Asia Pacific Centrifugal Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Overhung Pumps (Vertical Line, Horizontal End Suction), Split Case Pumps (Single/Two Stage, Multi Stage), Vertical Pumps (Turbine (Solid Handling, Non-Solid Handling), Axial, Mixed Flow), Submersible Pumps (Solid Handling, Non-Solid Handling)), By Operation Type (Electrical, Hydraulic, Air Driven), By End User (Residential, Commercial, Agriculture & Irrigation, Industrial), By Country (China, Japan, India, South Korea, Singapore, Rest of Asia Pacific)

- Energy & Power

- Feb 2026

- VI0931

- 140

-

Asia Pacific Centrifugal Pump Market Statistics and Insights, 2026

- Market Size Statistics

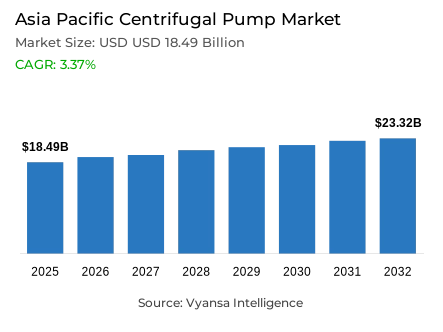

- Asia Pacific centrifugal pump market is estimated at USD 18.49 billion in 2025.

- The market size is expected to grow to USD 23.32 billion by 2032.

- Market to register a cagr of around 3.37% during 2026-32.

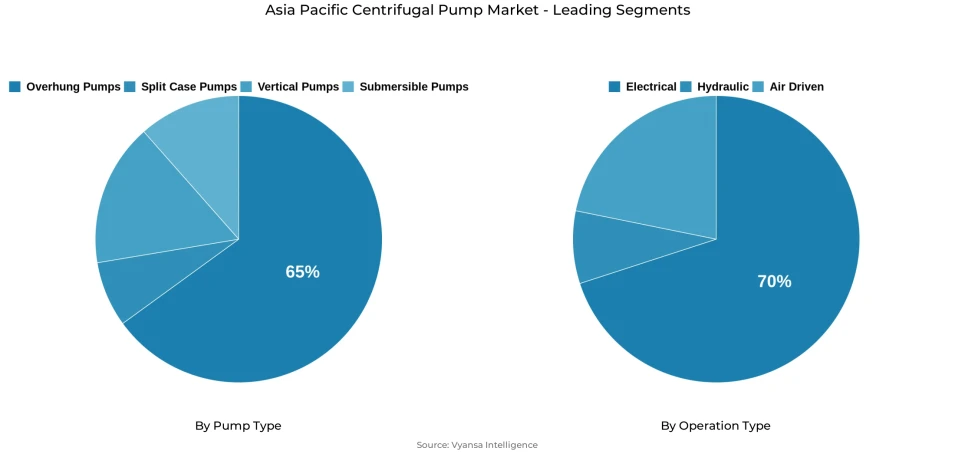

- Pump Type Shares

- Overhung pumps grabbed market share of 65%.

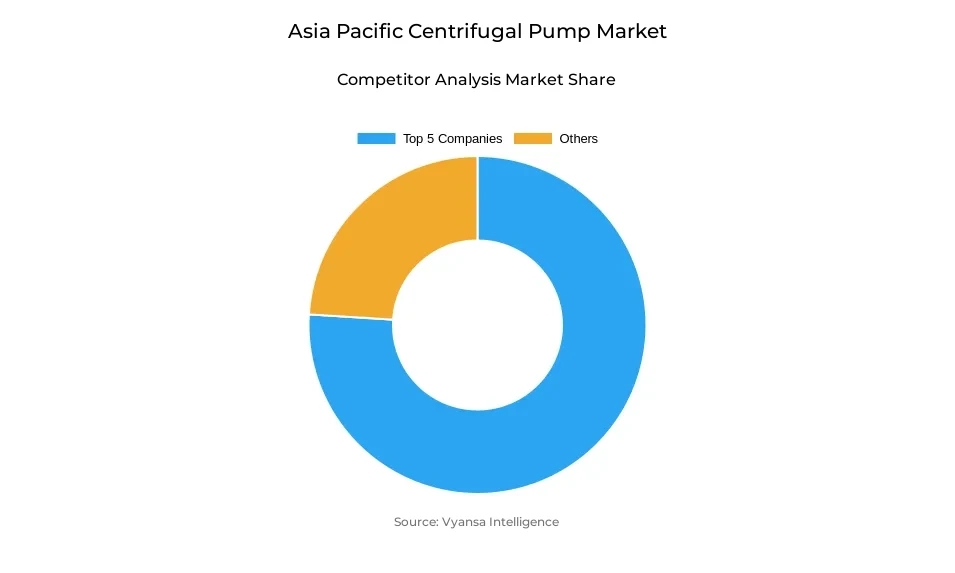

- Competition

- Centrifugal pump in Asia Pacific is currently being catered to by more than 10 companies.

