UK Ice Cream Market Report: Trends, Growth and Forecast (2025-2030)

By Category (Frozen Yoghurt, Impulse Ice Cream, Plant-based Ice Cream, Take-Home Ice Cream), By Leading Flavours (Chocolate, Vanilla, Strawberry, Cookies & Cream, Caramel, Mango, Pralines & Cream, Kulfi), By Format (Cup, Stick, Cone, Brick), By Sales Channel (Retail Offline, Retail E-Commerce)

- Food & Beverage

- Dec 2025

- VI0007

- 121

-

UK Ice Cream Market Statistics and Insights, 2025

- Market Size Statistics

- Ice Cream in UK is estimated at $ 3.66 Billion.

- The market size is expected to grow to $ 4.24 Billion by 2030.

- Market to register a CAGR of around 2.48% during 2025-30.

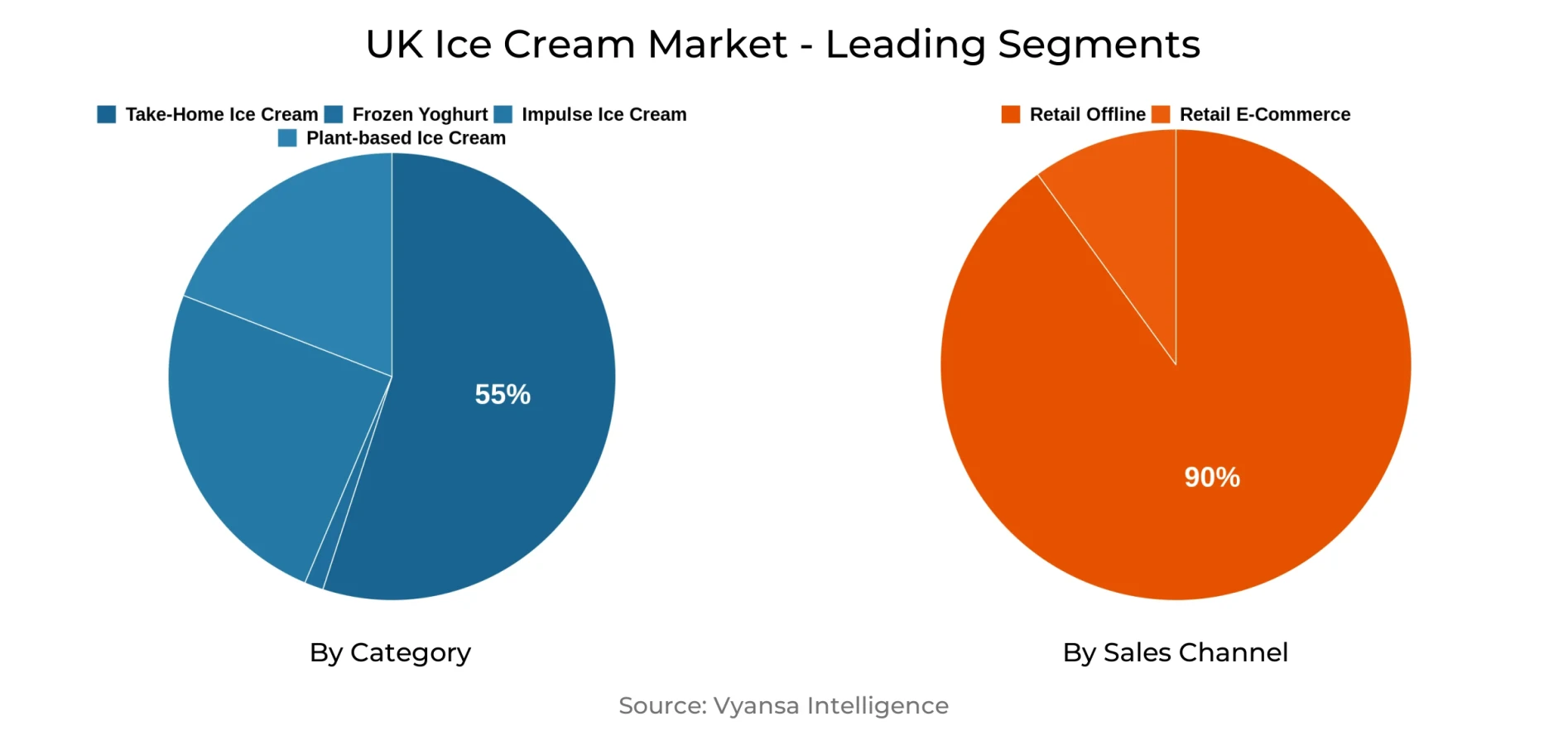

- Product Shares Shares

- Take-Home Ice Cream grabbed market share of 55%.

- Take-Home Ice Cream to witness a volume CAGR of around 0.78%.

