Global Lithium Sulfate Market Report: Trends, Growth and Forecast (2026-2032)

By Grade (Battery Grade, Industrial Grade), By Form (Powder, Crystals), By Application (Battery Electrolytes, Chemical Industry), By End-Use Industry (Battery Manufacturing, Chemicals), By Region (North America, Europe, Asia Pacific)

- Chemical

- Jan 2026

- VI0957

- 215

-

Global Lithium Sulfate Market Statistics and Insights, 2026

- Market Size Statistics

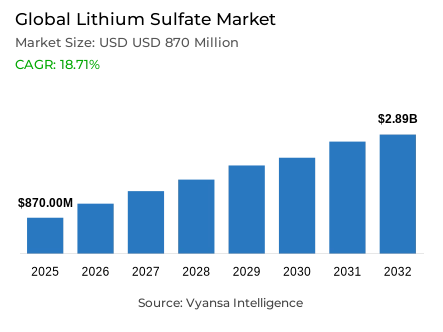

- Global lithium sulfate market is estimated at USD 870 million in 2025.

- The market size is expected to grow to USD 2.89 billion by 2032.

- Market to register a CAGR of around 18.71% during 2026-32.

- Grade Shares

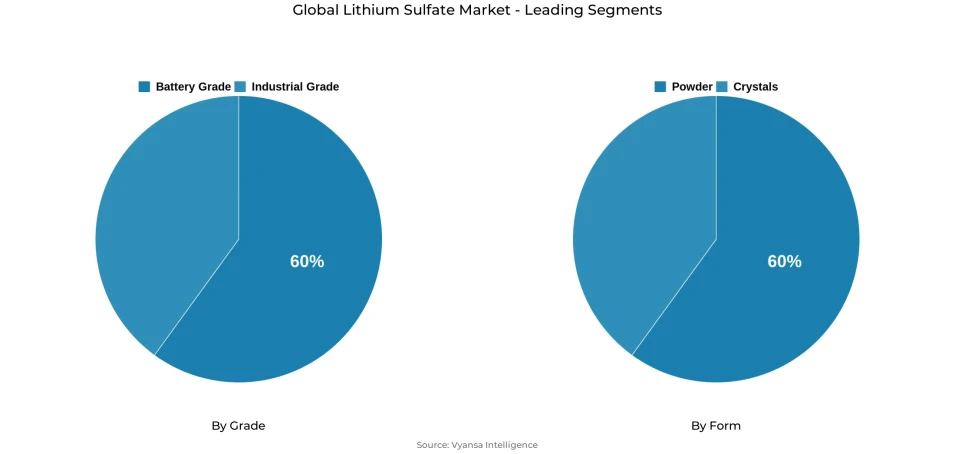

- Battery grade grabbed market share of 60%.

- Competition

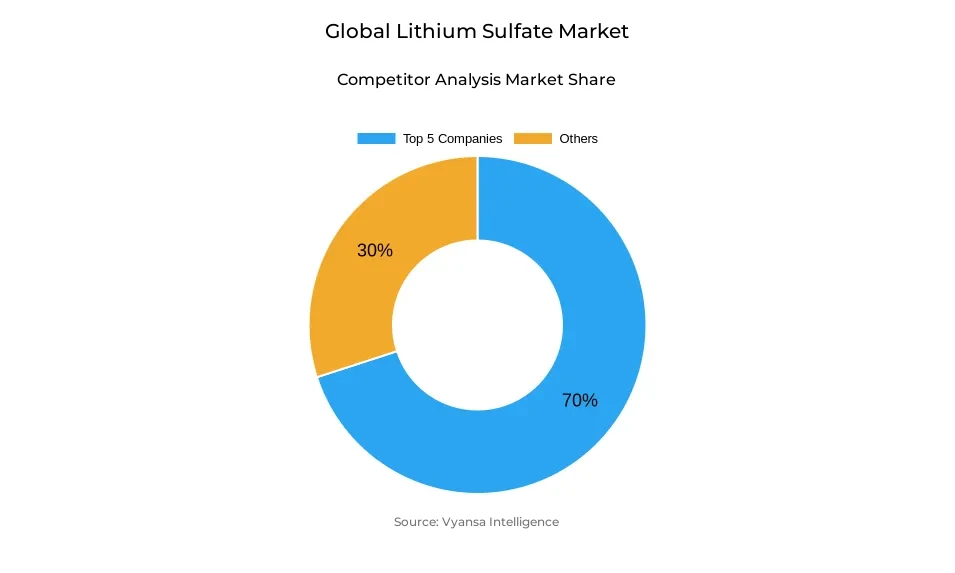

- Global lithium sulfate market is currently being catered to by more than 15 companies.

