US Pet Insurance Market Report: Trends, Growth and Forecast (2026-2032)

By Animal (Dog, Cat, Others), By Insurance Type (Accident & Illness, Accident only, Others), By Policy Type (Lifetime Coverage, Non-Lifetime Coverage), By Provider (Public, Private), By Sales Channel (Insurance Agency, Broker, Direct, Bancassurance, Others)

- ICT

- Oct 2025

- VI0556

- 120

-

US Pet Insurance Market Statistics and Insights, 2026

- Market Size Statistics

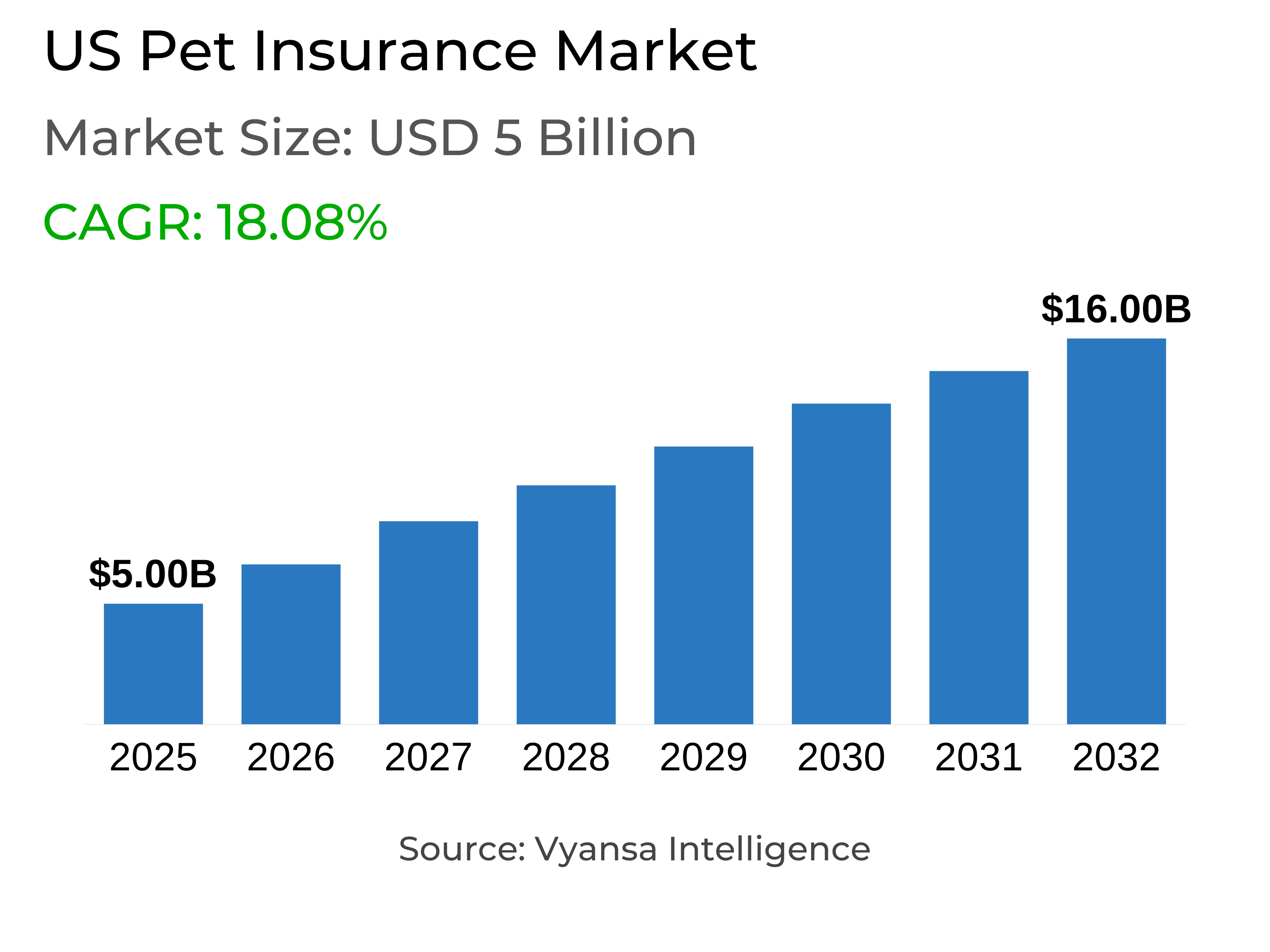

- Pet Insurance in US is estimated at $ 5 Billion.