- Top 5 companies acquired the maximum share of the market.

- Sulzer Ltd; Baker Hughes Company; KSB SE & Co. KGaA; Flowserve Corporation; Grundfos Holding A/S etc., are few of the top companies.

- Operation Type

- Electrical grabbed 70% of the market.

- Country

- China leads with a 40% share of the Asia Pacific market.

Asia Pacific Centrifugal Pump Market Outlook

It is expected that the Asia Pacific centrifugal pump market will experience a long-term and structurally-backed growth in 2026-2032, pegged on the continued public-sector investment in water infrastructure in the major economies. The market is estimated at USD 18.49 billion in 2025 and is expected to reach at USD 23.32 billion in 2032 with a CAGR of about 3.37%. This growth is not fuelled by replacement demand in the short term but by multi-year government programmes on water security, flood management, modernization of irrigation, wastewater treatment and hydropower development. Massive investment undertakings in China and India are already being translated into unending acquisition of centrifugal pumping systems in municipal, industrial and agricultural uses.

China is the key driver of growth, with almost 40% of the Asia Pacific market. Its long-term policy alignment is shown by its record investment of 1.35 trillion yuan in water conservancy infrastructure in 2024, as opposed to cyclical spending. Inter-basin water transfer, irrigation upgrades, and hydropower expansion projects generate predictable, multi-year demand pipelines of centrifugal pumps. The parallel movement in India, backed by increasing investments in national water programmes, enhances the stability of demand in the region and supports the belief in the medium-term market visibility.

Technologically, overhung pumps have a market share of 65% due to their compact design, cost-effectiveness, and the ability to install in space-limited infrastructure projects. Their popularity in municipal water distribution, industrial water treatment, and irrigation systems indicates engineering familiarity and low maintenance complexity. The ongoing advances in materials and hydraulic efficiency also make them applicable to high-volume infrastructure deployments.

In practice, centrifugal pumps that are electrically powered represent about 70% of installations, which is indicative of the prevalence of grid-connected infrastructure in the Asia Pacific. The availability of power, compatibility with variable-frequency drives, and consistent continuous-duty operation makes electric systems the choice in large-scale water and industrial facilities. These structural factors combined will help to have a stable and predictable future of the Asia Pacific centrifugal pump market up to 2032.

Asia Pacific Centrifugal Pump Market Growth DriverAccelerating Public Water Infrastructure Expenditure Across Asia Pacific

The current market of the Asia Pacific centrifugal pump is currently supported by an unprecedented surge in government-led spending on water infrastructure, especially in China and India. The 2024 budget of 1.35 trillion yuan by China on water-conservancy infrastructure is an illustration of a planned national priority, which includes flood control, modernisation of irrigation, inter-basin water transfer, and hydropower development. These are capital-intensive projects that require large quantities of centrifugal pumping systems to ensure the effective transportation of water across municipal, industrial, and agricultural systems. The scale of deployment, as shown by millions of jobs generated and years of project pipelines, reflects a long-term need of equipment as opposed to short-cycle procurements.

This regional trend is supported by the growing fiscal obligations of India, where the Ministry of Jal Shakti has budgeted Rs 98,714 crore in FY 2024-25 on water-resource development and management programmes. The World Bank estimates that the investment needs in the water-sector are over USD 1.37 trillion globally, and developing economies are already implementing only a small part of the requirement on an annual basis. This funding gap in structure implies a further growth of public investment, thus stabilizing long-term centrifugal-pump demand in the Asia Pacific in water distribution, irrigation, cooling, and wastewater systems.

Asia Pacific Centrifugal Pump Market ChallengeRising Energy Performance Standards Increasing Compliance Pressure

The increasing regulatory demands in relation to energy efficiency exert structural cost and compliance burdens on manufacturers in the Asia Pacific centrifugal-pump market. International and regional standards like ISO 9906, EN 16480, and the Chinese standard GB 19762 are requiring higher minimum efficiency levels of centrifugal pumps used in industrial and municipal services. Compliance requires significant investment in hydraulic redesign, performance testing, certification processes, and documentation management, especially where the manufacturer is serving multiple geographical markets with different regulatory regimes. The resultant barriers to entry increase development spending and time-to-market.

This difficulty is also increased by the increasing focus on integrated motor-pump efficiency, as opposed to the performance of individual components. According to the International Energy Agency, system-level optimisation with variable-frequency drives can reduce energy use by up to 30%, but the implementation of these technologies increases the complexity of engineering and the cost of manufacturing. To pump suppliers, maintaining cost competitiveness and addressing the various regulatory standards puts pressure on profit margins and capital allocation, particularly to mid-sized manufacturers expanding in Asia Pacific jurisdictions with non-harmonised efficiency frameworks.

