Strike Missiles Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Missile Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Guidance- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

7. United Kingdom Naval Long-Range Precision Strike Missiles Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Missile Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Guidance- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

8. United Kingdom Air-Launched Long-Range Precision Strike Missiles Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Missile Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Guidance- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.MBDA UK

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Lockheed Martin

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Raytheon Technologies

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.BAE Systems

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Northrop Grumman

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Thales Group

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Leonardo S.p.A.

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Kongsberg Gruppen

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Israel Aerospace Industries

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Rohde & Schwarz

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Platform |

|

| By Missile Type |

|

| By Guidance |

|

| By Application |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.