- Top 5 companies acquired around 70% of the market share.

- Posco; Jiangxi Ganfeng Lithium Co. Ltd.; Lithium Americas Corp.; Albemarle Corporation; Ganfeng Lithium etc., are few of the top companies.

- Form

- Powder grabbed 60% of the market.

- Region

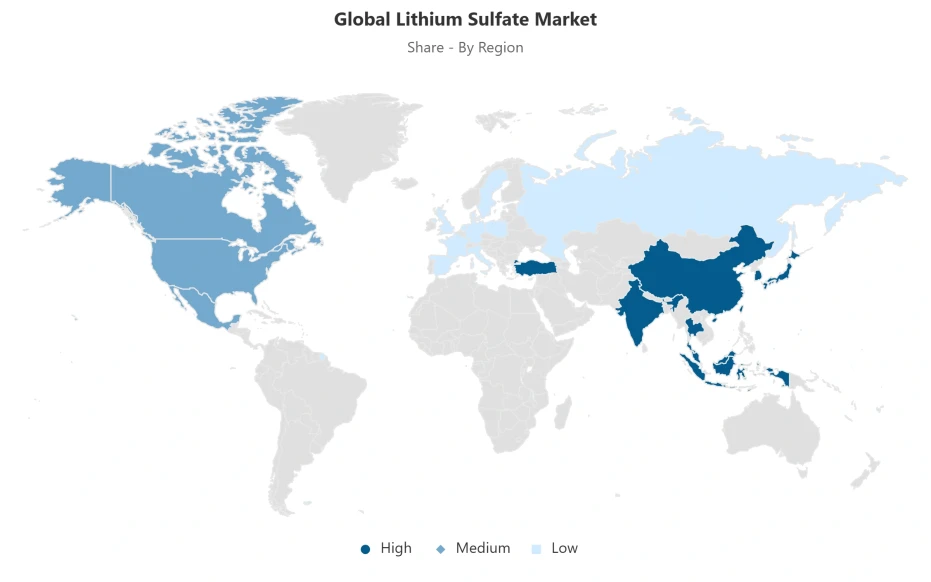

- Asia Pacific leads with a 50% share of the global market.

Global Lithium Sulfate Market Outlook

The Global lithium sulfate market is projected to reach USD 870 million in 2025 and is expected to grow to USD 2.89 billion by 2032 with a CAGR of approximately 18.71% in 2026–2032. This positive growth perspective is largely backed by the fact that the production of electric vehicles across the globe is growing at a very high rate and this has remained the major consumer of lithium in the world. The proportion of lithium used in batteries is almost 90% of the total lithium, as the automotive industry becomes increasingly electrified. In 2024, EV sales exceeded 17 million vehicles worldwide, which is over a fifth of all new vehicles sold worldwide, and this trend is projected to continue to drive battery production throughout the forecast period. With automakers ramping up standardised platforms and gigafactory production, the demand of lithium intermediates like lithium sulfate is becoming more stable and volume-based.

The environmental and regulatory pressures are also a characteristic that has been influencing the availability of lithium sulfate. Lithium mining and subsequent processing is extremely water-intensive, posing structural constraints in large producing areas where freshwater is limited. Since 2021, environmental licensing has become more stringent, water rights have been governed, and sustainability has been subject to scrutiny, which has slowed down project approvals and capacity expansions. These contribute to the decreased responsiveness of lithium sulfate supply to increasing demand, strengthening a structurally tighter market. Consequently, the availability of lithium sulfate is still more affected by regulatory and environmental factors than short-term price indicators.

The development of battery chemistry is still transforming the demand trends of lithium compounds. The increasing use of lithium iron phosphate batteries focuses on cost efficiency, safety and long cycle life, and the further increase in average battery pack size further increases lithium demand even in cases where EV unit growth levels off. Lithium sulfate is applicable in various conversion pathways as an intermediate to facilitate flexible battery material processing. Battery-grade lithium sulfate represents approximately 60% of total demand because of high purity standards, and powder form represents approximately 60%, indicating its applicability to large-scale chemical processing and standardised production.

