United Kingdom C4ISR Systems and Cyber Defense Market Report: Trends, Growth and Forecast (2026-2032)

By Platform (Land-Based, Airborne, Naval, Space-Based), By Component (Hardware, Software, Services), By Application (Command and Control, Communications and Networking, Intelligence, Surveillance and Reconnaissance, Electronic Warfare, Cyber Defense), By End User (Armed Forces, National Intelligence and Security Agencies, Homeland Security, Border Control, Others)

- Aerospace & Defense

- Dec 2025

- VI0442

- 110

-

United Kingdom C4ISR Systems and Cyber Defense Market Statistics and Insights, 2026

- Market Size Statistics

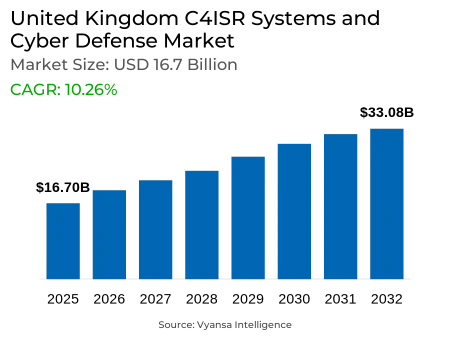

- C4ISR Systems and Cyber Defense in United Kingdom is estimated at $ 16.7 Billion.

- The market size is expected to grow to $ 33.08 Billion by 2032.

- Market to register a CAGR of around 10.26% during 2026-32.

- Component Shares

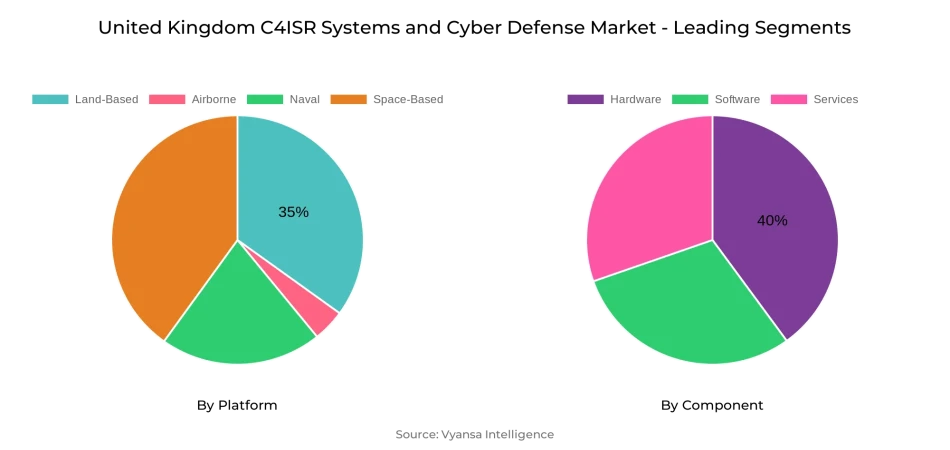

- Hardware grabbed market share of 40%.

