Global Graphite Market Report: Trends, Growth and Forecast (2026-2032)

By Type (Natural Graphite, Synthetic Graphite, Spherical Graphite), By Form (Powder, Flake, Spherical), By Application (Battery Anodes, Refractories, Lubricants), By End-Use Industry (Electronics, Automotive, Industrial Manufacturing), By Region (North America, South America, Europe, Asia Pacific)

- Chemical

- Jan 2026

- VI0932

- 200

-

Global Graphite Market Statistics and Insights, 2026

- Market Size Statistics

- Global graphite market is estimated at USD 3.12 billion in 2025.

- The market size is expected to grow to USD 5.78 billion by 2032.

- Market to register a CAGR of around 9.21% during 2026-32.

- Type Shares

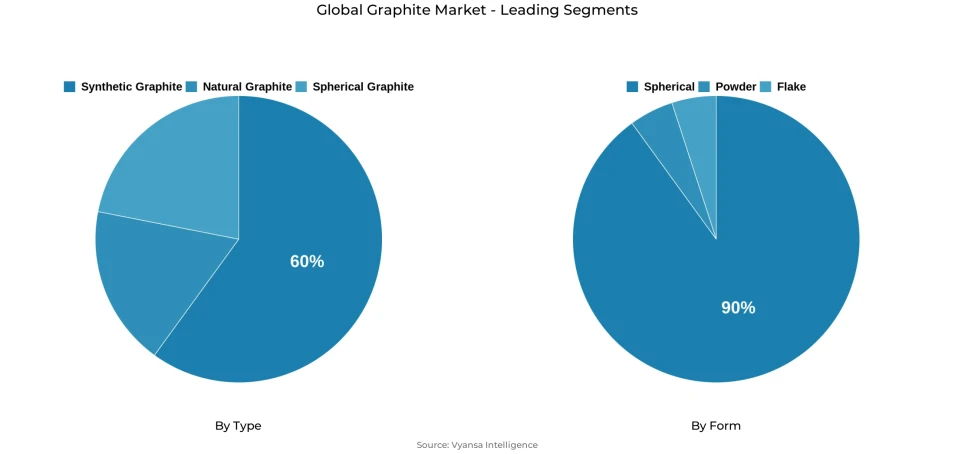

- Synthetic graphite grabbed market share of 60%.

- Competition

- Global graphite market is currently being catered to by more than 15 companies.

- Top 5 companies acquired around 70% of the market share.

- Asbury Carbons; BTR New Energy Materials Inc.; Superior Graphite; Imerys Graphite & Carbon; Syrah Resources etc., are few of the top companies.

- Form

- Spherical grabbed 90% of the market.

- Region

- Asia Pacific leads with a 80% share of the global market.

Global Graphite Market Outlook

The Global graphite market is in a period of structurally-backed growth, mainly due to electrified transportation and battery production. The market is estimated to be USD 3.12 billion in 2025 and USD 5.78 billion in 2032, with a compound annual growth rate of about 9.21% between 2026 and 2032. This expansion is pegged on the implementation of electric-vehicles because graphite is the most common anode material in lithium-ion batteries. The average electric vehicle needs about 50-100 kg of graphite, making EV manufacturing the biggest and most foreseeable demand centre. Battery demand is long-cycle, unlike traditional metallurgical or refractory applications, and is backed by multi-year procurement contracts with battery manufacturers and automotive OEMs.

The market is gradually redefining the demand distribution through clean-energy applications. The most material-intensive use is battery production, and clean-energy applications will likely consume over half of all graphite demand by 2030. This shift promotes long-term investment in mining, purification and anode-grade processing facilities. Meanwhile, the supply-side concentration is also a characteristic limitation, and China controls the production of natural graphite and battery-grade processing. The 2023 export licensing measures have introduced lead-time and compliance complexity, further solidifying supply-chain risk to non-Asian end-users.

Synthetic graphite has a market share of about 60% of the market, which is attributed to its high consistency, purity and performance stability in quality sensitive battery applications. The end users are becoming more concerned with specification compliance and reliability rather than the cost of raw material, which is favouring the premium positioning of synthetic graphite. Natural graphite is still used in cost-driven industrial applications, but is slowly losing market share in high-technology battery applications.

Spherical graphite has nearly 90% of the battery-grade demand because it has a high packing density and electrochemical performance. In the region, Asia-Pacific is the largest consumer with approximately 80 percent of the world consumption, which is backed by its battery production, integrated processing capacity and strong policy backing of electric mobility and clean energy.