Regionally, Asia Pacific represents a market that currently consumes around 50% of the global lithium sulfate due to the unparalleled refination, battery production, and EV assembly in the region. The integrated value chains, with the help of innovative policies from the governments, also continue to enhance regional leadership. This hinders the market, making the Asia Pacific the leading source of demand for lithium sulfate market through 2032, thus encouraging the market to expand to meet the global goals of electrification.

Global Lithium Sulfate Market Growth Driver

Electric Mobility Scale-Up Anchors Structural Lithium Demand

The most effective structural force that is influencing the Global lithium sulfate market is accelerating the production of electric vehicles. The consumption of lithium in the world increased dramatically in 2024, with batteries representing almost nine-tenths of all consumption, as the automotive industry continued to electrify. The International Energy Agency affirms that worldwide EV sales have exceeded 17 million units in 2024, or over one-fifth of the global new vehicle sales, and are expected to grow in 2025. This scale effect is directly proportional to increased demand of lithium intermediates, such as lithium sulfate, which is still part of downstream lithium chemical conversion and battery material processing.

Volume-based demand is further enhanced by cost compression across battery packs. According to industry data monitored by the IEA, the costs of lithium-related components per vehicle battery pack decreased significantly in 2022–2024, making them more affordable to end users and increasing the pace of mass-market adoption. With automakers standardizing platforms and gigafactory scale, the demand of lithium sulfate is becoming more resilient to regional economic cycles, pegged by long-term electrification commitments and long-term battery production throughput.

Global Lithium Sulfate Market Challenge

Water Intensity and Environmental Compliance Restrict Supply Expansion

There is a binding constraint on the growth of lithium compound supply through environmental constraints, especially the availability of freshwater. Lithium extraction using brine is still very water-intensive, with millions of litres of water per tonne of lithium extracted, which puts a heavy burden on arid areas of production. In large producing nations, government water authorities and environmental regulators have reported direct competition between lithium production, agriculture, and municipal water supply, and extraction limits are structural, not price-responsive. These pressures have a direct impact on the availability of lithium sulfate, with water demand continuing at both upstream extraction and downstream compound processing phases.

Since 2021, regulatory oversight of water rights, environmental licensing, and ecosystem protection has increased, delaying project approvals and capacity expansions. World Bank evaluations of mining sustainability affirm that water governance has become a bottleneck of critical concern throughout mineral supply chains associated with the energy transition. Despite the technological difference among the extraction processes, water use is inevitable, which restricts the rate at which the supply of lithium sulfate can be adjusted to the fast-growing demand in the world.

Global Lithium Sulfate Market Trend

Battery Chemistry Evolution Alters Lithium Compound Specifications

The battery producers are moving more towards lithium iron phosphate chemistry, and this is redefining demand trends in lithium compounds. LFP batteries are cost stable, safer, and have a longer cycle life, which makes them appealing to both electric vehicles and stationary energy storage. This shift to LFP influences the demand equilibrium of lithium compounds in battery manufacturing. The synthesis of LFP cathodes is usually focused on lithium carbonate, whereas other battery chemistries (NCM, NCA) use different compounds and processing routes. In all battery chemistries, lithium compounds such as lithium carbonate, lithium hydroxide and other intermediates are used based on particular chemistry needs and route optimization.

At the same time, the size of battery packs is growing on average, and the data in the global industry shows that the kilowatt-hour capacity per vehicle is growing steadily every year. This capacity increase has a compounding effect, as the lithium demand increases even when the growth of EV units slows down. The synergistic effect of chemistry transition and increased battery architecture supports lithium sulfate usage, which further supports its applicability in flexible, multi-chemistry battery production ecosystems.

Global Lithium Sulfate Market Opportunity

Public Energy Storage Investment Expands Non-Automotive Demand

The deployment of renewable energy by the government is establishing long-term demand outlets of lithium compounds other than electric vehicles. Grid stationary energy storage systems to provide grid stability, renewable integration, and peak load management are growing at a rapid pace, supported by national decarbonisation goals. Although the deployment of stationary energy storage is accelerating, industry analysis using International Energy Agency data shows that electric vehicles are expected to take up about 90% of the world lithium demand by 2030, with stationary storage making up about 10%. The fixed storage, however, creates a significant secondary demand pillar of lithium compounds in battery material processing, especially with grid-scale deployments increasing at 25% per year.

