Europe Pet Insurance Market Report: Trends, Growth and Forecast (2026-2032)

By Animal (Dog, Cat, Others), By Insurance Type (Accident & Illness, Accident only, Others), By Policy Type (Lifetime Coverage, Non-Lifetime Coverage), By Provider (Public, Private), By Sales Channel (Insurance Agency, Broker, Direct, Bancassurance, Others), By Country (Italy, France, Germany, UK, Spain, Denmark, Rest of Europe)

- ICT

- Oct 2025

- VI0553

- 165

-

Europe Pet Insurance Market Statistics and Insights, 2026

- Market Size Statistics

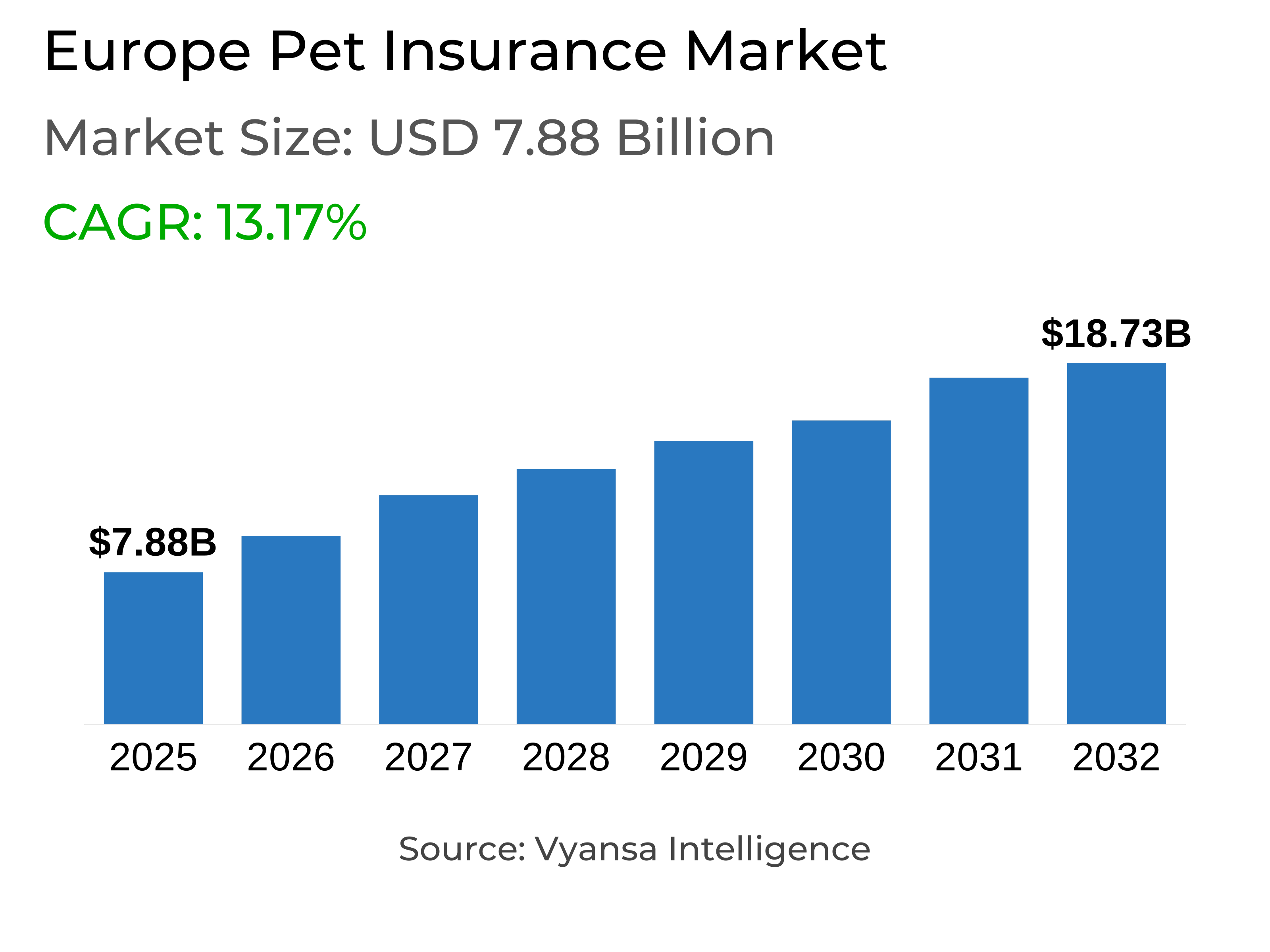

- Europe Pet Insurance Market is estimated at $ 7.88 Billion.

