Global Industrial Water & Wastewater Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (End Suction, Split Case, Vertical (Turbine, Axial Pump, Mixed Flow Pump), Submersible Pump), Positive Displacement Pumps (Progressing Cavity, Diaphragm, Gear Pump, Others)), By Application (Water, Wastewater), By Region (North America, South America, Europe, Middle East & Africa, Asia Pacific)

- Energy & Power

- Feb 2026

- VI0933

- 200

-

Global Industrial Water & Wastewater Pump Market Statistics and Insights, 2026

- Market Size Statistics

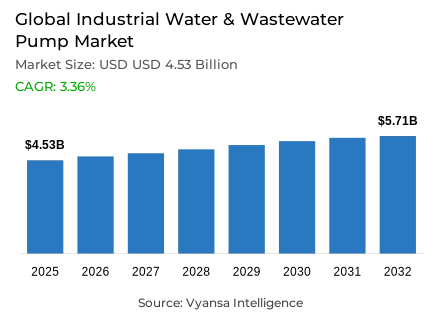

- Global industrial water & wastewater pump market is estimated at USD 4.53 billion in 2025.

- The market size is expected to grow to USD 5.71 billion by 2032.

- Market to register a CAGR of around 3.36% during 2026-32.

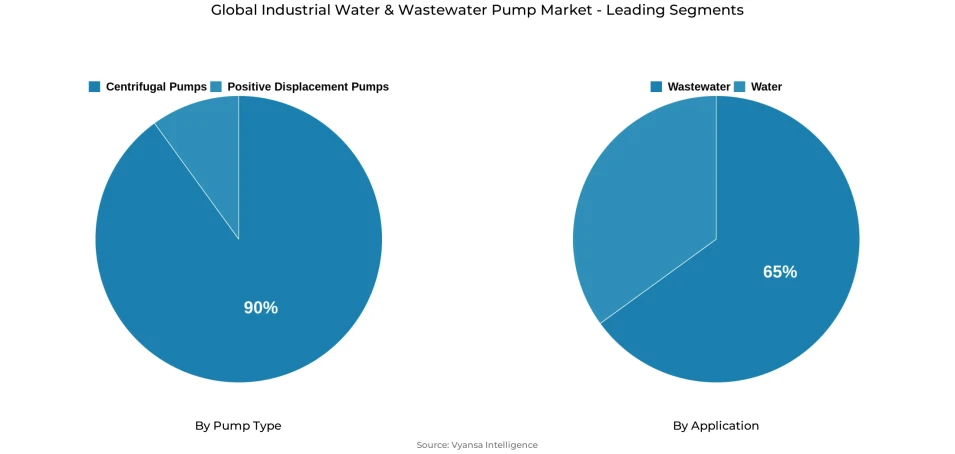

- Pump Type Shares

- Centrifugal pumps grabbed market share of 90%.