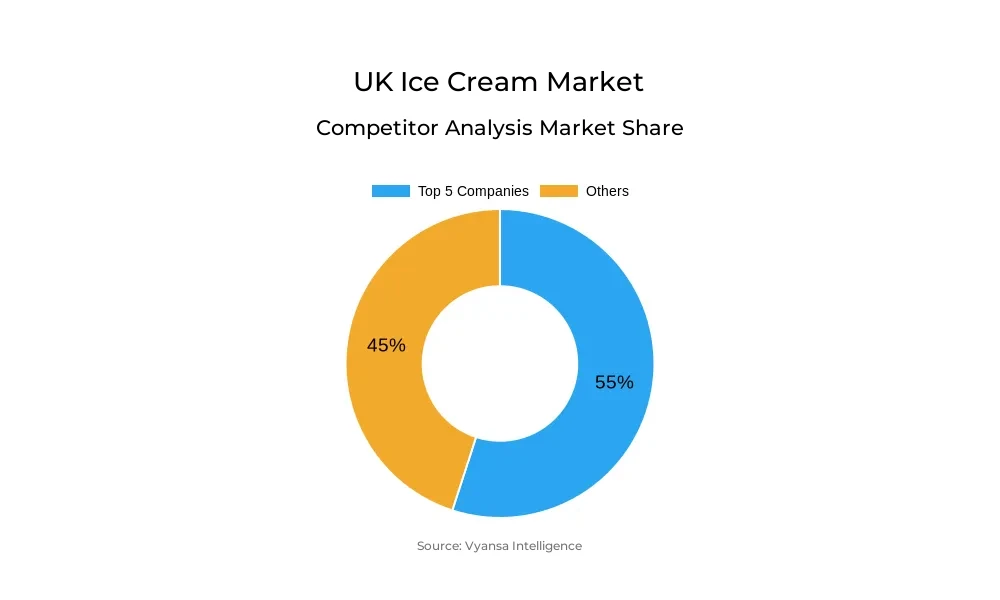

- Competition

- More than 10 companies are actively engaged in producing Ice Cream in UK.

- Top 5 companies acquired 55% of the market share.

- Mackie's Ltd, Halo Top Creamery, Calypso Soft Drinks Ltd, Unilever UK Ltd, R&R Ice Cream UK Ltd etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 90% of the market.

UK Ice Cream Market Outlook

The UK ice cream market is slowly recovering from the sharp retail volume sales downturn in 2023, prompted by a combination of economic and regulatory issues. Ongoing inflation in raw materials, energy, transport, and labor fueled double-digit price rises, and the introduction of HFSS regulations and adverse summer weather also kept demand subdued. Shrinkflation also contributed to volume sales declines, though current value sales were sustained by premiumisation and price growth.

In 2024, easing of inflationary pressures and a better consumer confidence are curbing volume declines. Nevertheless, tight global sugar and cocoa supplies are still affecting production costs, underpinning higher price levels. In spite of such setbacks, flavour innovation and format extension are rejuvenating consumer interest. Private labels and premium brands are taking note of changing tastes through indulgent, vegan, HFSS compliant, and snack formats.

The increasing trend of "snackification" has driven demand for bite-sized ice creams and non-ice cream frozen desserts, while plant-based and functional products are also seeing growth among health-aware consumers. Additionally, extension of seasonality through winter-inspired flavour and home snacking opportunities is creating new consumption occasions outside of traditional summer periods.

During the forecast period, retail volume sales will recover and grow as a result of innovations on healthier alternatives, indulgent formats, and strategic marketing. The industry will remain influenced by regulatory changes and Unilever's planned divestment of its ice cream business, which is likely to have a disrupting impact on competition. Generally, although the environment is difficult, the market is experiencing stabilisation and strategic growth opportunities.

UK Ice Cream Market Challenge

The UK Ice Cream Market has been subjected to a number of persistent economic and regulatory issues. It resulted in a steep decline in retail volume sales. In 2023, persistent cost pressures on key raw materials like milk, sugar, edible oils and cocoa beans, and rocketing transport, energy, and labour costs propelled another year of double-digit price growth. Unseasonal summer conditions curbed the ice cream intake, keeping demand below pre-pandemic levels. Additionally, the HFSS regulation introduced in October 2022 cut that in-store and online presence of ice creams with high fat, sugar and salt content are growing freezer competition and shelf visibility reducing less offering available to final consumers. Also, Shrinkflation measures are applied by players to mitigate the inflationary pressure is another reason for decreased volume sales. Although in 2024 the relaxing inflation and improved consumer confidence is encouraging cut in the declined sales, however the global sugar and cocoa tight supplies still impact pricing dynamics but less probable than earlier.

UK Ice Cream Market Trend

Increasing demand for miniature-sized ice cream, it is because of the new trend of "snackification.". The end users are buying smaller portions that are more in control of calorie intake without compromising on pleasure. The move to more responsible and healthy consumption is fueling premium positioning and stimulating value sales. The players are grabbing the moment and launching the new products. For example, Haagen-Dazs introduced Bites in 2024, and Little Moons introduced a Sweet and Salty Popcorn flavour ice cream in 2023. Doughlicious renovated its packaging for improved shelf appeal.

