UAE Fire Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (Overhung Pumps, Vertical Inline, Horizontal End Suction), Split Case Pumps (Single/Two Stage, Multi Stage)), Positive Displacement Pumps (Diaphragm Pumps, Piston Pumps), By Mode of Operation (Diesel Fire Pump, Electric Fire Pump, Others), By End-User (Residential, Commercial, Industrial)

- Energy & Power

- Feb 2026

- VI0511

- 120

-

UAE Fire Pump Market Statistics and Insights, 2026

- Market Size Statistics

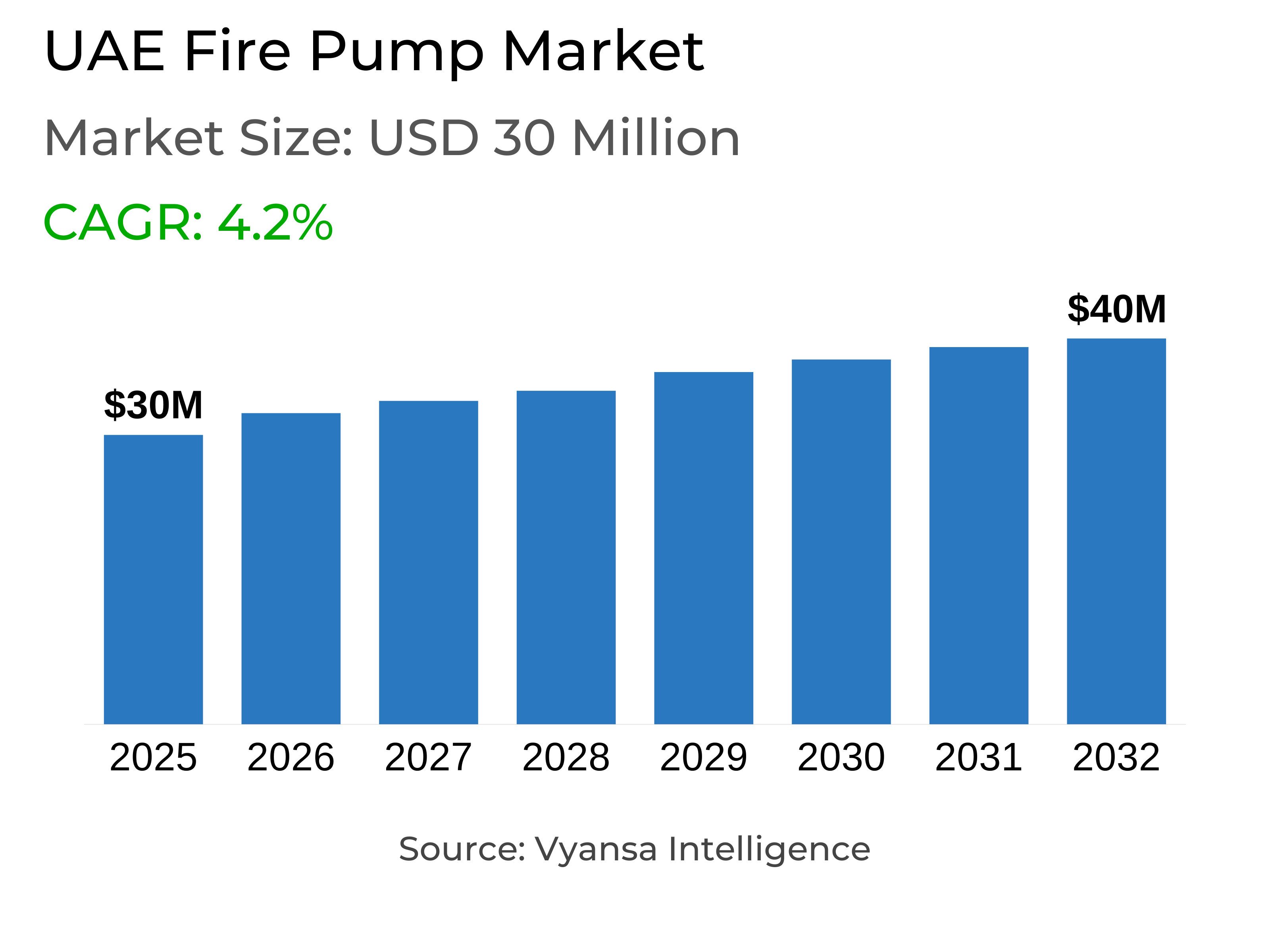

- Fire Pump in UAE is estimated at $ 30 Million.

- The market size is expected to grow to $ 40 Million by 2032.

- Market to register a CAGR of around 4.2% during 2026-32.

