UAE Ice Cream Market Report: Trends, Growth and Forecast (2025-2030)

By Category (Frozen Yoghurt, Impulse Ice Cream, Plant-based Ice Cream, Take-Home Ice Cream), By Leading Flavours (Chocolate, Vanilla, Strawberry, Cookies & Cream, Caramel, Mango, Pralines & Cream, Kulfi), By Format (Cup, Stick, Cone, Brick), By Sales Channel (Retail Offline, Retail E-Commerce)

- Food & Beverage

- Dec 2025

- VI0006

- 113

-

UAE Ice Cream Market Statistics and Insights, 2025

- Market Size Statistics

- Ice Cream in UAE is estimated at $ 140 Million.

- The market size is expected to grow to $ 180 Million by 2030.

- Market to register a CAGR of around 4.28% during 2025-30.

- Product Shares Shares

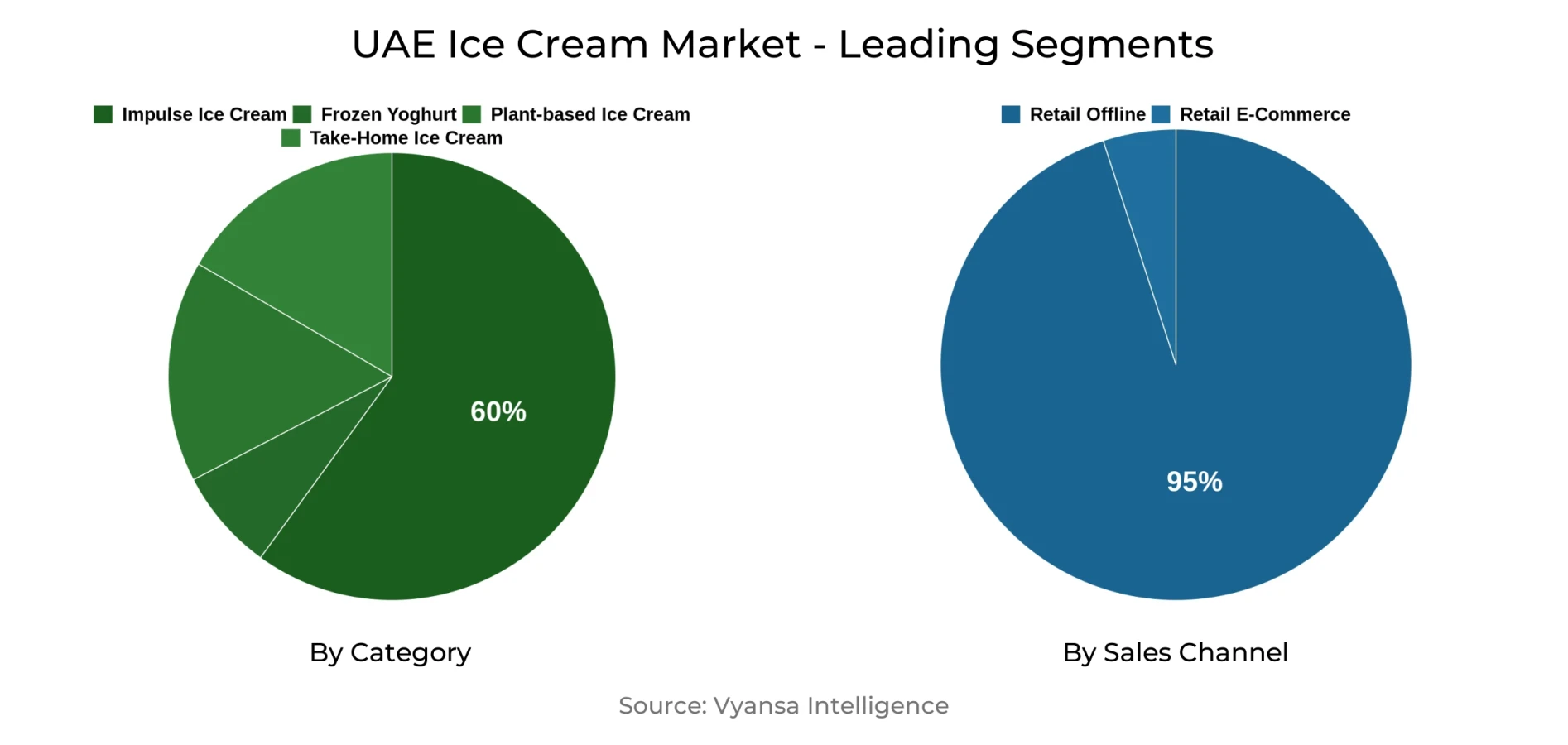

- Impulse Ice Cream grabbed market share of 60%.