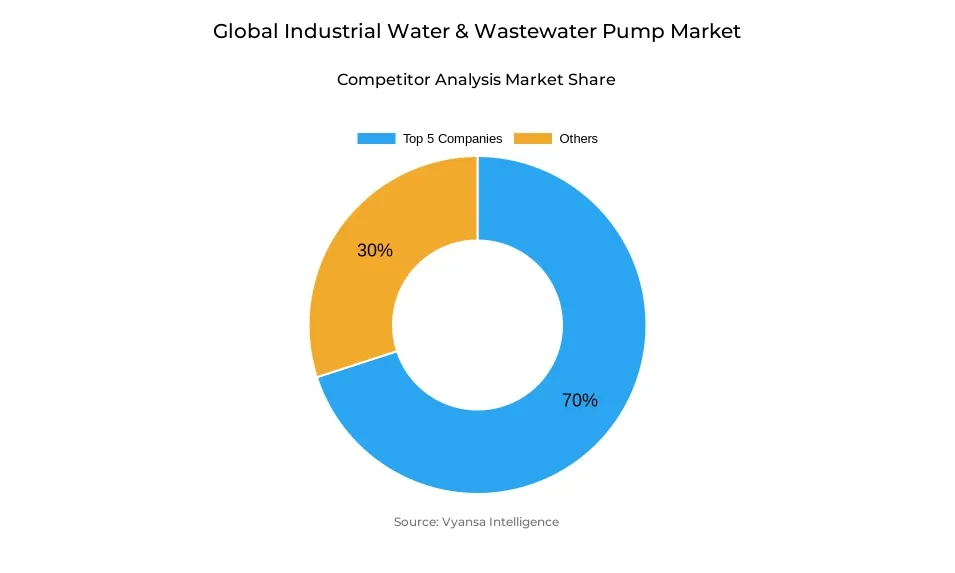

- Competition

- Global industrial water & wastewater pump market is currently being catered to by more than 20 companies.

- Top 5 companies acquired around 70% of the market share.

- WILO; Ebara; ITT Goulds Pumps; Grundfos; Flowserve etc., are few of the top companies.

- Application

- Wastewater grabbed 65% of the market.

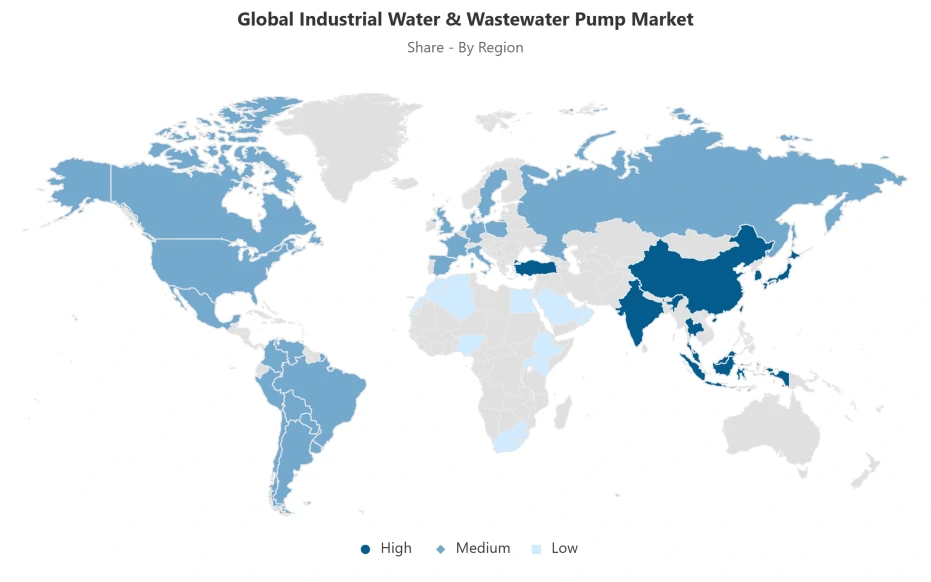

- Region

- Asia Pacific leads with a 45% share of the global market.

Global Industrial Water & Wastewater Pump Market Outlook

The Global industrial water and wastewater pump market is estimated at USD 4.53 billion in 2025 and expected to reach around USD 5.71 billion in 2032 with a CAGR of about 3.36% between 2026 and 2032. This gradual growth is an indication of a shift in water and wastewater pumping towards optional upgrades to mandatory infrastructure investment. The expansion of treatment gaps is a key driver, with WHO and UN-Water monitoring data of 2022 showing that approximately 42% of household wastewater is not treated globally, and only 27% of industrial wastewater meets safe treatment requirements. These circumstances are driving municipalities and industrial end users to invest in dependable pumping systems capable of transporting greater amounts of wastewater through collection, treatment, and discharge processes under progressively stricter environmental standards.

This growth is being provided with strong long-term funding by institutional financing. In 2024, ten multilateral development banks invested USD 19.6 billion in the water sector, almost three-quarters of which is to be invested in low- and middle-income economies with the most severe treatment deficits. This long-term investment is already converting into multi-year project pipelines of wastewater infrastructure, thus maintaining steady pump demand up to 2032. At the same time, electrification is affecting technology decisions, with industrial end users shifting to electrically powered pumps with digital controls to improve energy efficiency and lower operating expenses.