Asia Pacific Centrifugal Pump Market TrendDesalination Expansion and Renewable Integration Reshaping Demand

The demand patterns of centrifugal-pumps in the markets of the coastal areas of the Asian Pacific are being transformed by technological advancement in the desalination infrastructure. Water-stressed governments are hastening the installation of large-scale seawater reverse osmosis plants, which require centrifugal pumps of high precision that can maintain high pressure and continuous-duty operation. The Dahej desalination plant in India and the under-construction Perur plant in Tamil Nadu are examples of the growing size of desalination projects, with capacities reaching into the hundreds of millions of litres per day. Pumping equipment is subjected to high reliability and efficiency standards in such facilities.

The simultaneous adoption of renewable energy into desalination systems also affects equipment requirements. Other regional governments such as China are actively connecting desalination plants to solar and wind power to counter the high energy prices in the past. The reduction in the cost of renewable-energy improves the economics of projects and speeds up the implementation of energy-efficient, corrosion-resistant centrifugal pumps tailored to membrane filtration and reverse-osmosis operations. This development is a structural technology trend that broadens the market that can be addressed by conventional water conveyance to specialised, high-performance pumping.

Asia Pacific Centrifugal Pump Market OpportunityGovernment Water Security Programs Creating Multi-Year Demand Visibility

The Asia Pacific water-security projects in the public sector create a long-term procurement visibility to centrifugal-pump suppliers. In India, the Jal Jeevan Mission and Namami Gange Programme are large-scale programmes that create ongoing demand in the pumping systems in rural water supply, sewage treatment, and river rejuvenation infrastructure. Policy continuity is seen in central government allocations, such as the Rs 67,000 crore Jal Jeevan Mission in early 2025, which are not a one-time expenditure, and thus guarantee long-term demand stability to equipment suppliers serving municipal and treatment applications.

The continued investments of China in inter-basin water transfers, modernisation of irrigation, and hydropower infrastructure further strengthen this opportunity space. The convergence of water access and renewable-energy goals can be seen in the PM-KUSUM scheme in India, which allowed installing 440,000 solar-powered pumps in FY 2024-25. Together, these efforts establish a positive environment to manufacturers of energy efficient, long life centrifugal-pumping systems that are in line with government procurement priorities across the Asia Pacific centrifugal-pump market.

Asia Pacific Centrifugal Pump Market Country Analysis

By Country

- China

- Japan

- India

- South Korea

- Singapore

- Rest of Asia Pacific

China accounts for approximately 40% of the Asia Pacific centrifugal pump market, underpinned by unmatched infrastructure investment intensity and industrial scale. The country’s 2024 water conservancy expenditure of 1.35 trillion yuan spans flood control, hydropower, irrigation, and municipal water supply projects, each generating substantial demand for centrifugal pumping systems. These investments are reinforced by China’s manufacturing sector, which represents nearly 29% of global industrial output and requires extensive pumping infrastructure for cooling, processing, and wastewater management.

China’s market leadership reflects structural advantages including centralized planning, rapid project execution, and strong alignment between infrastructure investment and domestic manufacturing capacity. Large-scale initiatives such as the South-to-North Water Diversion project create multi-year procurement pipelines for advanced pumping systems. Combined with rising adoption of energy-efficient and digitally monitored pumps, China’s 40% regional share is expected to remain structurally intact throughout the 2026-2032 forecast period.

Asia Pacific Centrifugal Pump Market Segmentation Analysis

By Pump Type

- Overhung Pumps

- Vertical Line

- Horizontal End Suction

- Split Case Pumps

- Single/Two Stage

- Multi Stage

- Vertical Pumps

- Turbine

- Solid Handling

- Non-Solid Handling

- Axial

- Mixed Flow

- Turbine

- Submersible Pumps

- Solid Handling

- Non-Solid Handling

Overhung pump configurations dominate the Asia Pacific centrifugal pump market, accounting for approximately 65% of total demand. Their leadership is rooted in compact design, installation flexibility, and cost efficiency, making them well suited for municipal water distribution, industrial water treatment, and chemical processing facilities with constrained space requirements. Overhung designs have demonstrated consistent operational reliability across diverse environmental conditions, reinforcing confidence among end users deploying pumps at scale across urban and industrial infrastructure projects.

The sustained 65% market share reflects cumulative engineering familiarity and ease of maintenance relative to alternative configurations. Manufacturers continue enhancing overhung pumps through improved metallurgy, bearing systems, and hydraulic efficiency, extending service life and reducing downtime. Multi-stage overhung variants are increasingly adopted in irrigation and long-distance water transfer applications requiring higher head pressures. As baseline infrastructure investment expands, overhung pumps will remain the preferred configuration through the 2026-2032 period, anchoring overall market volumes.