- The market size is expected to grow to $ 16 Billion by 2032.

- Market to register a CAGR of around 18.08% during 2026-32.

- Insurance Type Segment

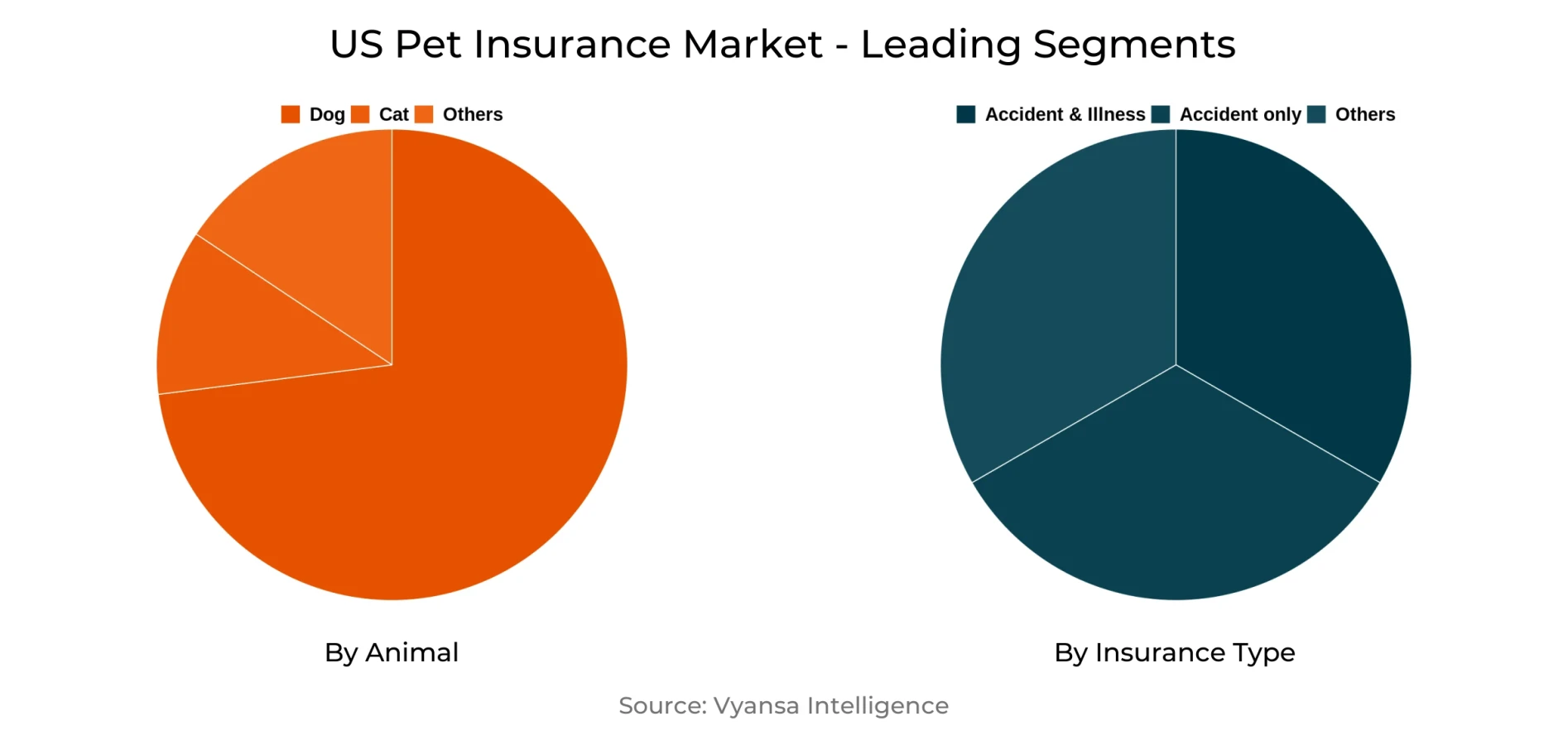

- Accident Only continues to dominate the market.

