Thailand Bath & Shower Products Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Bath Soaps, Body Wash/Shower Gels, Bath Additives, Body Powder, Hand Sanitisers, Intimate Hygiene), By Product Form (Solid, Gels & Jellies, Liquid, Powder), By Ingredient (Conventional/Synthetic, Natural/Organic), By Price Point (Premium, Mass), By End User (Women, Men, Kids/Children), By Sales Channel (Online, Offline)

- FMCG

- Dec 2025

- VI0058

- 120

-

Thailand Bath & Shower Products Market Statistics, 2025

- Market Size Statistics

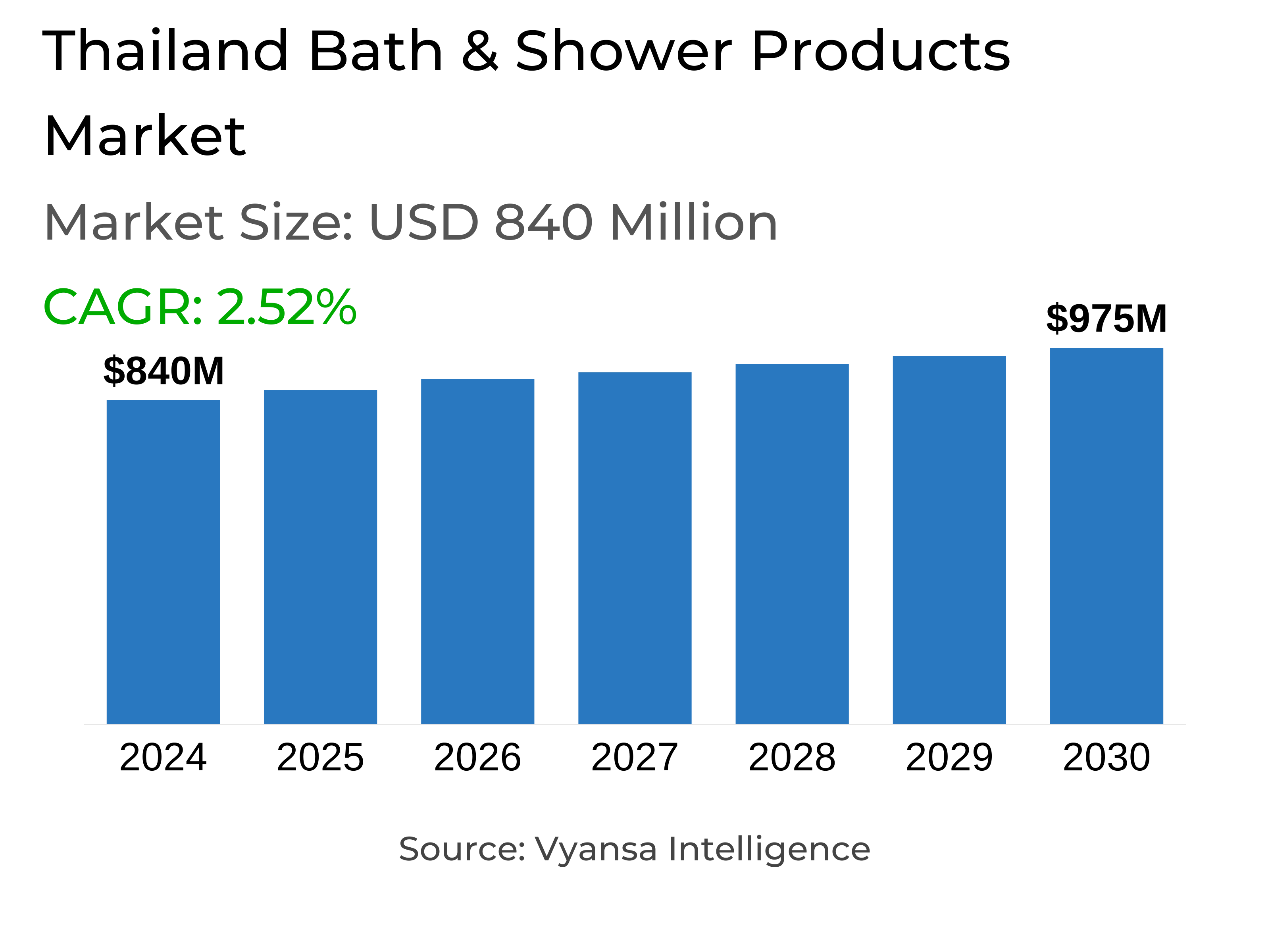

- Bath & Shower Products in Thailand is estimated at $ 840 Million.

- The market size is expected to grow to $ 975 Million by 2030.

- Market to register a CAGR of around 2.52% during 2025-30.

- Product Shares

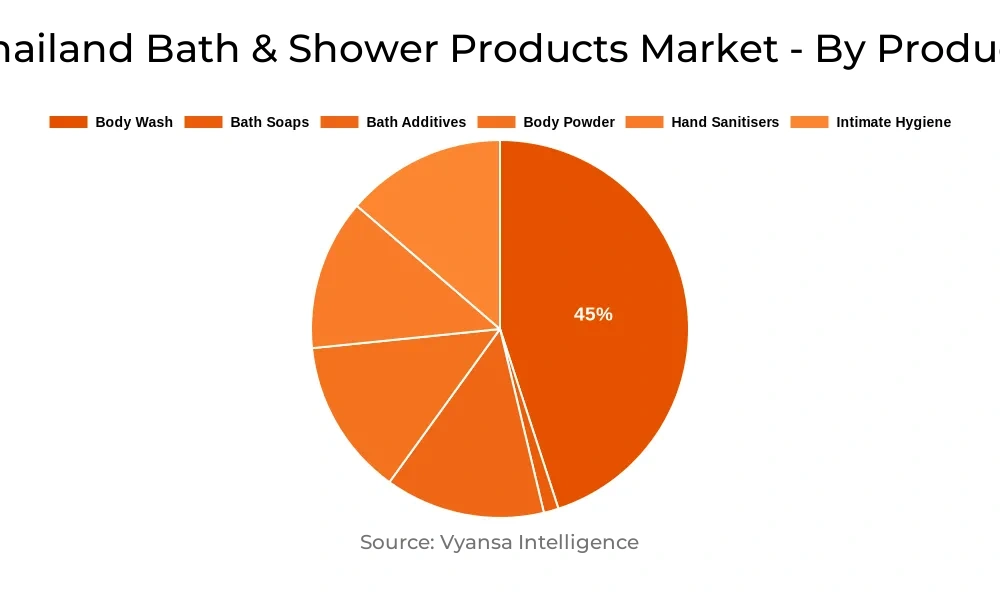

- Body Wash/Shower Gel grabbed market share of 45%.

