Global Municipal Water & Wastewater Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (End Suction, Split Case, Vertical (Turbine, Axial Pump, Mixed Flow Pump), Submersible Pump), Positive Displacement Pumps (Progressing Cavity, Diaphragm, Gear Pump, Others)), By Application (Water, Wastewater), By Region (North America, South America, Europe, Middle East & Africa, Asia Pacific)

- Energy & Power

- Jan 2026

- VI0965

- 190

-

Global Municipal Water & Wastewater Pump Market Statistics and Insights, 2026

- Market Size Statistics

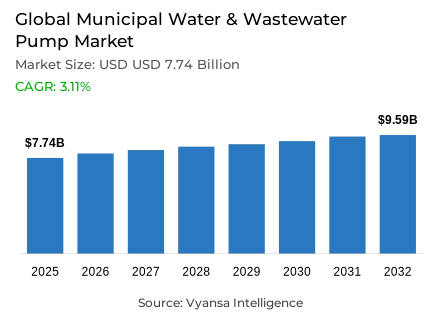

- Global municipal water & wastewater pump market is estimated at USD 7.74 billion in 2025.

- The market size is expected to grow to USD 9.59 billion by 2032.

- Market to register a CAGR of around 3.11% during 2026-32.

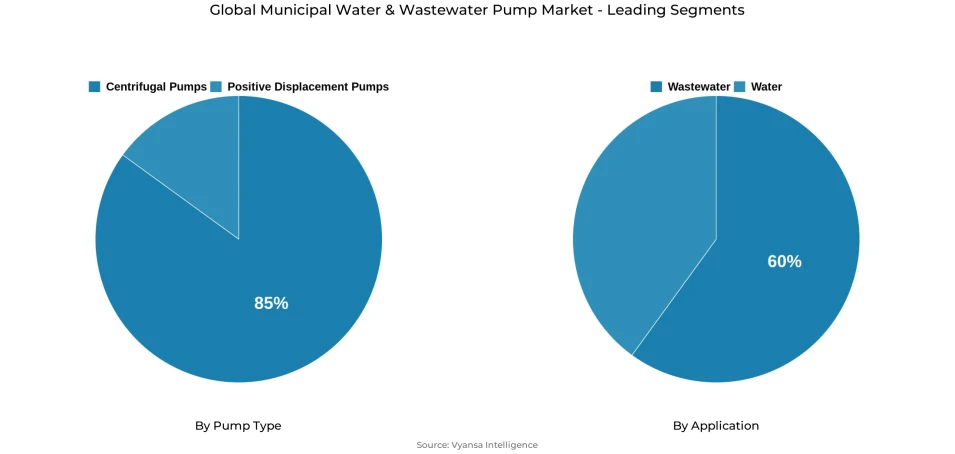

- Pump Type Shares

- Centrifugal pumps grabbed market share of 85%.

