UK Fire Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (Overhung Pumps, Vertical Inline, Horizontal End Suction), Split Case Pumps (Single/Two Stage, Multi Stage)), Positive Displacement Pumps (Diaphragm Pumps, Piston Pumps), By Mode of Operation (Diesel Fire Pump, Electric Fire Pump, Others), By End-User (Residential, Commercial, Industrial)

- Energy & Power

- Feb 2026

- VI0512

- 120

-

UK Fire Pump Market Statistics and Insights, 2026

- Market Size Statistics

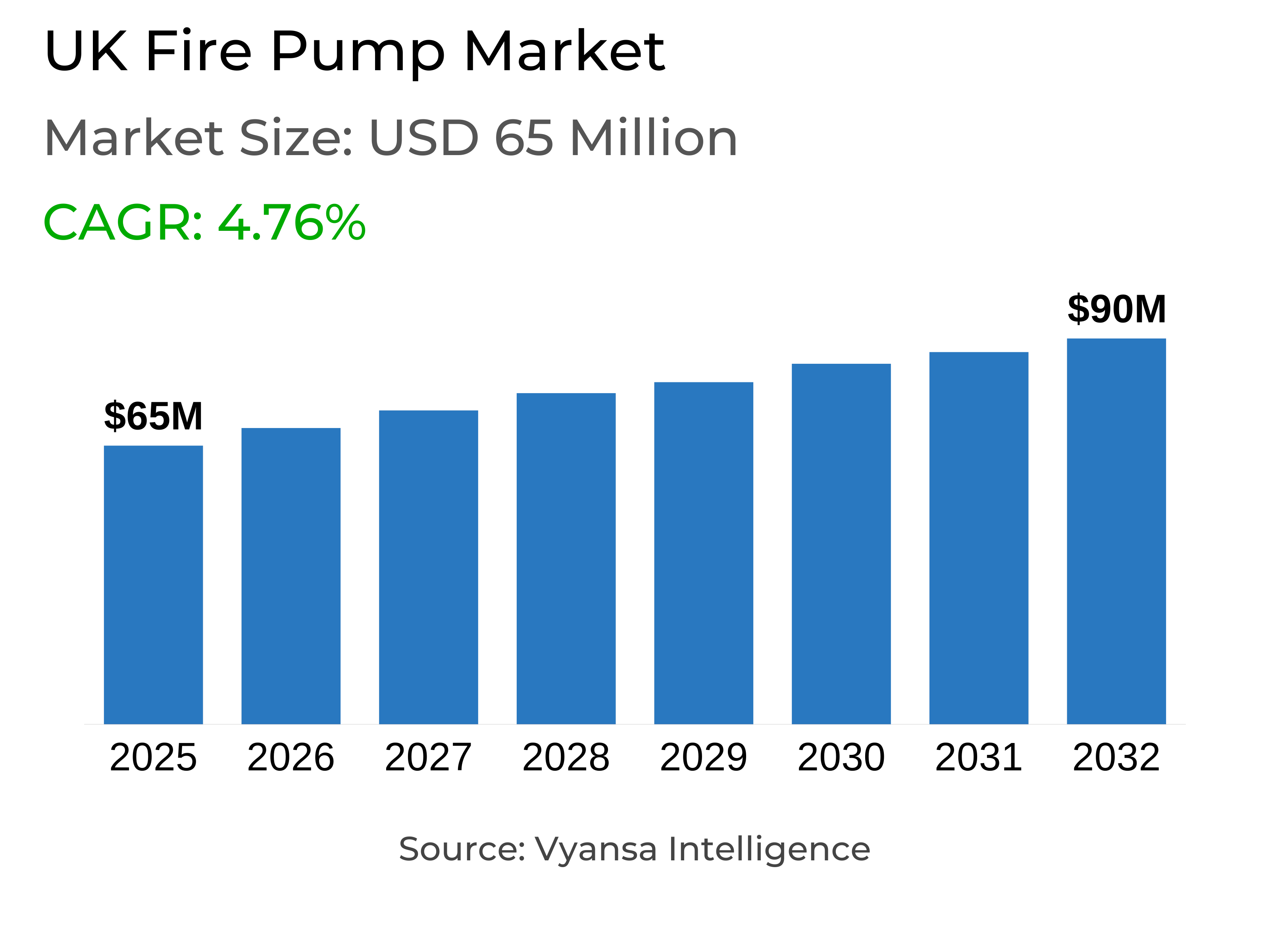

- Fire Pump in UK is estimated at $ 65 Million.

- The market size is expected to grow to $ 90 Million by 2032.

- Market to register a CAGR of around 4.76% during 2026-32.