- Impulse Ice Cream to witness a volume CAGR of around 3.42%.

- Competition

- More than 10 companies are actively engaged in producing Ice Cream in UAE.

- Top 5 companies acquired 85% of the market share.

- United Foods Co PSC, Graviss Foods Pvt Ltd, Pure Ice Cream Co LLC, IFFCO Group, Unilever Middle East etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 95% of the market.

UAE Ice Cream Market Outlook

The United Arab Emirates ice cream market is under-going a strategic shift, spurred by changing consumer habits and creative brand positioning. Once viewed as a weapon to fight the country's heat, ice cream is increasingly being positioned as a luxury offering, consumed year-round. Ferrero's foray into the UAE market with its luxury ice cream portfolio reflects this shift, tapping into its confectionery heritage to provide rich, luxurious experiences.

In addition to indulgence, health-oriented consumption is also driving the market. Companies such as The Brooklyn Creamery and House of Pops are countering with clean label products—preservative-free, sugar-free, and additive-free—aligned with increasing demand for natural and allergen-free products. Barakat's launch of Froza, an artisanal real fruit ice cream crafted using 100% natural ingredients, also points towards increasing demand for transparent and health-oriented formulations.

E-commerce is becoming a major growth engine, underpinned by advances in logistics and last-mile delivery. Enhanced cold chain facilities and real-time monitoring have made it possible to deliver perishable products like ice cream in a well-timed manner, giving online shopping greater confidence among consumers. Businesses like The Brooklyn Creamery are increasing their online presence to connect with convenience-oriented consumers.

Forward-looking, the UAE ice cream market is projected for consistent growth, driven by growing demand for high-end products, year-round consumption patterns, and growing consumer preference for clean labels. Ongoing innovation in flavour profiles and health-oriented SKUs, combined with improved e-commerce enablement, will define a dynamic and competitive market environment.

UAE Ice Cream Market Challenge

This fresh rule involves color-coded nutritional labeling from A to E. A being the most nutritious and E being the least nutritious. This Nutri- Mark label is put on food groups like oils, milk, drinks etc., including ice cream too. This is going to be a challenge for the manufacturers of ice cream. This is due to the fact that the producers will be required to reformulate the products, change the labelling plans, spend significantly on the high-end quality control etc. This will increase the operational expenditure of the producers. The producers will be forced to raise the prices of the ice cream, which may affect consumer demand. Additionally, the Nutri-Mark will enhance end user's consciousness regarding the products consumed by them. This will affect the volume of sales keeping in view the weakened health as a result of excessive sugar intake and other additives being incorporated in the process of making ice cream.

UAE Ice Cream Market Trend

The consumers are becoming increasingly health conscious. This is giving rise to an increasing trend towards better for you and clean label ice creams. End consumers are now more focused on transparency in nutritional value and sourcing of ingredients. This is compelling the manufacturers to develop new SKUs fusing indulgence with wellness, appealing to end consumers looking for guilt-free enjoyment. For Example, Companies like The Brooklyn Creamery and House of Pops with ice creams that are made without preservatives, refined sugars, or artificial additives, following 100% natural and allergen-free principles. Therefore, this is as per the end users expectation and also propelling the market in the forecast period.

UAE Ice Cream Market Opportunity

The increasing use of e-commerce among well-developed brands is causing the UAE ice cream market to experience a huge opportunity. This is driven by the ever-changing end users desire for convenience and quick delivery. Ice cream manufacturers are stepping up their online presence by enhancing their ecommerce, logistics features like real time tracking, cold chain technology etc. These functionalities have a crucial function for ensuring the quality of the food during the delivery which is critical in the context of perishable items such as ice creams. As an example, The Brooklyn Creamery has widened its selling points for reaching consumers in need of convenience more effectively. Integrating ecommerce and logistics together addresses the growing end user requirements. Thus, leading to subsequent expansion of the overall market in the forecast period and help create competitive differentiation in the UAE ice cream market.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 140 Million |

