UK Pet Products Market Report: Trends, Growth and Forecast (2026-2032)

By Product (Cat Litter, Pet Healthcare (Flea/Tick Treatments, Pet Dietary Supplements, Worming Treatments, Others), Other Pet Products (Beauty Products, Accessories, Others)), By Sales Channel (Retail Offline, Retail E-Commerce, Veterinary Clinics)

- FMCG

- Dec 2025

- VI0310

- 124

-

UK Pet Products Market Statistics and Insights, 2026

- Market Size Statistics

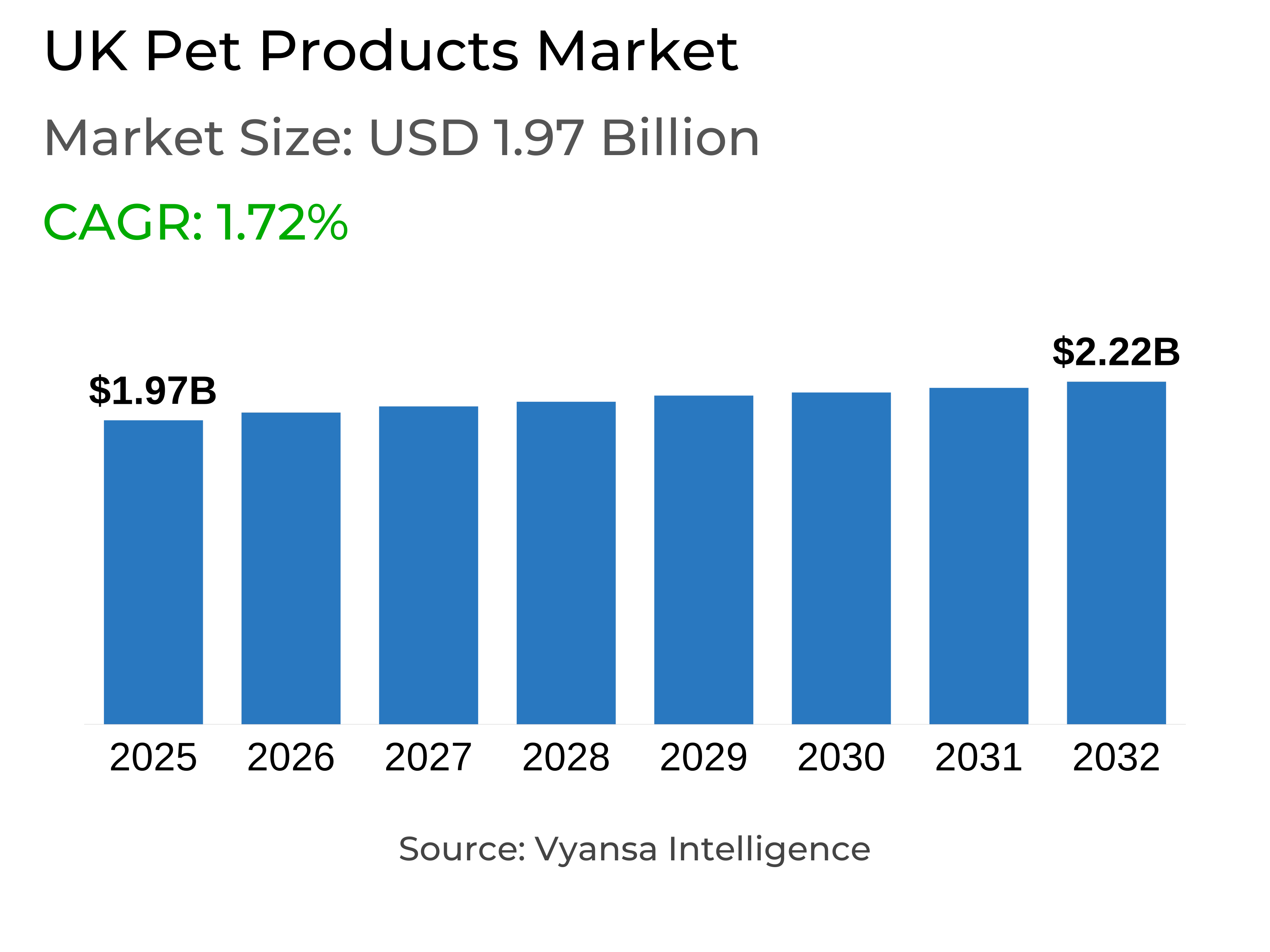

- Pet Products in UK is estimated at $ 1.97 Billion.

- The market size is expected to grow to $ 2.22 Billion by 2032.

- Market to register a CAGR of around 1.72% during 2026-32.

