UAE Wood Coatings Market Report: Trends, Growth and Forecast (2026-2032)

Resin Type (Polyurethane, Acrylic, Nitrocellulose, Unsaturated Polyester, Others (Alkyd, Vinyl Resins, Epoxy, etc.)), Technology (Waterborne, Solvent-borne, Powder coating, Radiation Cured, Others), Application (Furniture & Fixtures, Doors & Windows, Siding, Others)

- Chemical

- Jan 2026

- VI0657

- 110

-

UAE Wood Coatings Market Statistics and Insights, 2026

- Market Size Statistics

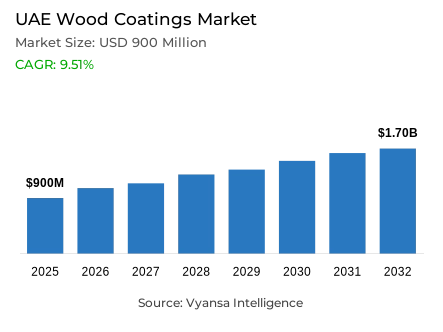

- Wood coatings in UAE is estimated at USD 900 million.

- The market size is expected to grow to USD 1.7 billion by 2032.

- Market to register a cagr of around 9.51% during 2026-32.

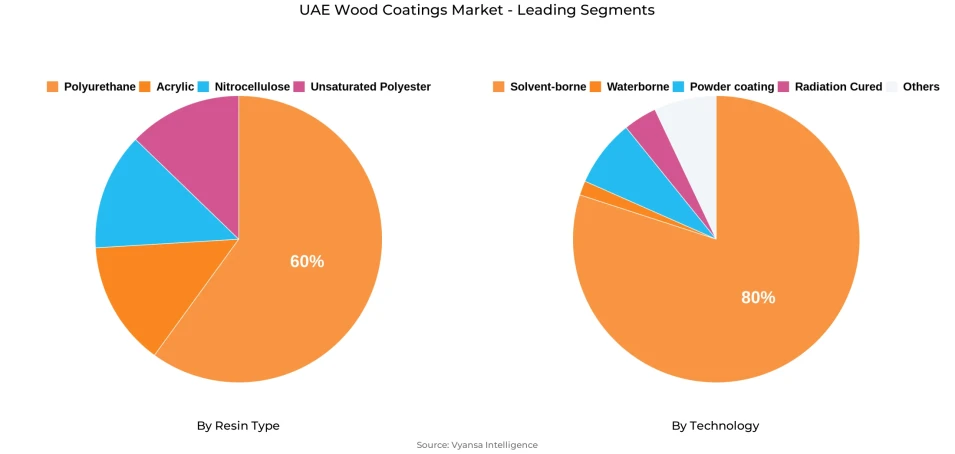

- Resin Type Shares

- Polyurethane grabbed market share of 60%.

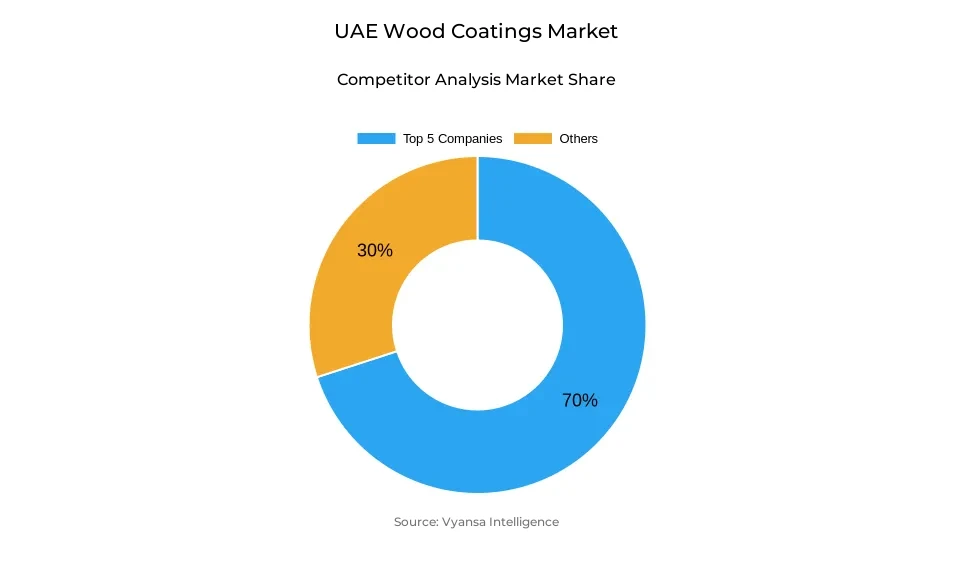

- Competition

- More than 10 companies are actively engaged in producing wood coatings in UAE.

- Top 5 companies acquired around 70% of the market share.

- Asian Paints; Jotun; Kansai Paint Co.; Akzo Nobel N.V.; PPG Industries Inc. etc., are few of the top companies.

- Technology

- Solvent-borne grabbed 80% of the market.

