France Electronic Warfare and Cyber Capabilities Market Report: Trends, Growth and Forecast (2026-2032)

By Deployment Mode (On-Premise, Cloud-Based, Hybrid), By Component (Hardware, Software, Services), By Solution Type (Threat Intelligence, Data Protection, Security Management, Identity & Access, Resilience), By End User (Defence and Intelligence, Government and Public Sector, Commercial and Enterprises, Others)

- Aerospace & Defense

- Oct 2025

- VI0439

- 115

-

France Electronic Warfare and Cyber Capabilities Market Statistics and Insights, 2026

- Market Size Statistics

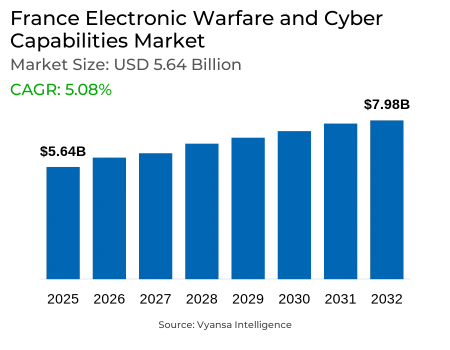

- Electronic Warfare and Cyber Capabilities in France is estimated at $ 5.64 Billion.

- The market size is expected to grow to $ 7.98 Billion by 2032.

- Market to register a CAGR of around 5.08% during 2026-32.

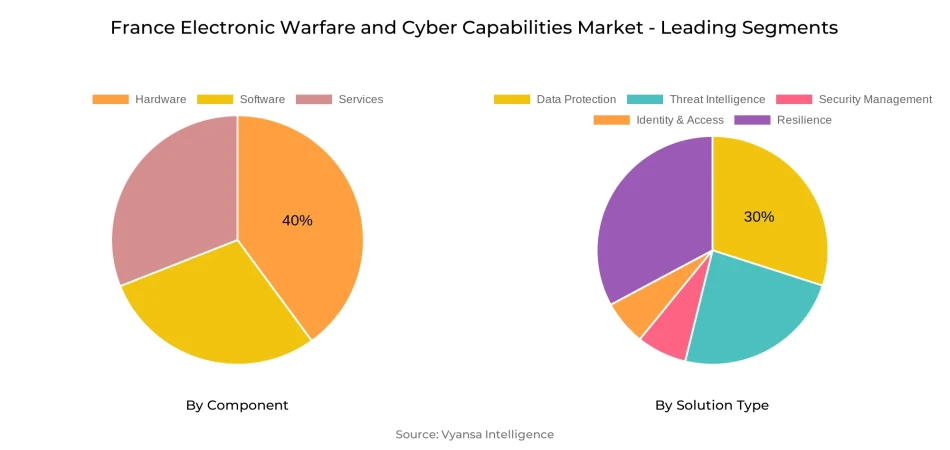

- Component Shares

- Hardware grabbed market share of 40%.

- Competition

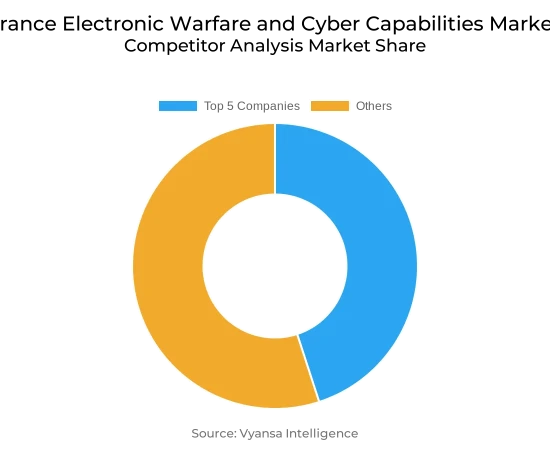

- More than 10 companies are actively engaged in producing Electronic Warfare and Cyber Capabilities in France.

- Top 5 companies acquired 45% of the market share.

- Orange Cyberdefense, Atos, Capgemini, Thales, Airbus Defence and Space etc., are few of the top companies.

- Solution Type

- Data Protection grabbed 30% of the market.

France Electronic Warfare and Cyber Capabilities Market Outlook

The France Electronic Warfare and Cyber Capabilities market is valued at $5.64 Billion in 2025 and is anticipated to reach $7.98 Billion by 2032. The growth is driven by escalating geopolitical tensions in the continent of Europe, mounting reliance on digital infrastructure, and the necessity to secure critical defense and government networks. Sophisticated electronic warfare systems and cybersecurity solutions are being given high priority to enhance national security and preserve technological superiority.