- Competition

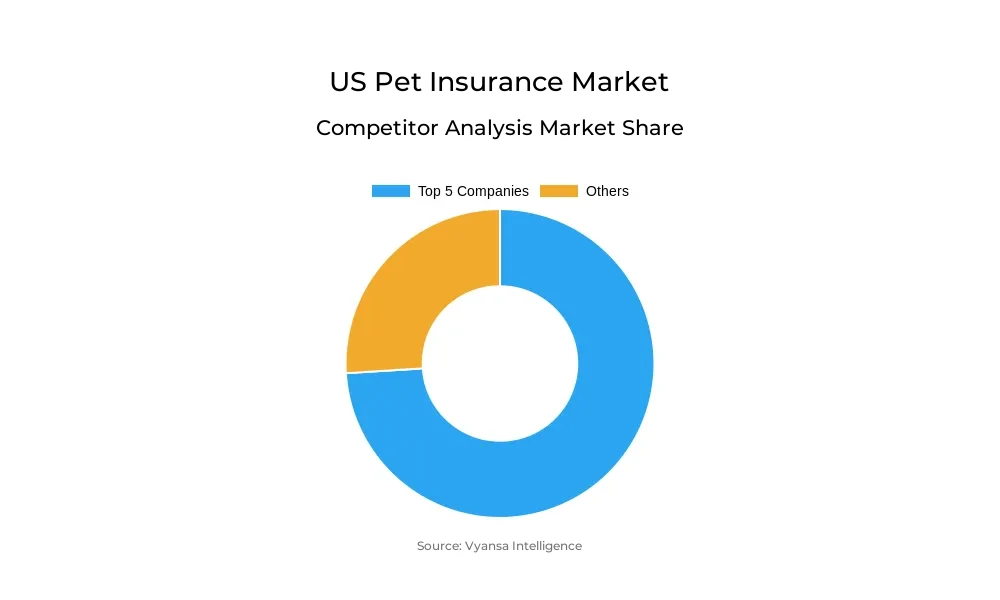

- US Pet Insurance Market is currently being catered to by more than 15 companies.

- Top 5 companies acquired the maximum share of the market.

- Trupanion, Inc., ManyPets (EQT Group), Crum & Foster, MetLife, Inc., Odie Pet Insurance etc., are few of the top companies.

- Animal Type

- Dog continues to dominate the market.

US Pet Insurance Market Outlook

The US pet insurance industry is poised for stable growth between 2025 and 2030, underpinned by the driving force of pet humanization. Pet owners increasingly treat pets as part of the family, providing them with services traditionally the domain of humans, including luxury flights, gourmet dining, and spa days. This has created a higher demand for full-service insurance coverage for check-ups, high-tech treatments, and preventive care. Wellness procedures such as vaccinations and tooth cleaning, which are often covered under policies, are gaining traction, motivating more pet owners to buy insurance to protect their pets from ailments.

However, the market is plagued by several major challenges that might slow down its growth. Premiums are too expensive to make policy coverage unaffordable for most pet owners, while coverage restrictions—e.g., exclusion of pre-existing conditions and low payout limits—reduce the policies' value. Transparency and standardization issues further complicate consumers' ability to compare and select best-fit plans. All these elements deter adoption, particularly among pet owners with low risks and tight budgets.

In the future, market expansion will be fueled by increased product diversification and customization. Insurers will provide flexible policies, from accident-only and sickness coverage to bundled packages with wellness features. Dental, alternative therapy, and hereditary condition add-ons will enable owners to customize policies to suit the needs of their pets, promoting adoption and satisfaction.

Among types of coverage, accident-only policies will maintain the biggest market share. With their more affordable price and focused protection for unexpected events like fractured bones, poisoning, or surgery, they remain attractive to budget-constrained buyers. This value combined with increasing awareness about financial coverage of unplanned pet healthcare expenditures will keep the segment in leadership position until 2030.