UAE Wood Coatings Market Outlook

The UAE Wood Coatings Market, which was estimated at approximately USD 900 million in 2025, is estimated to grow to almost USD 1.7 billion by 2032 at a CAGR of approximately 9.51% between 2026-2032. Large-scale investments in infrastructure and hospitality projects underpin robust market growth, with more than 100 hotel developments under construction and thousands of additional residential units in the pipeline throughout Dubai and Abu Dhabi. Ongoing construction of luxury resorts, branded residences, and premium housing maintains healthy demand for long-lasting and visually attractive coatings utilized for interior wood applications.

Constant demand also arises from increased emphasis on luxury interiors and top-notch wood finishes. Property developers and end users alike seek satin and matte appearances that exude elegance and current design fashion. Approximately 70% of luxury apartments today boast innovative coated wood components, especially in hospitality and residential developments that highlight craftsmanship and enduring durability. This follows the trend of increased use of UV-resistant long-life coating systems appropriate for upscale environments.

However, the market faces supply chain complexities due to the UAE’s reliance on imported timber and coating materials. Limited local resources and strict environmental mandates-such as Dubai’s Green Building Regulations and Estidama standards-have made it necessary for producers to adopt low-VOC, sustainable formulations. These requirements are driving innovation toward waterborne and eco-certified coatings that meet international green building norms.

By type of resin, polyurethane has a commanding 60% market share, prized for its high endurance, quick curing, and versatility in diverse applications. Solvent-borne coatings have an 80% share by technology, holding onto popularity due to their consistent adhesion and weather stability. These indicate combined trends that mark a steadily changing market led by luxury building, sustainability objectives, and performance-oriented coating technologies.

UAE Wood Coatings Market Growth Driver

Expanding Infrastructure and Hospitality Investments Supporting Market Growth

The UAE's building environment is witnessing dramatic change with high-value government and private investments in hospitality and residential infrastructure. The nation had 102 hotels in the pipeline as of Q1 2025, with 27,279 rooms, and 327 projects are advancing across the Middle East. Dubai alone added 12 hotels with 2,700 new rooms during the first half of 2024 and is scheduled to complete 40 more projects by 2025 year-end. At the same time, Abu Dhabi is managing 619 infrastructure projects worth more than AED 200 billion, including 33,074 residential units to be completed by 2029. Such projects heavily utilize coated wood for interiors-especially hospitality suites, lobbies, and cabinetry—creating consistent demand for high-performance coatings offering durability and appearance suitable to the UAE's extreme climate.

The intersection of high-end tourism and urban residential growth supports consistent consumption of coated wood systems, which make up almost 40-50% of the interior solutions in high-end developments. Long-term market development for manufacturers of factory-finished coatings specifically designed for both performance and aesthetics is supported by this consistent pipeline of upscale projects. The emphasis on high-end interior design coupled with increasing occupancy levels in hospitality and residential developments continues to drive robust prospects for creative, long-lasting, and visually elegant coating solutions throughout the rapidly changing built environment of the UAE.

UAE Wood Coatings Market Challenge

Complex Supply Chain Dynamics and Material Sourcing Limitations

The UAE's scarce indigenous forestry resources-under 1% of land area-require total reliance upon imported wood and engineered wood products, presenting logistical and cost challenges for coating producers. Based on FAO statistics, the Middle East has only 44 million hectares of forest, which accounts for 4% of global coverage, limiting local sourcing on an economic basis. Supply limitations are reinforced by international geopolitical disruptions that impact coating raw materials availability and cost stability, making project schedules challenging and procurement efficient.

Additionally, adherence to Dubai Green Building Regulations and Abu Dhabi sustainability requirements necessitates low-VOC, environmentally friendly coating formulations, which force manufacturers to invest in reformulation and testing. The market is also defined by consolidation among a limited number of large suppliers, with minimal regional production capacity for advanced coatings. Smaller manufacturers and furniture makers are thus forced to carry higher inventories and experience longer lead times. This complex supply chain, along with strict environmental compliance requirements, is a cost- and complexity-adder, affecting procurement practices and operational agility in the wood coatings industry.

UAE Wood Coatings Market Trend

Transition Toward Sustainable Building and Environmental Compliance

Green building requirements have become a signature characteristic of the UAE's building sector, making sustainability an absolute requirement in material choice. Dubai Green Building Regulations now require low-VOC coatings and sustainable practices in all new building projects, while new 2024 municipal codes require sustainable materials and third-party certification standards like Estidama and LEED. The UAE Nationally Determined Contribution seeks to reduce national emissions from 208 to 182 MtCO₂e by 2030, with the building sector accounting for 85% of the reduction, translating into increased demand for low-emission coatings in all finishing applications.

The trend is driven by increasing compliance with LEED, BREEAM, and International Living Future Institute certification, as firms embrace Life Cycle Assessments and passive design. Waterborne, bio-based, and zero-VOC technologies are favored in specifications to enhance indoor air quality. The mass conversion is an example of a structural market shift, forcing coating manufacturers to focus on open environmental credentials, third-party compliance, and R&D spending in eco-certified formulations that meet international best practices.

