Global Pet Insurance Market Report: Trends, Growth and Forecast (2026-2032)

By Animal (Dog, Cat, Others), By Insurance Type (Accident & Illness, Accident only, Others), By Policy Type (Lifetime Coverage, Non-Lifetime Coverage), By Provider (Public, Private), By Sales Channel (Insurance Agency, Broker, Direct, Bancassurance, Others), By Region (North America, South America, Europe, Middle East & Africa, Asia-Pacific)

- ICT

- Oct 2025

- VI0555

- 230

-

Global Pet Insurance Market Statistics and Insights, 2026

- Market Size Statistics

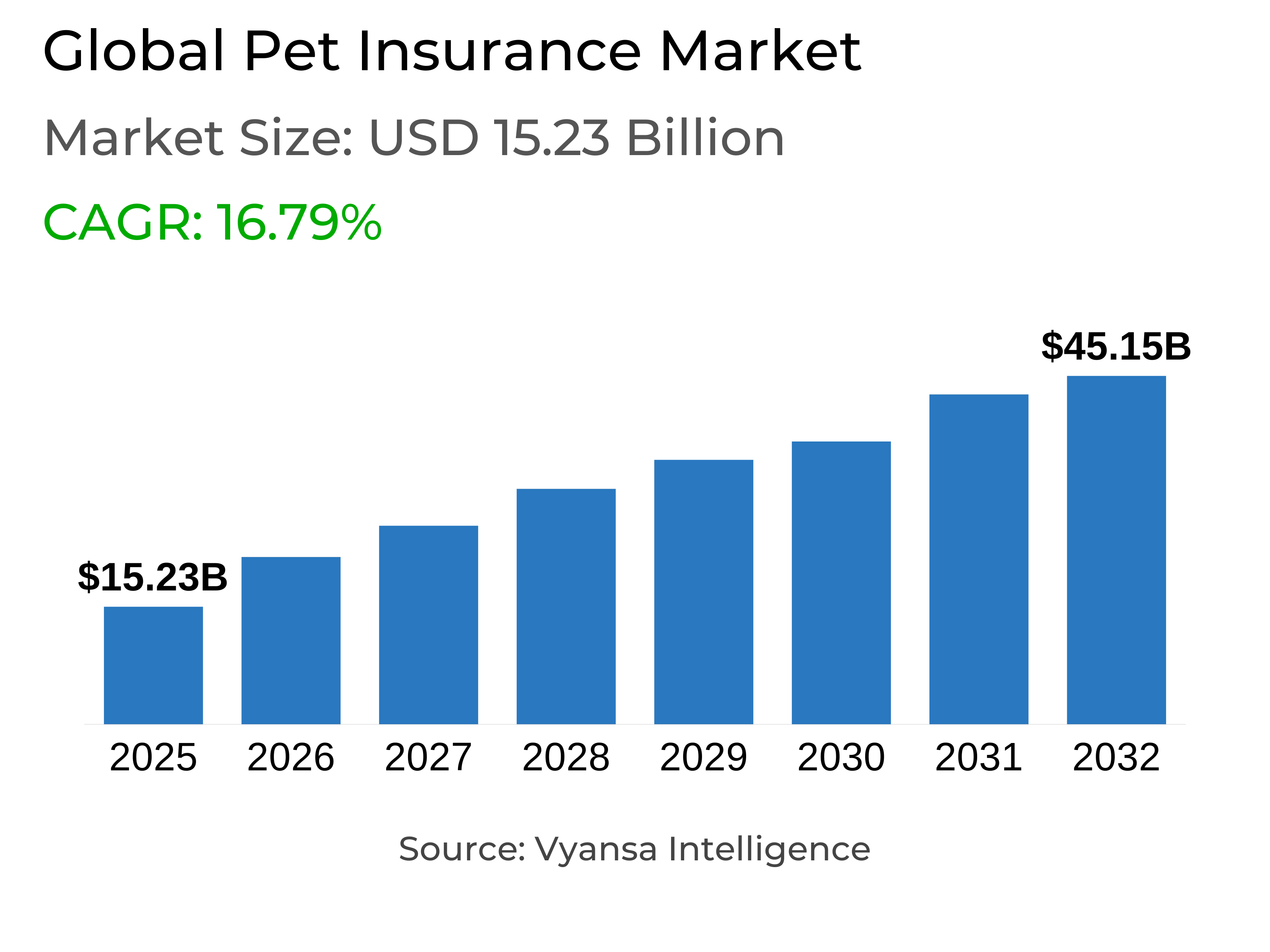

- Global Pet Insurance Market is estimated at $ 15.23 Billion.