By Operation Type

- Electrical

- Hydraulic

- Air Driven

Electrically powered centrifugal pumps represent roughly 70% of operational installations across the Asia Pacific region, reflecting the dominance of grid-connected infrastructure in industrial, municipal, and agricultural applications. Electric motor-driven systems offer standardized integration with established power networks, enabling reliable continuous operation in water treatment plants, manufacturing facilities, refineries, and irrigation schemes. Mature supply chains, regulatory familiarity, and long operational track records reinforce end user preference for electrically driven configurations.

The high penetration of electric systems is further supported by the growing adoption of variable-frequency drives, which allow dynamic speed control and improved energy efficiency under variable load conditions. While solar and hybrid-powered pumps are expanding in remote or off-grid applications, their deployment remains limited relative to grid-connected systems. As Asia Pacific economies continue industrial expansion and urban infrastructure development, electrically powered centrifugal pumps will remain the foundational operation type supporting large-scale water and industrial processes.

Various Market Players in Asia Pacific Centrifugal Pump Market

The companies mentioned below are highly active in the Asia Pacific centrifugal pump market, occupying a considerable portion of the market and shaping industry progress.

- Sulzer Ltd

- Baker Hughes Company

- KSB SE & Co. KGaA

- Flowserve Corporation

- Grundfos Holding A/S

- Xylem Inc.

- Ebara Corporation

- Kirloskar Brothers Limited

- The Weir Group PLC

- Dover Corporation

- Flowrox

- ITT Corporation

Market News & Updates

- Baker Hughes Company, 2025:

Baker Hughes signed a strategic Memorandum of Understanding with PETRONAS on July 14, 2025, establishing collaborative technology solutions for Asia-Pacific energy expansion and transition, while simultaneously announcing expansion of its Malaysia aeroderivative gas turbine module repair services facility with disassembly, assembling, grinding, and testing capabilities targeting 600+ installed turbines across the region. The company participated in the 8th China International Import Expo (CIIE 2025) showcasing advanced electrification technologies and signed complementary memoranda of understanding with CNPC and CNOCC for energy transition collaboration. Most significantly, Baker Hughes secured a multi-year contract from Kuwait Oil Company in December 2025 to supply electrical submersible pumps integrated with FusionPro intelligent production drive and Leucipa automated field production solution.

- Ebara Corporation, 2025:

Ebara maintains a comprehensive centrifugal pump product portfolio specifically engineered for Asia-Pacific infrastructure and industrial markets, featuring the 3D Series end-suction pumps capable of delivering flow rates up to 138 cubic meters per hour at heads reaching 70 meters, alongside PRK sealless immersion centrifugal pumps optimized for industrial technical fluid applications. The company's Middle East operations expanded the product line with the introduction of new high-performance centrifugal pump series designed to serve evolving demands across Asia-Pacific infrastructure development, petrochemical processing, and water treatment applications, strengthening competitive positioning in the region's fastest-growing industrial pump markets.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Asia Pacific Centrifugal Pump Market Policies, Regulations, and Standards

4. Asia Pacific Centrifugal Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Asia Pacific Centrifugal Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Million Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Overhung Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Vertical Line- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Horizontal End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Split Case Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Single/Two Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Multi Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Vertical Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.1. Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.2. Non-Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Axial- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Mixed Flow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Submersible Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Non-Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Operation Type

5.2.2.1. Electrical- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Hydraulic- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Air Driven- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End User

5.2.3.1. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Commercial- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Agriculture & Irrigation- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Industrial- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Country

5.2.4.1. China

5.2.4.2. Japan

5.2.4.3. India

5.2.4.4. South Korea

5.2.4.5. Singapore

5.2.4.6. Rest of Asia Pacific

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. China Centrifugal Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Million Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Operation Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Japan Centrifugal Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Million Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Operation Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. India Centrifugal Pump Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Units Sold in Million Units

8.2. Market Segmentation & Growth Outlook

8.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Operation Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

9. South Korea Centrifugal Pump Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Units Sold in Million Units

9.2. Market Segmentation & Growth Outlook

9.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Operation Type- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

10. Singapore Centrifugal Pump Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.1.2. By Units Sold in Million Units

10.2. Market Segmentation & Growth Outlook

10.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Operation Type- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By End User- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Xylem Inc.

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Ebara Corporation

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Kirloskar Brothers Limited

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Sulzer Ltd

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Baker Hughes Company

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. KSB SE & Co. KGaA

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. The Weir Group PLC

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Dover Corporation

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Flowrox

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. ITT Corporation

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Operation Type |

|

| By End User |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.