Thailand Leisure & Business Travel Booking Market Report: Trends, Growth and Forecast (2026-2032)

By Travel Sales Type (Leisure Travel, Business Travel), By Booking Channel (Offline Booking, Online Booking), By Booking Method (Travel Intermediaries, Direct Suppliers)

- ICT

- Nov 2025

- VI0406

- 130

-

Thailand Leisure & Business Travel Booking Market Statistics and Insights, 2026

- Market Size Statistics

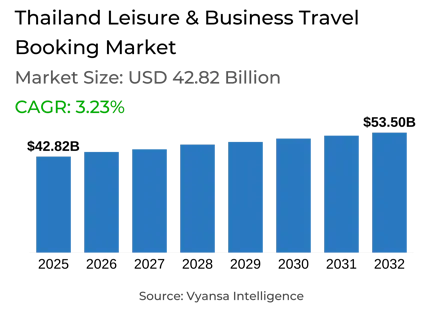

- Leisure & Business Travel Booking in Thailand is estimated at $ 42.82 Billion.

- The market size is expected to grow to $ 53.5 Billion by 2032.

- Market to register a CAGR of around 3.23% during 2026-32.

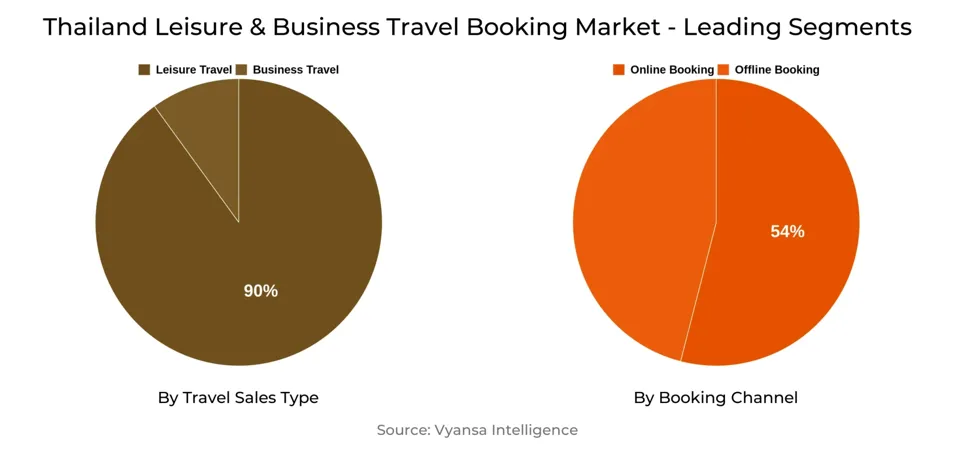

- Travel Sales Type Shares

- Leisure Travel grabbed market share of 90%.

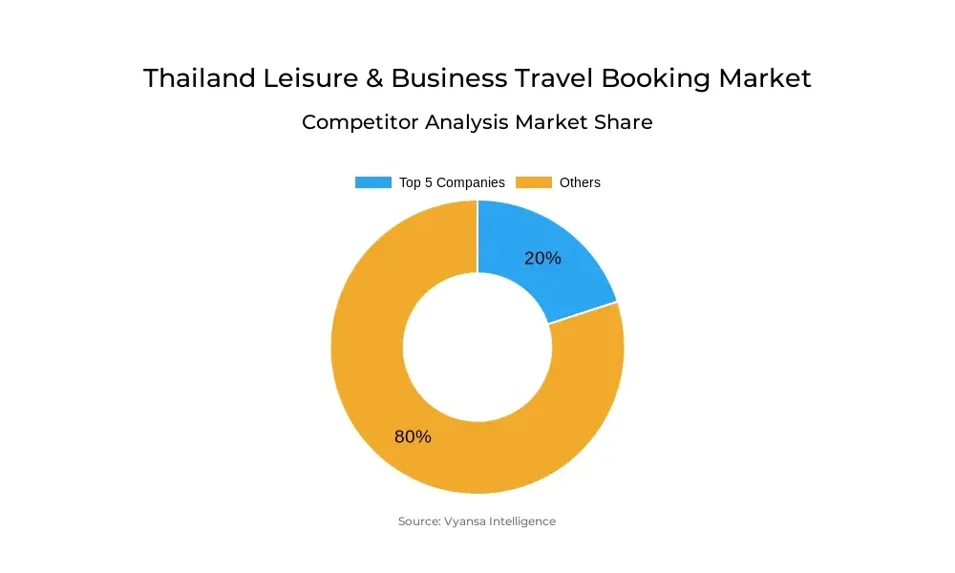

- Competition

- Thailand Leisure & Business Travel Booking Market is currently being catered to by more than 10 companies.

- Top 5 companies acquired 20% of the market share.