- Competition

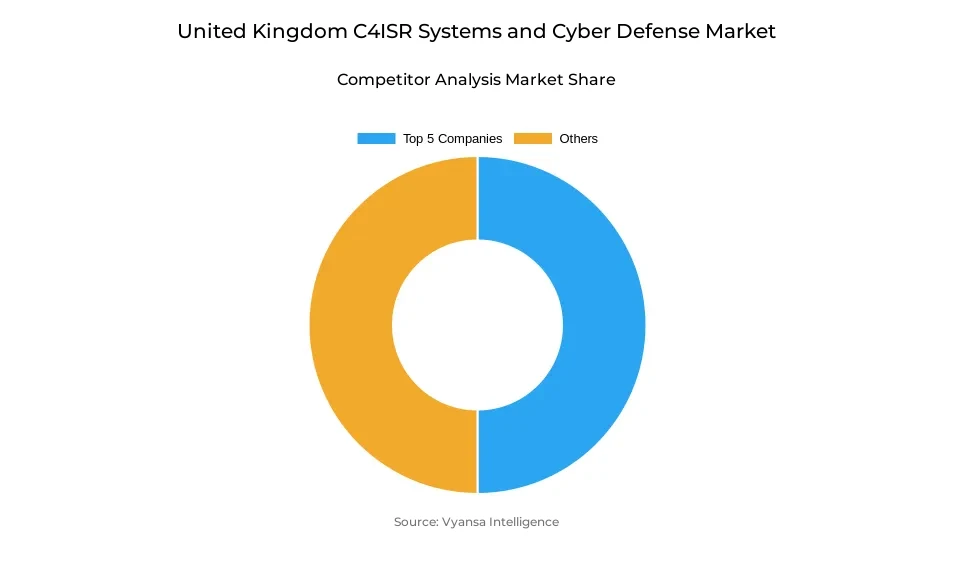

- More than 10 companies are actively engaged in producing C4ISR Systems and Cyber Defense in United Kingdom.

- Top 5 companies acquired 50% of the market share.

- QinetiQ Group plc, Serco Group plc, Chemring Group plc, BAE Systems plc, Thales UK Limited etc., are few of the top companies.

- Platform

- Land-Based grabbed 35% of the market.

United Kingdom C4ISR Systems and Cyber Defense Market Outlook

The United Kingdom C4ISR Systems and Cyber Defense Market is projected at $16.7 billion in 2026 and can expand to $33.08 billion by 2032, a factor of growing investments in defense modernization and cyber resilience. The market has over 10 players actively manufacturing sophisticated C4ISR systems and cyber defense solutions and the top 5 players hold 50% of the market share. This focus emphasizes the strategic position of established defense contractors to influence the market, with the smaller participants still bringing innovative technology in analytics, software, and system integration.

Out of various platforms, Land-Based systems dominate the market with 35% market share due to the modernization of battlefield management systems, tactical communications networks, and electronic warfare platforms. These systems are the backbone of the UK Army's operations and offer key integration points with airborne, naval, and space assets.

The market expansion is underpinned by growing demand for reliable and interoperable networks that allow productive command, control, and intelligence operations. Cyber defense capabilities are increasingly vital as a result of mounting threats from state-sponsored actors and advanced cyberattacks against defense infrastructure.

On the whole, the UK C4ISR and Cyber Defence market is ready for robust growth, led by increased investment in land-based platforms, software analytics, and integration services. The emphasis on multi-domain operational capabilities is always sure to keep the market in step with both present and future defence and security needs in an efficient manner.

United Kingdom C4ISR Systems and Cyber Defense Market Growth Driver

NATO Interoperability and Joint Domain Command Driving Demand

The UK's NATO interoperability effort has a substantial impact on the evolution of its land-based C4ISR systems. Programs such as the Federated Mission Networking (FMN) and Morpheus Tactical Communication and Information Systems programs focus on standardizing communication protocols and increasing data sharing between allied forces. Through these initiatives, UK military units can be integrated without interruption into NATO operations, enabling joint missions to respond in a coordinated manner. As an example, the UK 3rd Division's use of Systematic's SitaWare Headquarters reflects this, with a single command-and-control system based on NATO interoperability standards. The UK's support for NATO interoperability has a direct impact on its land-based C4ISR system development. Programs such as the Federated Mission Networking and Morpheus Tactical Communication and Information Systems work towards standardizing communications protocols and data sharing between allied forces. These initiatives guarantee that British military units are able to integrate into NATO operations, allowing for coordinated reactions in collaborative missions. An example of this is the UK 3rd Division's embracement of Systematic's SitaWare Headquarters, which ensures a common command-and-control platform that aligns with NATO interoperability standards.