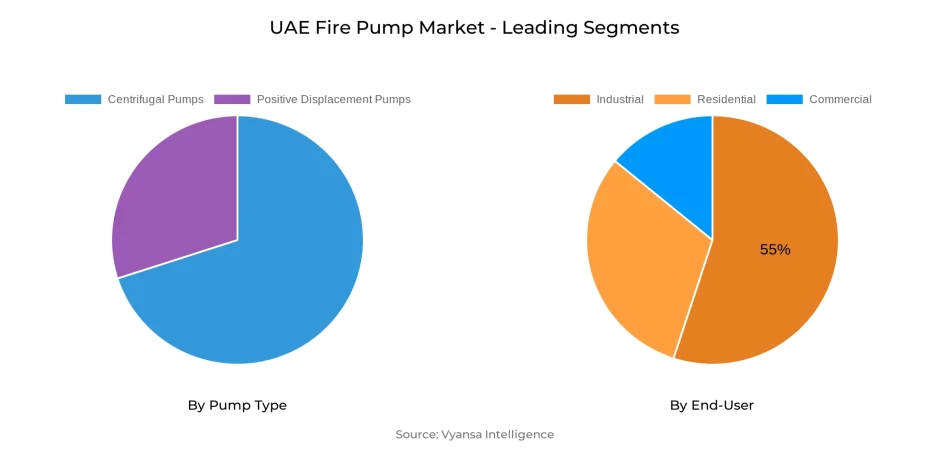

- Pump Type Segment

- Centrifugal Pumps continues to dominate the market.

- Competition

- More than 10 companies are actively engaged in producing Fire Pump in UAE.

- Top 5 companies acquired the maximum share of the market.

- WILO SE, Ebara Corporation, ITT Goulds Pumps, Flowserve Corporation, Pentair PLC etc., are few of the top companies.

- End-User

- Industrial grabbed 55% of the market.

UAE Fire Pump Market Outlook

The UAE Fire Pump Market size stood at USD 30 million in 2025 and is expected to grow at a CAGR of approximately 4.2% from 2026–32, reaching USD 40 million by 2032. This growth is underpinned by the accelerated industrialization in the country, with manufacturing and logistics bases like JAFZA, KEZAD, and Dubai Industrial City driving demand for sophisticated fire safety systems. While industrial activity rises, fire pumps become increasingly necessary to protect valuable assets and maintain compliance with changing safety regulations.

Regulatory compliance is another main driver since constant revisions to the UAE Fire and Life Safety Code and an increase in Dubai Civil Defence's inspection activities compel companies to implement certified and trusted fire pump solutions. While regulatory compliance adds costs to contractors and owners, it also generates consistent demand for efficient, reliable, and technologically advanced pump solutions across industry segments.

Adoption of technology is also transforming the market. AI-integrated and IoT-enabled fire pumps are being implemented in order to improve real-time monitoring, predictive maintenance, and quick response capabilities. With Dubai and Abu Dhabi focusing on smart infrastructure, the adoption of these sophisticated systems will gain pace, enhancing aggregate safety results and supporting long-term market opportunities.

From the point of view of end-users, the industrial sector takes the lead with a 55% market share, which puts it as the largest and fastest-growing application segment. The scope of industrial growth, supported by Operation 300bn and large government-led infrastructure developments, means industrial sites will remain the biggest drivers of fire pump demand, further solidifying their position as the backbone of market growth up to 2032.

UAE Fire Pump Market Growth Driver

Expanding Industrial Base Accelerates Fire Safety Demand

The UAE Fire Pump Market is reaping the rewards of fast industrial growth with the contribution of the sector to GDP rising by 57% and expectations crossing AED 210 billion. Manufacturing alone contributed AED 28.5 billion towards Abu Dhabi non-oil GDP in Q1 2025, making it the main non-oil activity. Dubai Industrial City has seen more than AED 350 million worth of food and beverage investments come in, with 25 firms renting 1.7 million square feet of industrial units, providing a solid foundation for fire safety needs.

The magnitude of this growth reflects the increased need for sophisticated fire protection facilities in factories, warehouses, and logistics centers. Operation 300bn, the UAE national industrial strategy, aims to double the sector's GDP contribution in 2031, requiring strict safety compliance. Since JAFZA accommodates over 8,700 businesses and Dubai Industrial City aims to have 500 operating factories by 2026, fire pump installations are gaining prominence for risk protection and regulatory compliance.

UAE Fire Pump Market Challenge

Regulatory Pressures and Cost Implications

Compliance with evolving fire safety regulations presents significant challenges for market participants. The UAE Fire and Life Safety Code undergoes regular revisions, while Dubai Civil Defence recorded a 35% rise in inspections since 2022, highlighting the growing enforcement pressure. Abu Dhabi’s Circular No. 4 of 2024, granting property owners a two-year compliance period, also reflects widespread retrofit needs and non-compliance risks. These demands are adding pressure on companies' costs, especially when 30% of business properties still need substantial safety improvements.

Contractors and system integrators have to dedicate themselves to ongoing training, certification, and system upgrades to stay compliant, increasing operational costs. Failure to comply can lead to fines between AED 500 and AED 50,000, in addition to project delays and forced business closures for major infractions. Increasing regulatory complexity introduces layers of responsibility, compelling market players to balance technical expertise requirements with rising costs while attempting to achieve steadily increasing safety standards.