- The market size is expected to grow to $ 45.15 Billion by 2032.

- Market to register a CAGR of around 16.79% during 2026-32.

- Animal Shares

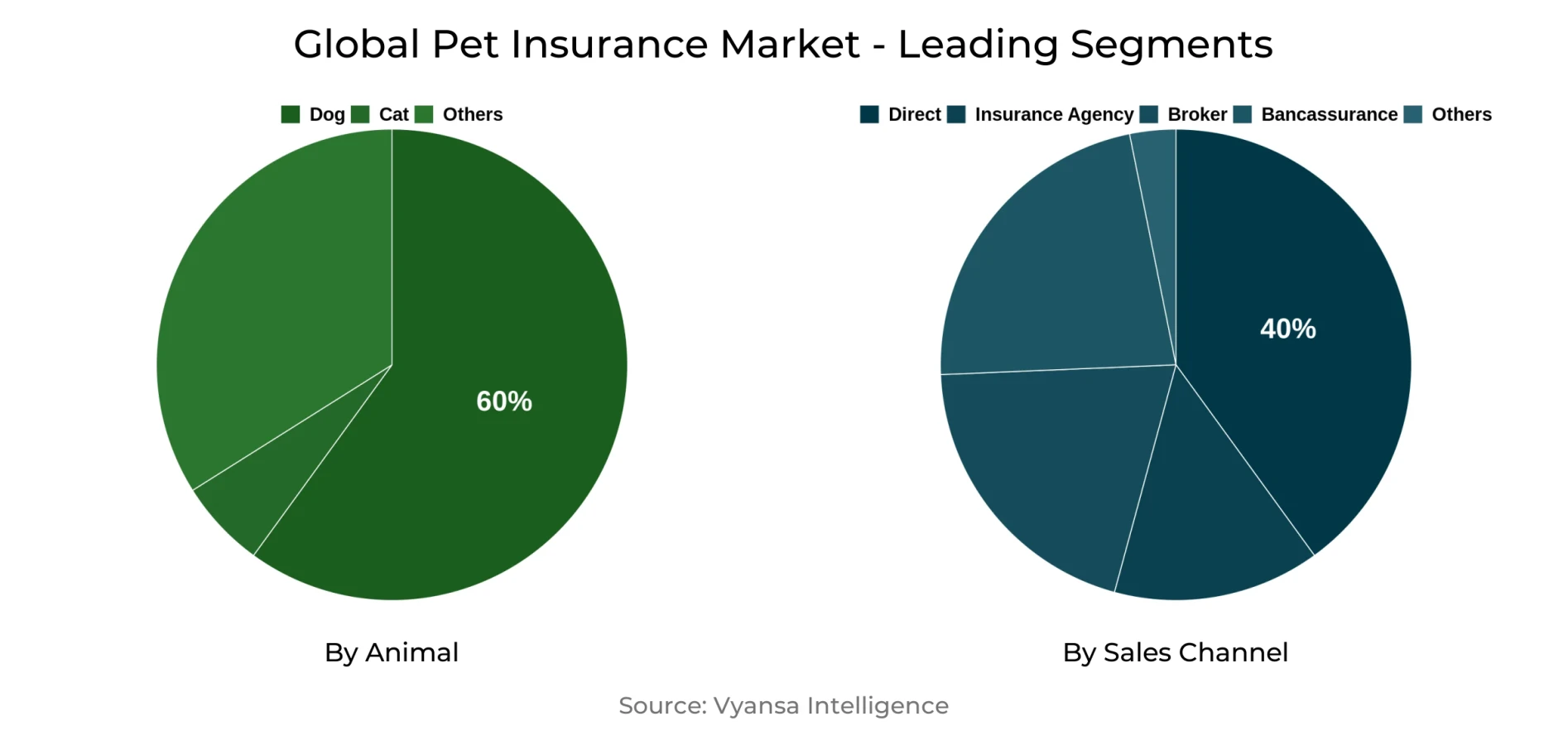

- Dog grabbed market share of 60%.