Global Graphite Market Growth Driver

Electrification-Driven Expansion in Battery Anode Consumption

The Global graphite market is undergoing a consistently anchored demand growth as electrified transportation redefines material intensity across the automotive value chain. The immediate effect of the rapid adoption of electric vehicles is an increase in the consumption of graphite, which is the most common anode material in lithium-ion batteries. The International Energy Agency estimates that mineral demand associated with clean-energy technologies, such as graphite, will rise by 2030 in the Stated Policies Scenario, highlighting the scale of structural demand acceleration. The most material-intensive use is battery production, with each electric vehicle using approximately 50-100 kg of graphite, making EV production the biggest and most foreseeable demand centre in the market.

Unlike cyclical refractory or metallurgical demand, battery-related demand is long-cycle and platform-based, with end-user multi-year procurement commitments pegged on battery manufacturers and automotive OEMs. By 2030, clean-energy uses will consume 54% of all graphite demand, compared to 33% today, indicating a long-term shift towards battery manufacturing. This shift facilitates long-term investment in mining, purification, and anode-grade processing infrastructure, which strengthens the role of graphite in meeting global net-zero emission goals.

Global Graphite Market Challenge

Structural Vulnerability from Concentrated Global Supply Chains

Supply-side concentration is one of the characteristic limitations of the Global graphite market, especially battery-grade materials. In 2023, China produced about 1.27 metric tonnes of natural graphite, which was about 77% of the world output. More importantly, China dominates an estimated 85 to 95% of the processing capacity of spherical graphite and more than 95% of the manufacturing of synthetic graphite anode-material. Export-licensing procedures implemented in October 2023 on various graphite products have created additional administrative burdens, requiring the disclosure of contracts, technical specifications, and end-user data, which has increased lead times and uncertainty in global battery supply chains.

This concentration causes systemic dependency among non-Chinese battery manufacturers, which restricts the choice of diversification. According to the International Energy Agency, battery-grade graphite is the most concentrated mineral market in the world, and more than 90% of the supply is expected to be based in China by 2030. The western economies are structurally exposed, with the United States having no active graphite mines at present, and Canada and Australia together producing less than 1% of the world production, which increases geopolitical and pricing risks.

Global Graphite Market Trend

Standardization of Spherical Graphite Specifications in Batteries

The standardisation of spherical graphite as the morphology of anode-material of choice is being accelerated by battery performance requirements. Spherical particles provide better packing density, better electronic conductivity, and optimised lithium-ion intercalation than flake or amorphous graphite, which directly facilitates higher energy density and faster charging. With the development of electric-vehicle platforms, original-equipment manufacturers are increasingly requiring strictly regulated spherical particle-size distributions, usually in the 5-20 micrometer range, making alternative forms of graphite inappropriate to next-generation battery designs. This technological change is redefining the quality levels in the Global graphite market.

The purification, granulation, and surface-coating technologies needed to process spherical graphite are highly sophisticated and are currently overwhelmingly concentrated in China. The prevalence of Chinese processors strengthens the role of the Asia-Pacific region as the world leader in the transformation of battery-grade graphite. The lack of processing capacity beyond the area restricts the development of independent supply chains, thus guaranteeing the further dependence on imported spherical graphite by battery producers in Europe and North America.

Global Graphite Market Opportunity

Emerging Role of Battery Recycling in Supply Diversification

Recycling of batteries is becoming a strategically significant avenue to reduce the primary pressure on graphite supply and enhance supply-chain resilience. Today, the world recovers less than 5% of end-of-life lithium-ion battery graphite, which is a significant untapped potential. Recent developments in hydrometallurgical and thermal purification methods now allow recovery purity to reach 99.8% and above, matching the purity of virgin material needed to make battery-anode, such as graphite. Closed-loop systems with recovery yields of over 99.9% have been demonstrated in commercial-scale operations, thus validating technical feasibility in industrial applications.

With the first-generation electric vehicle battery packs having a lifespan of 2025-2028, the volume of recovered graphite will increase significantly. The use of recycled graphite in anode manufacturing helps to achieve sustainability goals among end-users and mitigate the risk of supply associated with mining and the carbon-intensive mining process. The increase in recycling capacity is a twofold advantage, as it will not only alleviate the shortage of raw materials but also enhance the environmental impact of the global graphite market.

Global Graphite Market Regional Analysis

By Region

- North America

- South America

- Europe

- Asia Pacific

Asia Pacific accounted for approximately 80% of global graphite consumption, reflecting the region’s concentration of battery manufacturing, electronics production, and integrated supply chains. China, South Korea, and Japan host the majority of global lithium-ion battery gigafactories, positioning the region as the primary demand center for battery-grade graphite. China alone contributes a majority of global mine production and operates as the dominant processor and spheronization hub, anchoring regional leadership across the entire value chain. Emerging battery manufacturing capacity in India, Vietnam, and Indonesia is further reinforcing regional consumption growth.