- Product Shares

- Other Pet Products grabbed market share of 55%.

- Competition

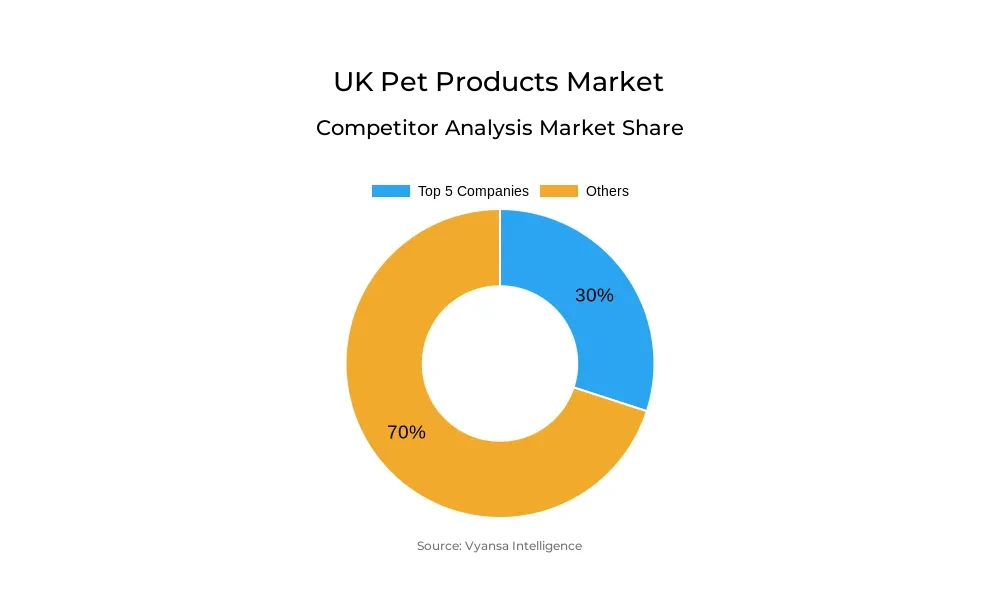

- More than 20 companies are actively engaged in producing Pet Products in UK.

- Top 5 companies acquired 30% of the market share.

- Elanco UK AH Ltd, Group55 Ltd, Johnson's Veterinary Products Ltd, Pets at Home Plc, Beaphar BV etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 45% of the market.

UK Pet Products Market Outlook

The UK pet products market is consistently growing with the aid of the humanisation factor in which pets are regarded as part of the family. The market is presently valued at approximately USD 1.97 billion, and this represents an increasing interest in health, wellbeing, and lifestyle enhancement for pets. Owners remain firm in their preferences for healthcare and grooming, but there is also interest in accessories, toys, and high-end lifestyle products.

The market will be worth USD 2.22 billion By 2032, propelled by premiumisation, innovation, and an increasing demand for customised solutions. Pet healthcare will continue to be a major growth driver, including dietary supplements and functional products aimed at mobility support, digestion, and overall wellness. Accessory and toy markets will enjoy growing innovation, meanwhile, with interactive play, dental care, and sustainable materials-themed products.

Distribution is key to this growth. Offline shopping is still important, commanding 45% of all market share through pet specialists and high-street retailers providing premium and value alternatives. E-commerce, nevertheless, is growing in strength through ease of access, diversity, and heavy social media influence, especially for younger consumers leading impulse purchases online.

Innovation opportunities are anticipated in both the healthcare and lifestyle segments. As owners become more inclined to invest in their pets' welfare and comfort, the market will experience increased demand for natural, premium, and functional items. Seasonal influences and online channels will also contribute to boosted sales, ensuring consistent growth for the UK pet products industry up to 2032.

UK Pet Products Market Growth Driver

Increased Focus on Pet Wellness and Nutrition

Pet health is emerging as a growth driver as pet owners increasingly prioritize health and nutrition. Supplements are becoming more popular, with companies providing innovative formats like chewables, liquids, and hydration-based products designed to address challenges such as digestion, mobility, and stress. Naturally derived and wholefood ingredient products are gaining traction, mirroring overall consumer trends toward cleaner and more transparent products. In spite of the competitive environment, supplements yielding definite health benefits continue to command significant demand.

The trend is not exclusive to cats and dogs but is also being carried over to small mammals with specialized items made specifically for rabbits, guinea pigs, and other pets. The expanding range of healthcare products reflects the increasing emphasis on nutrition to enhance pet well-being and underscores its position as one of the key drivers of the market.