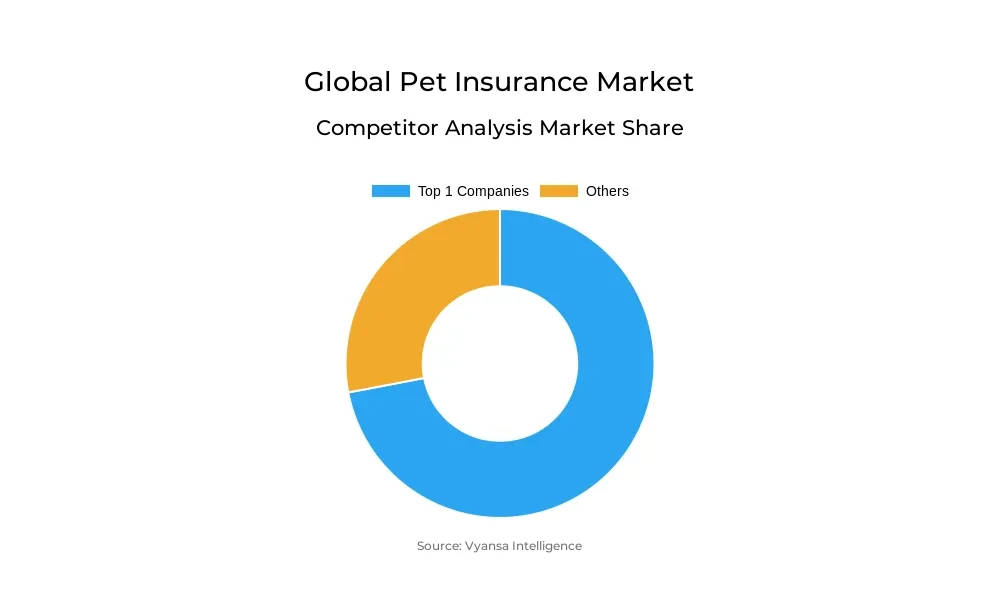

- Competition

- Global Pet Insurance Market is currently being catered to by more than 20 companies.

- Top 10 companies acquired the maximum share of the market.

- Direct Line, Spot Pet Insurance Services, LLC, Getsafe GmbH, Trupanion, Inc., Deutsche Familienversicherung AG (DFV) etc., are few of the top companies.

- Sales Channel

- Direct sales channel grabbed 40% of the market.

