UAE Pet Care Market Report: Trends, Growth and Forecast (2026-2032)

By Product (Pet Food (Dry Food, Wet Food, Treats & Mixers), Pet Products (Cat Litter, Pet Healthcare (Veterinary Diets, Probiotics and Supplements, Tele-health Services)), Services (Veterinary Clinics, Pet Insurance, Boarding, Day-Care, and Training), Grooming and Hygiene (Shampoos and Conditioners, Brushes and Combs, Clippers and Scissors)), By Pet Type (Dog, Cat, Others), By Sales Channel (Retail Offline, Retail E-Commerce, Veterinary Clinics)

|

Major Players

|

UAE Pet Care Market Statistics and Insights, 2026

- Market Size Statistics

- Pet Care in UAE is estimated at $ 285 Million.

- The market size is expected to grow to $ 415 Million by 2032.

- Market to register a CAGR of around 5.52% during 2026-32.

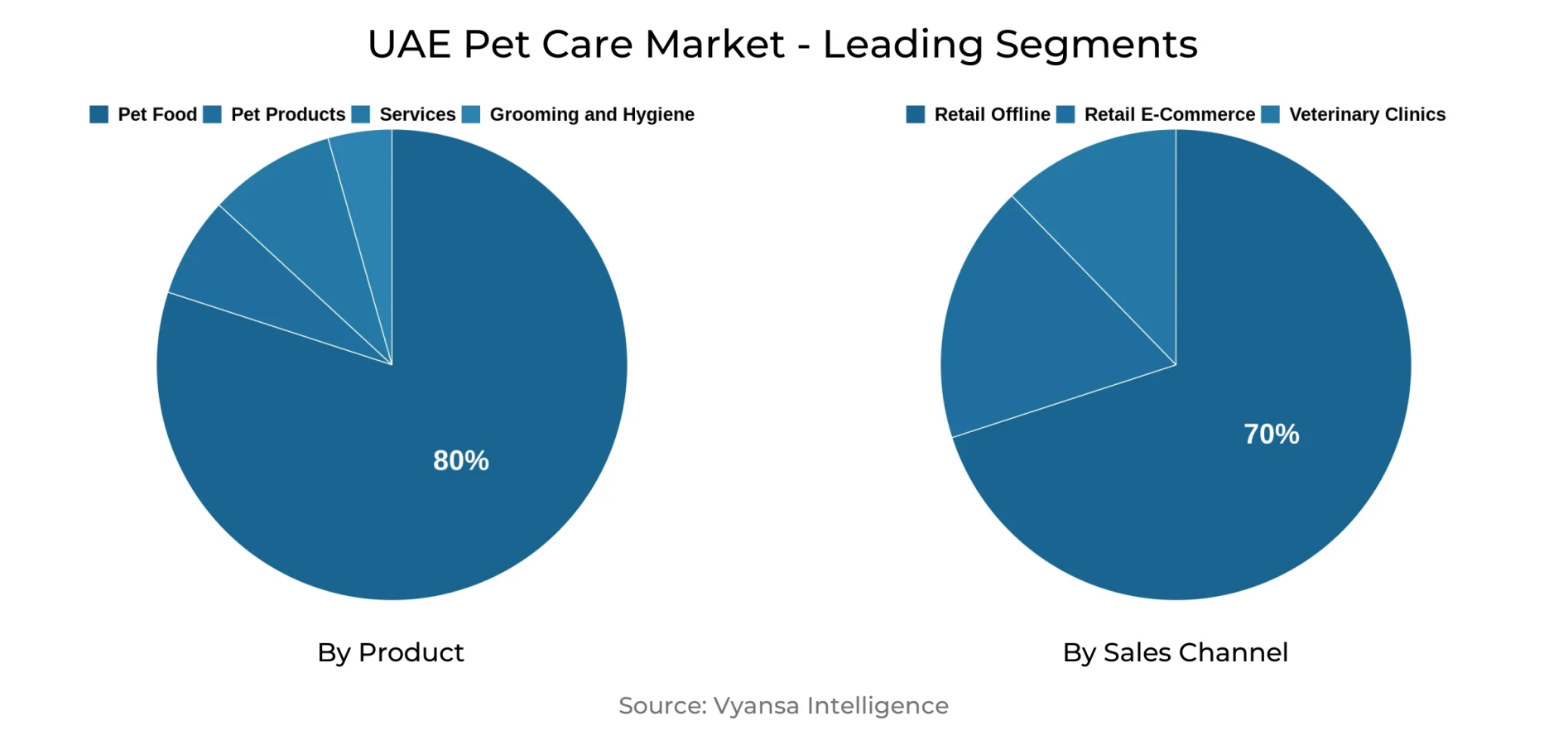

- Product Shares

- Pet Food grabbed market share of 80%.

- Pet Food to witness a volume CAGR of around 4.41%.

- Competition

- More than 15 companies are actively engaged in producing Pet Care in the UAE.

- Top 5 companies acquired 65% of the market share.

- Waitrose Ltd, Charoen Pokphand Group, Thumbay Marketing & Distribution Co, Saint Vincent Group GT LLC, Mars GCC etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 70% of the market.

UAE Pet Care Market Outlook

UAE pet care market is poised for steady growth at USD 285 million, with an expected growth to USD 415 million by 2032. Increasing pet population, aided by increasing disposable income and the humanisation of pets, continues to fuel demand in categories. End users are increasingly treating pets as members of the family, driving up sales of premium food, supplements, accessories, and healthcare. Pet food is likely to be the most vibrant category, with a forecasted volume CAGR of approximately 4.41%, indicative of increasing consumer interest in nutrition and customized diets.