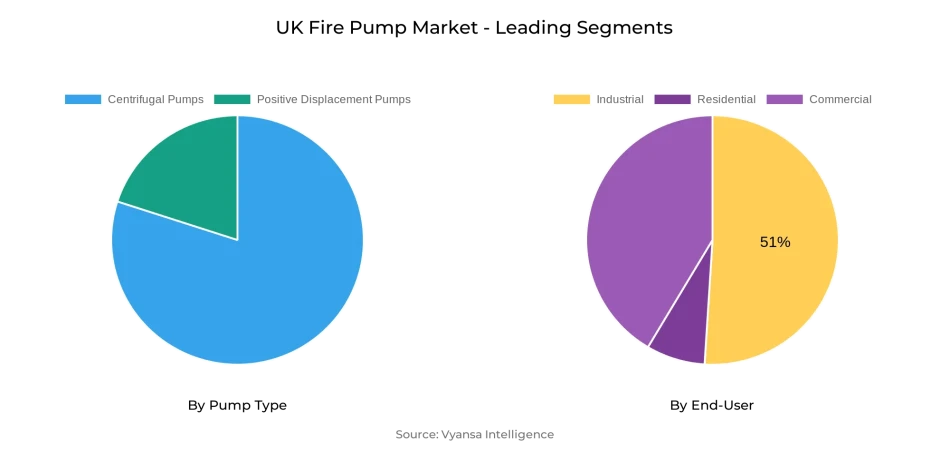

- Pump Type Segment

- Centrifugal Pumps continues to dominate the market.

- Competition

- More than 10 companies are actively engaged in producing Fire Pump in UK.

- Top 5 companies acquired the maximum share of the market.

- WILO SE, Ebara Corporation, ITT Goulds Pumps, Flowserve Corporation, Pentair PLC etc., are few of the top companies.

- End-User

- Industrial grabbed 51% of the market.

UK Fire Pump Market Outlook

The UK Fire Pump Market, in 2025 worth USD 65 million, is anticipated to grow to approximately USD 90 million by 2032, at a CAGR of approximately 4.76% from 2026–32. The growth is basically fueled by a tightened regulatory environment that mandates stringent safety norms. Adoption of BS 9991:2024, the Fire Safety (England) Regulation 2022, and the Building Safety Act 2022 has considerably increased compliance obligations, especially in residential and high-rise buildings. With fire audits, enforcement notices, and prosecutions increasing, these changing frameworks continue to drive uptake of sophisticated and dependable fire pumps in residential, commercial, and industrial structures.

Supply chain tensions continue to be a challenge, with Brexit delays, labor shortages, and increasing raw material prices impacting timely availability of equipment. Service life of older pump models is becoming increasingly harder to maintain due to unavailability of replacement parts, further facilitating upgrades. Concurrently, technology integration continues to transform the market. Intelligent, IoT-savvy fire systems now include real-time notification, predictive analysis, and hassle-free integration with building management systems. These developments enhance safety performance and working efficiency in alignment with the UK's transition towards digital-first safety solutions.

On the demand side, the growth in infrastructure and industry continues to provide steady drivers. Government plans to construct 1.5 million houses, as well as funding for remediation of unsafe cladding, support residential demand. Industrial expansion in high-risk industries like oil and gas, energy, and logistics also supports fire pump installations. Retrofitting existing buildings and construction of new-age warehouses also support long-term requirements.

In terms of product, centrifugal pumps are the market leaders through their reliability, affordability, and versatility of application. In terms of end-user, the industrial segment maintains the largest share at 51% of demand because compliance and risk reduction are still top of the agenda. The residential segment is, however, the fastest-growing due to obligatory sprinkler regulations in new care homes and large development housing schemes. Combined, these factors guarantee a diversified perspective of industrial stability and residential growth leading the UK Fire Pump Market up to 2032.

UK Fire Pump Market Growth Driver

Strengthened Regulatory Landscape Driving Adoption

Tough fire safety standards remain a driving factor in fueling fire protection equipment uptake throughout the UK. Fire and rescue authorities conducted 51,020 fire safety inspections during the year to March 2025, with 58% of establishments recording satisfactory results. The adoption of BS 9991:2024 Fire Safety Standard has widened specifications for residential premises, such as required protection in care homes. Similarly, the Fire Safety (England) Regulation 2022 also makes it obligatory for high-rise buildings of seven and above storeys to provide detailed plans to fire authorities and all new-build residential care homes have to incorporate fire sprinklers from March 2025 onwards.

The Building Safety Act 2022 also instils responsibility, with Part 4 requiring responsible individuals to oversee safety hazards in higher-risk buildings. Fire safety inspections have increased by 60% in one to three-storey purpose-built flats and by 61% for four to five-storey buildings. Formal enforcement notices increased by 11%, while prosecutions increased by 79%, highlighting increased pressures of compliance. These changing legislations maintain strong demand for high-end fire pumps in residential, commercial, and industrial markets.

UK Fire Pump Market Challenge

Supply Chain Pressures Impacting Availability

Supply chain disruptions are still the major constraint of the UK Fire Pump Market, with production delay impacting equipment readiness and project schedules. From 2020 to 2024, the combined effect of labor shortages, Brexit, and increasing raw material prices stretched procurement of electronic components essential to fire safety systems in the modern world. Since most fire pumps have a lifespan of 20–25 years, replacement parts for older pump models are becoming rare, posing serious maintenance issues for vintage installations.