Technologically, centrifugal pumps are the most popular with a market share of 90%, as they are suitable in high-volume, continuous wastewater processes. Their ability to handle fluctuating flows and high throughput makes them the choice of preference in both industrial and municipal plants. Continued efficiency improvements further cement their status as wastewater capacity continues to grow around the world.

Wastewater management contributes to about 65% of the total demand by application, which highlights its pivotal role in infrastructure investment. The Asia-Pacific region is the top region with a market share of 45%, due to the high rate of urbanization, industrial growth, and massive wastewater compliance programs in major economies.

Global Industrial Water & Wastewater Pump Market Growth Driver

Escalating Wastewater Treatment Deficits Driving Capital Deployment

The rapid growth of the global industrial water and wastewater pump market is directly linked to the increasing gaps in wastewater treatment capacity on a global scale. According to WHO and UN-Water monitoring data released in 2022, about 42% of household wastewater is not treated before discharge, which is about 113 billion cubic metres per year. Industrial wastewater conditions are worse, with only 27% of reporting countries satisfying safe treatment standards. These structural deficiencies force municipalities and industrial end users to hasten investments in pumping systems that can transport larger amounts of wastewater through collection, treatment and discharge processes and comply with more and more stringent environmental and public-health standards. This has resulted in the replacement of discretionary upgrades with necessary infrastructure spending on pumps in many areas.

This growth trend is being strengthened by development finance institutions by making long-term funding commitments. In 2024, ten multilateral development banks pledged USD 19.6 billion to water sector investments, of which almost three-quarters of the funds are to be allocated to low- and middle-income economies facing acute treatment deficits. This level of institutional funding supports long-term project portfolios, which ensure the ongoing implementation of industrial pumping systems in municipal and industrial wastewater plants until 2032.

Global Industrial Water & Wastewater Pump Market Challenge

Structural Financing Gaps and Data Limitations Constraining Market Execution

Despite the strong fundamentals of demand, the global industrial water and wastewater pump market is facing a fundamental limitation, which is the scale of investment needed to bridge the global water-security gaps. World Bank estimates suggest that universal access would require spending to increase up to seventeen times in sub-Saharan Africa, and in fragile and conflict-affected countries, up to forty-two times the present levels. Such capital requirements strain the public budgets and hinder the implementation of projects, especially in areas with low fiscal capacity and high sovereign risk, and thus postpone the acquisition of large-scale pumps despite the urgent infrastructure requirements.

Fragmented wastewater monitoring and reporting systems also complicate market planning. Only 22 countries provide industrial wastewater data to UN monitoring systems, which is only 8% of the world population. Lack of thorough baseline information clouds real infrastructure needs, increases project risk, and raises the cost of financing. To the private investors and the engineering contractors, the lack of assurance in the size of the demand kills confidence hence slows down penetration in the market where the pumping solutions are most needed.

Global Industrial Water & Wastewater Pump Market Trend

Electrification and Energy Efficiency Reshaping Technology Adoption

The Global industrial water and wastewater pump market is undergoing a radical transformation in technology choices. According to the International Energy Agency, the sales of heat-pumps in the world increased by 11% in 2022, and some of the markets are already surpassing the annual growth rates needed to reach net-zero pathways by 2030. This wider electrification trend has a direct impact on industrial water and wastewater processes, where electrically powered pumping systems offer better energy efficiency, reduced life-cycle emissions, and enhanced compatibility with renewable energy sources compared to fossil-fuel-based systems.

Electric pumps are being combined with digital control systems by industrial end users to maximise flow control, minimise energy wastage, and cut operating costs. With the growth of carbon-pricing mechanisms and the ongoing fall in the cost of renewable electricity, the economic case of electric pumping solutions is reinforced in the heavy industry, chemicals, and food processing sectors. These trends place the advanced electric pump systems as the leading technology direction, thus defining the procurement choices and design requirements up to 2032.