- Region

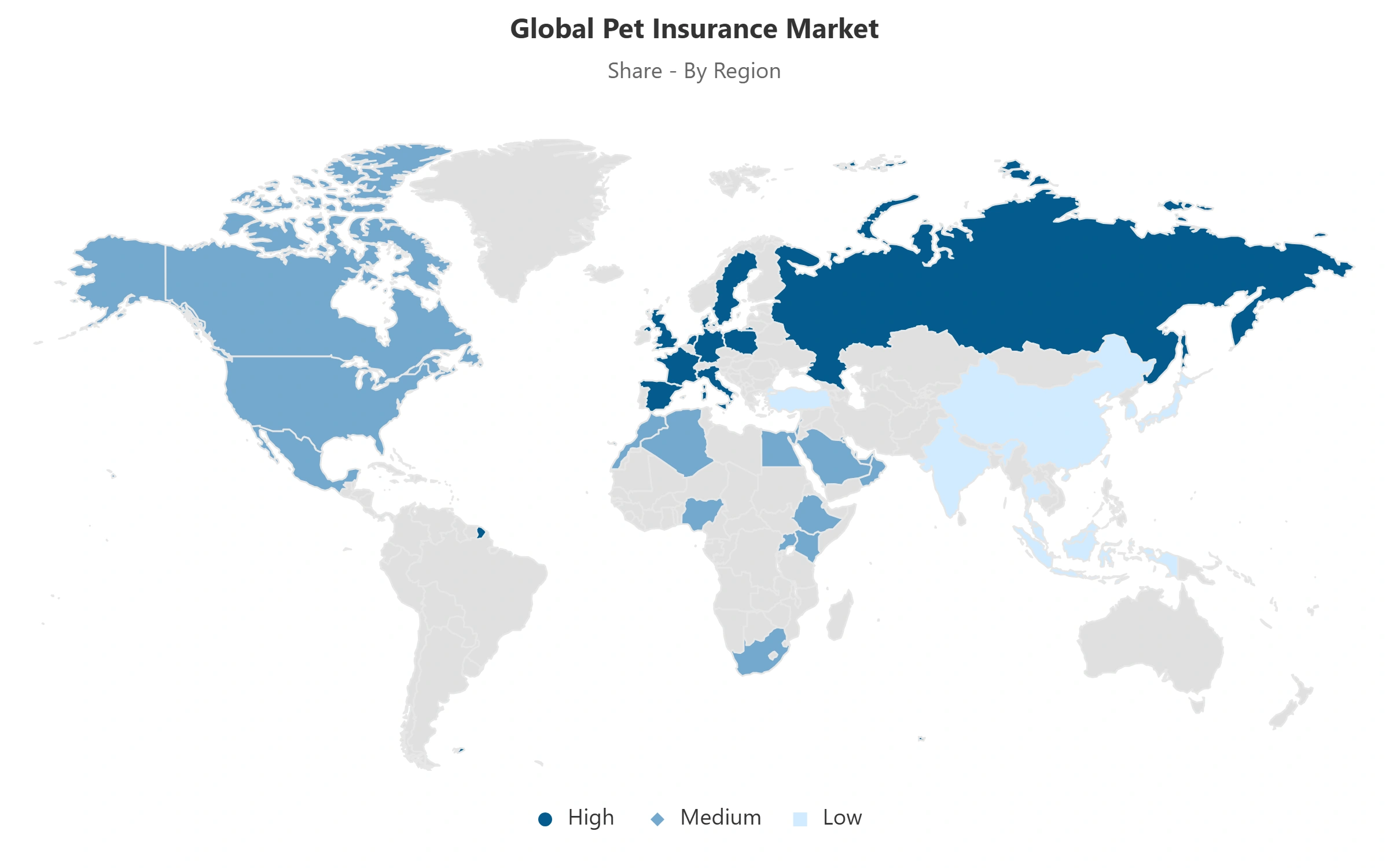

- Europe emerges as the leading regional market.

Global Pet Insurance Market Outlook

The global pet insurance market is projected to increase gradually between 2025 and 2030, boosted by the increasing trend of pet adoption and pet humanization. With pets being considered part of the family, healthcare expenditure on them is on the increase, including investment in insurance cover. Increased veterinary expenditure, driven by advances in medical technology and treatment, is making insurance appealing as a means of offsetting unforeseen and costly medical expenses. Enhanced understanding of pets' health requirements and the value of insurance is also prompting additional owners to secure coverage.

Moreover, low awareness and knowledge of pet insurance are still major hindrances. Most pet owners lack awareness of the monetary safeguards it provides against unexpected vet bills or preventive care. Even if they know of the product, some may not comprehend it well enough to act, making them hesitant to buy policies. To counteract this, firms are placing emphasis on educating pet owners, providing reasonable premiums, variable coverage plans, and clear policy terms to increase adoption rates.

Technological advancements, for example, telemedicine and wearable technology, are creating new possibilities for pet insurance companies. These technologies can be incorporated into products, providing services such as remote consultations, behavioral training, and preventive care, increasing the value of insurance to contemporary pet owners. The market in countries like Asia-Pacific, Latin America, and Eastern Europe remains underdeveloped, where businesses are adapting products to meet local needs to access high-growth potential.

In terms of pet type, dogs share the greatest market share because their high rates of adoption and maintenance charges raise the requirement for insurance coverage. The "others" segment is expected to develop at the most rapid pace driven by increasing veterinary expenditure. At the geographical level, Europe dominates the market and, in line with the growth of awareness, a rising population of pets, and strategic alliances, Asia-Pacific will experience the most rapid expansion.

Global Pet Insurance Market Growth Driver

Rising Pet Ownership and Humanization Driving Insurance Demand

The increase in pet ownership is promoting the growth in the pet insurance market. With pets being treated as family, the rise towards pet humanization is promoting increased expenditure on their care, including insurance protection. Pet owners are more ready to spend to secure the welfare of their pets, which is encouraging demand for pet insurance.

Concurrently, escalating veterinary costs, fueled by increased medical technology and medical treatment costs, are causing insurance to become a desirable choice to cover unforeseen and expensive medical charges. Improved recognition of pet health needs and the value of insurance is also setting more owners up to get covered. Improved awareness of the health needs of pets is, in turn, driving market expansion.

Global Pet Insurance Market Challenge

Limited Awareness and Understanding of Pet Insurance Hindering Market Growth

One of the biggest challenges is the low awareness and knowledge of pet insurance, which hinders its growth by keeping many potential clients unaware of its value. Most pet owners do not know the financial safety it provides against unforeseen veterinary bills or the protection it offers for preventive care.