Global trade uncertainty and re-certification of substitute materials have delayed introduction of fresh products while compelling previous versions to be in service longer. This dynamic makes facilities susceptible when equipment is no longer repairable, prompting organizations toward expensive replacements. Adding to the dilemma is competition from global "low-cost, low-quality" suppliers that makes procurement more difficult, with facility managers needing to weigh cost effectiveness against the requirements for trusty, regulation-compliant fire protection systems.

UK Fire Pump Market Trend

Advancing Technology and Smart Integration

The accelerated adoption of digital technology is revolutionizing fire protection systems into smart, networked solutions. IoT-based fire detection systems are now able to distinguish between genuine threats and false alarms such as steam or dust, sending fewer unnecessary alarms. These solutions provide instant smartphone alerts and hassle-free integration with building management systems, facilitating quicker responses. AI and machine learning solutions now process multi-source inputs, anticipating fire risks and issuing preventive suggestions.

There was a 46% increase in demand for IoT-enabled fire detection systems in 2024, showcasing robust adoption of smart technologies. Contemporary fire pumps are more and more integrated with building automation platforms to facilitate automatic HVAC shutdowns, elevator recalls, and intelligent door operation in emergency situations. Networked platforms consolidate system performance monitoring and provide early warning indicators, minimizing downtime and maximizing safety outcomes. These developments reinforce operational resilience while maintaining consistency with increasingly digital-first safety standards.

UK Fire Pump Market Opportunity

Expanding Infrastructure and Industrial Development

Expansion and large-scale building continue to drive significant opportunity for the UK Fire Pump Market. The government's pledge to deliver 1.5 million new homes by the end of the current Parliament underlines robust residential demand, supported by £2 million to fund the Building Safety Regulator to speed up project approvals. London's budget for 2024–25 invested £294 million in remediation of unsafe cladding across high-rise buildings, providing consistent opportunity for installations of fire safety systems.

Industrial development further provides momentum for the market, with fire protection systems being given priority in oil and gas, manufacturing, energy, and logistics industries because of their higher risk profiles. The countrywide initiative to eliminate hazardous cladding by 2029 in buildings over 18 meters guarantees continuous upgradation, while smart city initiatives in leading UK cities incorporate state-of-the-art detection technologies. Retrofitting of existing properties and construction of new logistics and warehousing facilities enhance demand for heavy-duty, high-capacity fire pumps in a variety of applications.

UK Fire Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pumps

The centrifugal pump segment has the greatest share in the UK Fire Pump Market, retaining its leadership position through consistent performance and broad application suitability. Steady water pressure and flow are provided by these pumps, rendering them indispensable for efficient sprinkler and suppression systems. Their long lifespan and comparatively low maintenance requirements contribute to them being the first choice in industrial, residential, and commercial settings, facilitating persistent adoption across the market.

Centrifugal pumps' established capacity to handle high water volumes effectively guarantees their place in projects requiring extensive coverage. Their versatility against different flow conditions ensures compatibility with a range of fire safety systems, while production being standardized and spare parts being readily accessible further amplifies their attraction. With a balance of cost savings, durability, and compliance with regulations, centrifugal pumps continue to be the cornerstone of UK fire suppression infrastructure.

By End-User

- Residential

- Commercial

- Industrial

The largest portion of the UK Fire Pump Market for the end-user segment is comprised of the industrial segment, which accounts for 51% of demand. Hazardous environments in oil and gas, transport, energy, and manufacturing require sophisticated protection systems to protect precious assets and prevent worker injury. Compliance strictures and the need to keep costly downtime to a minimum promote significant investment in detection and suppression technology throughout these segments.

The residential market is the quickest to grow, projected to grow at a CAGR of 5.57%. Increased awareness of safety advantage, combined with developing building codes requiring sprinklers in new residential care facilities, drives adoption. Major plans for housing development also spur the trend, leading to residential installations growing steadily. These forces together present a twin trajectory: industrial dominance maintaining market health while residential growth drives long-term performance.

Top Companies in UK Fire Pump Market

The top companies operating in the market include WILO SE, Ebara Corporation, ITT Goulds Pumps, Flowserve Corporation, Pentair PLC, Sulzer Limited, Grundfos Holding A/S, KSB SE & Co. KGaA, Patterson (Gorman Rupp), Armstrong, etc., are the top players operating in the UK Fire Pump Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UK Fire Pump Market Policies, Regulations, and Standards

4. UK Fire Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UK Fire Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.1. Overhung Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.2. Vertical Inline- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.3. Horizontal End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.1. Single/Two Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.2. Multi Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Diaphragm Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Piston Pumps - Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Mode of Operation

5.2.2.1. Diesel Fire Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Electric Fire Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End-User

5.2.3.1. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Commercial- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Industrial- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. UK Centrifugal Fire Pump Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

7. UK Positive Displacement Fire Pump Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Flowserve Corporation

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Pentair PLC

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Sulzer Limited

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Grundfos Holding A/S

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.KSB SE & Co. KGaA

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.WILO SE

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Ebara Corporation

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.ITT Goulds Pumps

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Patterson (Gorman Rupp)

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Armstrong

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Mode of Operation |

|

| By End-User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.