- MakeMyTrip Ltd, HIS Tours Co Ltd, Quality Express Co Ltd, Agoda Services Co Ltd, TVLK Services Co Ltd etc., are few of the top companies.

- Booking Channel

- Online Booking grabbed 54% of the market.

Thailand Leisure & Business Travel Booking Market Outlook

The Leisure & Business Travel Booking market in Thailand is estimated at $42.82 billion in 2025 and is projected to reach $53.5 billion by 2032. Online booking already representing 54% of the market. Agoda, Traveloka, and Booking.com remain the behemoths of the OTA space, but they are under threat from hotels, which are nudging direct booking channels. Big hotel groups are rewarding end users with offers like reduced prices, adaptable check-in times, and complimentary food and drink facilities to entice travellers without the intermediary. Loyalty programmes such as Centara's "The1" card also reinforce that trend, drawing domestic tourists towards valuing money via direct bookings.

Government initiatives also facilitate market expansion. The Tourism Authority of Thailand and Ascend Travel collaborated to introduce a tax refund campaign to encourage local tourism and build regional economies. By incentivizing travel outside cities and year-round visitation, the campaign supports Thailand's position as a diverse and accessible destination for travel. It also stimulates longer lengths of stay and increased off-season expenditure, which favors local communities and service providers.

In the forecast period, OTAs will struggle to diversify beyond accommodation as other leisure suppliers like tourist attractions and tour operators adopt direct digital bookings. Travelers are increasingly attracted to the ease of dealing directly with suppliers and customizing their experience. To remain competitive, OTAs will need to provide integrated travel solutions that bring together accommodation with experiences, attractions, and packages.

Concurrently, increasing travel expenses are turning local travellers into price-sensitive end users. This phenomenon presents opportunities for OTAs to be positioned as a one-stop shop with affordable offers, promotions, and packaged services. By focusing on price-sensitive travellers and building service coverage, OTAs can reposition themselves in Thailand's changing travel booking landscape.

Thailand Leisure & Business Travel Booking Market Growth Driver

Direct Booking Incentives

Thailand hotels are more and more encouraging direct booking to gain the attention of travelers, providing incentives like best-rate guarantees, loyalty program discounts, early check-in or late check-out, and food and beverage perks. These incentives make domestic and global tourists book hotels directly, avoiding online travel agencies. Direct booking not only enhances profitability through decreased commission charges but also enhances end user loyalty through tailored offers.

Larger hotel groups like Centara Hotels & Resorts emphasize these benefits to attract both value-conscious travellers as well as travellers looking for more experiences. With direct bookings as their priority, hotels can better control their prices, offer special deals, and offer more personalized service. Direct booking is favouring growth in value sales and playing a significant role in end user decision in the Thailand travel market.

Thailand Leisure & Business Travel Booking Market Challenge

Increasing Travel Expenses and Price Sensitivity

Domestic tourists in Thailand are also growing more price-sensitive as travel costs, such as air travel, fuel, and lodging, continue to be high. This poses a dilemma for travel suppliers who need to compromise on prices while ensuring standards and quality of service. Most travelers specifically look for bargains, promotions, and value-added services, and it becomes tough for suppliers to maintain margins while generating bookings.

Travel intermediaries and hotels are compelled to fulfill these expectations since travellers compare prices among various platforms and opt for those that provide the best value for money. Providers need to constantly innovate in promotion, loyalty schemes, and packages to keep end users interested and enticed to come back again. All this must be achieved while having a deep awareness of end user trends and cost control to compete in Thailand's fluid travel booking sector.

Thailand Leisure & Business Travel Booking Market Trend

Domestic Tourism Promotion

Thailand is seeing an incline towards domestic tourism, facilitated by schemes like tax refund campaigns for domestic travelers. These schemes induce travel from big cities to other parts of the nation, ensuring balanced tourist distribution and local economic support. Travelers are visiting less popular places, leading to longer durations of stay and higher expenditure during off-seasons.

This is a trend that demonstrates a greater end user interest in discovering new places and attempting different experiences within Thailand. Promotional programs and incentives are driving travel behavior, motivating travelers to go beyond the usual tourist destinations. By providing access to a broad array of places, these programs increase the overall attractiveness of Thailand as a destination for year-round travel and help promote sustainable domestic tourism growth.

Thailand Leisure & Business Travel Booking Market Opportunity

Diversification Beyond Lodging

Thailand online travel intermediaries have a chance to diversify their offerings beyond accommodation reservation to encompass experiences, activities, and holiday packages. Most tourists like direct interaction with service providers for activities in order to have options and flexibility. OTAs can gain more market share by providing end-to-end travel solutions through bundling multiple services under one umbrella.

Diversification of offerings by intermediaries allows them to offer convenience to price-conscious travellers, while building trust and credibility as go-to sources for end-to-end travel planning. Package-accommodation with activities or sightseeing can drive total sales, increase length of stay, and build a more immersive travel experience. This strategy keeps OTAs competitive in an environment where standalone accommodation bookings will not necessarily fuel growth.