UAE Wood Coatings Market Opportunity

Growing Preference for Luxury Interiors and Premium Wood Finishes

The UAE’s expanding affluent population and rising number of international residents are fueling demand for premium wood finishes that reflect modern aesthetics and cultural refinement. Abu Dhabi’s residential market saw a 17.3% annual price increase in 2025, with luxury apartment values up 28.7% since 2020, underscoring strong purchasing power. About 70% of high-end apartments today utilize premium wood coatings, especially satin and matte finishes, which account for 60% of new installations. This trend towards natural, subtle styles follows international design trends focusing on authenticity and craftsmanship.

Branded residential complexes like Mandarin Oriental and Nobu Residences on Saadiyat Island are opening new horizons for decorative and protective coating systems. In the same vein, hospitality developments such as the Wynn Al Marjan Island hotel, with 1,542 rooms and extensive wood interior finishes, highlight increased demand for UV-resistant, durable coatings appropriate for luxury settings. Growing e-commerce and the penetration of international furniture firms are further increasing availability of designer wood items, thus fueling continued growth for high-performance, attractive coatings in both residential and commercial end-user markets.

UAE Wood Coatings Market Segmentation Analysis

By Resin Type

- Polyurethane

- Acrylic

- Nitrocellulose

- Unsaturated Polyester

Polyurethane coatings represent the largest segment in the UAE Wood Coatings Market, holding around 60% of the resin type segmentation. They provide exceptional durability, UV resistance, and heat and humidity resistance-essential for the UAE desert environment. Their quick curing times, normally within two hours, minimize site labor by approximately 30%, presenting a huge boon for developers with tight construction timetables. Its versatility in residential, commercial, and hospitality settings enables broad applications in both protective and decorative purposes, offering the satin and matte finishes desired in upscale interiors.

Factory-applied coating systems more and more combine polyurethane with UV-cure technologies, providing greater consistency and less downtime production. Versatility of the material-compatible with both waterborne and solvent-borne systems-allows manufacturers to maintain environmental compliance along with outstanding surface performance. This synergy of visual flexibility, technical dependability, and environmental response cements polyurethane as the resin of choice in various end-user applications in the UAE's wood finishing industry.

By Technology

- Waterborne

- Solvent-borne

- Powder coating

- Radiation Cured

- Others

Solvent-based coatings dominate the UAE Wood Coatings Market with a share of around 80% under the technology segmentation. The reason behind their dominant position lies in their unique adhesion, quick curing, and mechanical wear resistance-features needed for the climatic conditions of the region as well as for on-site as well as factory applications. The proven reliability of this technology in diverse environments is the reason why applicators and manufacturers prefer it when they need ensured quality and performance consistency.

Recent innovations have enabled solvent-borne systems to meet Dubai’s low-VOC standards while maintaining durability and gloss retention. SMEs and furniture manufacturers in Sharjah’s free zones rely heavily on this technology due to its affordability, robust supply chains, and compatibility with existing spray infrastructure. Solvent-borne coatings continue to dominate applications in premium decorative finishes, UV-resistant outdoor structures, and high-traffic hospitality interiors. In spite of growing interest in waterborne options, solvent-borne technology continues to be the underpinning solution maintaining aesthetic superiority and functional toughness in the UAE's growing construction and furnishing industries.

List of Companies Covered in UAE Wood Coatings Market

The companies listed below are highly influential in the UAE wood coatings market, with a significant market share and a strong impact on industry developments.

- Asian Paints

- Jotun

- Kansai Paint Co.

- Akzo Nobel N.V.

- PPG Industries Inc.

- The Sherwin-Williams Company

- Nippon Paint Holdings Co. Ltd.

- RPM International Inc.

- Crown Paints Kenya PLC

- National Paints Factories Co. Ltd.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UAE Wood Coatings Market Policies, Regulations, and Standards

4. UAE Wood Coatings Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UAE Wood Coatings Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Resin Type

5.2.1.1. Polyurethane- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Acrylic- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Nitrocellulose- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Unsaturated Polyester- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Others (Alkyd, Vinyl Resins, Epoxy, etc.)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Technology

5.2.2.1. Waterborne- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Solvent-borne- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Powder coating- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Radiation Cured- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Application

5.2.3.1. Furniture & Fixtures- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Doors & Windows- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Siding- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. UAE Polyurethane Wood Coatings Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Technology- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7. UAE Acrylic Wood Coatings Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Technology- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8. UAE Nitrocellulose Wood Coatings Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Technology- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9. UAE Unsaturated Polyester Wood Coatings Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Technology- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Akzo Nobel N.V.

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. PPG Industries, Inc.

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. The Sherwin-Williams Company

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Nippon Paint Holdings Co. Ltd.

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. RPM International Inc.

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Asian Paints

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Jotun

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Kansai Paint Co.

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Crown Paints Kenya PLC

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. National Paints Factories Co. Ltd.

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Resin Type |

|

| By Technology |

|

| By Application |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.