- Competition

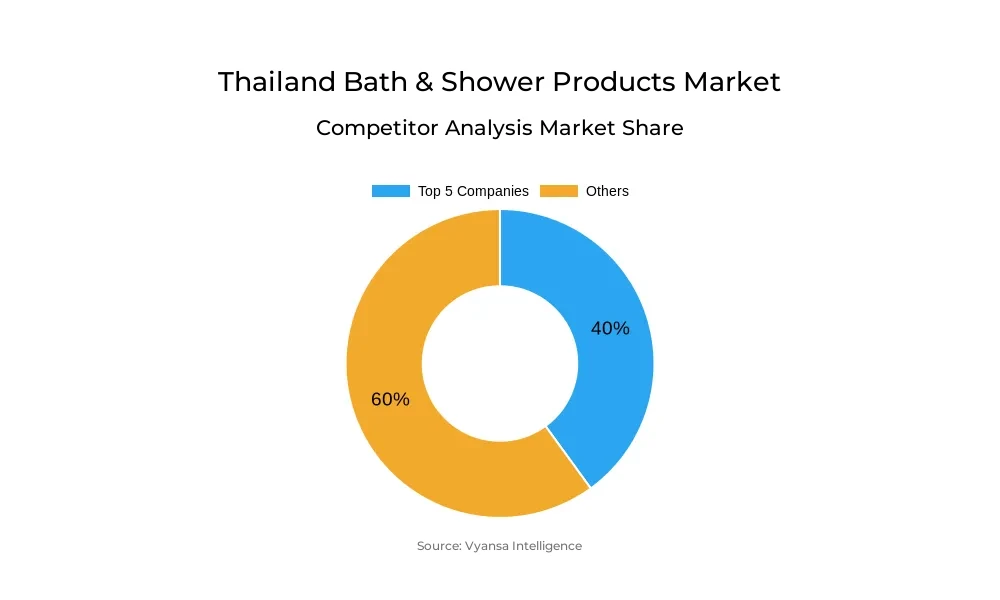

- More than 20 companies are actively engaged in producing Bath & Shower Products in Thailand.

- Top 5 companies acquired 40% of the market share.

- Berli Jucker PCL, Reckitt Benckiser (Thailand) Ltd, British Dispensary (LP) Co Ltd, The, Colgate-Palmolive Thailand Ltd, Unilever Thai Holdings Ltd etc., are few of the top companies.

Thailand Bath & Shower Products Market Outlook

Thailand bath and shower products market will develop steadily during the forecast period under the impetus of premiumisation, urbanisation, and increasing personal hygiene awareness. Consumers may move away from bar soap volume sales, but they are increasingly turning towards body wash and shower gel, particularly with premium and natural formulations. Bath and shower products that provide added benefits like moisturising, anti-ageing, or skin whitening are gaining traction. Brands are launching sophisticated formulations, pleasant fragrances, and specialty solutions to appeal to Thai consumers who are increasingly concerned with self-care.

Body wash and shower gel will remain in the lead in terms of value thanks to evolving lifestyles and a desire for modern, spa-quality experience at home. The trend towards bath additives like bath bombs and salts is also gaining ground, as consumers look for wellness and relaxation. These ingredients are being sold with additional skincare benefits in the form of hyaluronic acid and vitamin C. Intimate hygiene is also becoming the fastest-growing category, as there is growing demand for mild, pH-balanced, and plant-based solutions.

Store-based retail continues to dominate, thanks to robust in-store promotions, loyalty schemes, and sampling events. Yet, online and social media channels will increasingly extend consumer reach. Live streaming and influencer marketing are enhancing brands to promote good-looking products and drive online sales.

In the future, polarisation will characterize market directions as premium brands and private labels find favor. There will be a search for high value in the form of luxury products or economic yet value-laden private label products. Innovation will be the guiding force, with multi-tasking, skin-type specific, and natural ingredient-based products leading the market forward.

Thailand Bath & Shower Products Market Growth Driver

Increased emphasis on personal grooming and hygiene is likely to fuel firm growth in Thailand's bath and shower products market throughout 2025-30. Although the trend of bar soap use is waning, value sales are projected to increase as a result of urbanisation and premiumisation. Shoppers are being attracted to high-quality body wash and shower gels with natural or organic ingredients. These items will be in sync with the increasing focus on self-care and well-being, especially as hectic city lifestyles and escalating stress levels drive demand for products with calming and refreshing benefits through fragrance-based formulations.

Additionally, bath additives are anticipated to post the highest growth rate in the forecast period. With the increasing trend of home spa experience and self-grooming, bath bombs and other comparable products have gained more popularity. Parents are also buying these for kids, particularly when companies include a surprise gift within, making the process entertaining and adventurous.

Thailand Bath & Shower Products Market Trend

Thailand's bath and shower market is anticipated to experience growing polarisation in 2025-30, with premium lines as well as private label offerings becoming popular. Customers are developing an interest in advanced bath and shower solutions. Premium players are fulfilling this demand with premium products offering distinctive fragrance and multi-benefit solutions. Some popular ones are Hermès Eau D'orange Verte Hair And Body Shower Gel, Clarins Tonic Bath & Shower Concentrate, and Jo Malone English Pear & Freesia Body & Hand Wash.