Retail Offline continues to be the leading sales channel, with an approximate 70% market share, and pet shops, superstores, and hypermarkets still forming the core. Shoppers appreciate the ample product range and specialist guidance offered in these stores, which supports their continued relevance even as Retail E-commerce has been growing strongly.

Retail E-commerce will grow substantially with End users who are time-strapped, drawn to convenience, subscription services, and lower prices. Retail online also favors smaller operators, who enter the market without relying on big-box stores. But brick-and-mortar retail will retain its dominance, with most shoppers continuing to shop in stores for human food and health care items.

Overall, the UAE pet market trend is indicative of continued growth, influenced by pet health consciousness, technology-led innovations, and sustainability factors. With rising investments, product innovation, and changing consumer needs, both offline and online platforms are likely to supplement each other to ensure a strong and diversified pet care sector in the near future.

UAE Pet Care Market Growth Driver

Increasing End usership and Health Consciousness Driving Premiumisation

The market is driven by growing End usership and rising disposable incomes, which compels owners to splurge on their pet welfare. Pet humanisation is a key driver, with pets being viewed as family members, resulting in greater demand for premium and bespoke products. The behavior is influencing purchasing habits with owners looking for products that promote comfort and lifestyle for the pets.

Growing awareness around pet health and nutrition also acts as a major driver.Consumers are increasingly interested in nutritionally complete and functional pet food that meets specific dietary requirements. Demand for dietary supplements and specialist healthcare products is also rising as owners prioritize preventive measures and long-term health. These trends combined are compelling the market to premiumisation and broadening product ranges.

UAE Pet Care Market Trend

Innovation Driving Pet Care Advancements

Innovation is emerging as a major trend in the pet care Market, with technology increasingly at the forefront. Devices like wearable health trackers, grooming devices from artificial intelligence, and smart collars are enhancing the monitoring and management of pet health. Such solutions are more convenient for End users and provide improved care and protection for their pets, mirroring the increased expectation for sophisticated and trusted solutions.

Concurrently, innovation can be seen in product innovation. Green products such as biodegradable garbage bags and eco-friendly toys are picking up steam, particularly among young and environmentally aware shoppers. Customized nutrition plans and plant diets are also becoming trendy, providing customized solutions for pets individual needs. These continuous innovations underscore how shifting tastes are propelling the development of pet care in the UAE.

Unlock Market Intelligence

Explore the market potential with our data-driven report

UAE Pet Care Market Opportunity

Growing Role of Retail E-commerce

Retail E-commerce will provide a significant opportunity for the UAE pet care Market, with increasing consumers moving online for convenience and range. Online purchasing will develop strongly with attributes like subscription plans, promotions, and competitive prices that will draw in busy End users and promote repeat business. This will open up new growth opportunities for both dominant brands and new entrants since they can tap into larger audiences without depending on the big retailers.

Concurrently, the key to opportunity will be embracing an omnichannel strategy. As Retail E-commerce grows, pet shops, superstores, and hypermarkets will remain essential by providing in-store experiences and specialist guidance. When these strengths are combined, manufacturers and retailers will be able to meet increasingly varied consumer needs so that Retail E-commerce becomes a driving force for growth in the UAE pet care market in the coming years.

Unlock Market Intelligence

Explore the market potential with our data-driven report

UAE Pet Care Market Segmentation Analysis

By Sales Channel

- Retail Offline

- Retail E-Commerce

- Veterinary Clinics

The segment with the highest market share under the sales channel is retail offline, holding nearly 70% of the UAE pet care market. End users prefer this channel as it offers convenience, allowing them to purchase pet products alongside their regular grocery shopping. The wide selection of products available in pet shops, superstores, and hypermarkets strengthens offline retail as a trusted option for consumers. Additionally, the presence of knowledgeable staff in these outlets adds value, helping pet owners make informed decisions for their pets.

Retail offline continues to dominate as leading retailers expand their offerings and allocate more shelf space to pet products. This ensures greater accessibility and variety, meeting the evolving needs of end user. With its strong end users preference and established presence, retail offline remains the backbone of distribution in the UAE pet care market during the forecast period.

Top Companies in UAE Pet Care Market

The top companies operating in the market include Waitrose Ltd, Charoen Pokphand Group, Thumbay Marketing & Distribution Co, Saint Vincent Group GT LLC, Mars GCC, Nestlé Middle East FZE, Naturally for Pets LLC, Pet Shop LLC, The, Safcol Australia Pty Ltd, Beaphar BV, etc., are the top players operating in the the UAE Pet Care Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UAE Pet Care Market Policies, Regulations, and Standards

4. UAE Pet Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UAE Pet Care Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Pet Food- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Dry Food- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Wet Food- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Treats & Mixers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Pet Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Cat Litter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Pet Healthcare- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.1. Veterinary Diets- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.2. Probiotics and Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.3. Tele-health Services- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Services- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Veterinary Clinics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Pet Insurance- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Boarding, Day-Care, and Training- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Grooming and Hygiene- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Shampoos and Conditioners- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Brushes and Combs- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Clippers and Scissors- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Pet Type

5.2.2.1. Dog- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Cat- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Sales Channel

5.2.3.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Retail E-Commerce- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Veterinary Clinics- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. UAE Pet Food Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Quantity Sold in Kilo Tons

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Pet Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. UAE Pet Product Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Pet Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. UAE Pet Care Service Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Services- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Pet Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. UAE Grooming and Hygiene Pet Care Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Product- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Pet Type- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Saint Vincent Group GT LLC

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Mars GCC

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Nestlé Middle East FZE

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Naturally for Pets LLC

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Pet Shop LLC, The

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Waitrose Ltd

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Gonzalo Zaragoza Manresa SL

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Charoen Pokphand Group

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Thumbay Marketing & Distribution Co

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Beaphar BV

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Pet Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.