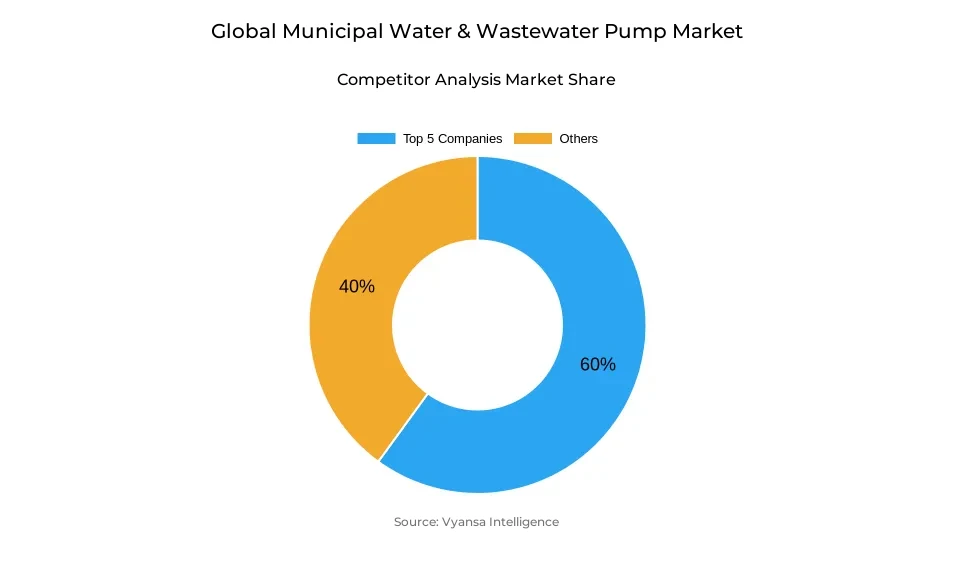

- Competition

- Global municipal water & wastewater pump market is currently being catered to by more than 25 companies.

- Top 5 companies acquired around 60% of the market share.

- Flowserve; Ebara; Pentair; Xylem; Grundfos etc., are few of the top companies.

- Application

- Wastewater grabbed 60% of the market.

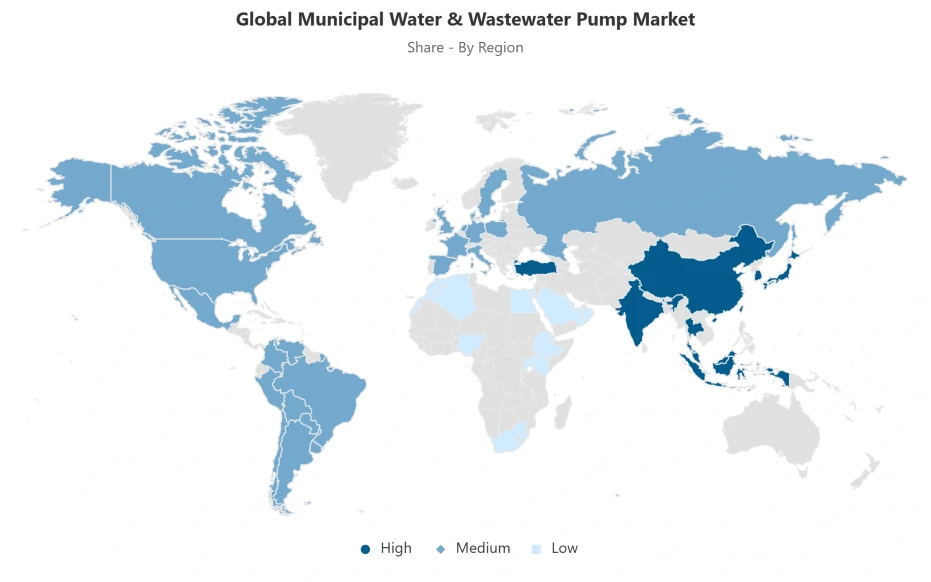

- Region

- Asia Pacific leads with a 55% share of the global market.

Global Municipal Water & Wastewater Pump Market Outlook

The Global municipal water and wastewater pump market is estimated at USD 7.74 billion in 2025 and is expected to be USD 9.59 billion in 2032 with a CAGR of about 3.11% between the years 2026 and 2032. This steady increase highlights the inseparable nature of pumps in the water supply and wastewater management systems in cities. With the growth of cities and the rise in population, cities must constantly invest in pumping systems to move, treat, and distribute water in a reliable manner, making demand structurally stable instead of cyclical.

The rapid increase in the urban population puts a long-term strain on the municipal water and wastewater systems. The growing population of urban dwellers directly increases water abstraction, wastewater production, and the necessary pumping capacity at the intake, treatment, and distribution levels. The core of these systems is pumps, which enable utilities to maintain pressure, control flow through thick networks, and ensure continuous service delivery to end users. This demographic change is long-term and makes the demand of pumps more associated with urban development than with short-term consumption trends.

Moreover, investment priorities are being influenced by energy consumption and regulatory compliance. Most of the electricity used in municipal water and wastewater systems is in pumping systems, which makes efficiency a central issue to cost and emission management utilities. Tighter wastewater treatment policies and reporting standards further force municipalities to improve facilities, increase capacity, and improve reliability. These aspects increase the speed of replacement cycles and promote the use of more efficient and digitally enabled pumping solutions.