UK Pet Products Market Trend

Innovation Driving Pet Care & Premium Solutions

Pet products innovation in the future is driven by increasing demand for high-end solutions that enhance pet health andvenience for end users. Technology is the driving force, with apps such as Perro providing all-in-one health and activity tracking and PetInstincts' Smart Pet Care system leveraging a beacon, Wi-Fi camera, and app to assist pets through separation. In the ultra-premium category, offerings like Neakasa's self-cleaning cat litter box are attracting attention by meeting odour control demands and cutting down on daily care for owners who are strapped for time and constantly travelling.

Part of this is driven by technology, while healthcare-oriented innovation is also shaping the market. Pet supplements are becoming increasingly specialised, with Nutravet launching chews for various stages of a dog's life, and stress solutions such as B-Calm spray increasing in popularity. The trend towards natural products is also visible, with higher-end ranges like For All Dog Kind's shampoos utilising coconut oil-based ingredients, which is part of a wider trend towards healthier, more sustainable pet care.

UK Pet Products Market Opportunity

Increasing Role of Online Shopping and Seasonal Trends to Drive Market Growth

Retail Online will continue to be an important channel for pet product sales in the UK, offering convenient access to a wide range of products and enabling the visibility of niche brands. Amazon, and improved online platforms operated by leading retailers, are likely to drive future growth. Pets at Home's ability to succeed with its mobile app already indicates the way app-based sales can influence faster purchases and impulse buying, a development that will continue to reinforce the digital space in the future.

Seasonal shopping also stands to provide extensive opportunities as pet owners become increasingly interested in festive and themed products. Top sales growth at previous Christmas seasons indicates this trend, with increasing demand for seasonal toys and accessories projected to persist. Trends indicate that digital platforms and seasonal products are to become key to market development over the forecast period.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2026-32 |

| USD Value 2025 | $ 1.97 Billion |

| USD Value 2032 | $ 2.22 Billion |

| CAGR 2026-2032 | 1.72% |

| Largest Category | Other Pet Products segment leads with 50% market share |

| Top Drivers | Increased Focus on Pet Wellness and Nutrition |

| Top Trends | Innovation Driving Pet Care & Premium Solutions |

| Top Opportunities | Increasing Role of Online Shopping and Seasonal Trends to Drive Market Growth |

| Key Players | Elanco UK AH Ltd, Group55 Ltd, Johnson's Veterinary Products Ltd, Pets at Home Plc, Beaphar BV, Mars Petcare UK Ltd, Bob Martin (UK) Ltd, Merial Animal Health Ltd, Karlie Heimtierbedarf GmbH, Ceva Animal Health Ltd and Others. |

UK Pet Products Market Segmentation Analysis

By Sales Channel

- Retail Offline

- Retail E-Commerce

- Veterinary Clinics

The largest market share within the sales channel is retail offline, which has grabbed 45% market share in the United Kingdom Pet Products Market. Supermarkets, despite having a negligible share in this channel, are anticipated to experience the most dynamic value growth in 2025. This rebound follows a relatively poor performance in 2024, based mainly on the increasing popularity of e-commerce platforms. Pet owners are increasingly oscillating between online and in-store purchases, contributing towards consistent supermarket sales improvements.

However, supermarkets are not set to emerge as a leading destination for the purchase of pet products. Shoppers tend to take essentials like cat litter and toys on their regular shopping visits, but convenience and greater choice provided by e-commerce will continue to draw the majority of customers.

Top Companies in UK Pet Products Market

The top companies operating in the market include Elanco UK AH Ltd, Group55 Ltd, Johnson's Veterinary Products Ltd, Pets at Home Plc, Beaphar BV, Mars Petcare UK Ltd, Bob Martin (UK) Ltd, Merial Animal Health Ltd, Karlie Heimtierbedarf GmbH, Ceva Animal Health Ltd, etc., are the top players operating in the UK Pet Products Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UK Pet Products Market Policies, Regulations, and Standards

4. UK Pet Products Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UK Pet Products Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Cat Litter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Pet Healthcare- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Flea/Tick Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Pet Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Worming Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Other Pet Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Beauty Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail E-Commerce- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Veterinary Clinics- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Competitors

5.2.3.1. Competition Characteristics

5.2.3.2. Market Share & Analysis

6. UK Cat Litter Products Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. UK Pet Healthcare Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. UK Other Pet Products Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Pets at Home Plc

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Beaphar BV

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Mars Petcare UK Ltd

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Bob Martin (UK) Ltd

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Merial Animal Health Ltd

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Elanco UK AH Ltd

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Group55 Ltd

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Johnson's Veterinary Products Ltd

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Karlie Heimtierbedarf GmbH

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Ceva Animal Health Ltd

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.