- The market size is expected to grow to $ 18.73 Billion by 2032.

- Market to register a CAGR of around 13.17% during 2026-32.

- Animal Shares

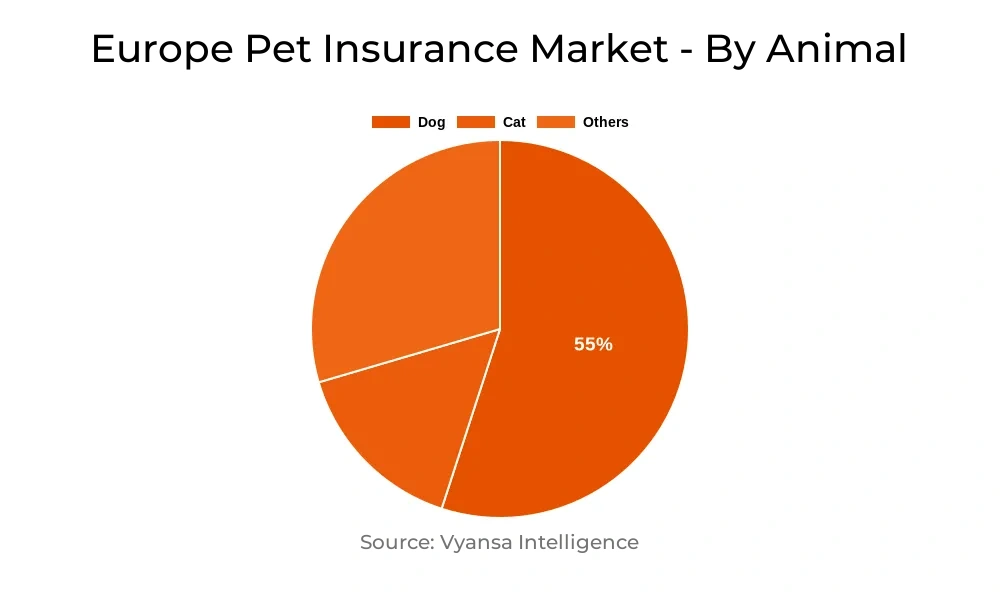

- Dog grabbed market share of 55%.

- Competition

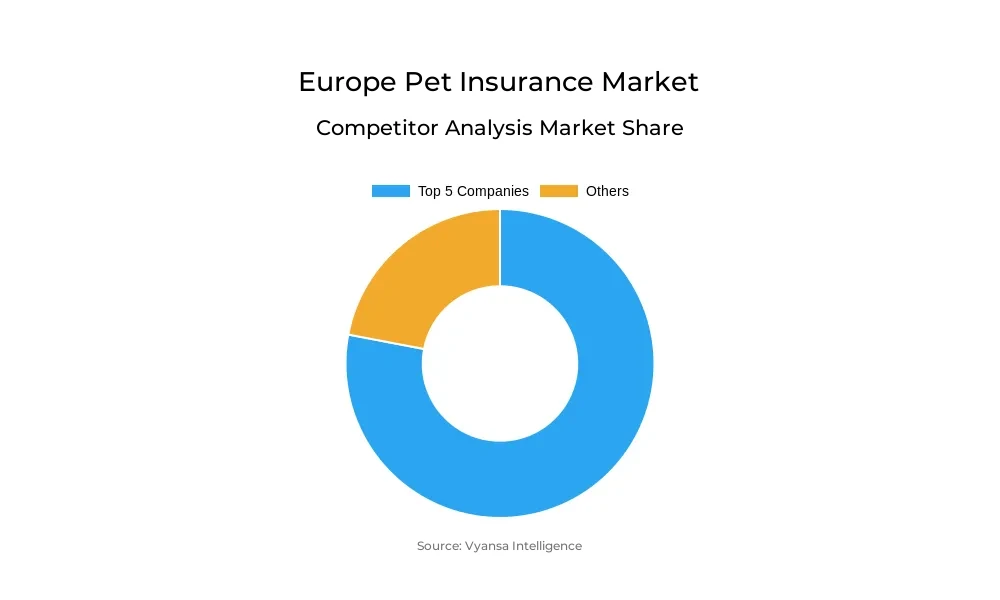

- Europe Pet Insurance Market is currently being catered to by more than 10 companies.

- Top 5 companies acquired the maximum share of the market.