Moreover, centrifugal pumps are the most prevalent in the market, with a 85% share, which is indicative of their appropriateness in managing large amounts of water in constant use. The largest application segment is wastewater, which makes up 60% of the total demand due to its multi-stage, complicated pumping needs. The Asia Pacific region has the highest market share of 55% regionally, which is backed by the high rate of urbanization and the large amount of government spending on water and wastewater systems.

Global Municipal Water & Wastewater Pump Market Growth Driver

Urban Population Expansion Elevates Municipal Water System Demand

The high rate of urbanization is exerting a strain on the municipal water and wastewater systems across the globe. The number of urban dwellers experiencing water shortage is estimated to increase to between 1.693 and 2.373 billion by 2050, an increase of 121.3% due to population growth, urbanisation and economic activity. Since 1900, freshwater use has increased six times, pushing current abstraction, treatment, and conveyance systems to levels that were not originally designed. Areas like the Middle East and North Africa are under acute exposure, and 83% of the population is under extremely high water stress, which increases the dependence on engineered municipal water systems to maintain the health and economic sustainability of the population.

The urbanization of the world population, which is projected to be 68% by 2050, directly raises the volume of municipal water withdrawal and wastewater generation. The utilities have to constantly increase the pumping capacity to move the raw water, maintain pressure in the dense networks, and maintain the steady supply of the service to the final consumers. This demographic shift renders pump infrastructure a structural necessity of urban resilience, and municipal investment cycles are structurally coupled to long-term urban growth patterns, as opposed to short-term demand cycles.

Global Municipal Water & Wastewater Pump Market Challenge

Rising Energy Intensity Creates Operational and Financial Pressures

The use of energy has emerged as a characteristic limitation to municipal water and wastewater operators with pumping systems consuming most of the electricity in treatment and distribution facilities. Pumps consume 86% of the electricity used in drinking water systems and 62% in wastewater plants, and combined water operations take 30% to 40% of the total municipal energy budgets. Public water and wastewater systems in the United States alone account for approximately 2% of national energy consumption and produce over 45 million tons of greenhouse gas emissions each year, which demonstrates the magnitude of cost and sustainability risk inherent in pumping processes.

The water sector already uses approximately 4% of total electricity globally, and this figure is expected to increase to 2040 due to the increase in service coverage. The cities are confronted with the two-fold challenge of expanding infrastructure to underserved urban regions and keeping energy costs down and climate promises. Increased power tariffs and decarbonisation requirements restrict the viability of capacity growth with traditional equipment, imposing financial burdens on utilities and compelling prudent prioritisation of capital investment, operating efficiency, and lifecycle cost control across pumping assets.

Global Municipal Water & Wastewater Pump Market Trend

Regulatory Pressure Accelerates Wastewater Infrastructure Modernization

Compliance with wastewater treatment has become a structural force that determines the decisions of municipal infrastructure. In 2022, 42% of all household wastewater, or 113 billion cubic metres, was released without safe treatment, and only 58% was properly processed worldwide. The performance of industrial wastewater is less strong, with only 27% of the wastewater safely treated in the reporting countries. These loopholes are directly opposed to Sustainable Development Goal 6.3, which requires the reduction of untreated wastewater by half by 2030, which governments are now enhancing enforcement and reporting systems across the globe.

The regulatory visibility has increased tremendously, with 107 countries currently reporting wastewater statistics that cover 73% of the global population. This openness is translated into direct pressure on municipalities to improve treatment plants, increase capacity, and enhance process reliability. High-tech pumping systems are necessary in lift stations, sludge management, and chemical dosing processes to achieve more stringent discharge limits. Consequently, regulatory compliance is no longer restricted to treatment technologies but goes deep into pump performance, redundancy and efficiency requirements in municipal wastewater facilities.