Data Protection dominates the Solution Type category with a market share of 30%. Data protection solutions encompass encryption programs, secure communication platforms, and threat monitoring software that protect sensitive defense and government data. Rising levels of cyber threats have necessitated data protection as a priority solution, providing confidentiality, integrity, and availability of essential information in defense operations.

In the Component segment, hardware still leads with 40% share, representing investment in radar, jamming devices, sensors, and integrated communication platforms. Software and services are other components that support hardware by offering mission planning, simulation, maintenance, and system integration to ensure operational efficiency and lifecycle management.

The market is moderately concentrated, with the largest five firms holding 45% of the market share. Major players are emphasizing creating modular, scalable, and integrated solutions that bring electronic warfare capabilities together with advanced cybersecurity steps. These moves allow market players to address changing defense needs while improving operational resilience and reinforcing their position in the France EW and cyber capabilities market.

France Electronic Warfare and Cyber Capabilities Market Growth Driver

Geopolitical Instability Boosting Demand

Geopolitical insecurity is the prime motivator for France's electronic warfare (EW) and cyber capabilities market, forcing the country to strengthen its defense infrastructure and strategic independence. France's National Strategic Review 2025 stresses the relevance of European independence and building sovereign defense capabilities against global uncertainty. The conflict in Ukraine has further emphasized the significant importance of EW and cyber operations in contemporary warfare, leading France to invest in cutting-edge systems such as the Archange program, which fuses signals intelligence capabilities into the Dassault Falcon 8X airplane, thus increasing national EW and cyber defense preparedness.

Along with national investments, France is also engaging in European defense partnerships to create air defense, electronic warfare, and associated military capabilities. These collaborative efforts seek to enhance regional security, consolidate market fragmentation, and gear up for high-intensity conflict scenarios. Together, these strategic partnerships and investments demonstrate how increasing geopolitical tensions are directly spurring demand for leading-edge electronic warfare and cyber capabilities to ensure that France can defend national and European interests while retaining technological and operational dominance in the emerging threat areas.

France Electronic Warfare and Cyber Capabilities Market Challenge

Increasing Number of Cyberattacks Impeding Growth

The rising frequency of cyberattacks poses a significant threat to the development of France's electronic warfare (EW) and cybersecurity capabilities market. France had 64 reported cyber incidents from February 2023 to August 2024, which averaged about three per month, with 83% of the attacks coming from an unknown origin. Six attacks were attributed to Russia-affiliated groups that hit government ministries as well as critical infrastructure and organizations related to the 2024 Paris Olympics.

These ongoing cyber threats put resources to work at both public and private levels, making procurement, deployment, and maintenance of EW systems more challenging. The French cyber agency (ANSSI) noted a 30% rise in ransom attacks between 2022 and 2023. This threat exposure climate heightens operational risk and adds costs to market participants, thus hindering market development and slowing down the uptake of sophisticated EW and cyber solutions.

France Electronic Warfare and Cyber Capabilities Market Trend

Development of Modular Electronic Warfare Platform Shaping Market Dynamics

The evolution of modular electronic warfare (EW) platforms is a leading trend in France's EW and cybersecurity capabilities market. The reason behind this trend is the demand for flexible and scalable systems that can be easily reconfigured to counter emerging threats across domains like air, land, sea, and cyber. Modular platforms provide greater flexibility, enabling the integration of cutting-edge technologies like artificial intelligence, machine learning, and cognitive electronic warfare features, which are critical for real-time threat identification and response. Modular systems' adoption allows defense forces to stay ahead technologically while keeping costs under control and shortening development cycles.

Market participants are taking advantage of this trend by investing in the development and deployment of modular EW solutions. An example is Thales Group's SPECTRA system, which is integrated into the Dassault Rafale aircraft, and which is a typical example of a modular solution that brings radar warning, laser warning, missile approach warning, and electronic countermeasures within a single flexible suite. Also, companies such as Northrop Grumman, Raytheon Technologies, and BAE Systems are pioneering innovations in modular EW systems, which are scalable and can be configured to match mission-specific requirements. Not only does this strategic emphasis on modularity increase operational effectiveness, but it also enables these companies to address the shifting requirements of contemporary warfare, thus solidifying their market leadership in the EW segment.

France Electronic Warfare and Cyber Capabilities Market Opportunity

Expansion of Space-Based Electronic Warfare Capabilities Offering Lucrative Opportunity

The growth in space-based electronic warfare (EW) capabilities presents a key opportunity for France's market players, given the mounting dependence on space assets for military operations and the resultant threats to these assets. The French government plans to become completely capable of defending space by 2030, with an emphasis on military space capabilities like Earth observation, communications, and defense satellite systems. This strategic initiative makes clear the strategic significance of the protection of space-based assets from future competitors.

