UK Water & Wastewater Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (End Suction, Split Case, Vertical (Turbine, Axial Pump, Mixed Flow Pump), Submersible Pump), Positive Displacement Pumps (Progressing Cavity, Diaphragm, Gear Pump, Others)), By Application (Water, Wastewater), By End User (Industrial Water & Wastewater, Municipal Water & Wastewater)

- Energy & Power

- Dec 2025

- VI0492

- 125

-

UK Water & Wastewater Pump Market Statistics and Insights, 2026

- Market Size Statistics

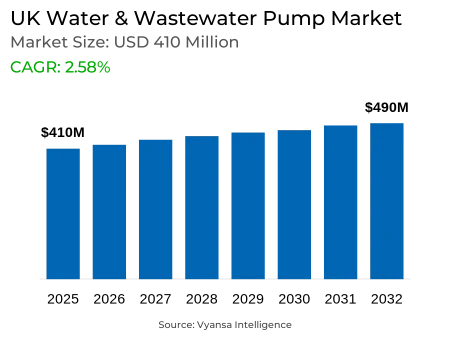

- Water & Wastewater Pump in UK is estimated at $ 410 Million.

- The market size is expected to grow to $ 490 Million by 2032.

- Market to register a CAGR of around 2.58% during 2026-32.

- Pump Type Segment

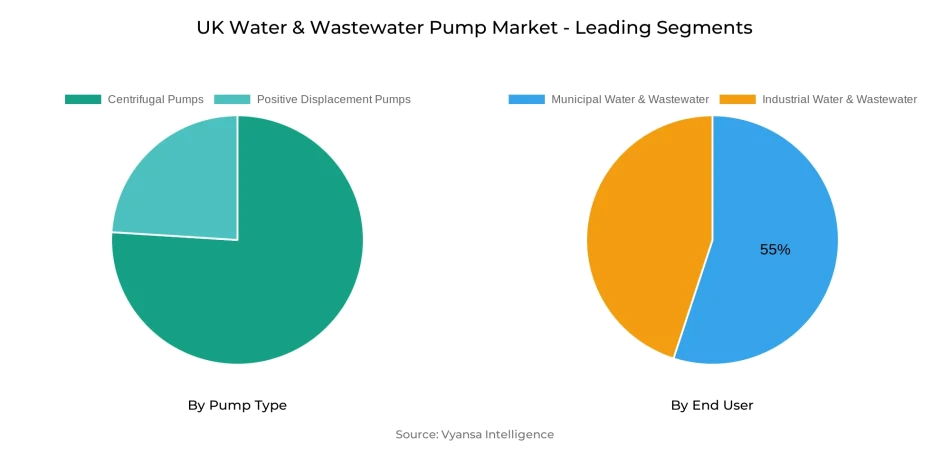

- Centrifugal Pumps continues to dominate the market.

- Competition

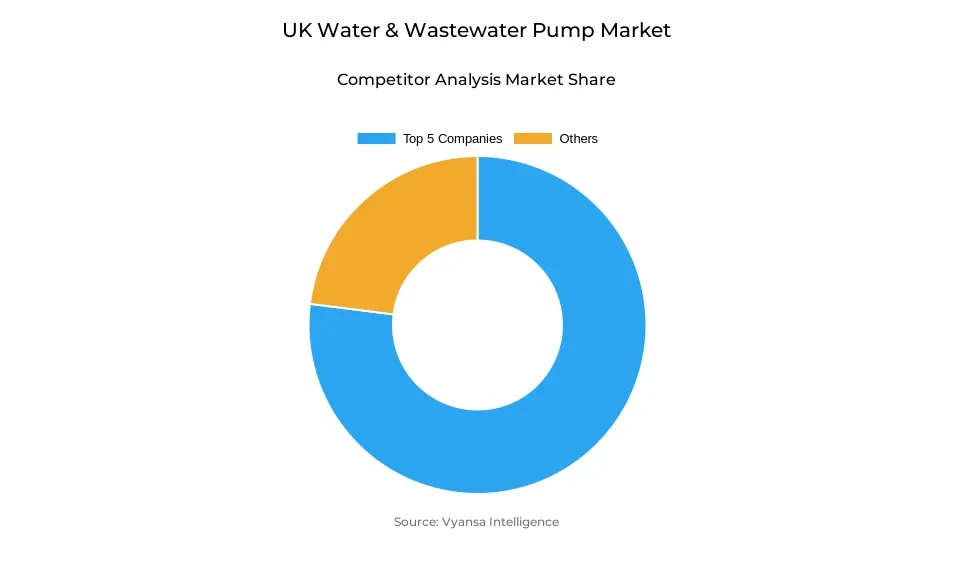

- More than 10 companies are actively engaged in producing Water & Wastewater Pump in UK.