Global Municipal Water & Wastewater Pump Market Opportunity

Digital Pumping Solutions Unlock Efficiency and Resilience Gains

The old water infrastructure in the cities is a definite avenue of modernisation by the use of smart pumping systems. Most utilities are operating assets beyond their planned service life with increased volatility in demand and increased performance expectations. This challenge is becoming more and more consistent with multilateral funding, with the World Bank Global Water Security and Sanitation Partnership funding US$13.5 billion in water sector projects in fiscal year 2023, with a heavy focus on infrastructure renewal and digital integration in developing countries. Such programmes focus on reliability enhancements without necessitating complete network rebuilding.

Smart pumping technologies are fitted with sensors, automated controls, and variable frequency drives that allow real-time monitoring and adaptive operation. Water pumping is a priority digitalisation area of the International Energy Agency, with an estimated electricity savings of 15 to 30% through optimised control systems. Predictive maintenance has the potential to cut unplanned downtime by up to 50%, extending the life of assets and stabilising service delivery to end users. These efficiency improvements enable municipalities to balance expansion requirements with energy savings goals, enhancing long-term operational resilience.

Global Municipal Water & Wastewater Pump Market Regional Analysis

By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific

Asia Pacific holds a dominant 55% share of the Global municipal water & wastewater pump market, supported by rapid urban expansion and large scale public infrastructure investment. Developing Asia requires an estimated 1.7 trillion dollars annually in infrastructure spending through 2030, with water and wastewater systems identified as core priorities by regional development institutions. China alone invested 673.31 billion renminbi in water pollution control between 2017 and 2022, directly translating into extensive municipal pump installations across treatment and distribution projects.

Urban population growth underpins this regional leadership, with Asia expected to add 1.2 billion urban residents by 2050. National programs such as India’s Jal Jeevan Mission, aimed at universal household water connections, further accelerate demand for municipal pumping systems. Combined population density, industrial growth, and government backed infrastructure initiatives ensure sustained capital deployment. These structural conditions position Asia Pacific as the central engine of market expansion, with long term visibility across both new installations and network modernization.

Global Municipal Water & Wastewater Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- End Suction

- Split Case

- Vertical

- Turbine

- Axial Pump

- Mixed Flow Pump

- Submersible Pump

- Positive Displacement Pumps

- Progressing Cavity

- Diaphragm

- Gear Pump

- Others

Centrifugal pumps represent the dominant technology within the Global municipal water & wastewater pump market, accounting for approximately 85% share under the pump type category. This leadership reflects their adaptability across raw water intake, transmission pipelines, treatment plant circulation, and distribution networks. Municipal systems require continuous movement of very high water volumes, often ranging from hundreds to millions of gallons per day, conditions under which centrifugal designs deliver stable performance, mechanical simplicity, and favorable efficiency characteristics. Their suitability for continuous duty operations makes them integral to large scale public water infrastructure.

Municipal operators consistently prioritize centrifugal pumps due to their ability to handle fluctuating flow rates, seasonal demand shifts, and diverse hydraulic conditions. Standardized designs ensure broad service availability, ease of maintenance, and reliable spare parts access, reducing downtime risks in critical public health applications. Ongoing improvements in impeller geometry and motor efficiency have further reinforced their position, enabling compliance with tightening energy performance standards while lowering total lifecycle costs for municipal budgets and long term infrastructure planning.

By Application

- Water

- Wastewater

Wastewater management constitutes the largest application segment in the Global municipal water & wastewater pump market, capturing around 60% share of total demand. This dominance reflects the complex and multi stage pumping requirements inherent in wastewater collection and treatment systems. From lift stations that move sewage across varying elevations to pumps supporting primary treatment, biological processing, sludge transfer, and final discharge, wastewater facilities incorporate multiple pumping points with distinct operational profiles. Urbanization continues to increase sewage volumes, reinforcing the need for extensive and reliable pumping infrastructure.

Modern wastewater plants demand pumps capable of handling solids laden fluids, variable flow conditions, and corrosive environments while maintaining efficiency and reliability. Regulatory mandates for higher treatment standards increase internal recirculation and process complexity, further expanding pump deployment intensity. As municipalities retrofit aging assets to meet stricter discharge limits, wastewater applications generate consistent replacement and upgrade demand. This structural reliance positions wastewater pumping as the primary volume and value driver within municipal pump procurement cycles globally.