Domestic refining and secure supply chains are becoming part of energy security in policy frameworks. The energy storage infrastructure and critical mineral processing are still being financed by public financing institutions such as the World Bank in regulated jurisdictions. These efforts prefer standardised, high-purity lithium compounds manufactured under certified procedures, which provide openings to lithium sulfate manufacturers in line with government-supported energy transition policies and long-term grid-scale storage development.

Global Lithium Sulfate Market Regional Analysis

By Region

- North America

- Europe

- Asia Pacific

Asia Pacific commands approximately 50% of global lithium sulfate consumption, reflecting its unmatched concentration of battery manufacturing, refining capacity, and electric vehicle production. Australia's position as the world's largest lithium miner feeds directly into Asia-Pacific processing hubs, while China alone controls a dominant share of global lithium refining and battery cell output. This integrated ecosystem enables efficient conversion of raw lithium into battery-grade compounds, including lithium sulfate, at scale.

Government industrial policies across the region continue reinforcing this dominance through investments in refining, battery manufacturing, and renewable energy storage deployment. National strategies emphasize supply chain security, technology leadership, and downstream value addition, sustaining regional demand for lithium compounds. Rapid expansion of renewable capacity across Asia-Pacific further strengthens lithium sulfate consumption through stationary storage systems supporting grid reliability and clean energy integration.

Global Lithium Sulfate Market Segmentation Analysis

By Grade

- Battery Grade

- Industrial Grade

Battery-grade lithium sulfate dominates grade-based demand, accounting for approximately 60% of the Global lithium sulfate market. This leadership reflects stringent purity requirements imposed by lithium-ion battery manufacturers, where controlled impurity thresholds are essential for cathode synthesis, electrolyte formulation, and conversion into higher-value lithium chemicals. Battery-grade lithium sulfate serves as a critical intermediate, particularly in conversion pathways toward lithium hydroxide, while also supporting specialized battery material processes requiring consistent solubility and ionic behavior.

As global battery manufacturing capacity expands toward multi-terawatt-hour levels, standardization becomes essential for supplier qualification across multiple production sites. Battery-grade specifications enable manufacturers to streamline procurement and ensure uniform performance, reinforcing this segment's dominance. Non-battery applications, including ceramics, glass, pharmaceuticals, and specialty chemicals, collectively represent the remaining 40% of demand, but lack the scale and consistency requirements driving battery-grade adoption.

By Form

- Powder

- Crystals

Battery-related applications represent the core demand base within the Global lithium sulfate market, reflecting lithium's central role in energy storage and electric mobility systems. Electric vehicle batteries account for the largest application share, driven by high-volume cell production, standardized chemistries, and continuous capacity expansion. Lithium sulfate supports these applications indirectly through chemical conversion processes and material preparation stages that underpin large-scale battery manufacturing for automotive end users.

Stationary energy storage systems form the second major application pillar, supported by renewable energy integration and grid modernization programs. Government mandates and utility-scale investments continue to expand deployment of lithium-based storage, increasing compound demand independent of automotive cycles. Other applications, including industrial chemicals and specialty materials, remain comparatively smaller, reinforcing the concentration of lithium sulfate demand within battery-centric energy transition use cases.

Market Players in Global Lithium Sulfate Market

These market players maintain a significant presence in the Global lithium sulfate market sector and contribute to its ongoing evolution.

- Posco

- Jiangxi Ganfeng Lithium Co. Ltd.

- Lithium Americas Corp.

- Albemarle Corporation

- Ganfeng Lithium

- Tianqi Lithium

- SQM

- Livent Corporation

- American Lithium Minerals

- Neo Lithium

- Sichuan Yahua Industrial Group

- Shenzhen Chengxin Lithium Group

- Lithium Energy Japan

- FMC Corporation

Market News & Updates

- Ganfeng Lithium, 2025:

Ganfeng Lithium achieved commercial-scale mass production of lithium sulfide in 2025, a critical electrolyte material for solid-state battery applications, and launched integrated solid-state battery capabilities through its Ganfeng LiEnergy subsidiary. The company's solid-state batteries have been successfully deployed in eVTOL (electric vertical takeoff and landing) aircraft by Farasis Energy, marking the first commercial integration of Ganfeng's proprietary solid-state battery technology in advanced aerospace mobility applications. Ganfeng completed construction of the nation's largest green lithium iron phosphate (LFP) battery recycling facility at Xinyu, Jiangxi in 2025, enabling comprehensive closed-loop battery material recovery and circular economy positioning. The company entered strategic partnerships with international automakers for high-energy lithium anode development targeting next-generation EV battery performance, with sample deliveries to leading humanoid robot manufacturers and pilot production lines achieving mass production readiness for 2026 commercial deployment, solidifying Ganfeng's position as an integrated battery materials and solid-state battery technology supplier.