- Protectapet, AGILA, Petsecure, Petplan, Embrace etc., are few of the top companies.

- Sales Channel

- Direct sales channel grabbed 40% of the market.

- Country

- UK emerges as the leading market.

Europe Pet Insurance Market Outlook

The Europe pet insurance market is poised to experience steady expansion from 2025 to 2030, helped by increasing pet adoption in cities. Evolving family structures—lower numbers of children, postponement of marriages, and growth of one-person households—are prompting more individuals to own companion animals. Pets in Berlin, Paris, and London are just like family, and that is why owners are paying extra for top-of-the-line services such as pet health insurance to finance veterinary emergencies, hereditary conditions, and accidents. Promotion campaigns by animal welfare organizations are also increasing adoption of insurance in these cities.

Despite this, the market is still challenged in price-sensitive Eastern and Southern European markets such as Romania, Bulgaria, Portugal, and Greece. Low disposable income, poor awareness, and cultural belief that pets are more utilitarian than companion animals restrain demand. Poorly fragmented veterinary services, variable treatment standards, and limited cost visibility make it difficult to increase in these markets for insurers, which curbs overall growth.

Dog insurance continues to be the biggest sector, with strong take-up in the UK, France, and Germany as owners purchase cover for breed-related health conditions and expensive treatments. Dog insurance premiums are increasing because of sophisticated veterinary treatments, high-priced medicines, and rising treatment charges. Inflation, shifting dog owner behavior, and changes in insurer cover all have an effect on prices.

Looking to the future, bundling pet insurance with wider insurance or retail ecosystems will become increasingly popular. Merging pet coverage with home, life, or wellness policies, discounting through veterinarians and pet stores, and embedding insurance in e-commerce platforms will improve convenience, customer interaction, and market reach. The UK will remain at the forefront of the region due to its established market, solid regulatory environment, and innovative insurance products.

Europe Pet Insurance Market Growth Driver

Rising Pet Ownership in Urban Households Driving Market Growth

The increasing rate of pet adoption, particularly in cities, is one of the drivers of the market. Shifting family dynamics, fewer children, delayed marriage, and more single-person households are driving individuals to take on companion animals. In cities like Berlin, Paris, and London, pet-keeping has become a part of urban culture, indicative of a greater emotional bond between pet and owner.

This change prompts pet parents to invest more in premium services, such as pet health insurance. As pets are regarded as family members, owners are focusing on financial security in the event of veterinary emergencies, hereditary diseases, and accidents. Campaigns by animal welfare bodies also promote this shift, increasing the adoption of pet insurance among urban homes.

Europe Pet Insurance Market Challenge

Limited Reach in Price-Sensitive Regions Hindering Market Growth

A prominent problem is the low adoption of pet insurance in price-conscious areas of Eastern and Southern Europe, including Romania, Bulgaria, Portugal, and Greece. In these nations, low disposable income, low awareness, and cultural behaviors where pets are appreciated less as companions and more for their utility dampen the demand for pet insurance. The product is still quite new, and numerous owners use out-of-pocket payments or skip expensive veterinary care.

To this, the veterinary service infrastructure in these markets tends to be fragmented, with irregular treatment quality and low cost transparency. This detains insurers from growing aggressively. Consequently, both new entrants and established players struggle to pick up pace, thereby slowing growth in these markets and presenting a major obstacle to broader market expansion.

Europe Pet Insurance Market Trend

Traction Towards Expensive and Advanced Canine Healthcare Driving Premium Growth

Increasing Tracion Towards Premiums on dog insurance are increasing as veterinary services become more sophisticated and pricey. Greater use of new technologies and medications drives healthcare expenses higher for dogs, making claims more costly. Increased occurrence of diseases or the increasing expense of treatment drives premiums even higher.

Insurance providers also modify coverage options, benefit caps, and underwriting procedures, which can affect premiums. Economic considerations, such as inflation, contribute to the cost of operations overall, driving prices upward. Further, changes in dog ownership patterns and adjustments in the demographics of dog owners affect the risk profile for insurers, leading to premium changes.

Europe Pet Insurance Market Opportunity

Bundling with Broader Insurance and Retail Platforms

The Insurers are likely to embed pet insurance within general insurance offerings or retail ecosystems. Pet insurance can be packaged along with home, life, or wellness insurance policies, allowing customers to service several policies—pet, health, and property—on a unified digital platform. This will likely enhance convenience for customers, increase engagement, and lower policy cancellations.