Market Players in Global Municipal Water & Wastewater Pump Market

These market players maintain a significant presence in the Global municipal water & wastewater pump market sector and contribute to its ongoing evolution.

- Flowserve

- Ebara

- Pentair

- Xylem

- Grundfos

- KSB

- WILO

- Sulzer

- ITT Goulds Pumps

- Kirloskar Brothers Ltd

- Shanghai Kaiquan

- CNP

- LEO Group

- LianCheng Group

- SHIMGE

Market News & Updates

- Xylem Inc., 2025:

Xylem inaugurated state-of-the-art innovation facilities in Vadodara and Chennai, India during early 2025, establishing crucial technological hubs for municipal water technology commercialization and customer engagement across the Indian subcontinent. The company achieved a landmark contract to supply three ozonation systems for Chennai's 45 million liters-per-day Tertiary Treatment Reverse Osmosis facility, which treats and recycles wastewater to conserve 16 million cubic meters of freshwater annually and enabled Chennai to exceed the 20 percent treated wastewater reuse threshold. Concurrently, Xylem partnered with Thames Water in October 2025 to establish a new standard for pump upgrades at scale across UK wastewater infrastructure, demonstrating the company's ability to drive transformative upgrades in both emerging and mature water markets globally.

- Grundfos Holding A/S, 2025:

Grundfos released a comprehensive 2025 product catalog expanding its municipal wastewater treatment portfolio to include specialized grinder and free-passage pump models, residential lifting stations, commercial dry-rotor inline pumps, pressure boosting systems, and the LC232 Smart Controller for groundwater agricultural management. The company's IoT-enabled predictive maintenance systems reduce energy consumption while facilitating continuous 24/7 automated monitoring across municipal wastewater treatment plants, enabling intelligent operations management without constant operator intervention. These integrated hardware and software solutions position Grundfos as a provider of comprehensive, intelligence-driven water infrastructure platforms rather than isolated pump equipment.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Municipal Water & Wastewater Pump Market Policies, Regulations, and Standards

4. Global Municipal Water & Wastewater Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Million Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Progressing Cavity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Diaphragm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Region

5.2.3.1. North America

5.2.3.2. South America

5.2.3.3. Europe

5.2.3.4. Middle East & Africa

5.2.3.5. Asia Pacific

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. North America Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Million Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Country

6.2.3.1. US

6.2.3.2. Canada

6.2.3.3. Mexico

6.2.3.4. Rest of North America

6.3. US Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.1.2. By Units Sold in Million Units

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.1.2. By Units Sold in Million Units

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.1.2. By Units Sold in Million Units

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

7. South America Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Million Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Country

7.2.3.1. Brazil

7.2.3.2. Argentina

7.2.3.3. Rest of South America

7.3. Brazil Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.1.2. By Units Sold in Million Units

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

7.4. Argentina Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

7.4.1.Market Size & Growth Outlook

7.4.1.1. By Revenues in USD Million

7.4.1.2. By Units Sold in Million Units

7.4.2.Market Segmentation & Growth Outlook

7.4.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.4.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

8. Europe Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Units Sold in Million Units

8.2. Market Segmentation & Growth Outlook

8.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Country

8.2.3.1. Germany

8.2.3.2. UK

8.2.3.3. France

8.2.3.4. Spain

8.2.3.5. Italy

8.2.3.6. Poland

8.2.3.7. Rest of Europe

8.3. Germany Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.1.2. By Units Sold in Million Units

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

8.4. UK Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.1.2. By Units Sold in Million Units

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

8.5. France Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.1.2. By Units Sold in Million Units

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

8.6. Spain Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.1.2. By Units Sold in Million Units

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

8.7. Italy Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.1.2. By Units Sold in Million Units

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

8.8. Poland Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

8.8.1.Market Size & Growth Outlook

8.8.1.1. By Revenues in USD Million

8.8.1.2. By Units Sold in Million Units

8.8.2.Market Segmentation & Growth Outlook

8.8.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.8.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