UAE Fire Pump Market Trend

Integration of Smart Technologies Reshapes the Market

Adoption of smart technology is transforming the UAE Fire Pump Market, with IoT-based systems witnessing 28% growth in 2024. Dubai Civil Defence launched AI-powered firefighting drones that can respond to incidents within less than 60 seconds, showcasing the government's focus on technology-driven safety solutions. Fire detection sensors based on IoT are increasingly being integrated into building management systems, offering real-time monitoring and minimizing emergency response times. Such developments increase system reliability and overall safety standards.

By 2030, more than 40% of UAE buildings will have adopted AI-based fire detection and suppression systems in line with the country's smart city vision. Wireless mesh alarm systems are also increasingly popular, particularly for retrofitting the country's 220,000 upgraded villas in 2024. Equipped with predictive maintenance, data analytics, and ease of integration into automation platforms, smart fire pump systems are well-placed to enhance efficiency, reduce false alarm rates, and boost proactive hazard management across a wide range of applications.

UAE Fire Pump Market Opportunity

Expanding Infrastructure Fuels Growth Prospects

Massive investment in infrastructure is opening up new opportunities in the UAE Fire Pump Market. In 2024, the government invested AED 66 billion in 144 projects in Abu Dhabi, including housing, education, and industrial developments. Dubai building permits increased by 20% in the first half of 2025, which amounted to more than 30,000 approved permits and 5.5 million square meters of additional built-up area. All such high-scale building work simply translates to increasing need for fire safety equipment, comprising sophisticated pump installation.

Key mega-projects provide substantial scope for specialized fire pump applications. The AED 128 billion expansion of Al Maktoum International Airport and Dubai’s AED 30 billion rainwater drainage project both demand extensive fire protection measures. With the UAE construction sector valued at USD 66.89 billion in 2024 and projected to reach USD 96.06 billion by 2030, the steady flow of projects guarantees long-term opportunities for fire pump suppliers across residential, commercial, and industrial segments.

UAE Fire Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pumps

Under the Pump Type category, centrifugal pumps hold the largest market share due to their reliability and efficient operation. Their capacity to supply high volumes of water at a constant pressure makes them essential for large commercial fire suppression systems in residential buildings, office complexes, and industrial units. Dominance of this segment is an indication of proven success under challenging conditions where long-term operation and low maintenance are essential.

Centrifugal pumps continue to be the favorite of system designers and contractors installing holistic fire safety solutions. Their versatility to suit various applications, combined with affordability and high emergency preparedness, solidifies their market base. While urbanization and industrialization continue to spread in the UAE, the demand for high-capacity and durable pump systems guarantees centrifugal pumps maintain a dominant position, reflecting their central role in protecting assets and lives in different categories of infrastructure.

By End-User

- Residential

- Commercial

- Industrial

Industrial applications represent the largest part of the UAE Fire Pump Market with 55% and are the fastest-growing segment at a CAGR of 4.99%. This dominance mirrors the UAE's ambitious industrialization strategy, aided by Operation 300bn and continued growth in areas such as JAFZA, Dubai Industrial City, and KEZAD. These areas have manufacturing, petrochemical, and logistics businesses that need robust fire protection infrastructure to guard valuable assets and conform to international safety standards.

The size and sophistication of industrial operations call for high-tech fire pump systems that can meet challenging environments, heavy equipment installations, and around-the-clock operations. With ongoing industrial growth, the demand for high-performance pumps should continue to increase, solidifying this segment's leading market share. The industrial end-user population's focus on reliability and robustness underscores its continued significance, positioning it as a bedrock for future market growth in the UAE.

Top Companies in UAE Fire Pump Market

The top companies operating in the market include WILO SE, Ebara Corporation, ITT Goulds Pumps, Flowserve Corporation, Pentair PLC, Sulzer Limited, Grundfos Holding A/S, KSB SE & Co. KGaA, Patterson (Gorman Rupp), Armstrong, etc., are the top players operating in the UAE Fire Pump Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UAE Fire Pump Market Policies, Regulations, and Standards

4. UAE Fire Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UAE Fire Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.1. Overhung Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.2. Vertical Inline- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.3. Horizontal End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.1. Single/Two Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.2. Multi Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Diaphragm Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Piston Pumps - Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Mode of Operation

5.2.2.1. Diesel Fire Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Electric Fire Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End-User

5.2.3.1. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Commercial- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Industrial- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. UAE Centrifugal Fire Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

7. UAE Positive Displacement Fire Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Flowserve Corporation

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Pentair PLC

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Sulzer Limited

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Grundfos Holding A/S

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.KSB SE & Co. KGaA

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.WILO SE

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Ebara Corporation

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.ITT Goulds Pumps

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Patterson (Gorman Rupp)

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Armstrong

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Mode of Operation |

|

| By End-User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.