US Pet Insurance Market Growth DriverRising Pet Humanization Boosting Market Demand

The pet insurance market in the U.S. increases as the pet humanization trend becomes stronger. Pet owners live with their pets like members of the family and offer them services previously only offered to humans, including luxury travel, gourmet food, and spa treatments. This change in attitude compels pet owners to access improved healthcare for their pets through, among other things, insurance coverage.

Pet humanization fuels demand for full-coverage insurance policies for routine check-ups, complicated medical treatments, and preventive care. Owners increasingly opt for wellness services like vaccinations and dental cleaning, frequently part of plans. Consequently, more owners spend money on insurance policies to safeguard their pet's health and wellness, fueling consistent market growth.

US Pet Insurance Market ChallengeHigh Premiums and Limited Coverage Hinder Market Growth

The U.S. pet insurance market is confronted with major challenges that hamstring its expansion. Premium prices continue to be a major hindrance, making the plans inaccessible to many pet owners. Meanwhile, the majority of the plans have their coverage capped, excluding pre-existing conditions and setting tight limits on reimbursements for certain treatments or procedures. Such limitations leave owners with more limited choices to deal with medical bills for their pets.

The lack of transparency and standardization makes things even more complicated, as consumers have a hard time comparing policies and selecting the most appropriate for their needs. For low-risk animal owners or those on a limited budget, such a policy becomes a questionable value. All this combines to discourage adoption and continues to hinder overall market growth.

US Pet Insurance Market OpportunityRising Scope for Product Diversification and Customization

The market is anticipated to expand through growing product diversification and customization. Insurers will provide all kinds of flexible plans catering to various requirements, such as accident-only protection, protection against illness, and inclusive packages with wellness and preventive services. For instance, Unum Group will broaden its voluntary benefits portfolio in May 2024 through the release of Unum Pet Insurance covered by Nationwide, which will account for accidents, illnesses, and wellness care.

The addition of riders and add-ons, like dental care, alternative therapies, and hereditary condition cover, will enable pet owners to tailor policies according to the needs of their pets. This strategy will assist in catering to evolving customer needs, improve competitiveness, and foster increased adoption rates, in addition to driving greater customer satisfaction in the industry.

US Pet Insurance Market Segmentation Analysis

By Insurance Type

- Accident & Illness

- Accident only

- Others

The segment in terms of highest market share under the insurance category is the accident-only category in the American pet insurance industry. The accident-only segment is likely to experience healthy growth through 2025–2030, driven by growing awareness among consumers and the necessity of being financially secured against unforeseen medical costs resulting from accidents or injuries. In contrast to wellness policies for regular care, accident-only policies cover unexpected events like broken bones, poisoning, or surgery, which can be expensive for pet owners.

Accident-only policies tend to be cheaper than comprehensive wellness and accident insurance policies, so they are a good option for price-conscious consumers. The relative lower cost along with niche coverage ensures flexibility and accessibility, which is likely to boost demand further. With more pet owners looking for affordable and efficient insurance, the accident-only segment will continue to dominate the market.

Top Companies in US Pet Insurance Market

The top companies operating in the market include Trupanion, Inc., ManyPets (EQT Group), Crum & Foster, MetLife, Inc., Odie Pet Insurance, Allianz, Fetch Pet Insurance, Spot Pet Insurance, Jab Holding Company, Nationwide Mutual Insurance Company, etc., are the top players operating in the US Pet Insurance Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. US Pet Insurance Market Policies, Regulations, and Standards

4. US Pet Insurance Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. US Pet Insurance Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Animal

5.2.1.1. Dog- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Cat- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Insurance Type

5.2.2.1. Accident & Illness- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Accident only- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Policy Type

5.2.3.1. Lifetime Coverage- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Lifetime Coverage- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Provider

5.2.4.1. Public- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Private- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Insurance Agency- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Broker- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Direct- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Bancassurance- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. US Dog Insurance Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Policy Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Provider- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. US Cat Insurance Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Insurance Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Policy Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Provider- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.MetLife, Inc.

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Odie Pet Insurance

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Allianz

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Fetch Pet Insurance

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Spot Pet Insurance

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Trupanion, Inc.

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.ManyPets (EQT Group)

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Crum & Foster

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Jab Holding Company

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Nationwide Mutual Insurance Company

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Animal |

|

| By Insurance Type |

|

| By Policy Type |

|

| By Provider |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.