9. Middle East & Africa Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Units Sold in Million Units

9.2. Market Segmentation & Growth Outlook

9.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Country

9.2.3.1. Saudi Arabia

9.2.3.2. UAE

9.2.3.3. Egypt

9.2.3.4. Nigeria

9.2.3.5. South Africa

9.2.3.6. Rest of Middle East & Africa

9.3. Saudi Arabia Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.1.2. By Units Sold in Million Units

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

9.4. UAE Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.1.2. By Units Sold in Million Units

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

9.5. Egypt Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

9.5.1.Market Size & Growth Outlook

9.5.1.1. By Revenues in USD Million

9.5.1.2. By Units Sold in Million Units

9.5.2.Market Segmentation & Growth Outlook

9.5.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.5.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

9.6. Nigeria Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

9.6.1.Market Size & Growth Outlook

9.6.1.1. By Revenues in USD Million

9.6.1.2. By Units Sold in Million Units

9.6.2.Market Segmentation & Growth Outlook

9.6.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.6.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

9.7. South Africa Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

9.7.1.Market Size & Growth Outlook

9.7.1.1. By Revenues in USD Million

9.7.1.2. By Units Sold in Million Units

9.7.2.Market Segmentation & Growth Outlook

9.7.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.7.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

10. Asia Pacific Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.1.2. By Units Sold in Million Units

10.2. Market Segmentation & Growth Outlook

10.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Country

10.2.3.1. China

10.2.3.2. India

10.2.3.3. Japan

10.2.3.4. South Korea

10.2.3.5. Australia

10.2.3.6. Indonesia

10.2.3.7. Rest of Asia Pacific

10.3. China Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in USD Million

10.3.1.2. By Units Sold in Million Units

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.3.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

10.4. India Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in USD Million

10.4.1.2. By Units Sold in Million Units

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.4.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

10.5. Japan Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in USD Million

10.5.1.2. By Units Sold in Million Units

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.5.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

10.6. South Korea Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

10.6.1. Market Size & Growth Outlook

10.6.1.1. By Revenues in USD Million

10.6.1.2. By Units Sold in Million Units

10.6.2. Market Segmentation & Growth Outlook

10.6.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.6.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

10.7. Australia Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

10.7.1. Market Size & Growth Outlook

10.7.1.1. By Revenues in USD Million

10.7.1.2. By Units Sold in Million Units

10.7.2. Market Segmentation & Growth Outlook

10.7.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.7.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

10.8. Indonesia Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

10.8.1. Market Size & Growth Outlook

10.8.1.1. By Revenues in USD Million

10.8.1.2. By Units Sold in Million Units

10.8.2. Market Segmentation & Growth Outlook

10.8.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.8.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Xylem

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Grundfos

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. KSB

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. WILO

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Sulzer

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Flowserve

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Ebara

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Pentair

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. ITT Goulds Pumps

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Kirloskar Brothers Ltd

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

11.1.11. Shanghai Kaiquan

11.1.11.1.Business Description

11.1.11.2.Product Portfolio

11.1.11.3.Collaborations & Alliances

11.1.11.4.Recent Developments

11.1.11.5.Financial Details

11.1.11.6.Others

11.1.12. CNP

11.1.12.1.Business Description

11.1.12.2.Product Portfolio

11.1.12.3.Collaborations & Alliances

11.1.12.4.Recent Developments

11.1.12.5.Financial Details

11.1.12.6.Others

11.1.13. LEO Group

11.1.13.1.Business Description

11.1.13.2.Product Portfolio

11.1.13.3.Collaborations & Alliances

11.1.13.4.Recent Developments

11.1.13.5.Financial Details

11.1.13.6.Others

11.1.14. LianCheng Group

11.1.14.1.Business Description

11.1.14.2.Product Portfolio

11.1.14.3.Collaborations & Alliances

11.1.14.4.Recent Developments

11.1.14.5.Financial Details

11.1.14.6.Others

11.1.15. SHIMGE

11.1.15.1.Business Description

11.1.15.2.Product Portfolio

11.1.15.3.Collaborations & Alliances

11.1.15.4.Recent Developments

11.1.15.5.Financial Details

11.1.15.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Application |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.