Concurrently, private label products also gain ground, particularly among thrifty consumers who look for value addition. Carkoo brands carry peach, violet, and hyacinth-shaded glitter shower gels with floral extracts. Love My Skin by Watsons features Thai herbal ingredients, aloe vera, and niacinamide, providing brightening benefits and sensitive skin care. This development emphasizes the double road to demand in the changing market.

Thailand Bath & Shower Products Market Opportunity

The increased desire for multifunctional shower and bath products is a significant opportunity for Thai brands. Consumers are being attracted to products that combine multiple benefits of moisturising, anti-bacterial protection, cooling, firming, glowing skin, and vitamin enrichment. Brands will be increasingly driven to innovate as consumers seek out advanced formulations meeting emerging needs.

Natural ingredients and focused solutions specifically for certain skin types will also drive product appeal. Consumers in Thailand are increasingly interested in ingredients such as niacinamide, hyaluronic acid, ceramide, collagen, prebiotics, and traditional herbs such as turmeric, coconut oil, aloe vera, and lemongrass. With more exclusive and limited ranges coming into the market, consumer loyalty will surely drop, which will result in higher experimentation. This transformation provides great scope for both local and international brands to target new consumer groups.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 840 Million |

| USD Value 2030 | $ 975 Million |

| CAGR 2025-2030 | 2.52% |

| Largest Category | Body Wash/Shower Gel segment leads with 45% market share |

| Top Drivers | Premiumisation and Wellness Trends Fueling Demand |

| Top Trends | Rising Polarisation Between Premium and Private Label Products |

| Top Opportunities | Rising Demand for Multi-Functional and Ingredient-Rich Formulations |

| Key Players | Berli Jucker PCL, Reckitt Benckiser (Thailand) Ltd, British Dispensary (LP) Co Ltd, The, Colgate-Palmolive Thailand Ltd, Unilever Thai Holdings Ltd, Lion Corp (Thailand) Ltd, Neo Corporate Co Ltd, Sanofi-Aventis Thailand Ltd, PZ Cussons (Thailand) Ltd, Osotspa Co Ltd and Others. |

Thailand Bath & Shower Products Market Segmentation

Body wash/shower gel has the largest market share in the Thailand Bath & Shower Products Market. Body wash/shower gel led in 2024 in terms of value, driven by an increasing demand for modern and luxurious showering habits. Consumers in Thailand are abandoning traditional bar soaps and turning to body wash due to skin benefits, sophisticated formulation, and range of sophisticated fragrances. The trend is an indication of changing lifestyles, with convenience, personal grooming, and self-indulgence gaining priority.

Premiumisation is still fueling this trend, with buyers displaying a demand for products that provide an added advantage such as moisturising or anti-ageing. Products containing organic and natural ingredients are gaining traction. One prime example is Berli Jucker PCL's Parrot Fruity Serum Vitamin Shower Gel, which comes in multiple versions and contains ingredients such as superfruit and collagen. Its use of German technology for improved skin absorption adds to its popularity among Thai consumers.

Top Companies in Thailand Bath & Shower Products Market

The top companies operating in the market include Berli Jucker PCL, Reckitt Benckiser (Thailand) Ltd, British Dispensary (LP) Co Ltd, The, Colgate-Palmolive Thailand Ltd, Unilever Thai Holdings Ltd, Lion Corp (Thailand) Ltd, Neo Corporate Co Ltd, Sanofi-Aventis Thailand Ltd, PZ Cussons (Thailand) Ltd, Osotspa Co Ltd, etc., are the top players operating in the Thailand Bath & Shower Products Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Thailand Bath and Shower Product Market Policies, Regulations, and Standards