In addition, the UK's emphasis on Joint Domain Command is transforming its C4ISR environment. JDC calls for land, air, sea, cyber, and space domains to be integrated into one, facilitating commanders' decision-making through an all-encompassing operational picture. The UK's partnership with NATO for developing secure communication structures and cyber resilience in initiatives such as TRINITY and LETacCIS attests to this policy direction. These programs not only contribute to the UK's defense strength but also create the need for more sophisticated C4ISR systems that facilitate multi-domain operations.

United Kingdom C4ISR Systems and Cyber Defense Market Challenge

Data Sovereignty and Cloud Security Concerns Hampering Growth

The implementation of cloud technologies within the UK's land-based C4ISR and cyber defense systems presents profound challenges because of the need for data sovereignty. Sensitive defense information needs to be kept under UK jurisdiction in order to meet national security guidelines and legal frameworks, restricting the levels of flexibility to employ overseas or worldwide cloud infrastructure. Any information stored or processed outside of the UK can be subject to overseas law and may risk exposing sensitive operational information to unauthorized access or regulatory difficulties. This makes it more challenging to deploy contemporary cloud-based C4ISR systems, particularly those that include multinational cooperation or NATO interoperability, where cross-border data transfers are prevalent.

Secondly, cloud security threats compound the challenge. Consolidating key operational and intelligence data in the cloud environment heightens vulnerability to cyberattacks, ransomware, and insider threats. Maintaining the confidentiality, integrity, and availability of this data in fluid operational environments is technically demanding, especially when combining legacy systems with contemporary cloud platforms. Consequently, data sovereignty and cloud security issues constitute the main deterrent to swift modernization and complete operational deployment of UK C4ISR systems.

United Kingdom C4ISR Systems and Cyber Defense Market Trend

Implementation of Quantum-Resilient Encryption shaping Market Dynamics

The UK Ministry of Defence (MoD) is actively working against the nascent threat from quantum computing to conventional encryption techniques. Quantum computers are capable of cracking popular cryptographic schemes like RSA and ECC, which form the basis of military communications and information security. Consequently, the National Cyber Security Centre (NCSC) has published advice calling on critical sectors like defense to transition to post-quantum cryptography technology by 2035.

In order to take advantage of this trend, industry players are creating and implementing quantum-resilient encryption technology specifically adapted for defense use. Such companies as Arqit are providing quantum encryption products intended to secure military communications and sensitive information. Moreover, the UK's investment in quantum work, represented by the USD 585.72 million funding of quantum computing, also highlights the strategic value of quantum resilience for national security. These efforts confirm the defense industry's proactive stance in implementing quantum-safe encryption within its C4ISR systems to future-proof against future cyber threats.

United Kingdom C4ISR Systems and Cyber Defense Market Opportunity

AI-Driven Threat Detection and ISR Data Fusion offering Lucrative Opportunity

The emergence of Artificial Intelligence (AI) in Intelligence, Surveillance, and Reconnaissance (ISR) systems offers a major potential for the UK's land C4ISR and cyber defense markets. AI improves the capacity for rapid processing and analysis of huge volumes of data drawn from a variety of sources, allowing threats and anomalies to be quickly identified. This is essential to support continued operational advantage in dynamic and intricate environments. The UK Ministry of Defence (MoD) has acknowledged the strategic relevance of AI, as encapsulated in the Defence Artificial Intelligence Strategy, which provides plans to embrace AI in different defense areas to enhance decision-making and operational effectiveness. Industry players are aggressively taking advantage of the trend by creating and implementing AI-based solutions specifically for defense needs.

Organizations such as QinetiQ are using AI to process large datasets gathered by numerous sensors, further developing the UK's ISR. Moreover, the investment by the MoD in the Defence Data Analytics Platform (DDAP), which is being created together with Kainos, is intended to offer an end-to-end data analytics solution that would support all aspects of British military and defense missions. These efforts highlight increasing focus on AI to improve the effectiveness and efficiency of C4ISR systems, posing a tremendous opportunity for growth and innovation in the industry.