UK Ice Cream Market Opportunity

The delayed launch of HFSS (High in Fat, Sugar and Salt) regulations, now effective from October 2025. The regulatory development prompts manufacturers to accelerate the product development process by reducing sugar and fat levels in the ice creams. Water-based ice creams have been the favorite replacement option. It is because of the less complex reformulation process. For example, Little Moons launched new variants which are HFSS-compliant Refreshos line is now being expanded with new tastes like Blood Orange, Pink, Very Berry and Pineapple & Mandarin. The taste is not just healthier (non-HFSS), but also gluten-free and vegan, which is ideal for people having special diets. Increased end users understanding of sports nutrition and healthy consumption is fueling functional product sales even when faced with challenges of reformulation. For example, Myprotein has ridden this wave by launching the high-protein ice cream items. The market shall experience growth in demand for clean-label, low-calorie, functional/fortified claimed, and natural ingredients improved products in the forecast period.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 3.66 Billion |

| USD Value 2030 | $ 4.24 Billion |

| CAGR 2025-2030 | 2.48% |

| Largest Category | Take-Home Ice Cream segment leads with 55% market share |

| Top Challenges | Economic Pressures and Regulatory Constraints |

| Top Trends | Rising Popularity of Miniature and Premium Offerings |

| Top Opportunities | Reformulation-Driven Innovation and Clean Label Demand |

| Key Players | Mackie's Ltd, Halo Top Creamery, Calypso Soft Drinks Ltd, Unilever UK Ltd, R&R Ice Cream UK Ltd, General Mills UK Ltd, Mars Food UK Ltd, V&H Ltd, Irma Management Ltd, Oppo Brothers Ltd and Others. |

UK Ice Cream Market Segmentation Analysis

Take-Home Ice Cream is the top segment under the Category segment with the market share of approximately 55%. It is driven by the end users' desire for value-based indulgence as a result of inflation and increasing living expenses. As the unit price of the ingredients like sugar, milk, cocoa rise etc., are rising. Hence, to escape the situation, the end users are shifting towards purchasing dairy products in bulk so that they will get more value per serving.

Further, the trend of 'buying well but buying less' has driven the demand for the Take-Home ice cream format. It makes it possible for the end users to control the budget and simultaneously enjoy the premium indulgences at home. The take-home ice cream format is value and long-lasting in its provision of satisfaction, so it is a preferred option of the end users for comfort in tough economic times.

Top Companies in UK Ice Cream Market

The top companies operating in the market include Mackie's Ltd, Halo Top Creamery, Calypso Soft Drinks Ltd, Unilever UK Ltd, R&R Ice Cream UK Ltd, General Mills UK Ltd, Mars Food UK Ltd, V&H Ltd, Irma Management Ltd, Oppo Brothers Ltd, etc., are the top players operating in the UK Ice Cream Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UK Ice Cream Market Policies, Regulations, and Standards

4. UK Ice Cream Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UK Ice Cream Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.1.2.By Volume in Million Litres

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Frozen Yoghurt- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.2. Impulse Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.2.1. Single Portion Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.2.2. Single Portion Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.3. Plant-based Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4. Take-Home Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.1. Take-Home Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.1.1. Bulk Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.1.2. Multi-Pack Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.2. Take-Home Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.2.1. Bulk Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.2.2. Multi-Pack Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.By Leading Flavours

5.2.2.1. Chocolate- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.2. Vanilla- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.3. Strawberry- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.4. Cookies & Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.5. Caramel- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.6. Mango- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.7. Pralines & Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.8. Kulfi- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.By Format

5.2.3.1. Cup- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.2. Stick- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.3. Cone- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.4. Brick- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.5. Others (Sandwich, Tub, etc.)- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1. Grocery Retailers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.1. Convenience Retailers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.1.1. Convenience Stores- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.1.2. Forecourt Retailers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.2. Supermarkets- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.3. Hypermarkets- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.4. Food & Drink Specialists- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.5. Small Local Grocers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.2. Retail E-Commerce- Market Insights and Forecast, 2020-2030, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. UK Frozen Yoghurt Ice Cream Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Volume in Million Litres

6.2. Market Segmentation & Growth Outlook

6.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

6.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

7. UK Impulse Ice Cream Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.1.2.By Volume in Million Litres

7.2. Market Segmentation & Growth Outlook

7.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

7.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

8. UK Plant-based Ice Cream Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.1.2.By Volume in Million Litres

8.2. Market Segmentation & Growth Outlook

8.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

8.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

9. UK Take-Home Ice Cream Market Statistics, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.1.2.By Volume in Million Litres

9.2. Market Segmentation & Growth Outlook

9.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

9.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Mackie's Ltd

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Halo Top Creamery

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Calypso Soft Drinks Ltd

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Unilever UK Ltd

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. R&R Ice Cream UK Ltd

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. General Mills UK Ltd

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Mars Food UK Ltd

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. V&H Ltd

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Irma Management Ltd

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Oppo Brothers Ltd

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Leading Flavours |

|

| By Format |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.