Integrated regional supply chains provide Asia-Pacific with structural advantages, combining mining, purification, spheronization, and battery production within efficient logistics networks. Supportive government policies promoting renewable energy, electric mobility, and industrial capacity expansion continue to amplify graphite demand. This integration ensures Asia-Pacific will retain its dominant consumption share through the forecast period, capturing a majority of the value created by the global energy transition.

Global Graphite Market Segmentation Analysis

By Type

- Natural Graphite

- Synthetic Graphite

- Spherical Graphite

Synthetic graphite accounted for approximately 60% of the Global graphite market in 2024, reflecting its strong positioning in quality-sensitive battery anode applications. Produced from petroleum coke through controlled high-temperature processing, synthetic graphite offers superior consistency, lower impurity levels, and enhanced compatibility with advanced coating technologies. These attributes are critical for meeting stringent electrochemical performance requirements demanded by battery manufacturers and original equipment manufacturers, supporting its premium pricing relative to natural alternatives.

Natural graphite retains around 40% market share, supported by cost advantages and established use in refractories, foundries, and steelmaking. However, within battery applications, demand is increasingly shifting toward synthetic and synthetic-coated natural graphite variants, where additional purification and surface treatment add value. End users prioritize specification compliance, supply reliability, and performance stability over raw material cost, reinforcing the structural advantage of synthetic grades in advanced energy storage applications.

By Form

- Powder

- Flake

- Spherical

Spherical graphite is estimated to supply about 90% of the battery-grade material, thus confirming its unquestionable dominance in the Global graphite market. This leadership is based on the strict engineering standards of lithium-ion batteries, where the morphology of the spheres provides the best packing density, the best electronic conductivity, and the best lithium-ion intercalation kinetics. To obtain desired energy density, cycle life, and rapid-charging characteristics, original equipment manufacturers require narrowly controlled distributions of spherical particles, typically between 5 and 20 micrometres. Other types like flake, amorphous and vein graphite do not have the structural homogeneity needed in high-performance battery applications, thus restricting their use in high-performance energy-storage systems.

Non-spherical graphite products are still used by end users in lubricants, foundry, refractories, and specialty industrial applications, where electrochemical performance is not the primary consideration. However, Asia-Pacific region is the leader in processing of spherical graphite, with China controlling most of the world purification, coating and granulation capacity. The battery producers located outside this area are dependent on imported spherical graphite, which increases the downstream supply-chain reliance and spreads the concentration risks beyond the extraction of the raw material to the critical processing phases.

Market Players in Global Graphite Market

These market players maintain a significant presence in the Global graphite market sector and contribute to its ongoing evolution.

- Asbury Carbons

- BTR New Energy Materials Inc.

- Superior Graphite

- Imerys Graphite & Carbon

- Syrah Resources

- Qingdao Haida Graphite Co. Ltd.

- Showa Denko K.K.

- SGL Carbon SE

- Nippon Graphite Industries

- Tokai Carbon Co. Ltd.

- Nacional de Grafite

- Qingdao Tanfeng Graphite Co. Ltd.

- Graphite India Limited

- Focus Graphite Inc.

Market News & Updates

- Syrah Resources Limited, 2025:

Syrah Resources resumed large-scale production at its Balama graphite mine in Mozambique in 2025 following resolution of prior disruptions. In Q3 2025, the company produced 26 kilotonnes of natural graphite, with most volumes sold outside China, supporting diversification of global supply. Balama operates at 350,000 tonnes annual capacity, while Syrah’s Vidalia facility in Louisiana is positioned to supply natural graphite anode material under a multi-year agreement with Lucid Motors starting in 2026.

- SGL Carbon SE, 2025:

SGL Carbon reported weaker H1 2025 performance, with its Graphite Solutions unit generating €221.0 million in sales, reflecting subdued demand from semiconductor and LED customers. The company initiated restructuring measures during Q3 2025 in response to ongoing market softness. For full-year 2025, management expects sales to decline by 10–15% year-on-year and projects adjusted EBITDA of €130–150 million, citing continued uncertainty around semiconductor recovery and electric vehicle market dynamics.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Graphite Market Policies, Regulations, and Standards

4. Global Graphite Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Graphite Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Type

5.2.1.1. Natural Graphite- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Synthetic Graphite- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Spherical Graphite- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Form

5.2.2.1. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Flake- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Spherical- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Application

5.2.3.1. Battery Anodes- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Refractories- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Lubricants- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By End-Use Industry

5.2.4.1. Electronics- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Automotive- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Industrial Manufacturing- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Region

5.2.5.1. North America

5.2.5.2. South America

5.2.5.3. Europe

5.2.5.4. Asia Pacific

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. North America Graphite Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By End-Use Industry- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Country

6.2.5.1. US

6.2.5.2. Canada

6.2.5.3. Mexico

6.2.5.4. Rest of North America

6.3. US Graphite Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Graphite Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Graphite Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