4. Thailand Bath and Shower Product Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Thailand Bath and Shower Product Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Bath Soaps- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Body Wash/Shower Gels- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Bath Additives- Market Insights and Forecast 2020-2030, USD Million

5.2.1.4. Body Powder- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5. Hand Sanitisers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.6. Intimate Hygiene- Market Insights and Forecast 2020-2030, USD Million

5.2.1.6.1. Intimate Washes- Market Insights and Forecast 2020-2030, USD Million

5.2.1.6.2. Intimate Wipes- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Product Form

5.2.2.1. Solid- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Gels & Jellies- Market Insights and Forecast 2020-2030, USD Million

5.2.2.3. Liquid- Market Insights and Forecast 2020-2030, USD Million

5.2.2.4. Powder- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Ingredient

5.2.3.1. Conventional/Synthetic- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Natural/Organic- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By Price Point

5.2.4.1. Premium- Market Insights and Forecast 2020-2030, USD Million

5.2.4.2. Mass- Market Insights and Forecast 2020-2030, USD Million

5.2.5.By End User

5.2.5.1. Women- Market Insights and Forecast 2020-2030, USD Million

5.2.5.2. Men- Market Insights and Forecast 2020-2030, USD Million

5.2.5.3. Kids/Children- Market Insights and Forecast 2020-2030, USD Million

5.2.6.By Sales Channel

5.2.6.1. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.6.2. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Thailand Bath Soaps Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product Form- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By Ingredient- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Price Point- Market Insights and Forecast 2020-2030, USD Million

6.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

6.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. Thailand Body Wash/Shower Gels Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Form- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Ingredient- Market Insights and Forecast 2020-2030, USD Million

7.2.3.By Price Point- Market Insights and Forecast 2020-2030, USD Million

7.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

7.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Thailand Bath Additives Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Form- Market Insights and Forecast 2020-2030, USD Million

8.2.2.By Ingredient- Market Insights and Forecast 2020-2030, USD Million

8.2.3.By Price Point- Market Insights and Forecast 2020-2030, USD Million

8.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

8.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. Thailand Body Powder Market Statistics, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Product Form- Market Insights and Forecast 2020-2030, USD Million

9.2.2.By Ingredient- Market Insights and Forecast 2020-2030, USD Million

9.2.3.By Price Point- Market Insights and Forecast 2020-2030, USD Million

9.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

9.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

10. Thailand Hand Sanitisers Market Statistics, 2020-2030F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Product Form- Market Insights and Forecast 2020-2030, USD Million

10.2.2. By Ingredient- Market Insights and Forecast 2020-2030, USD Million

10.2.3. By Price Point- Market Insights and Forecast 2020-2030, USD Million

10.2.4. By End User- Market Insights and Forecast 2020-2030, USD Million

10.2.5. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

11. Thailand Intimate Hygiene Market Statistics, 2020-2030F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Product- Market Insights and Forecast 2020-2030, USD Million

11.2.2. By Product Form- Market Insights and Forecast 2020-2030, USD Million

11.2.3. By Ingredient- Market Insights and Forecast 2020-2030, USD Million

11.2.4. By Price Point- Market Insights and Forecast 2020-2030, USD Million

11.2.5. By End User- Market Insights and Forecast 2020-2030, USD Million

11.2.6. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Colgate-Palmolive Thailand Ltd

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Unilever Thai Holdings Ltd

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Lion Corp (Thailand) Ltd

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Neo Corporate Co Ltd

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Sanofi-Aventis Thailand Ltd

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Berli Jucker PCL

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Reckitt Benckiser (Thailand) Ltd

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. British Dispensary (LP) Co Ltd, The

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. PZ Cussons (Thailand) Ltd

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Osotspa Co Ltd

12.1.10.1.Business Description

12.1.10.2.Product Portfolio

12.1.10.3.Collaborations & Alliances

12.1.10.4.Recent Developments

12.1.10.5.Financial Details

12.1.10.6.Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Product Form |

|

| By Ingredient |

|

| By Price Point |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.