| USD Value 2030 | $ 180 Million |

| CAGR 2025-2030 | 4.28% |

| Largest Category | Impulse Ice Cream segment leads with 60% market share |

| Top Challenges | Regulatory Pressure Due to Nutri-Mark Labelling |

| Top Trends | Shift Toward Clean-Label and Health-Conscious Offerings |

| Top Opportunities | Rising E-Commerce Integration Enhancing Market Reach |

| Key Players | United Foods Co PSC, Graviss Foods Pvt Ltd, Pure Ice Cream Co LLC, IFFCO Group, Unilever Middle East, Mars GCC FZE, Galadari Ice Cream Co LLC, General Mills Inc, Unipex Dairy Products Co Ltd, Majid Al Futtaim Hypermarkets LLC and Others. |

UAE Ice Cream Market Segmentation Analysis

The leading segment under the category type with the market share of around 60% is Impulse Ice Cream. The dominance of this segment is because of recovery of tourism in the UAE. For Example, the tourism growth in Dubai in 2024 is around 18.72 million international tourists which is 9% YOY higher than last year. In addition, Dubai has also crossed its pre pandemic tourism growth peaks which was 16.73 million international tourists. Still have more potential to welcome more international tourists and could be achieved in the future forecast period. Also, The UAE's hot climatic condition is an important driver of sales for the ice cream since the final consumers require a cooling treat. The final consumers like it convenient which are usually handy in form. Thus, they opt for items like single-serve cups, sticks, and cones etc.

Top Companies in UAE Ice Cream Market

The top companies operating in the market include United Foods Co PSC, Graviss Foods Pvt Ltd, Pure Ice Cream Co LLC, IFFCO Group, Unilever Middle East, Mars GCC FZE, Galadari Ice Cream Co LLC, General Mills Inc, Unipex Dairy Products Co Ltd, Majid Al Futtaim Hypermarkets LLC, etc., are the top players operating in the UAE Ice Cream Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. The UAE Ice Cream Market Policies, Regulations, and Standards

4. The UAE Ice Cream Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. The UAE Ice Cream Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.1.2.By Volume in Million Litres

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Frozen Yoghurt- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.2. Impulse Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.2.1. Single Portion Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.2.2. Single Portion Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.3. Plant-based Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4. Take-Home Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.1. Take-Home Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.1.1. Bulk Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.1.2. Multi-Pack Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.2. Take-Home Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.2.1. Bulk Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.2.2. Multi-Pack Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.By Leading Flavours

5.2.2.1. Chocolate- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.2. Vanilla- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.3. Strawberry- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.4. Cookies & Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.5. Caramel- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.6. Mango- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.7. Pralines & Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.8. Kulfi- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.By Format

5.2.3.1. Cup- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.2. Stick- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.3. Cone- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.4. Brick- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.5. Others (Sandwich, Tub, etc.)- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1. Grocery Retailers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.1. Convenience Retailers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.1.1. Convenience Stores- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.1.2. Forecourt Retailers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.2. Supermarkets- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.3. Hypermarkets- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.4. Food & Drink Specialists- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.5. Small Local Grocers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.2. Retail E-Commerce- Market Insights and Forecast, 2020-2030, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. The UAE Frozen Yoghurt Ice Cream Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Volume in Million Litres

6.2. Market Segmentation & Growth Outlook

6.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

6.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

7. The UAE Impulse Ice Cream Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.1.2.By Volume in Million Litres

7.2. Market Segmentation & Growth Outlook

7.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

7.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

8. The UAE Plant-based Ice Cream Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.1.2.By Volume in Million Litres

8.2. Market Segmentation & Growth Outlook

8.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

8.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

9. The UAE Take-Home Ice Cream Market Statistics, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.1.2.By Volume in Million Litres

9.2. Market Segmentation & Growth Outlook

9.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

9.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. IFFCO Group

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Unilever Middle East

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Mars GCC FZE

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Galadari Ice Cream Co LLC

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. General Mills Inc

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. United Foods Co PSC

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Graviss Foods Pvt Ltd

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Pure Ice Cream Co LLC

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Unipex Dairy Products Co Ltd

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Majid Al Futtaim Hypermarkets LLC

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Leading Flavours |

|

| By Format |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.