United Kingdom C4ISR Systems and Cyber Defense Market Segmentation Analysis

By Component

- Hardware

- Software

- Services

The most dominant segment in the United Kingdom C4ISR Systems and Cyber Defense Market 2026–32 is Hardware, with a market share of 40%. It comprises sensors, tactical radios, ground and airborne computing systems, electronic warfare equipment, and satellite communication terminals. Hardware remains in the lead since it constitutes the framework of all ground-based, air-based, sea-based, and space-based integrated C4ISR systems, offering the infrastructure to support command, control, and intelligence operations. Defence modernization initiatives like the Morpheus Tactical CIS, Skynet 6 satellite enhancements, and Type 26/31 frigate combat systems make hardware investments even more critical, thus making it the market-share leader.

The Software segment is a close second, while Services represents a large share of continuous support, lifecycle management, and cyber defense activities. Overall, the UK market is dominated by a strong focus on hardware-driven modernization, supported by software intelligence and system integration initiatives designed to drive operational efficiency across multi-domain operations.

By Platform

- Land-Based

- Airborne

- Naval

- Space-Based

The most dominant segment in the United Kingdom C4ISR Systems and Cyber Defense Market 2026–32 is the Land-Based platform, with a market share of 35%. It comprises ground-based command and control platforms, tactical radios, mobile ISR units, and electronic warfare vehicles. Land-based systems lead the market because they are the backbone of army operations and essential connectivity with airborne, naval, and space assets. Products like the Morpheus Tactical CIS and battlefield management enhancements for the British Army compound the significance of land-based platforms, making them the largest contributor to the market.

Other domains, such as airborne, naval, and space systems, come next in terms of share but are relatively smaller as they have fewer units and are more expensive on a per-unit basis. The British market focuses on a multi-domain integration model, where land-based platforms serve as the master platform for C4ISR operations supplemented by software, analytics, and services to provide greater situational awareness, interoperability, and operational effectiveness across defense domains.

Top Companies in United Kingdom C4ISR Systems and Cyber Defense Market

The top companies operating in the market include QinetiQ Group plc, Serco Group plc, Chemring Group plc, BAE Systems plc, Thales UK Limited, Leonardo UK Ltd, Airbus Defence and Space Ltd (UK), Babcock International Group plc, Cobham Limited, Darktrace Holdings Limited, etc., are the top players operating in the United Kingdom C4ISR Systems and Cyber Defense Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. United Kingdom C4ISR Systems and Cyber Defense Market Policies, Regulations, and Standards

4. United Kingdom C4ISR Systems and Cyber Defense Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. United Kingdom C4ISR Systems and Cyber Defense Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Platform

5.2.1.1. Land-Based- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Airborne- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Naval- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Space-Based- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Component

5.2.2.1. Hardware- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Software- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Services- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Application

5.2.3.1. Command and Control- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Communications and Networking- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Intelligence, Surveillance and Reconnaissance- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Electronic Warfare- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Cyber Defense- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By End User

5.2.4.1. Armed Forces- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. National Intelligence and Security Agencies- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Homeland Security- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Border Control- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

1.1.1.1. Competition Characteristics

1.1.1.2. Market Share & Analysis

6. United Kingdom Land-Based C4ISR Systems and Cyber Defense Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. United Kingdom Airborne C4ISR Systems and Cyber Defense Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. United Kingdom Naval C4ISR Systems and Cyber Defense Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

9. United Kingdom Space-Based C4ISR Systems and Cyber Defense Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1.Company Profiles

10.1.1. BAE Systems plc

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Thales UK Limited

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Leonardo UK Ltd

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Airbus Defence and Space Ltd (UK)

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Babcock International Group plc

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. QinetiQ Group plc

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Serco Group plc

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Chemring Group plc

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Cobham Limited

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Darktrace Holdings Limited

10.1.10.1. Business Description

10.1.10.2. Product Portfolio

10.1.10.3. Collaborations & Alliances

10.1.10.4. Recent Developments

10.1.10.5. Financial Details

10.1.10.6. Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Platform |

|

| By Component |

|

| By Application |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.