Global Industrial Water & Wastewater Pump Market Opportunity

Untreated Industrial Effluents Creating a Long-Term Expansion Runway

The high percentage of untreated industrial effluents presents a significant opportunity in the global industrial water and wastewater pump market. According to UN-Water statistics, only a quarter of the industrial wastewater in the world is treated safely, which creates a large untapped market of strong pumping infrastructure. The industrial end user needs specialised pumps that can accommodate high solids loads, corrosive fluids and variable flow rates that are characteristic of effluents produced by chemical manufacturing, food processing and textiles. Every new treatment or reuse plant requires a large pumping system with several process steps.

This opportunity is strengthened by development finance momentum. The USD 19.6 billion that multilateral banks have pledged to water projects in 2024 is an indication that there will be continued funding of industrial wastewater upgrades. With the tightening of discharge regulations and the growing economic viability of water reuse, industrial facilities are under increasing pressure to install full pumping and treatment systems. This regulatory and financial alignment supports sustainable growth in demand up to 2032.

Global Industrial Water & Wastewater Pump Market Regional Analysis

By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific

Asia Pacific holds roughly 45% of the Global industrial water & wastewater pump market, driven by large-scale infrastructure investment and sustained industrial expansion. Rapid urban population growth and stringent wastewater compliance mandates are accelerating pump installations across China, India, and Southeast Asia. National development programs focused on water pollution control and river restoration, alongside industrial estate wastewater requirements, are translating directly into high-volume demand for pumping systems.

The region’s manufacturing base further amplifies market leadership. Asia Pacific accounts for over 60% of global textile production and maintains strong concentrations in chemicals and food processing, all of which require intensive water management. Policies promoting water recycling and zero-liquid-discharge in industrial zones are increasing system complexity and pump density per facility. Continued foreign direct investment and ongoing urban infrastructure upgrades are expected to sustain regional dominance through 2032.

Global Industrial Water & Wastewater Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- End Suction

- Split Case

- Vertical

- Turbine

- Axial Pump

- Mixed Flow Pump

- Submersible Pump

- Positive Displacement Pumps

- Progressing Cavity

- Diaphragm

- Gear Pump

- Others

Within pump type segmentation, centrifugal pumps account for approximately 90% of the Global industrial water & wastewater pump market, reflecting their structural suitability for high-volume water and wastewater handling. Their capability to efficiently manage continuous-duty operations, variable flow rates, and large throughput makes them the preferred mechanical configuration across industrial and municipal installations. This dominance is further reinforced by their critical role in wastewater applications, which are also the fastest-growing segment, expanding at a CAGR of 4.86% during 2025-2030. Rising wastewater treatment capacity additions directly translate into higher centrifugal pump deployments due to their operational reliability and scalability.

Ongoing technological advancements continue to strengthen centrifugal pump leadership. Manufacturers are optimizing impeller designs, hydraulic efficiency, and material compatibility, delivering energy efficiency improvements of 15-25% over older systems. These enhancements align with end users’ priorities to reduce energy consumption and lifecycle costs while handling corrosive and solids-laden wastewater streams. The combination of accelerating wastewater growth, proven mechanical performance, and continuous innovation ensures centrifugal pumps remain the dominant configuration through 2032.

By Application

- Water

- Wastewater

Wastewater management application represents about 65% of demand in the Global industrial water & wastewater pump market, underscoring its central role in infrastructure investment priorities. Industrial and municipal end users allocate the majority of pumping budgets to wastewater collection, primary and secondary treatment, sludge transfer, and effluent discharge. Increasingly complex wastewater compositions, including higher solids content and emerging contaminants, require durable pumping solutions throughout each stage of the treatment process.

This dominance is reinforced by rapid infrastructure development in emerging economies experiencing accelerated urbanization and industrial growth. Treatment facilities depend on extensive pumping networks to move influent through screening, sedimentation, biological treatment, and advanced filtration. As discharge standards tighten and water reuse initiatives expand, wastewater management will continue to command the largest share of pump installations, sustaining its leadership position through the forecast period.