7. South America Graphite Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By End-Use Industry- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Country

7.2.5.1. Brazil

7.2.5.2. Rest of South America

7.3. Brazil Graphite Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

8. Europe Graphite Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By End-Use Industry- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Country

8.2.5.1. Germany

8.2.5.2. France

8.2.5.3. UK

8.2.5.4. Italy

8.2.5.5. Spain

8.2.5.6. Netherlands

8.2.5.7. Belgium

8.2.5.8. Poland

8.2.5.9. Russia

8.2.5.10. Turkey

8.2.5.11. Rest of Europe

8.3. Germany Graphite Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

8.4. France Graphite Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

8.5. UK Graphite Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

8.6. Italy Graphite Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

8.7. Spain Graphite Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

8.8. Netherlands Graphite Market Statistics, 2022-2032F

8.8.1.Market Size & Growth Outlook

8.8.1.1. By Revenues in USD Million

8.8.2.Market Segmentation & Growth Outlook

8.8.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.8.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

8.9. Belgium Graphite Market Statistics, 2022-2032F

8.9.1.Market Size & Growth Outlook

8.9.1.1. By Revenues in USD Million

8.9.2.Market Segmentation & Growth Outlook

8.9.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.9.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

8.10. Poland Graphite Market Statistics, 2022-2032F

8.10.1. Market Size & Growth Outlook

8.10.1.1. By Revenues in USD Million

8.10.2. Market Segmentation & Growth Outlook

8.10.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.10.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

8.11. Russia Graphite Market Statistics, 2022-2032F

8.11.1. Market Size & Growth Outlook

8.11.1.1. By Revenues in USD Million

8.11.2. Market Segmentation & Growth Outlook

8.11.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.11.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

8.12. Turkey Graphite Market Statistics, 2022-2032F

8.12.1. Market Size & Growth Outlook

8.12.1.1. By Revenues in USD Million

8.12.2. Market Segmentation & Growth Outlook

8.12.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.12.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

9. Asia Pacific Graphite Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By End-Use Industry- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Country

9.2.5.1. China

9.2.5.2. India

9.2.5.3. Japan

9.2.5.4. South Korea

9.2.5.5. Australia

9.2.5.6. Thailand

9.2.5.7. Rest of Asia Pacific

9.3. China Graphite Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

9.4. India Graphite Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

9.5. Japan Graphite Market Statistics, 2022-2032F

9.5.1.Market Size & Growth Outlook

9.5.1.1. By Revenues in USD Million

9.5.2.Market Segmentation & Growth Outlook

9.5.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

9.5.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

9.6. South Korea Graphite Market Statistics, 2022-2032F

9.6.1.Market Size & Growth Outlook

9.6.1.1. By Revenues in USD Million

9.6.2.Market Segmentation & Growth Outlook

9.6.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

9.6.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

9.7. Australia Graphite Market Statistics, 2022-2032F

9.7.1.Market Size & Growth Outlook

9.7.1.1. By Revenues in USD Million

9.7.2.Market Segmentation & Growth Outlook

9.7.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

9.7.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

9.8. Thailand Graphite Market Statistics, 2022-2032F

9.8.1.Market Size & Growth Outlook

9.8.1.1. By Revenues in USD Million

9.8.2.Market Segmentation & Growth Outlook

9.8.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

9.8.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Imerys Graphite & Carbon

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Syrah Resources

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Qingdao Haida Graphite Co. Ltd.

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Showa Denko K.K.

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. SGL Carbon SE

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Asbury Carbons

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. BTR New Energy Materials Inc.

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Superior Graphite

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Nippon Graphite Industries

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Tokai Carbon Co. Ltd.

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

10.1.11. Nacional de Grafite

10.1.11.1.Business Description

10.1.11.2.Product Portfolio

10.1.11.3.Collaborations & Alliances

10.1.11.4.Recent Developments

10.1.11.5.Financial Details

10.1.11.6.Others

10.1.12. Qingdao Tanfeng Graphite Co. Ltd.

10.1.12.1.Business Description

10.1.12.2.Product Portfolio

10.1.12.3.Collaborations & Alliances

10.1.12.4.Recent Developments

10.1.12.5.Financial Details

10.1.12.6.Others

10.1.13. Graphite India Limited

10.1.13.1.Business Description

10.1.13.2.Product Portfolio

10.1.13.3.Collaborations & Alliances

10.1.13.4.Recent Developments

10.1.13.5.Financial Details

10.1.13.6.Others

10.1.14. Focus Graphite Inc.

10.1.14.1.Business Description

10.1.14.2.Product Portfolio

10.1.14.3.Collaborations & Alliances

10.1.14.4.Recent Developments

10.1.14.5.Financial Details

10.1.14.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Type |

|

| By Form |

|

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.