- FMC Corporation, 2025:

FMC Corporation continues to operate its lithium business and has announced strategic initiatives in 2025 focused on expanding specialty lithium products including lithium sulfate for automotive battery applications. The company maintains operations at multiple production facilities across South America, North America, and Asia-Pacific regions supporting diverse lithium compound applications from battery-grade hydroxide to sulfate products for EV cathode manufacturing. FMC's lithium portfolio benefits from long-term offtake agreements with major automotive manufacturers and battery producers, with the corporation actively participating in supply chain consolidation initiatives across the lithium sector, including strategic partnerships to secure feedstock access and expand production capacity of specialty lithium compounds, particularly battery-grade lithium sulfate and hydroxide products for meeting accelerating electric vehicle demand through 2026 and beyond.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Lithium Sulfate Market Policies, Regulations, and Standards

4. Global Lithium Sulfate Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Lithium Sulfate Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Grade

5.2.1.1. Battery Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Industrial Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Form

5.2.2.1. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Crystals- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Application

5.2.3.1. Battery Electrolytes- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Chemical Industry- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By End-Use Industry

5.2.4.1. Battery Manufacturing- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Chemicals- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Region

5.2.5.1. North America

5.2.5.2. Europe

5.2.5.3. Asia Pacific

5.2.6. By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. North America Lithium Sulfate Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.4. By End-Use Industry- Market Insights and Forecast 2022-2032, USD Million

6.2.5. By Country

6.2.5.1. North America: US

6.2.5.2. Canada

6.2.5.3. Mexico

6.2.5.4. Rest of North America

6.3. North America: US Lithium Sulfate Market Statistics, 2022-2032F

6.3.1. Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.2. Market Segmentation & Growth Outlook

6.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Lithium Sulfate Market Statistics, 2022-2032F

6.4.1. Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.2. Market Segmentation & Growth Outlook

6.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Lithium Sulfate Market Statistics, 2022-2032F

6.5.1. Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.2. Market Segmentation & Growth Outlook

6.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

7. Europe Lithium Sulfate Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.4. By End-Use Industry- Market Insights and Forecast 2022-2032, USD Million

7.2.5. By Country

7.2.5.1. Europe: Germany

7.2.5.2. France

7.2.5.3. UK

7.2.5.4. Italy

7.2.5.5. Spain

7.2.5.6. Netherlands

7.2.5.7. Belgium

7.2.5.8. Russia

7.2.5.9. Poland

7.2.5.10. Turkey

7.2.5.11. Rest of Europe

7.3. Europe: Germany Lithium Sulfate Market Statistics, 2022-2032F

7.3.1. Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.2. Market Segmentation & Growth Outlook

7.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

7.4. France Lithium Sulfate Market Statistics, 2022-2032F

7.4.1. Market Size & Growth Outlook

7.4.1.1. By Revenues in USD Million

7.4.2. Market Segmentation & Growth Outlook

7.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.4.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

7.5. UK Lithium Sulfate Market Statistics, 2022-2032F

7.5.1. Market Size & Growth Outlook

7.5.1.1. By Revenues in USD Million

7.5.2. Market Segmentation & Growth Outlook

7.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.5.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

7.6. Italy Lithium Sulfate Market Statistics, 2022-2032F

7.6.1. Market Size & Growth Outlook

7.6.1.1. By Revenues in USD Million

7.6.2. Market Segmentation & Growth Outlook

7.6.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.6.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

7.7. Spain Lithium Sulfate Market Statistics, 2022-2032F

7.7.1. Market Size & Growth Outlook

7.7.1.1. By Revenues in USD Million

7.7.2. Market Segmentation & Growth Outlook

7.7.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.7.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