Market Players in Global Industrial Water & Wastewater Pump Market

These market players maintain a significant presence in the Global industrial water & wastewater pump market sector and contribute to its ongoing evolution.

- WILO

- Ebara

- ITT Goulds Pumps

- Grundfos

- Flowserve

- Sulzer

- KSB

- Xylem

- Pentair

- Kirloskar Brothers Ltd

- Shanghai Kaiquan

- CNP

- LEO Group

- LianCheng Group

- SHIMGE

Market News & Updates

- Sulzer Ltd., 2025:

Sulzer launched the Sulzer Energy Optimization Service on March 26, 2025, integrating digital analysis, machine learning algorithms, and continuous operational monitoring to drive centrifugal pump efficiency improvements across power generation, oil and gas, chemicals, and water desalination sectors. A pilot project in Spain delivered €1 million annual energy cost savings and 2,300 tonnes CO₂ reduction through 5-pump rerating that increased efficiency from 72% to 83%, while the service's proprietary PumpWise calculator and Blue Box machine learning technology enable ongoing real-time performance optimization. Additionally, Sulzer equipped a state-of-the-art wastewater treatment plant in Venice with 10 latest-generation DynaBelt belt filters achieving 90% footprint reduction versus conventional solutions while maintaining exceptional solids removal efficiency.

- Flowserve Corporation, 2025:

Flowserve launched the INNOMAG TB-MAG Dual Drive pump on March 5, 2025, establishing the world's first sealless magnetic-drive pump with integrated secondary containment and double hermetic sealing designed to completely eliminate operational leaks in hazardous chemical processing applications. The innovation overcomes the fundamental vulnerability of traditional canned motor pumps by creating both liquid and drive sections as independent sealed chambers, providing superior operator protection when managing hazardous fluids including hydrofluoric acid and acrylonitrile. The technological achievement was recognized with the prestigious 2025 Vaaler Award in December 2025, which celebrates products that set new safety and environmental responsibility standards in chemical processing industries.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Industrial Water & Wastewater Pump Market Policies, Regulations, and Standards

4. Global Industrial Water & Wastewater Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Million Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Progressing Cavity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Diaphragm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Region

5.2.3.1. North America

5.2.3.2. South America

5.2.3.3. Europe

5.2.3.4. Middle East & Africa

5.2.3.5. Asia Pacific

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. North America Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Million Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Country

6.2.3.1. US

6.2.3.2. Canada

6.2.3.3. Mexico

6.2.3.4. Rest of North America

6.3. US Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.1.2. By Units Sold in Million Units

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.1.2. By Units Sold in Million Units

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.1.2. By Units Sold in Million Units

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

7. South America Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Million Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Country

7.2.3.1. Brazil

7.2.3.2. Argentina

7.2.3.3. Rest of South America

7.3. Brazil Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.1.2. By Units Sold in Million Units

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

7.4. Argentina Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

7.4.1.Market Size & Growth Outlook

7.4.1.1. By Revenues in USD Million

7.4.1.2. By Units Sold in Million Units

7.4.2.Market Segmentation & Growth Outlook

7.4.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.4.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

8. Europe Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Units Sold in Million Units

8.2. Market Segmentation & Growth Outlook

8.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Country

8.2.3.1. Germany

8.2.3.2. UK

8.2.3.3. France

8.2.3.4. Spain

8.2.3.5. Italy

8.2.3.6. Poland

8.2.3.7. Rest of Europe

8.3. Germany Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.1.2. By Units Sold in Million Units

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

8.4. UK Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.1.2. By Units Sold in Million Units

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

8.5. France Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.1.2. By Units Sold in Million Units

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

8.6. Spain Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.1.2. By Units Sold in Million Units

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

8.7. Italy Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.1.2. By Units Sold in Million Units

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

8.8. Poland Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

8.8.1.Market Size & Growth Outlook

8.8.1.1. By Revenues in USD Million

8.8.1.2. By Units Sold in Million Units

8.8.2.Market Segmentation & Growth Outlook

8.8.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.8.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