Second, some of those who own pets are not fully aware of how pet insurance operates or the advantages it can have on their pet's health. These unknowns frequently translate to reluctance to buy policies. In response, firms target communicating its value to pet owners, charging modest premiums, and providing flexible coverage plans and transparent information about its policies.

Global Pet Insurance Market Trend

Innovations in Pet Healthcare Technology Driving Market

Innovations in pet healthcare technology, including telemedicine and wearable technology, are creating new possibilities for pet insurance companies. Insurance products that complement these technologies provide pet owners with more convenient and inclusive coverage, such as remote consultation, behavioral training, and preventive care. These innovations make the overall pet healthcare experience better, making insurance more meaningful and useful to contemporary pet owners.

The market is still quite underdeveloped in most areas, particularly in emerging markets in Asia-Pacific, Latin America, and Eastern Europe. Pet insurance companies are increasing their presence in these regions, modifying their products to suit the unique demands of local pet owners. By integrating technology-based services with region-specific products, firms gain access to new customer segments and consolidate their market base in high-potential markets.

Global Pet Insurance Market Regional Analysis

By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

Europe leads the pet insurance market because increasing numbers of pets are being adopted across nations like the UK, Italy, France, Russia, and Germany. A number of insurance firms operating in the region are launching varied policy coverage packages to promote pet adoption, particularly for dogs. The coverage includes diseases, injuries, and illnesses, which are still leading the growth of the pet insurance market in Europe.

Asia-Pacific is anticipated to be the highest-growing region in the forecast period, driven by increasing awareness about pet insurance and care during the lockdown. India, with its growing pet population consisting mainly of dogs, is a leading contributor to this growth. Furthermore, collaborations like InsuranceDekho's partnership with Future Generali India Insurance Company for offering specialty dog health insurance are anticipated to drive the market further in the region.

Global Pet Insurance Market Segmentation Analysis

By Animal

- Dogs

- Cats

- Others

The most market-share dominating segment among animal category segments is dogs segment. Dogs are the preferred pet in most countries globally and enjoy a high adoption rate, and hence, their demand for pet insurance is led by the same. The reasons for adopting them as pets, such as their ability to provide safety, companionship, and their maintenance being relatively higher compared to other pets, make insurance coverage more desirable among dog owners. These factors in combination consolidate the dominance of the dogs segment of the global pet insurance market.

The others segment, however, is expected to achieve the highest growth rate in the forecast period. This is brought about by the increasing expense of veterinary care, which makes it difficult for pet owners to cater to vital treatments. Pet insurance provides relief by assisting in meeting these costs, making the product an ever more desirable choice for pet owners under the "others" segment.

Top Companies in Global Pet Insurance Market

The top companies operating in the market include Direct Line, Spot Pet Insurance Services, LLC, Getsafe GmbH, Trupanion, Inc., Deutsche Familienversicherung AG (DFV), Nationwide Mutual Insurance Company, Petplan (Allianz), Jab Holding Company, Waggel Limited, Feather Insurance, Napo Limited, Tesco, Sainsbury Bank Plc, Fressnapf Holding SE, EQT Group, etc., are the top players operating in the Global Pet Insurance Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Pet Insurance Market Policies, Regulations, and Standards

4. Global Pet Insurance Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Pet Insurance Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Animal

5.2.1.1. Dog- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Cat- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Insurance Type

5.2.2.1. Accident & Illness- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Accident only- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Policy Type

5.2.3.1. Lifetime Coverage- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Lifetime Coverage- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Provider

5.2.4.1. Public- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Private- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

5.2.5.1. Insurance Agency- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Broker- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Direct- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Bancassurance- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Region

5.2.6.1. North America

5.2.6.2. South America

5.2.6.3. Europe

5.2.6.4. Middle East & Africa

5.2.6.5. Asia-Pacific

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. North America Pet Insurance Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Animal- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Policy Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Provider- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Country

6.2.6.1. The US

6.2.6.2. Canada

6.2.6.3. Mexico

6.3. US Pet Insurance Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in US$ Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Pet Insurance Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in US$ Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Pet Insurance Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in US$ Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

7. South America Pet Insurance Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Animal- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Policy Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Provider- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Country

7.2.6.1. Brazil

7.2.6.2. Argentina

7.2.6.3. Rest of South America

7.3. Brazil Pet Insurance Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in US$ Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