7.8. Netherlands Lithium Sulfate Market Statistics, 2022-2032F

7.8.1. Market Size & Growth Outlook

7.8.1.1. By Revenues in USD Million

7.8.2. Market Segmentation & Growth Outlook

7.8.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.8.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

7.9. Belgium Lithium Sulfate Market Statistics, 2022-2032F

7.9.1. Market Size & Growth Outlook

7.9.1.1. By Revenues in USD Million

7.9.2. Market Segmentation & Growth Outlook

7.9.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.9.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

7.10.Russia Lithium Sulfate Market Statistics, 2022-2032F

7.10.1. Market Size & Growth Outlook

7.10.1.1. By Revenues in USD Million

7.10.2. Market Segmentation & Growth Outlook

7.10.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.10.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

7.11.Poland Lithium Sulfate Market Statistics, 2022-2032F

7.11.1. Market Size & Growth Outlook

7.11.1.1. By Revenues in USD Million

7.11.2. Market Segmentation & Growth Outlook

7.11.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.11.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

7.12.Turkey Lithium Sulfate Market Statistics, 2022-2032F

7.12.1. Market Size & Growth Outlook

7.12.1.1. By Revenues in USD Million

7.12.2. Market Segmentation & Growth Outlook

7.12.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.12.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

8. Asia Pacific Lithium Sulfate Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.4. By End-Use Industry- Market Insights and Forecast 2022-2032, USD Million

8.2.5. By Country

8.2.5.1. Asia Pacific: China

8.2.5.2. India

8.2.5.3. Japan

8.2.5.4. South Korea

8.2.5.5. Australia

8.2.5.6. Thailand

8.2.5.7. Rest of Asia Pacific

8.3. Asia Pacific: China Lithium Sulfate Market Statistics, 2022-2032F

8.3.1. Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.2. Market Segmentation & Growth Outlook

8.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

8.4. India Lithium Sulfate Market Statistics, 2022-2032F

8.4.1. Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.2. Market Segmentation & Growth Outlook

8.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

8.5. Japan Lithium Sulfate Market Statistics, 2022-2032F

8.5.1. Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.2. Market Segmentation & Growth Outlook

8.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

8.6. South Korea Lithium Sulfate Market Statistics, 2022-2032F

8.6.1. Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.2. Market Segmentation & Growth Outlook

8.6.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

8.7. Australia Lithium Sulfate Market Statistics, 2022-2032F

8.7.1. Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.2. Market Segmentation & Growth Outlook

8.7.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

8.8. Thailand Lithium Sulfate Market Statistics, 2022-2032F

8.8.1. Market Size & Growth Outlook

8.8.1.1. By Revenues in USD Million

8.8.2. Market Segmentation & Growth Outlook

8.8.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.8.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1. Albemarle Corporation

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2. Ganfeng Lithium

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3. Tianqi Lithium

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4. SQM

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5. Livent Corporation

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6. Posco

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7. Jiangxi Ganfeng Lithium Co., Ltd.

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8. Lithium Americas Corp.

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9. American Lithium Minerals

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Neo Lithium

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

9.1.11. Sichuan Yahua Industrial Group

9.1.11.1. Business Description

9.1.11.2. Product Portfolio

9.1.11.3. Collaborations & Alliances

9.1.11.4. Recent Developments

9.1.11.5. Financial Details

9.1.11.6. Others

9.1.12. Shenzhen Chengxin Lithium Group

9.1.12.1. Business Description

9.1.12.2. Product Portfolio

9.1.12.3. Collaborations & Alliances

9.1.12.4. Recent Developments

9.1.12.5. Financial Details

9.1.12.6. Others

9.1.13. Lithium Energy Japan

9.1.13.1. Business Description

9.1.13.2. Product Portfolio

9.1.13.3. Collaborations & Alliances

9.1.13.4. Recent Developments

9.1.13.5. Financial Details

9.1.13.6. Others

9.1.14. FMC Corporation

9.1.14.1. Business Description

9.1.14.2. Product Portfolio

9.1.14.3. Collaborations & Alliances

9.1.14.4. Recent Developments

9.1.14.5. Financial Details

9.1.14.6. Others

9.1.15. Company 14

9.1.15.1. Business Description

9.1.15.2. Product Portfolio

9.1.15.3. Collaborations & Alliances

9.1.15.4. Recent Developments

9.1.15.5. Financial Details

9.1.15.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Grade |

|

| By Form |

|

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.