Market participants are taking advantage of this by creating sophisticated space-based EW systems and making strategic alliances. For example, Thales Alenia Space is working diligently on the creation of space-based EW platforms using its satellite technology expertise to improve France's space defense capabilities. Additionally, French industry is pushing to develop high-altitude spy airships and balloons to target the largely unexploited "Very High Altitude" region, which spans from 20 to 100 km above the Earth. This region gained international prominence after the 2023 U.S. downing of a suspected Chinese spy balloon. The effort is an example of increased awareness of space as a contested environment and the requirement for powerful EW capabilities to safeguard national interests in space.

France Electronic Warfare and Cyber Capabilities Market Segmentation Analysis

By Component

- Hardware

- Software

- Services

The most valued segment under the Component category with the largest market share is Hardware, which captures 40% of the France Electronic Warfare and Cyber Capabilities market. Hardware consists of strategic systems like radar, jamming devices, sensors, and integrated communication platforms that are the pillars of electronic warfare operations. The high hardware share indicates France's continued efforts at updating its defense infrastructure and strengthening national security through enhanced EW technologies. Defense forces focus on strong and dependable hardware solutions to provide operational effectiveness in sophisticated environments and evolving threat spaces.

The rest of the Component segment, such as Software and Services, is also experiencing steady growth. Software includes mission planning, simulation, and cyber defense applications that enable hardware operations, while Services include installation, maintenance, system integration, and training. Players are more and more providing bundled solutions with hardware paired with software and services to provide trouble-free operation and lifecycle management. Such an integrated strategy enables defense forces to optimize efficiency, eliminate downtime, and quickly respond to changing threats, improving the overall component segment dynamics.

By Solution Type

- Threat Intelligence

- Data Protection

- Security Management

- Identity & Access

- Resilience

The most dominant segment under the Solution Type category is Data Protection and it accounts for 30% of the France Electronic Warfare and Cyber Capabilities market. Data Protection solutions consist of encryption systems, secure communication platforms, and threat monitoring tools that protect sensitive data from cyberattacks. The high share of this segment is an indication of growing importance in securing military and governmental data in light of enhanced cyber threats. Organizations are making top priority advanced data protection technologies in order to ensure the confidentiality, integrity, and availability of sensitive information throughout defense operations.

The rest of the Solution Type category, which consists of Threat Intelligence, Security Management & Identity & Access, and Resilience, are also responsible for growth. Threat Intelligence solutions give real-time alerts about emerging cyber threats, facilitating proactive defense. Security Management and Identity & Access solutions provide controlled and secure access to users across platforms, whereas Resilience solutions are dedicated to sustaining operations in the course of, and after, cyber incidents. Collectively, all these solutions enhance Data Protection to offer extended security protection for France's EW and cyber capabilities.

Top Companies in France Electronic Warfare and Cyber Capabilities Market

The top companies operating in the market include Orange Cyberdefense, Atos, Capgemini, Thales, Airbus Defence and Space, Safran, MBDA, Naval Group, CS Group, Rohde & Schwarz, etc., are the top players operating in the France Electronic Warfare and Cyber Capabilities Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France Electronic Warfare and Cyber Capabilities Market Policies, Regulations, and Standards

4. France Electronic Warfare and Cyber Capabilities Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France Electronic Warfare and Cyber Capabilities Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Deployment Mode

5.2.1.1. On-Premise- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Cloud-Based- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Hybrid- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Component

5.2.2.1. Hardware- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Software- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Services- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Solution Type

5.2.3.1. Threat Intelligence- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Data Protection- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Security Management- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Identity & Access- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Resilience- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By End User

5.2.4.1. Defence and Intelligence- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Government and Public Sector- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Commercial and Enterprises- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

1.1.1.1. Competition Characteristics

1.1.1.2. Market Share & Analysis

6. France On-Premise Electronic Warfare and Cyber Capabilities Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Solution Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. France Cloud-Based Electronic Warfare and Cyber Capabilities Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Solution Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. France Hybrid Electronic Warfare and Cyber Capabilities Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Solution Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Thales

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Airbus Defence and Space

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Safran

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.MBDA

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Naval Group

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Orange Cyberdefense

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Atos

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Capgemini

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.CS Group

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Rohde & Schwarz

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Deployment Mode |

|

| By Component |

|

| By Solution Type |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.