9. Middle East & Africa Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Units Sold in Million Units

9.2. Market Segmentation & Growth Outlook

9.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Country

9.2.3.1. Saudi Arabia

9.2.3.2. UAE

9.2.3.3. Egypt

9.2.3.4. Nigeria

9.2.3.5. South Africa

9.2.3.6. Rest of Middle East & Africa

9.3. Saudi Arabia Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.1.2. By Units Sold in Million Units

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

9.4. UAE Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.1.2. By Units Sold in Million Units

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

9.5. Egypt Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

9.5.1.Market Size & Growth Outlook

9.5.1.1. By Revenues in USD Million

9.5.1.2. By Units Sold in Million Units

9.5.2.Market Segmentation & Growth Outlook

9.5.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.5.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

9.6. Nigeria Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

9.6.1.Market Size & Growth Outlook

9.6.1.1. By Revenues in USD Million

9.6.1.2. By Units Sold in Million Units

9.6.2.Market Segmentation & Growth Outlook

9.6.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.6.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

9.7. South Africa Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

9.7.1.Market Size & Growth Outlook

9.7.1.1. By Revenues in USD Million

9.7.1.2. By Units Sold in Million Units

9.7.2.Market Segmentation & Growth Outlook

9.7.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.7.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

10. Asia Pacific Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.1.2. By Units Sold in Million Units

10.2. Market Segmentation & Growth Outlook

10.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Country

10.2.3.1. China

10.2.3.2. India

10.2.3.3. Japan

10.2.3.4. South Korea

10.2.3.5. Australia

10.2.3.6. Indonesia

10.2.3.7. Rest of Asia Pacific

10.3. China Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in USD Million

10.3.1.2. By Units Sold in Million Units

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.3.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

10.4. India Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in USD Million

10.4.1.2. By Units Sold in Million Units

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.4.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

10.5. Japan Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in USD Million

10.5.1.2. By Units Sold in Million Units

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.5.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

10.6. South Korea Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

10.6.1. Market Size & Growth Outlook

10.6.1.1. By Revenues in USD Million

10.6.1.2. By Units Sold in Million Units

10.6.2. Market Segmentation & Growth Outlook

10.6.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.6.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

10.7. Australia Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

10.7.1. Market Size & Growth Outlook

10.7.1.1. By Revenues in USD Million

10.7.1.2. By Units Sold in Million Units

10.7.2. Market Segmentation & Growth Outlook

10.7.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.7.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

10.8. Indonesia Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

10.8.1. Market Size & Growth Outlook

10.8.1.1. By Revenues in USD Million

10.8.1.2. By Units Sold in Million Units

10.8.2. Market Segmentation & Growth Outlook

10.8.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.8.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Grundfos

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Flowserve

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Sulzer

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. KSB

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Xylem

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. WILO

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Ebara

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. ITT Goulds Pumps

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Pentair

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Kirloskar Brothers Ltd

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

11.1.11. Shanghai Kaiquan

11.1.11.1.Business Description

11.1.11.2.Product Portfolio

11.1.11.3.Collaborations & Alliances

11.1.11.4.Recent Developments

11.1.11.5.Financial Details

11.1.11.6.Others

11.1.12. CNP

11.1.12.1.Business Description

11.1.12.2.Product Portfolio

11.1.12.3.Collaborations & Alliances

11.1.12.4.Recent Developments

11.1.12.5.Financial Details

11.1.12.6.Others

11.1.13. LEO Group

11.1.13.1.Business Description

11.1.13.2.Product Portfolio

11.1.13.3.Collaborations & Alliances

11.1.13.4.Recent Developments

11.1.13.5.Financial Details

11.1.13.6.Others

11.1.14. LianCheng Group

11.1.14.1.Business Description

11.1.14.2.Product Portfolio

11.1.14.3.Collaborations & Alliances

11.1.14.4.Recent Developments

11.1.14.5.Financial Details

11.1.14.6.Others

11.1.15. SHIMGE

11.1.15.1.Business Description

11.1.15.2.Product Portfolio

11.1.15.3.Collaborations & Alliances

11.1.15.4.Recent Developments

11.1.15.5.Financial Details

11.1.15.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Application |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.