- Top 5 companies acquired the maximum share of the market.

- ITT, IDEX, Dover, Flowserve, Sulzer AG etc., are few of the top companies.

- End User

- Municipal Water & Wastewater grabbed 55% of the market.

UK Water & Wastewater Pump Market Outlook

UK wastewater and water pump market is changing swiftly as the industry is facing a desperate need for infrastructure overhaul. At the current rate of replacement, it would take 700 years to replace the current water mains, which is an expression of the desperate need for upgrading. Water companies are planning £47 billion in enhancement expenditure over the next five years, a 70% rise in infrastructure spending, with further approval of £104 billion investment for 2025–2030 by Ofwat. This rising expenditure is expected to drive demand for pumping solutions, with the market projected to grow from $410 million in 2025 to $490 million by 2032.

Municipal water and wastewater services are the biggest end-use segment, with 55% of the market share because of widespread infrastructure owned by utilities, such as 9,000 sewage works plants treating more than 11 billion liters of wastewater each day. But severe pollution events increased by 60% in 2024, showing chronic underinvestment and demonstrating the need for uncompromised pump systems. Industrial water and wastewater uses are the most rapidly growing market segment, driven by manufacturing growth, stringent energy efficiency standards, and increasing use of smart pumps with IoT and AI capabilities.

Technological advancement is redefining the sector with intelligent pumping systems providing real-time monitoring, predictive maintenance, and enhanced energy efficiency. High-end centrifugal pumps have the largest market share due to their adaptability, and positive displacement pumps are turning out to be the fastest-growing segment with specialized applications in sophisticated treatment processes. These advancements are complemented by renewable integration and energy-saving motors that reduce energy costs.

Avenues are also increasing through circular economy strategies and government support. The £100 million Water Efficiency Fund and the extraction of resources from treatment sludges present new opportunities for pump makers. Advanced pumping technologies to aid water recycling, reuse of resources, and eco-friendly operations will be crucial in bringing assured supply, regulatory compliance, and increased efficiency to the UK water industry.

UK Water & Wastewater Pump Market Growth Driver

Aging Infrastructure Demands Urgent Modernization

The UK water and sewage industry is under severe threat from aging infrastructure, with the current rate of replacement implying it would take 700 years to replace the current water mains at this rate. The severe demand that modernization brings results in huge demand for pumping solutions as water companies intend to spend £47 billion on improvement costs over the next five years, a 70% rise in expenditure on infrastructure.

Water businesses treat more than 11 billion litres of wastewater every day at around 9,000 sewage treatment works throughout the UK. Infrastructure challenges facing the sector are also emphasized by the fact that major pollution incidents were up by 60% in 2024, with 75 category 1 and 2 incidents, largely due to chronic underinvestment in new infrastructure and inadequate asset maintenance. This crisis of performance, in which three water companies alone were responsible for 81% of major incidents, highlights the urgent need for dependable pumping systems to serve improved treatment plant and distribution systems.

UK Water & Wastewater Pump Market Challenge

High Installation and Maintenance Costs Constrain Adoption

The incorporation of cutting-edge pump technologies is subjected to enormous financial hurdles, with excessive upfront costs discouraging expansive use throughout the UK water industry. The intricacies of smart pumping systems installation and maintenance come with a high cost that is burdensome for particularly price-conscious customers in emerging markets as well as small municipal organizations with limited budgets.

The scarcity of skilled labor is another challenge since the intricate nature of installing, maintaining, and diagnosing complicated water pump systems necessitates specialized training that does not currently exist in sufficient quality throughout the UK. Such a shortfall in skills will inhibit the uptake and effective usage of new pumping technologies, risking inefficient system performance or early system failure. Water utilities need to spend money on training programs for staff to meet this shortage, further increasing already considerable investment in infrastructure. The combination of high capital cost and staff shortage represents a huge obstacle to the rapid modernization that the industry desperately requires.