Thailand Leisure & Business Travel Booking Market Segmentation Analysis

By Travel Sales Type

- Leisure Travel

- Business Travel

The most market-share-under-the-Travel-Sales-Type segment is Leisure Travel, which captured 90% of the market. Leisure travel remains the leading source of Thailand's travel booker market because tourists have a greater preference for holiday experience, such as hotels, resorts, cruises, and attractions. Both outbound and domestic leisure travellers are demanding competitive offers as well as fringe benefits, in turn triggering both direct bookings and intermediaries to react with competitive packages.

Domestic travelers, especially, are moving towards direct bookings with hotels for cheaper rates, rewards loyalty program benefits, and additional comforts like early check-in, late check-out, and food and beverage promotions. Concurrently, online travel agencies such as Agoda, Traveloka, and Booking.com remain central to the mix by facilitating convenient room price, location, and amenity comparison. This helps leisure tourism continue to be the growth driver of the market

By Booking Channel

- Offline Booking

- Online Booking

The most market share holding segment under the Booking Channel is Online Booking, which enjoyed 54% of the market. The online sites continue to be the most dominant in booking due to their convenience, ease of comparison, and opportunity to offer travellers quick access to several lodging and travel choices. The OTAs like Agoda, Traveloka, and Booking.com are still the tourists' first choice, especially in booking hotels and package holidays.

But increasing is a trend towards direct bookings promoted by competitive advantages offered by hotels, loyalty schemes, and extra features for end users. More and more travellers prefer both convenience online and direct communication with suppliers as they want higher value for their money and tailored experiences. Online booking websites are extending their services beyond accommodations to include experiences, activities, and packages in order to stay competitive as they capture changing needs of price-sensitive and experience-driven travellers up to 2026-32.

Top Companies in Thailand Leisure & Business Travel Booking Market

The top companies operating in the market include MakeMyTrip Ltd, HIS Tours Co Ltd, Quality Express Co Ltd, Agoda Services Co Ltd, TVLK Services Co Ltd, Booking.com BV, Expedia Group Inc, Expedia (Thailand) Co Ltd, JTB (TH) Co Ltd, Diethelm (Thailand) Co Ltd, etc., are the top players operating in the Thailand Leisure & Business Travel Booking Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Thailand Leisure & Business Travel Booking Market Policies, Regulations, and Standards

4. Thailand Leisure & Business Travel Booking Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Thailand Leisure & Business Travel Booking Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Travel Sales Type

5.2.1.1. Leisure Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Business Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Booking Channel

5.2.2.1. Offline Booking- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Online Booking- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Booking Method

5.2.3.1. Travel Intermediaries- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Direct Suppliers- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Thailand Leisure Travel Booking Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Travel Sales Type- Market Insights and Forecast 2022-2032, USD Million

6.2.1.1. Leisure Air Travel- Market Insights and Forecast 2022-2032, USD Million

6.2.1.2. Leisure Car Rental- Market Insights and Forecast 2022-2032, USD Million

6.2.1.3. Leisure Cruise- Market Insights and Forecast 2022-2032, USD Million

6.2.1.4. Leisure Experiences and Attractions- Market Insights and Forecast 2022-2032, USD Million

6.2.1.5. Leisure Lodging- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Booking Method- Market Insights and Forecast 2022-2032, USD Million

7. Thailand Business Travel Booking Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Travel Sales Type- Market Insights and Forecast 2022-2032, USD Million

7.2.1.1. Business Air Travel- Market Insights and Forecast 2022-2032, USD Million

7.2.1.2. Business Car Rental- Market Insights and Forecast 2022-2032, USD Million

7.2.1.3. Business Lodging- Market Insights and Forecast 2022-2032, USD Million

7.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Booking Method- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1. Agoda Services Co Ltd

8.1.1.1. Business Description

8.1.1.2. Service Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2. TVLK Services Co Ltd

8.1.2.1. Business Description

8.1.2.2. Service Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3. Booking.com BV

8.1.3.1. Business Description

8.1.3.2. Service Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4. Expedia Group Inc

8.1.4.1. Business Description

8.1.4.2. Service Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5. MakeMyTrip Ltd

8.1.5.1. Business Description

8.1.5.2. Service Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6. HIS Tours Co Ltd

8.1.6.1. Business Description

8.1.6.2. Service Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7. Quality Express Co Ltd

8.1.7.1. Business Description

8.1.7.2. Service Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8. JTB (TH) Co Ltd

8.1.8.1. Business Description

8.1.8.2. Service Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9. Diethelm (Thailand) Co Ltd

8.1.9.1. Business Description

8.1.9.2. Service Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Asian Trails Co Ltd

8.1.10.1. Business Description

8.1.10.2. Service Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Travel Sales Type |

|

| By Booking Channel |

|

| By Booking Method |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.