7.4. Argentina Pet Insurance Market Statistics, 2022-2032F

7.4.1.Market Size & Growth Outlook

7.4.1.1. By Revenues in US$ Million

7.4.2.Market Segmentation & Growth Outlook

7.4.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

7.4.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

8. Europe Pet Insurance Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Animal- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Policy Type- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Provider- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Country

8.2.6.1. Germany

8.2.6.2. The UK

8.2.6.3. France

8.2.6.4. Spain

8.2.6.5. Italy

8.2.6.6. Rest of Europe

8.3. Germany Pet Insurance Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in US$ Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

8.4. France Pet Insurance Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in US$ Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

8.5. The UK Pet Insurance Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in US$ Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

8.6. Spain Pet Insurance Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in US$ Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

8.7. Italy Pet Insurance Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in US$ Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

9. Middle East & Africa Pet Insurance Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Animal- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Policy Type- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Provider- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Country

9.2.6.1. The UAE

9.2.6.2. Saudi Arabia

9.2.6.3. South Africa

9.2.6.4. Rest of the Middle East & Africa

9.3. The UAE Pet Insurance Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in US$ Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

9.4. Saudi Arabia Pet Insurance Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in US$ Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

9.5. South Africa Pet Insurance Market Statistics, 2022-2032F

9.5.1.Market Size & Growth Outlook

9.5.1.1. By Revenues in US$ Million

9.5.2.Market Segmentation & Growth Outlook

9.5.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

9.5.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

10. Asia-Pacific Pet Insurance Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Policy Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Provider- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Country

10.2.6.1. China

10.2.6.2. India

10.2.6.3. Japan

10.2.6.4. South Korea

10.2.6.5. Australia

10.2.6.6. Rest of Asia-Pacific

10.3. China Pet Insurance Market Statistics, 2022-2032F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in US$ Million

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

10.3.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

10.4. India Pet Insurance Market Statistics, 2022-2032F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in US$ Million

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

10.4.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

10.5. Japan Pet Insurance Market Statistics, 2022-2032F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in US$ Million

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

10.5.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

10.6. South Korea Pet Insurance Market Statistics, 2022-2032F

10.6.1. Market Size & Growth Outlook

10.6.1.1. By Revenues in US$ Million

10.6.2. Market Segmentation & Growth Outlook

10.6.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

10.6.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

10.7. Australia Pet Insurance Market Statistics, 2022-2032F

10.7.1. Market Size & Growth Outlook

10.7.1.1. By Revenues in US$ Million

10.7.2. Market Segmentation & Growth Outlook

10.7.2.1. By Animal- Market Insights and Forecast 2022-2032, USD Million

10.7.2.2. By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Trupanion, Inc.

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Deutsche Familienversicherung AG (DFV)

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Nationwide Mutual Insurance Company

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Petplan (Allianz)

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Jab Holding Company

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Direct Line

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Spot Pet Insurance Services, LLC

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Getsafe GmbH

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Waggel Limited

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Feather Insurance

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

11.1.11. Napo Limited

11.1.11.1.Business Description

11.1.11.2.Product Portfolio

11.1.11.3.Collaborations & Alliances

11.1.11.4.Recent Developments

11.1.11.5.Financial Details

11.1.11.6.Others

11.1.12. Tesco

11.1.12.1.Business Description

11.1.12.2.Product Portfolio

11.1.12.3.Collaborations & Alliances

11.1.12.4.Recent Developments

11.1.12.5.Financial Details

11.1.12.6.Others

11.1.13. Sainsbury Bank Plc

11.1.13.1.Business Description

11.1.13.2.Product Portfolio

11.1.13.3.Collaborations & Alliances

11.1.13.4.Recent Developments

11.1.13.5.Financial Details

11.1.13.6.Others

11.1.14. Fressnapf Holding SE

11.1.14.1.Business Description

11.1.14.2.Product Portfolio

11.1.14.3.Collaborations & Alliances

11.1.14.4.Recent Developments

11.1.14.5.Financial Details

11.1.14.6.Others

11.1.15. EQT Group

11.1.15.1.Business Description

11.1.15.2.Product Portfolio

11.1.15.3.Collaborations & Alliances

11.1.15.4.Recent Developments

11.1.15.5.Financial Details

11.1.15.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Animal |

|

| By Insurance Type |

|

| By Policy Type |

|

| By Provider |

|

| By Sales Channel |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.