UK Water & Wastewater Pump Market Trend

Smart Technology Integration Drives Innovation

The market is witnessing expedited up-take of IoT and AI-based smart pumping systems offering real-time monitoring, smart predictive maintenance, and remote control functions. The advanced intelligent systems maximize performance with continuous monitoring of parameters such as flow rate, pressure, temperature, and energy consumption and allow never-beforeseen visibility into system performance even from remote locations.

Energy efficiency gains are one of the main trends, with next-generation pumps having high-efficiency motors and variable frequency drives that modulate pump speed based on real water demand. The technology causes substantial reductions in electricity use while keeping target performance at optimal levels. Smart pumps that have IoT sensors report real-time information on pump performance, which facilitates predictive maintenance solutions that avoid downtime, reduce repair expenses, and prolong equipment life. The use of renewable energy technologies, especially solar-powered pumps, is increasingly becoming mainstream and providing effective water delivery in off-grid situations and enabling the industry to meet its sustainability goals.

UK Water & Wastewater Pump Market Opportunity

Circular Economy Creates Value-Added Opportunities

The UK water industry offers substantial potential for circular economy solutions that convert waste streams into new resources, with water treatment sludges amounting to more than 115 thousand metric tons of dry solids per year that can be reused for multiple purposes. Direct reuse programs for ferric sludges in biogas purification and acid-treated sludges for phosphate elimination at wastewater treatment plants show immediate commercial potential for upgraded pumping equipment to facilitate these resource recovery operations.

Government spending of £100 million via the Water Efficiency Fund provides great market opportunities for innovative pumping solutions for demand reduction and efficiency gain throughout England and Wales. Added to the £104 billion infrastructure spend sanctioned by Ofwat for 2025-2030, it provides a solid platform for advanced pumping technologies that facilitate water recycling, resource recovery, and energy production from treatment operations. The industry shift to circular business models, facilitated by regulatory environments that favor reuse of resources as opposed to disposal, presents pump makers with opportunities to benefit from up-and-coming markets for water-as-a-service offerings and comprehensive water management systems.

UK Water & Wastewater Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pumps

The most popular market share under pump type is Centrifugal Pumps. This is due to the universal use of centrifugal pumps in water and wastewater applications ranging from simple water distribution to intricate treatment processes demanding dependable fluid handling capability.

Even as centrifugal pumps lead the market today, the positive displacement segment has been growing at the fastest clip and is the most profitable segment to record double-digit growth in the projection period. This growth pattern reflects changing industry needs for higher-specialized pumping equipment that can manage changing flow rates and pressure with enhanced accuracy, especially in advanced treatment procedures and smart water management systems that require higher control functionality.

By End User

- Industrial Water & Wastewater

- Municipal Water & Wastewater

The most market-share dominated segment under the End User segment is Municipal Water & Wastewater, which took 55% of the market share. This reflects the widespread infrastructure needs of public water utilities and local authorities for delivering core water services to residential and business customers throughout the UK.

Industrial Water & Wastewater is the most rapidly growing end-user market, reflecting a CAGR of 3.66%. Growth is spurred by increased manufacturing activity, tight EU regulations on energy efficiency, and smart pump adoption with Internet of Things for operational efficiency and regulatory compliance. Industrial processes such as chemicals, auto, pharmaceuticals, and food processing are specifically fueling demand for sophisticated pumping solutions capable of meeting both environmental and operational demands.

Top Companies in UK Water & Wastewater Pump Market

The top companies operating in the market include ITT, IDEX, Dover, Flowserve, Sulzer AG, KSB, Xylem, Grundfos, Ebara, SPX Flow, etc., are the top players operating in the UK Water & Wastewater Pump Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UK Water & Wastewater Pump Market Policies, Regulations, and Standards

4. UK Water & Wastewater Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UK Water & Wastewater Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Progressing Cavity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Diaphragm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End User

5.2.3.1. Industrial Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Municipal Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. UK Centrifugal Water & Wastewater Pump Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. UK Positive Displacement Water & Wastewater Pump Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Flowserve Corporation

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Ebara Corporation

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.WILO SE

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Sulzer Limited

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Grundfos Holding A/S

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Xylem Inc.

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.KSB SE & Co. KGaA

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Kirloskar Brothers Limited (KBL)

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Franklin Electric

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Pentair PLC

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Application |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.