Dollar-off discounts through partnerships with veterinarians, pet food stores, and grooming businesses will also drive holistic offerings beyond reimbursement. Cashback benefits, rewards for loyalty, and pet health monitoring each month will increase bundled plans' attractiveness. With e-commerce vendors such as Amazon and Zooplus growing in the pet wellness segment, tie-ups with insurers to provide embedded pet protection at checkout are likely to be a compelling growth driver.

Europe Pet Insurance Market Country Analysis

The United Kingdom leads the pet insurance industry with the highest market share in policy volume, gross written premium, and number of insurers present. Pet insurance has existed in the UK for many years, with some policies dating back to the early 20th century. The expense of veterinary treatment, backed by sophisticated treatment centers, has resulted in insurance becoming a necessary option for the majority of pet owners.

Leading UK-based insurers provide customized plans with speedy digital onboarding, with robust regulatory environments guaranteeing policyholder protection and transparency. The digitally aware and well-educated consumers of the country are major contributors to robust market penetration. Ongoing innovations in the form of lifetime coverage, wellness benefits, and behaviour training reimbursements make the UK a model for other pet insurance markets.

Europe Pet Insurance Market Segmentation Analysis

By Animal

- Dog

- Cat

- Others

The most market share under the animal category belongs to the segment of dogs. Dogs are the most insured pets in countries such as the UK, France, and Germany, and in many cases, they are covered from when they were puppies. Their susceptibility to breed-related ailments like hip dysplasia, heart conditions, and skin disorders promotes pet owners to opt for full insurance coverages. Moreover, top-end veterinary procedures such as orthopedic procedures and behavior therapies are increasingly employed for canines, further solidifying their hold on the pet insurance industry.

Other animals segment, covering horses, small mammals, reptiles, and others, is expected to increase at the highest rate in the forecast period. Although historically low-maintenance, increasing cat ownership among younger professionals and residents of apartments has seen increased veterinary consultations and associated expenses. With more cases of urinary tract infections, diabetes, and dental problems, insurers are now providing specialized cat insurance policies, driving high growth in this segment.

Top Companies in Europe Pet Insurance Market

The top companies operating in the market include Protectapet, AGILA, Petsecure, Petplan, Embrace, RSA Insurance, Petfirst Healthcare, Pethealth Inc, Hartville Group, NSM Insurance Group, Trupanion, Inc., EQT Group, etc., are the top players operating in the Europe Pet Insurance Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Europe Pet Insurance Market Policies, Regulations, and Standards

4. Europe Pet Insurance Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Europe Pet Insurance Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Animal

5.2.1.1. Dog- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Cat- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Insurance Type

5.2.2.1. Accident & Illness- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Accident only- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Policy Type

5.2.3.1. Lifetime Coverage- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Lifetime Coverage- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Provider

5.2.4.1. Public- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Private- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

5.2.5.1. Insurance Agency- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Broker- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Direct- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Bancassurance- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Country

5.2.6.1. Italy

5.2.6.2. France

5.2.6.3. Germany

5.2.6.4. UK

5.2.6.5. Spain

5.2.6.6. Denmark

5.2.6.7. Rest of Europe

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Italy Pet Insurance Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Animal- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Policy Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Provider- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. France Pet Insurance Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Animal- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Policy Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Provider- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Germany Pet Insurance Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Animal- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Policy Type- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Provider- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. UK Pet Insurance Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Animal- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Policy Type- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Provider- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Spain Pet Insurance Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Policy Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Provider- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Denmark Pet Insurance Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Policy Type- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Provider- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Petplan

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Embrace

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. RSA Insurance

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Petfirst Healthcare

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Pethealth Inc

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Protectapet

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. AGILA

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Petsecure

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Hartville Group

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. NSM Insurance Group

12.1.10.1.Business Description

12.1.10.2.Product Portfolio

12.1.10.3.Collaborations & Alliances

12.1.10.4.Recent Developments

12.1.10.5.Financial Details

12.1.10.6.Others

12.1.11. Trupanion, Inc.

12.1.11.1.Business Description

12.1.11.2.Product Portfolio

12.1.11.3.Collaborations & Alliances

12.1.11.4.Recent Developments

12.1.11.5.Financial Details

12.1.11.6.Others

12.1.12. EQT Group

12.1.12.1.Business Description

12.1.12.2.Product Portfolio

12.1.12.3.Collaborations & Alliances

12.1.12.4.Recent Developments

12.1.12.5.Financial Details

12.1.12.6.Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Animal |

|

| By Insurance Type |

|

| By Policy Type |

|

| By Provider |

|

| By Sales Channel |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.